-

ETH short-term holders see profit.

ETH has broken resistance for the first time in weeks.

As a long-term Ethereum investor with a keen interest in market trends and analysis, I have observed the recent surge in Ethereum’s price and market capitalization with great enthusiasm. The past week has been particularly intriguing, as ETH has shown attractive trends that could potentially yield substantial returns for investors.

As a crypto investor, I’ve noticed that Ethereum [ETH] has been making waves in the past week. Its market value has surged by more than 14%, putting it among the top performers in the cryptocurrency space.

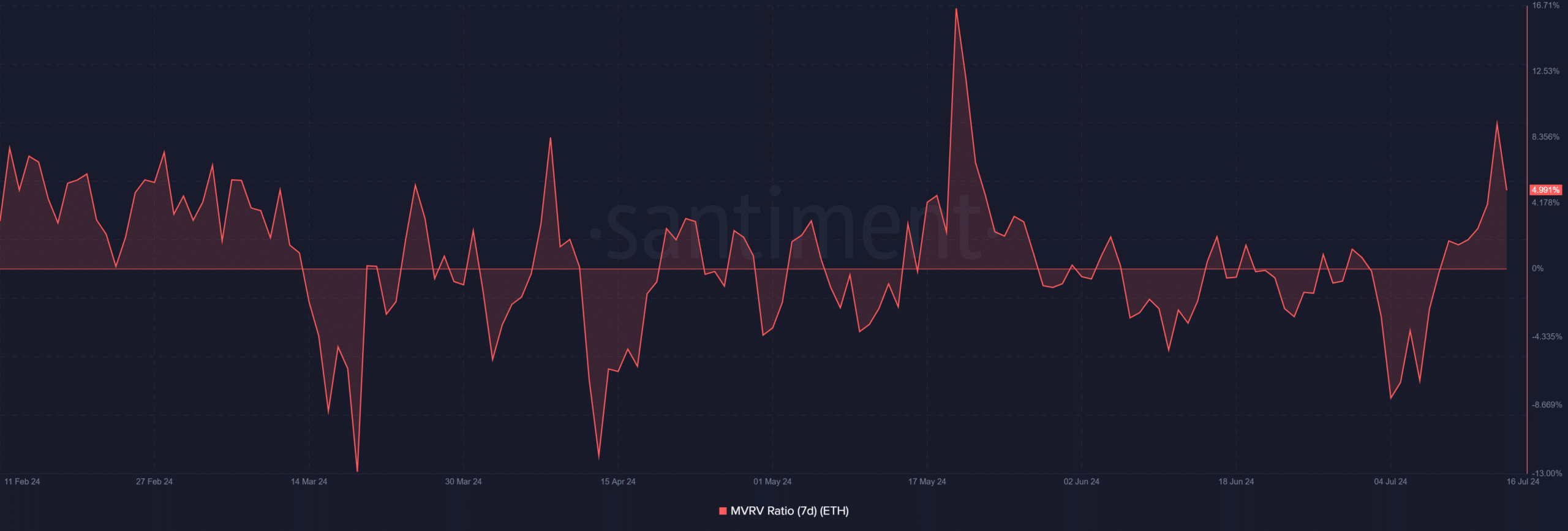

Furthermore, the seven-day Market Value to Realized Value (MVRV) ratio signifies that investors who purchased during this seven-day span are currently enjoying profits on their investments.

Ethereum shows attractive trends

Based on Santiment’s data analysis, buying Ethereum when its price dipped proved to be profitable for investors as they are currently witnessing notable gains. This is evident from the surge in Ethereum’s market capitalization, along with several other assets, according to the data.

The value of Ethereum (ETH) has significantly risen, boosting its total market worth by more than 14%. This growth not only elevates the worth of existing ETH holdings but also highlights lucrative opportunities for investors who purchased at cheaper prices in the past.

It also highlights its attractiveness as an investment during volatile market phases.

How ETH trended

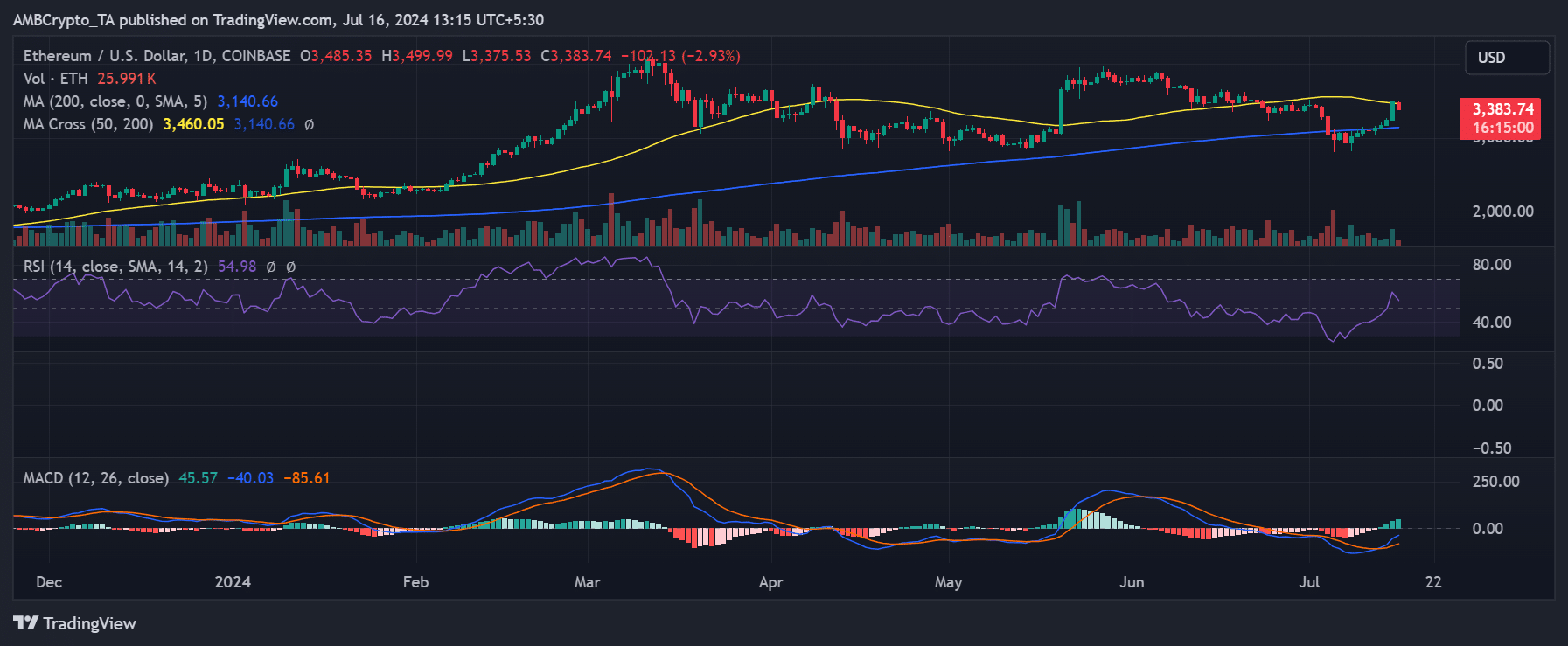

The analysis conducted by AMBCrypto on Ethereum’s daily chart revealed a noticeable upward trend that emerged on July 15th.

Ether’s price rose by roughly 8%, shifting from about $3,246 to roughly $3,485 at the close. This significant uptick brought its value above its short-term moving average (represented by the yellow line), which previously functioned as a barrier for price increases.

A leap over the short-term moving average signifies a noteworthy development for Ethereum, indicating that it successfully surmounted initial resistance, potentially paving the way for additional growth.

However, as of the latest observations, it was trading with a nearly 3% decline at around $3,380.

As a researcher studying market trends, I can share that the price has hovered slightly above the yellow line, which serves as both a resistance and support level. However, if the downward trend persists, it may dip back below this significant threshold. The ongoing trading actions in this pivotal area will ultimately shape the short-term price trend.

Short-term holders see profit

Based on the seven-day Market Value to Realized Value (MVRV) assessment of Ethereum, it appears that short-term investors have been reaping substantial gains from their holdings.

Based on Santiment’s figures, the MVRV ratio for Ethereum stood at approximately 5.6% as of now. This figure has dropped significantly from around 9% reported on July 15th, which correlates with Ethereum’s price decrease.

Although there has been a recent downturn, the MVRV ratio continues to show profits for investors. This implies that newcomers to investing in this asset have still managed to make a profit despite the recent price drop.

Read Ethereum (ETH) Price Prediction 2024-25

Around the 9th of July, the MVR Realized Profit Ratio shifted into the profitable range and kept climbing until its latest decline. This trend implies that more recent investors have largely maintained a positive outlook towards the market.

The present economic slump calls for close observation in order to assess if it will lead to long-term profits or if there are more adjustments to come.

Read More

2024-07-16 17:12