-

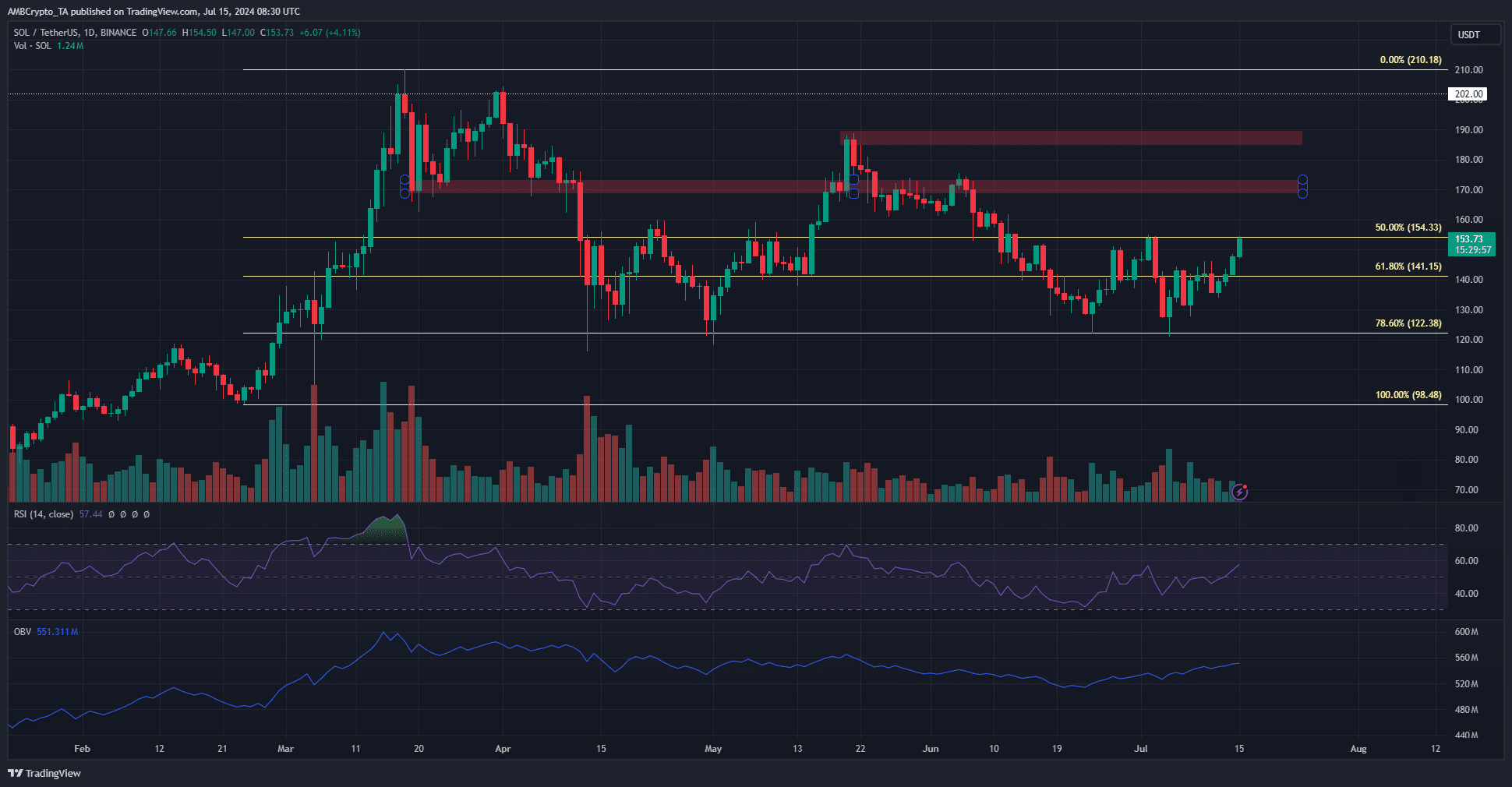

The 78.6% retracement level at $122 has been defended since April, marking the higher timeframe bias as bullish.

The gains of the past three days meant SOL is on the verge of establishing a bullish structure.

As a seasoned researcher with extensive experience in the crypto market, I have closely followed Solana’s [SOL] price action and its underlying fundamentals. The recent gains above $120 have been noteworthy, especially considering that the 78.6% retracement level at $122 has been fiercely defended since April. This higher timeframe bias adds to my bullish outlook on SOL.

Over the weekend, Solana (SOL) experienced growth alongside Bitcoin (BTC), which surpassed the $60,000 mark once again. Analysts remain optimistic about Solana, with a well-known cryptocurrency analyst predicting a potential price of $950.

Independently, Firedancer, a fresh and autonomous client on the network, achieved a significant milestone in its testnet phase. Its anticipated launch on the mainnet is scheduled for the final quarter of 2024, fueling optimism among bulls.

The $155 resistance zone is under siege

The market’s one-day chart hadn’t turned bullish yet, but it was on the verge. If the market closes above its recent low of $155 in a daily session, this would be an initial indication of a forthcoming shift.

When the price forms a higher low after achieving this, the trend is said to be changing.

At present, the Relative Strength Index (RSI) reached a level of 57, indicating persistent bullish energy. Over the previous three weeks, On-Balance Volume (OBV) has risen as well. These indicators suggest that the bulls might succeed in surmounting the $155 resistance.

To the north, the $170 and $187 supply zones need to be beaten to sustain a long-term uptrend.

Solana bullish sentiment picking up speed

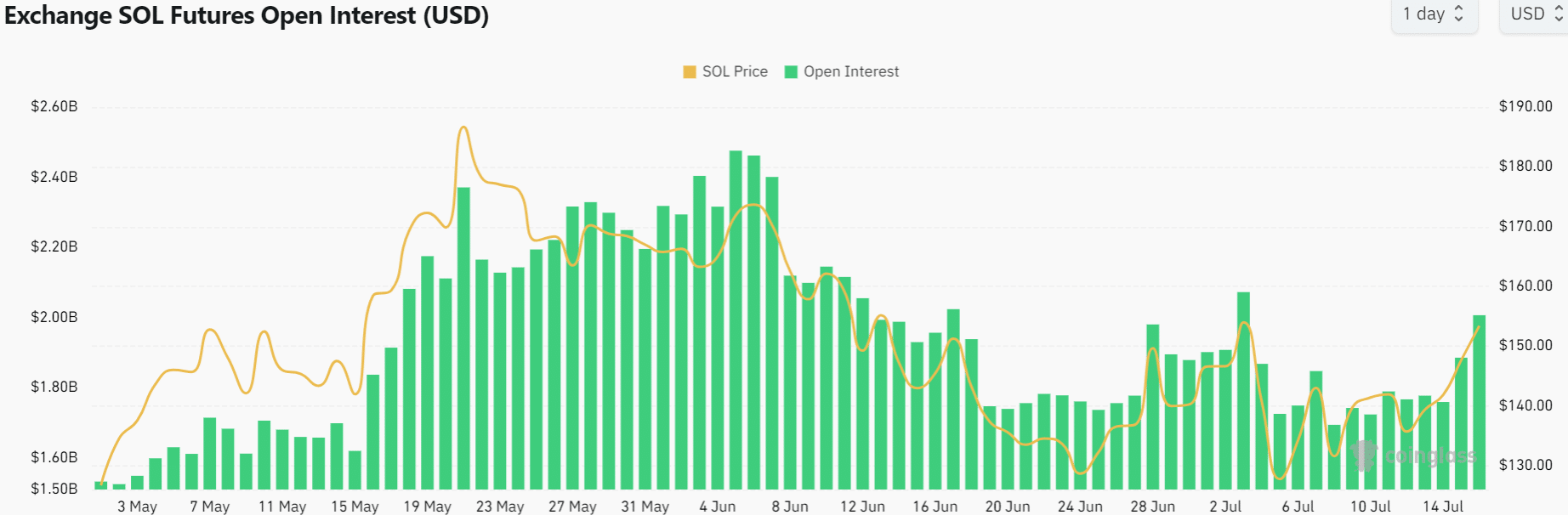

As a researcher observing the cryptocurrency market, I’ve noticed an intriguing development regarding Solana (SOL). The Open Interest associated with this digital asset has significantly increased from $1.69 billion to $2.01 billion within just a few days. This surge indicates a heightened interest among speculators to invest in SOL. Moreover, the improved short-term prospects of Bitcoin have likely fueled this trend, making it an attractive choice for those looking to go long on crypto.

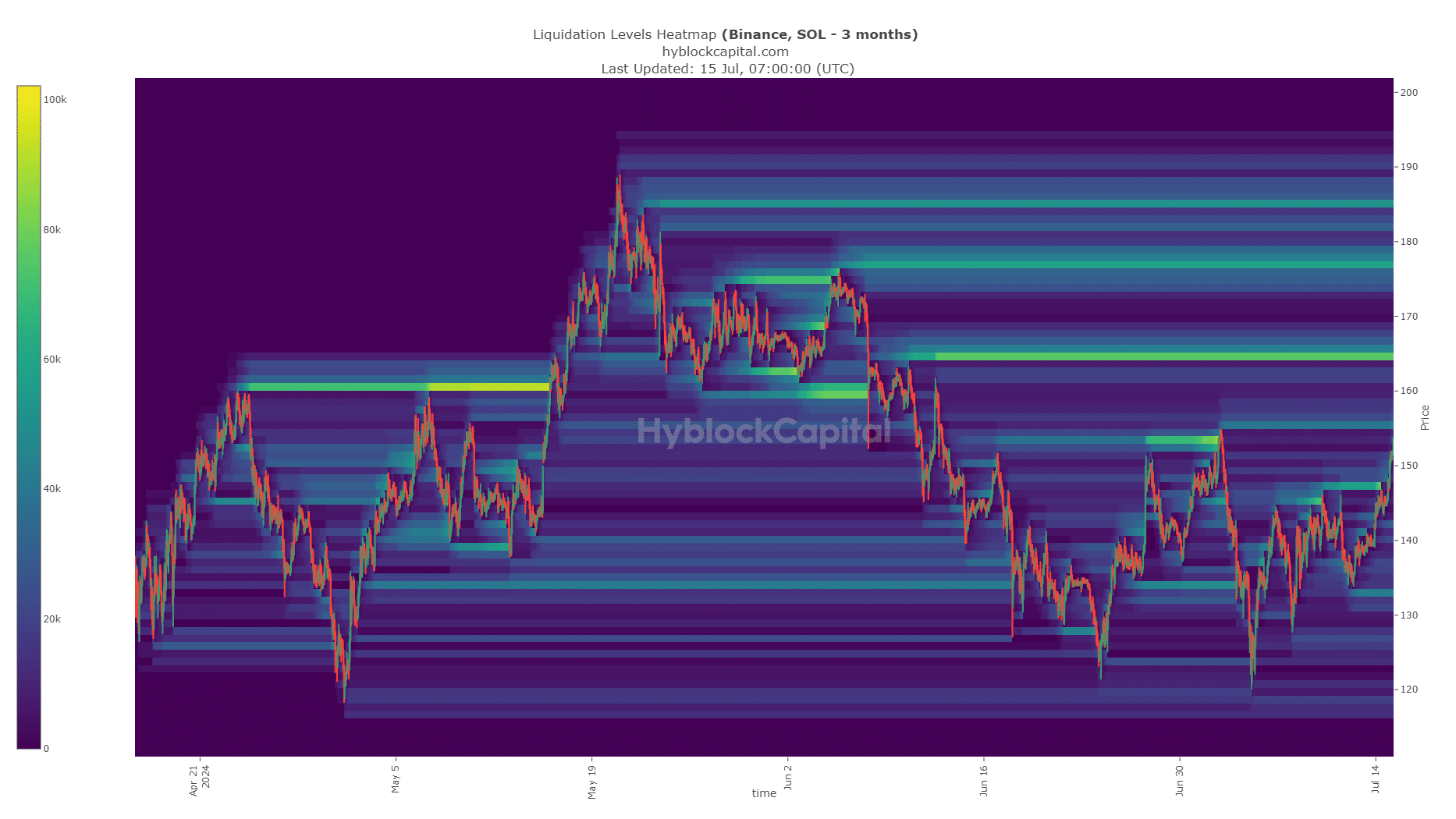

As an analyst, I’ve examined the liquidation heatmap and identified key price levels that could lead to significant short liquidations. These levels are situated at $155, $165, $177, and $185.

Among them, the $165-$168 zone was the biggest liquidity cluster.

Is your portfolio green? Check the Solana Profit Calculator

Based on the current trend and market sentiment, it seemed that Solana and Bitcoin could potentially reach prices of $170 and $185 respectively. However, whether these prices would be surpassed or if gains would plateau was uncertain. The growing accumulation of financial resources or liquidity in these cryptocurrencies points northward, suggesting a possible price surge.

The price of the latter could reach as high as $73k, at which point it may need to reassess its direction and potentially resume its upward trend, thereby increasing the likelihood of a bullish outcome for SOL.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-07-15 17:11