-

The cryptocurrency market has seen a $1.44 Billion surge, led by Bitcoin and Ethereum.

BTC spot ETFs and anticipated ETHs spot ETFs captured investor attention.

As a seasoned financial analyst with extensive experience in the cryptocurrency market, I have witnessed firsthand the rollercoaster ride that this industry has been on. Despite the market volatility and uncertainty, the cryptocurrency space continues to attract investors from all corners of the world.

In recent months, cryptocurrency markets have experienced considerable volatility.

In spite of the volatile market conditions, the cryptocurrency sector has persistently drawn in new investors and witnessed heightened investment from existing ones.

The recent data by Coinshare showed a net inflow of $1.4B over the past week in the crypto market.

Increase inflows

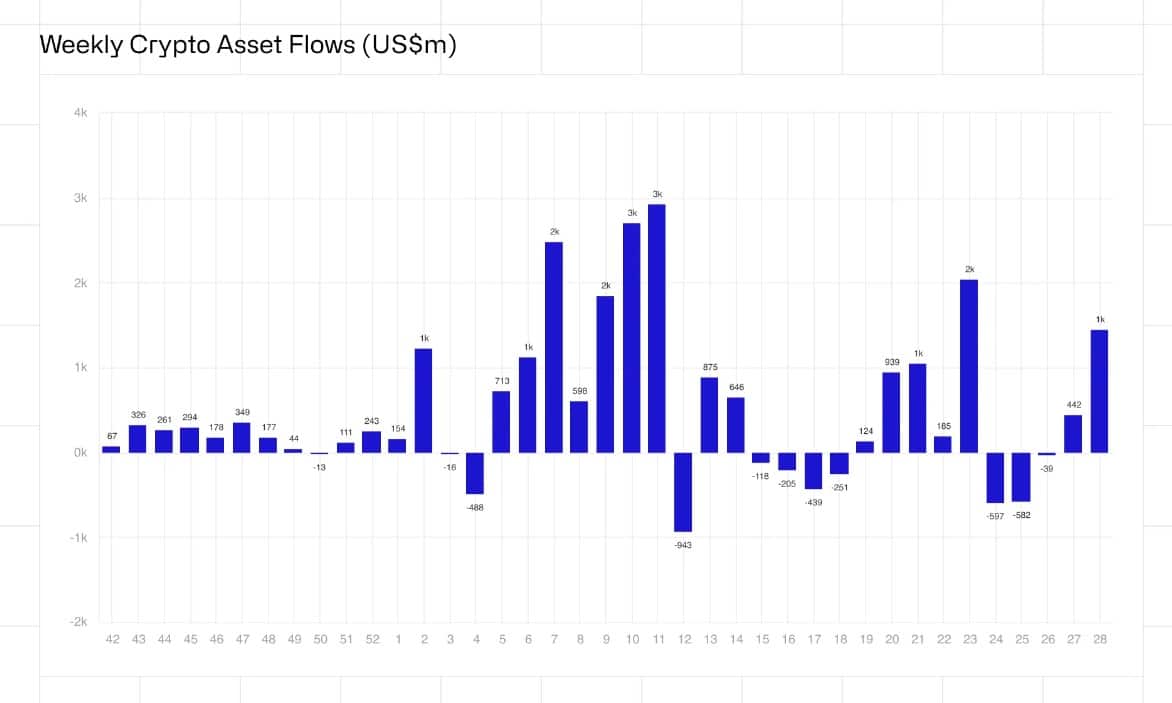

Based on the data from the report, there has been a significant increase in crypto market investments, reaching an all-time high of $17.8 billion over the course of the last year. Furthermore, the weekly inflows have also seen a substantial rise, amounting to $1.44 billion.

The inflow amount in YTD (Year-to-Date) graphs has exceeded the previous peak of $10.6 billion set in 2021. This surge can be attributed primarily to heightened institutional investment in cryptocurrencies via spot Exchange-Traded Funds (ETFs).

As a researcher studying the cryptocurrency market, I’ve observed some significant developments that have reshaped the landscape recently. Specifically, the approval of Bitcoin (BTC) spot Exchange-Traded Funds (ETFs) in January and Ethereum (ETH) spot ETFs in May have brought about notable changes in the crypto space.

BTC leads with a record-high inflow

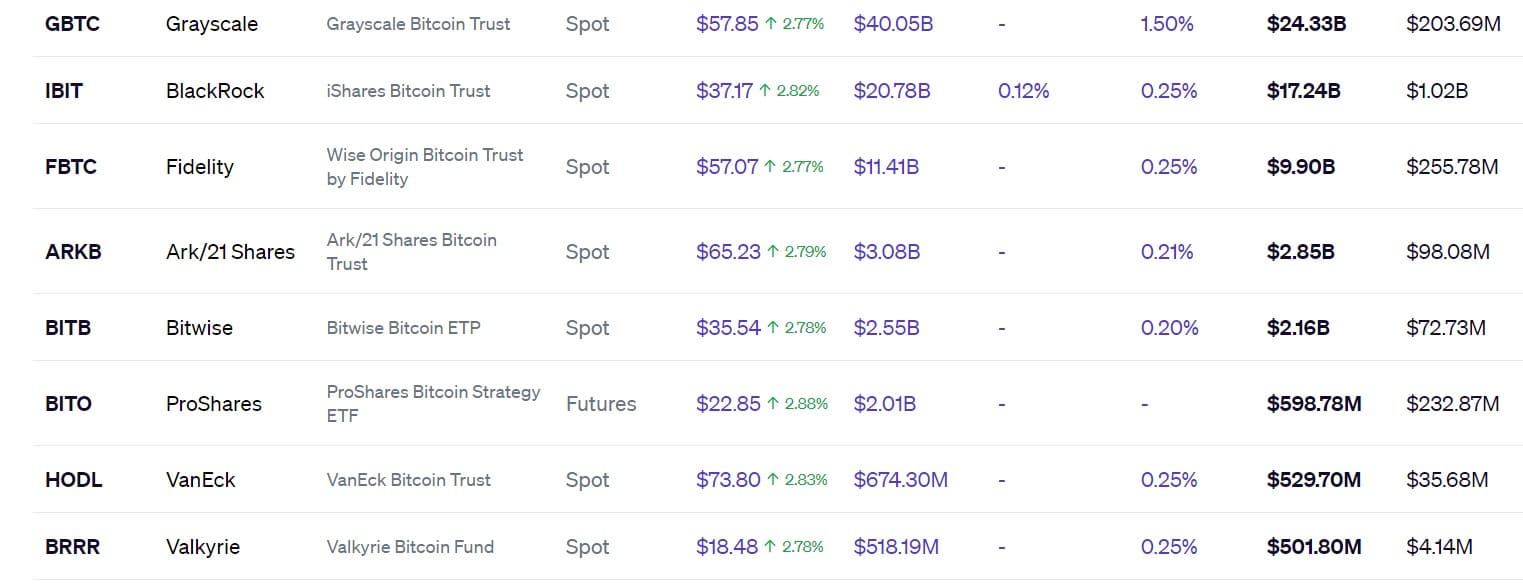

As the market influxes persisted in their upward trend, Bitcoin (BTC) registered the largest weekly inflow of approximately $1.35 billion. This significant surge in Bitcoin inflows was primarily driven by heightened institutional investment in Bitcoin via spot Exchange-Traded Funds (ETFs).

As a crypto investor, I’m excited to share that BlackRock’s IBIT (Index Fund Basket) saw an impressive gain of $117.25 after seven consecutive days of inflow. With a substantial trading volume of $1.2 billion, IBIT maintained its leading position in the market.

As a researcher, I’ve discovered that ARK Invests and 21shared’s ARKB fund experienced an enormous influx of approximately $117.19 million, accompanied by a substantial trading volume of around $98.8 million. Notably, other major players like Fidelity and BITB also reported significant inflows, with Fidelity bringing in roughly $15.24 million and BITB recording an inflow of approximately $7.93 million.

Over the last week, there has been a significant withdrawal of funds from BTC short positions due to the German government’s sales and the Mt. Gox transactions.

ETH leads the altcoins

Although Bitcoin remains the leading cryptocurrency, Ethereum (ETH) and Solana (SOL) have been experiencing significant growth and are poised to contest Bitcoin’s position.

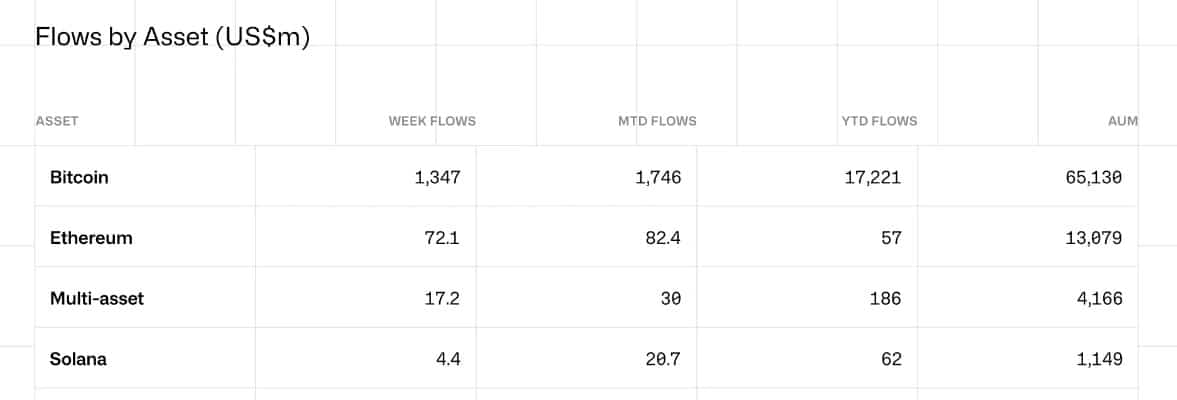

According to AMBCrypto’s latest report, there’s a growing belief in the cryptocurrency market that Ethereum (ETH) could surpass Bitcoin (BTC) following the launch of spot Ethereum Exchange-Traded Funds (ETFs). As a result, ETH has witnessed significant investment inflows amounting to $72 million over the past week, as investors prepare for this anticipated development.

The significant increase in the value of Ethereum (ETH) marks the most substantial growth since March. This shift comes as investors’ attitudes towards Ethereum are evolving, primarily due to the potential impact of upcoming Ethereum-based Exchange Traded Funds (ETFs).

Read Bitcoin’s [BTC] Price Prediction 2024-25

As an analyst, I’ve observed a notable surge in inflows to Solana, reaching a new peak of $4.4 million. This uptick comes after several months of decreased activity. The persisting trend indicates a growing appetite among investors for crypto assets, even as market volatility continues to escalate.

Multiple expected approvals for ETH and SOL exchange-traded funds (ETFs) this month could lead to a steady growth in the altcoin and cryptocurrency market.

Read More

2024-07-18 08:08