- Northern Data refutes fraud allegations by former employees.

- The firm has moved to dismiss the allegations to pave for its US IPO.

As a seasoned researcher with extensive experience in the Bitcoin and technology industries, I find Northern Data’s response to the fraud allegations by former employees intriguing. The timing of these allegations, just days before the company’s planned Initial Public Offering (IPO) in the US, raises some eyebrows.

Europe‘s leading Bitcoin miner, Northern Data, has denied allegations of wrongdoing made by its former employees and is seeking to have a legal claim brought against them dismissed.

In a Bloomberg interview, Northern Data’s COO, Rosanne Smith, addressed allegations against the company and stated that they intend to dismiss them.

As a crypto investor, I firmly believe that the criticisms levied against the company are baseless. I’m optimistic because we have already initiated the process to have the case dismissed. My faith in the company remains unwavering, as I trust that the legal proceedings will ultimately prove its innocence.

Smith added that they were not ‘worried’ about the allegations.

Bitcoin miner vs ex-employees

From a different viewpoint, it has been alleged by the previous executives of Northern Data, Joshua Porter and Gulsen Kama, that the company falsified its financial reports and engaged in tax fraud.

According to the Financial Times’ report from June, some of the accusations made in California include:

Intentionally giving a deceptive picture of its financial health to investors, regulatory bodies, and commercial associates… Was engaged in concealing substantial taxes amounting to possibly tens of millions of dollars from the authorities.

As an analyst, I would rephrase it as follows: I’ve come across some reports raising allegations against Northern Data. However, the company has denied these claims and expressed concerns over the timing of their release, given its upcoming Initial Public Offering (IPO) in the US. In their official statement, Northern Data questioned the validity of the accusations.

Northern Data strongly denies the accusations made by disgruntled ex-employees. It’s worth noting that these allegations surfaced following unverified media reports suggesting that the company is considering a financial market occasion.

Similar to many Bitcoin miners, Northern Data aims to broaden its income sources by developing the artificial intelligence (AI) sector. The company intends to grow its cloud and data center segments in the US stock market and anticipates a market capitalization of around $16 billion upon going public.

Smith brought up a concern: The suspected fraud might negatively impact the company’s reputation just before its anticipated initial public offering (IPO), which could potentially take place as soon as the first half of 2025.

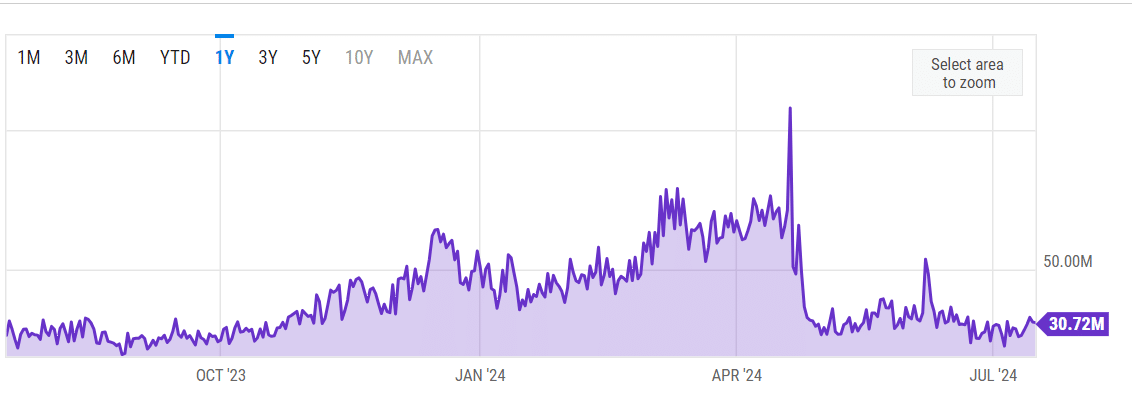

In contrast to the more than $40 million in daily Bitcoin mining revenues seen in the first half of 2024, current earnings have stayed below the $30 million mark.

After the revenue decrease following the halving event, most miners have had to adapt and explore alternative income sources, with a significant focus on artificial intelligence, in order to keep their operations financially stable.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-07-18 12:59