-

We could see an ETH approval this week.

The approval news is based on the confidence of observers in the space.

As a seasoned researcher with extensive experience in the crypto market, I have closely observed the dynamic interplay between regulatory decisions and market reactions. The recent prediction of an imminent Ethereum ETF approval this week by Nate Geraci, though not based on specific regulatory indications, has piqued my interest due to its optimistic outlook fueled by broader industry movements.

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing development that’s generating considerable buzz: the anticipated approval of an Ethereum [ETH] Exchange-Traded Fund (ETF) is causing quite a stir. This prospect has led to one of Ethereum’s most notable price surges in recent weeks.

As a crypto investor, I’ve noticed an intriguing contrast between the bustling nature of Ethereum’s underlying technology and the relatively tranquil social sphere surrounding it.

Is an Ethereum ETF imminent?

Nate Geraci’s latest musings suggest a potential Ethereum ETF approval this week, although without concrete regulatory signals, are driven by an upbeat perspective fueled by wider industry trends.

His self-assurance appeared to gain strength due to the recent moves of various ETF issuers, including VanEck and 21Shares, who filed updated registrations within the past week in an attempt to obtain the Securities and Exchange Commission (SEC)’s approval for listing Ethereum spot ETFs.

“These institutions are jumping on the bandwagon with this strategic decision, following the favorable regulatory environment set by the Bitcoin [BTC] ETF’s approval.”

Geraci’s perspective mirrored a widespread viewpoint within the cryptocurrency sector, suggesting that the regulatory landscape was favorable for granting approval to another Exchange-Traded Fund (ETF).

All trends look normal

Although there’s been great excitement about the possibility of an Ethereum ETF being given the green light, its social media buzz has stayed fairly consistent.

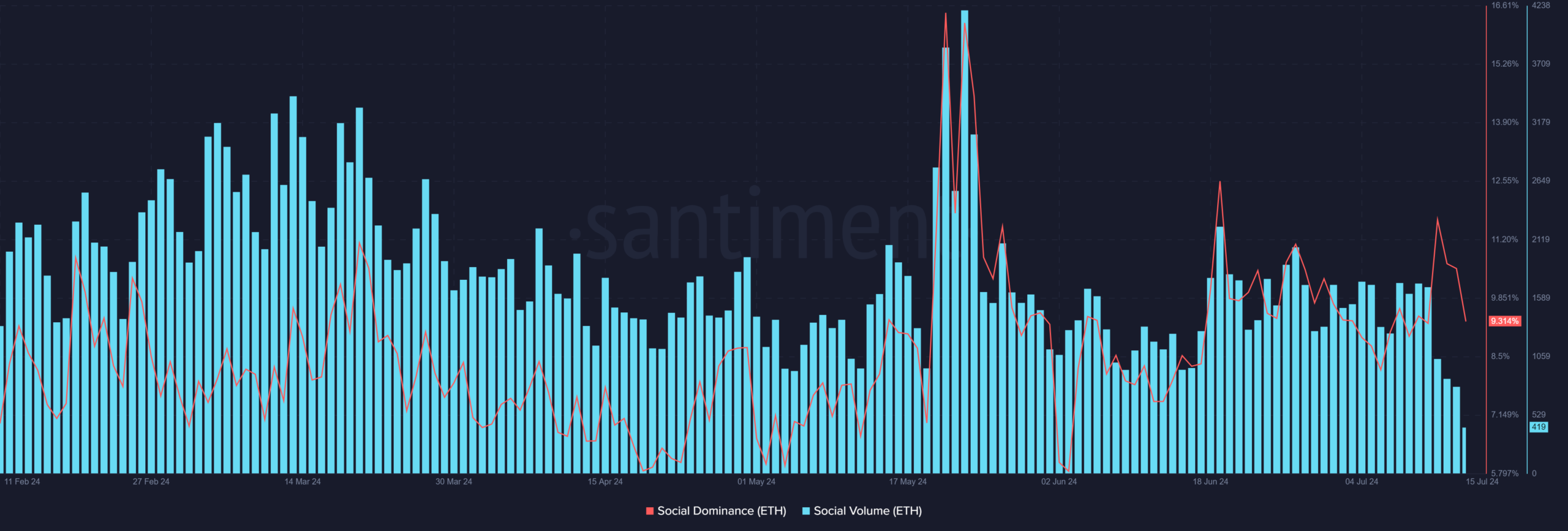

Based on AMBCrypto’s assessment using Santiment, the social dominance of Ethereum reached approximately 11% within the past two weeks. This signifies that Ethereum was a factor in around 11% of all crypto-related discussions during this timeframe.

Currently, Social Dominance has slipped to around 9.4%, representing a slight decrease from the 10.2% figure observed the day prior.

As a crypto investor, I’ve noticed that the Social Volume metric, which represents the total number of mentions or discussions about Ethereum on different social media channels, hasn’t experienced any notable surges recently.

The press time Social Volume was at around 380.

Prices react to ETF approval news

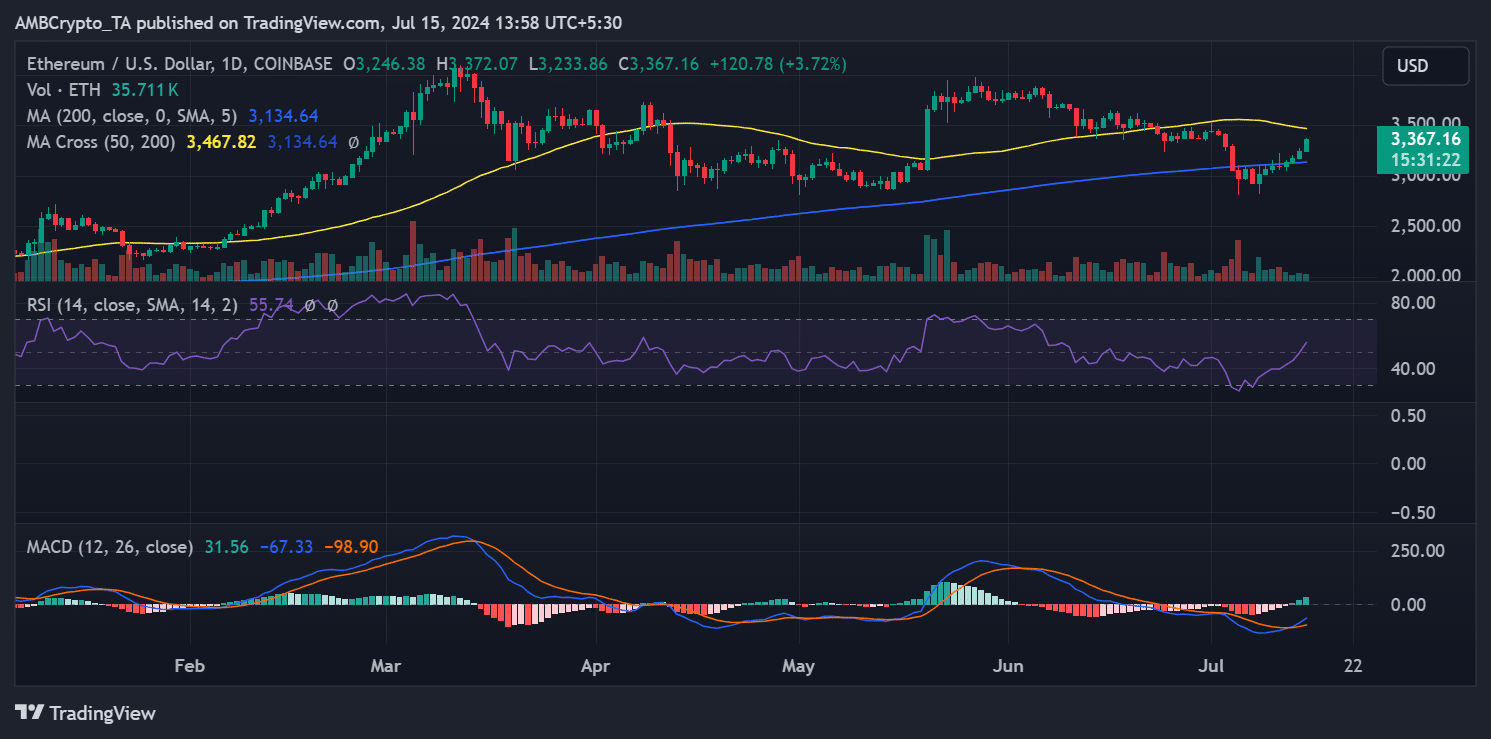

As a crypto investor, I’ve been keeping an eye on Ethereum’s daily chart according to AMBCrypto’s analysis. The graph suggests that Ethereum’s price is showing increasing momentum.

Following a considerable drop, Ethereum has started to recover, showing a noticeable upward trend currently. According to recent figures, its price has risen by roughly $3.7, bringing it close to $3,360.

The price reached a new high in the past fortnight, approaching the yellow line representing the short-term moving average.

Over the last two weeks, the yellow line served as a barrier for price advances, with significant resistance observed near $3,400 and $3,500.

Read Ethereum’s [ETH] Price Prediction 2024-25

An Ethereum ETF’s possible acceptance might serve as a significant catalyst for Ethereum surmounting the existing resistance thresholds.

Should the ETF be given the green light, it has the potential to markedly enhance investor trust and attract more institutional investors. Consequently, this influx of capital could propel the price back up to reach its peak value (all-time high).

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-07-15 22:16