-

Solana reclaimed the crucial $154 support level and jumped above its 20-day and 50-day EMA.

SOL’s funding rate rose amid the recent market-wide bull run.

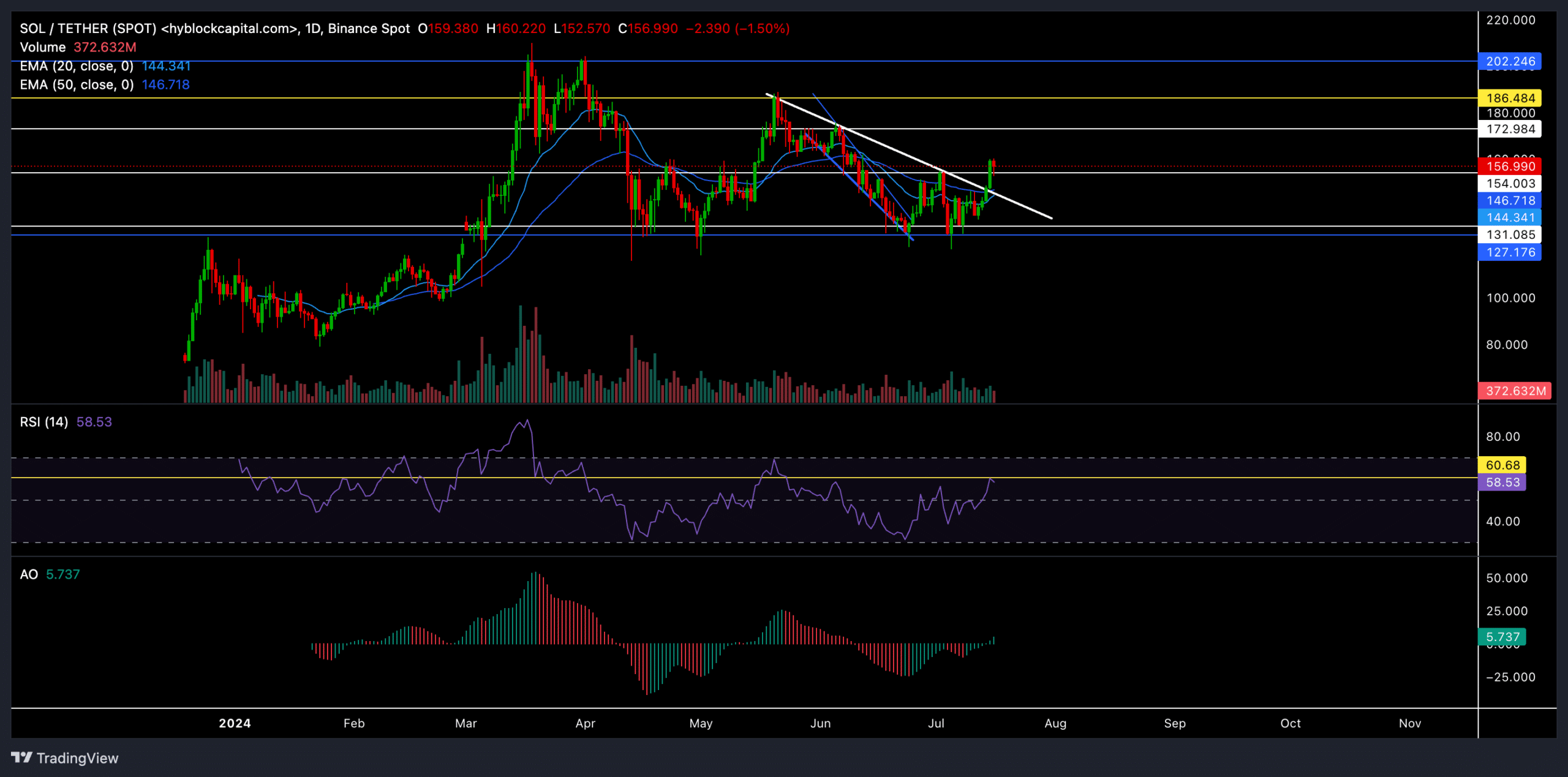

As a seasoned analyst with extensive experience in cryptocurrency markets, I have closely monitored Solana (SOL) and its recent price action. Based on my analysis of the charts, SOL reclaimed the crucial $154 support level and surged above both the 20-day and 50-day EMAs, signaling a potential bullish trend.

As a crypto investor, I’ve noticed an encouraging recovery in Solana (SOL) surpassing the vital $154 mark. This development has given the bulls a stronger foothold, enabling them to apply more pressure on the price. At present, SOL is displaying a robust bullish momentum as it rises above both the 20-day and 50-day Exponential Moving Averages (EMA).

Previously, the price of the coin had fallen below its support at $131 due to overselling. This led to a much-anticipated rebound. The market for the coin became quite unpredictable during this bounce back, exhibiting significant volatility. At present, Solana’s price hovers around $156.5.

Can SOL bulls continue to exert pressure?

As an analyst, I’ve observed a significant shift in Solana (SOL)’s price action following a robust Q1 performance. After hitting a resistance at around $202, SOL experienced a bearish trend for the past three months, resulting in a roughly 37% price decrease. Throughout this downturn, the support level at $127 was repeatedly tested multiple times.

A recent development in the altcoin’s daily chart is the formation of a falling wedge pattern. Upon breaking out of this bullish pattern, the coin encountered resistance at the $154 mark. This level presented a significant challenge for buyers due to the presence of both horizontal and trendline resistances converging at this point.

Lately, the price of SOL bounced back from the $127-$131 support zone, creating a textbook double-bottom chart configuration. Subsequently, the recent closing above the $154 mark validated this pattern, allowing SOL to reclaim an essential support level.

Moving ahead, it’s expected that SOL will bounce back from its current support at $154 and attempt to reach the $172-$175 price zone in the near future.

Based on my extensive experience in analyzing cryptocurrency market trends, I strongly recommend exercising patience and waiting for the 20-day Exponential Moving Average (EMA) to surpass the 50-day EMA before confirming a bullish outlook. This proven technical indicator has served me well in my career as it provides valuable insights into price trend reversals and momentum shifts.

At the current moment, the Relative Strength Index (RSI) managed to achieve a noteworthy closing point above 50. Yet, it faced challenges in surpassing the 60 resistance level.

Additionally, the Awesome Oscillator crossed above its zero line in the previous day’s trading session. This upward movement further validated the presence of bullish twin peaks on the indicator.

These peaks also occurred a few months ago when SOL saw a bullish rally toward the $186 resistance.

Funding rates improved

The data from Coinglass reveals that the funding rates for SOL have noticeably increased in the past few days, indicating a surge in demand from bullish investors. This upward trend is something to monitor closely, as a reversal could potentially signal decreased enthusiasm among buyers.

It’s also crucial to consider Bitcoin’s sentiment and trajectory before making buying decisions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-17 10:15