- FTX and CFTC have reached a $12.7 billion settlement.

- FTX filled for bankruptcy in 2022, and regulators filled civil lawsuits against the firm.

As a seasoned researcher with extensive experience in the cryptocurrency industry, I have closely followed the FTX and CFTC case with great interest. The recent $12.7 billion settlement between the two parties marks the end of one of the most significant bankruptcy claims in crypto history.

As a financial analyst, I’ve followed the lengthy dispute between FTX and the Commodity Futures Trading Commission (CFTC) for the past two years. Now, I’m pleased to report that they have reached a settlement. This recent agreement is intended to resolve one of the most significant bankruptcy claims against FTX.

The Commodity Futures Trading Commission (CFTC) intended to retrieve approximately $12.7 billion to reimburse affected creditors, without pursuing monetary fines for this case.

Details of the settlement

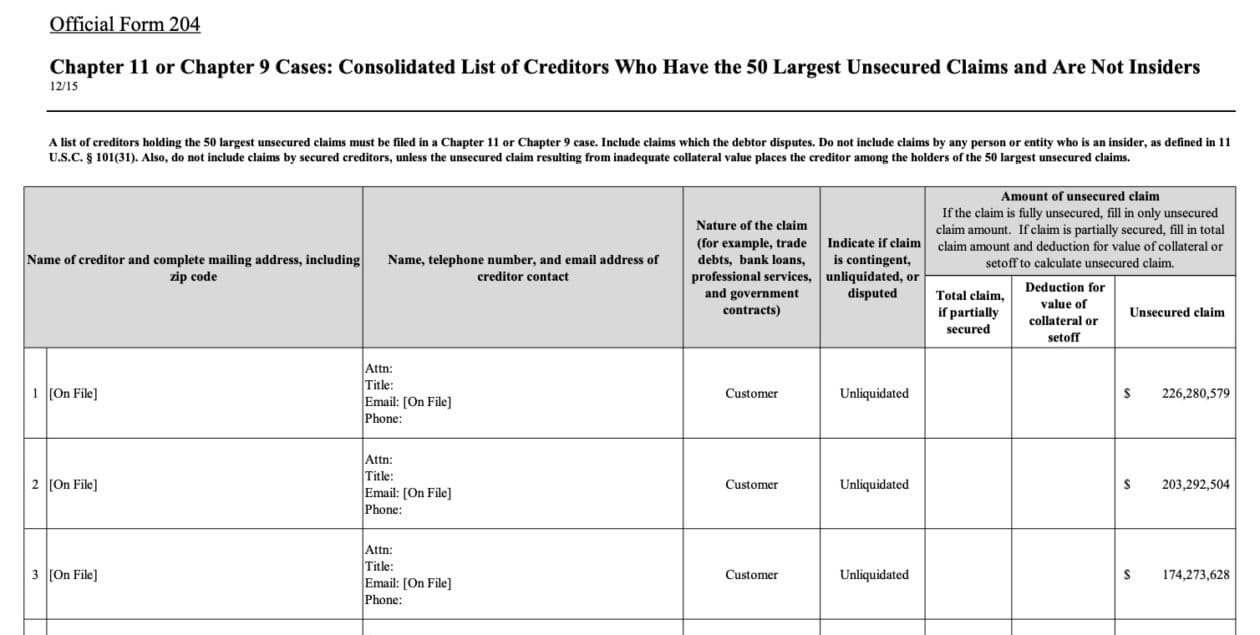

As a legal analyst, I can tell you that according to the filed court documents, my analysis reveals that FTX, the distressed cryptocurrency company, and the Commodity Futures Trading Commission (CFTC) have reached an agreement in their ongoing lawsuit. Based on the records, FTX will be responsible for a settlement payment of approximately $12.7 billion to resolve this significant legal dispute.

According to leaked bankruptcy court papers from the digital asset titan that crumbled in 2022, it is obligated to fork over $4 billion in disgorgement payments.

The company is set to shell out an additional $8.7 billion for restitution costs, subject to judicial authorization.

FTX vs. CFTC case

In my role as a financial analyst, I’d rephrase it this way: Prior to declaring bankruptcy in 2022, FTX was a prominent player in the crypto industry. Through its platform, clients had the opportunity to trade, purchase, or invest in digital tokens by speculating on their price fluctuations.

I’ve analyzed the situation and found that the company filed for bankruptcy in November 2022. It has been reported that the firm may have provided inaccurate information to its investors about their financial status.

FTX’s co-founder, Sam Bankman Fried, was arrested and subsequently sentenced to 25 years in prison following the revelation that his firm, FTX, employed funds from investors for gambling activities conducted through its affiliated company, Alameda Research.

I analyzed the filings made in Delaware’s district court during that particular month and identified 101 affiliated debtors who chose to file for Chapter 11 bankruptcy protection under the United States Bankruptcy Code.

Impact on defrauded customers

Significantly, FTX has encountered several regulatory bodies in legal disputes since its downfall. The Commodity Futures Trading Commission (CFTC) accused the firm of deceitfully misappropriating clients’ investment funds.

Therefore, the recent settlement is a major relief for FTX investors after two years of waiting.

The significant creditors anticipate a return of 166% on their investment in cryptocurrencies, considering both the market capitalizations and price fluctuations.

For the next month, creditors have the flexibility to choose their preferred method of repayment, pending the court’s decision on other case-related matters.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- PI PREDICTION. PI cryptocurrency

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

2024-07-18 03:03