- Latest hack has crippled the India-based crypto exchange to the tune of over $230M

- Recovery efforts are underway right now, with the culprits identified too

As a seasoned crypto investor with years of experience under my belt, I’ve seen my fair share of market volatility and security breaches. The latest hack at WazirX, an Indian cryptocurrency exchange, has left me feeling uneasy, to say the least. With over $230 million worth of tokens stolen in a single attack, it’s a stark reminder of the risks that come with investing in this space.

Yesterday, WazirX, a well-known cryptocurrency exchange in India, had to momentarily pause all withdrawal requests due to a security breach resulting in the theft of approximately $230 million worth of tokens. However, within a day, it appears that the perpetrators have been found.

Based on a study conducted by Elliptic, a well-known blockchain analysis company, it is believed that the infamous cybercriminal group Lazarus was responsible for orchestrating this significant theft.

North Korea’s shadow

As a researcher studying cybercrime, I’ve come across the infamous Lazarus Group. This group has made headlines for their involvement in various high-profile cryptocurrency heists throughout the years. They have built a formidable reputation for themselves, primarily targeting financial institutions and cryptocurrency exchanges. Using sophisticated methods, they infiltrate systems and exploit any vulnerabilities they discover.

The Lazarus Group’s role in this theft is part of a larger trend of cyberattacks linked to the North Korean administration. This group has been implicated in various high-profile incidents, such as the 2017 WannaCry ransomware attack and significant cryptocurrency robberies. Their actions are suspected to finance the North Korean government’s activities, helping them bypass international sanctions.

Elliptic’s report also revealed that soon after the heist,

“… exchanged several tokens with Ether through different decentralized platforms, a common preliminary move in the laundering procedure.”

A post-mortem

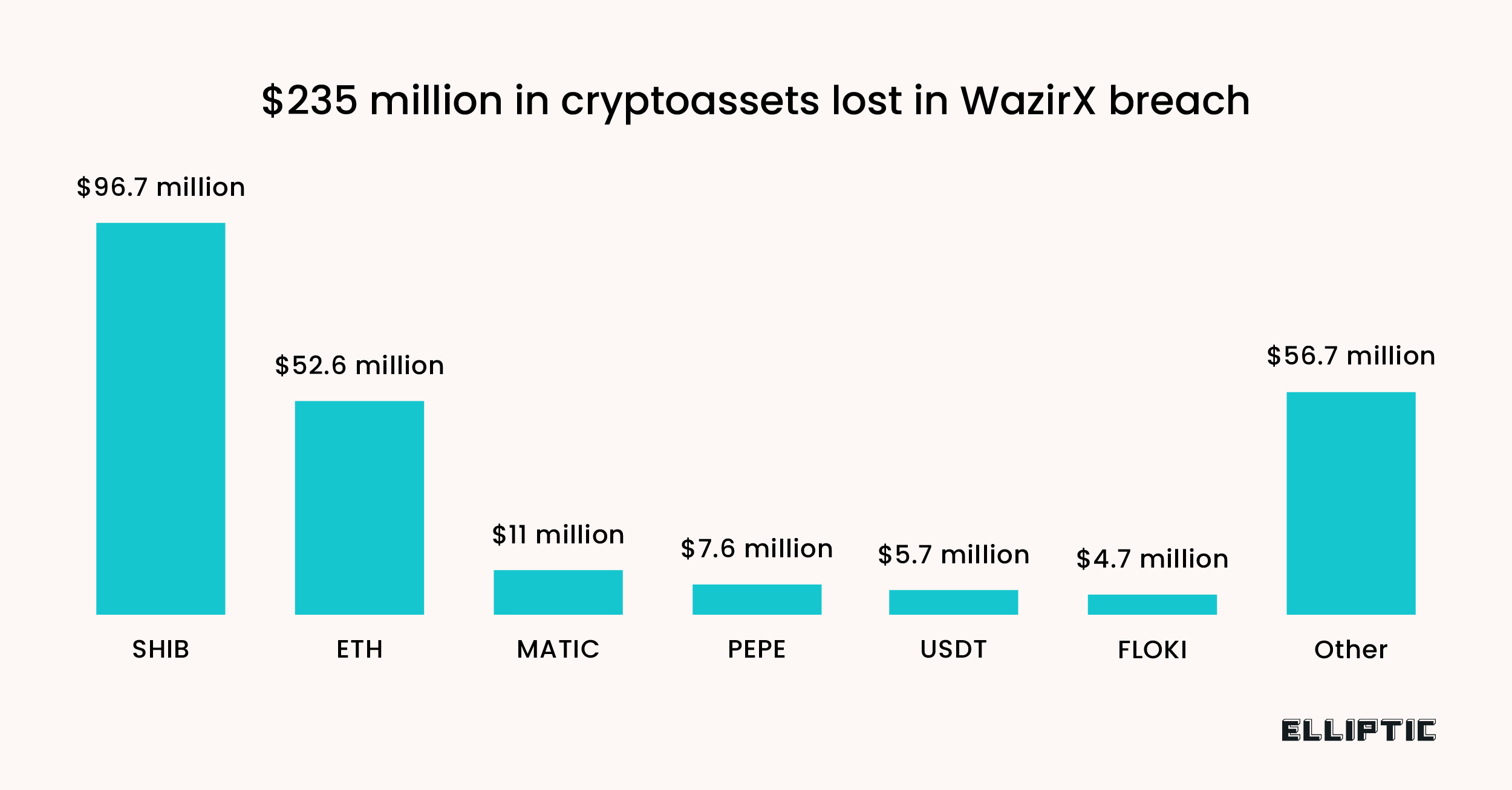

Initially, hackers made off with $96 million worth of SHIB, $52 million of ETH, and $11 million in MATIC from the exchange. The conversion of these tokens into ETH is noteworthy, as an Ethereum-based Spot ETF is about to be launched in the US. There’s widespread anticipation that this ETF will significantly boost the price of Ethereum, potentially setting a new all-time high for the second largest cryptocurrency by market cap.

Before a full investigation report has been released by the exchange, Mudit Gupta from Polygon provided an in-depth explanation of how the hack occurred.

The executive discovered that the hackers had carried out a trial run of their attack on the blockchain nine days prior to the successful breach. They achieved this by infiltrating and emptied the exchange’s multi-signature wallet through an upgraded, malicious version. Additionally, he mentioned,

“Two out of four private keys have been directly accessed, while the other two have been obtained through signature phishing following a compromise of a UI or wallet.”

WazirX has reassured its users that they are collaborating with law enforcement and cybersecurity professionals to probe the incident and attempt to retrieve the stolen funds. However, it’s important to note that Lazarus Group’s recent cyberattacks haven’t resulted in full prosecutions. Consequently, recovering the funds in the current situation might present a challenge.

“Yes but KYC means nothing as KYC verified accounts can be easily purchased online for <$100.”

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-07-19 15:35