-

ETH is still stuck below its short-moving average.

The price trend, however, showed that bulls were active in the market.

As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely monitored Ethereum’s [ETH] recent price trends and market dynamics.

Lately, Ethereum [ETH] has seen a string of price increases, and even when it dips slightly, these declines have been insufficient to halt its predominant upward trend.

With ETH‘s price on the rise, traders are growing more optimistic and taking bolder steps in their trading strategies.

Ethereum sends strong signals

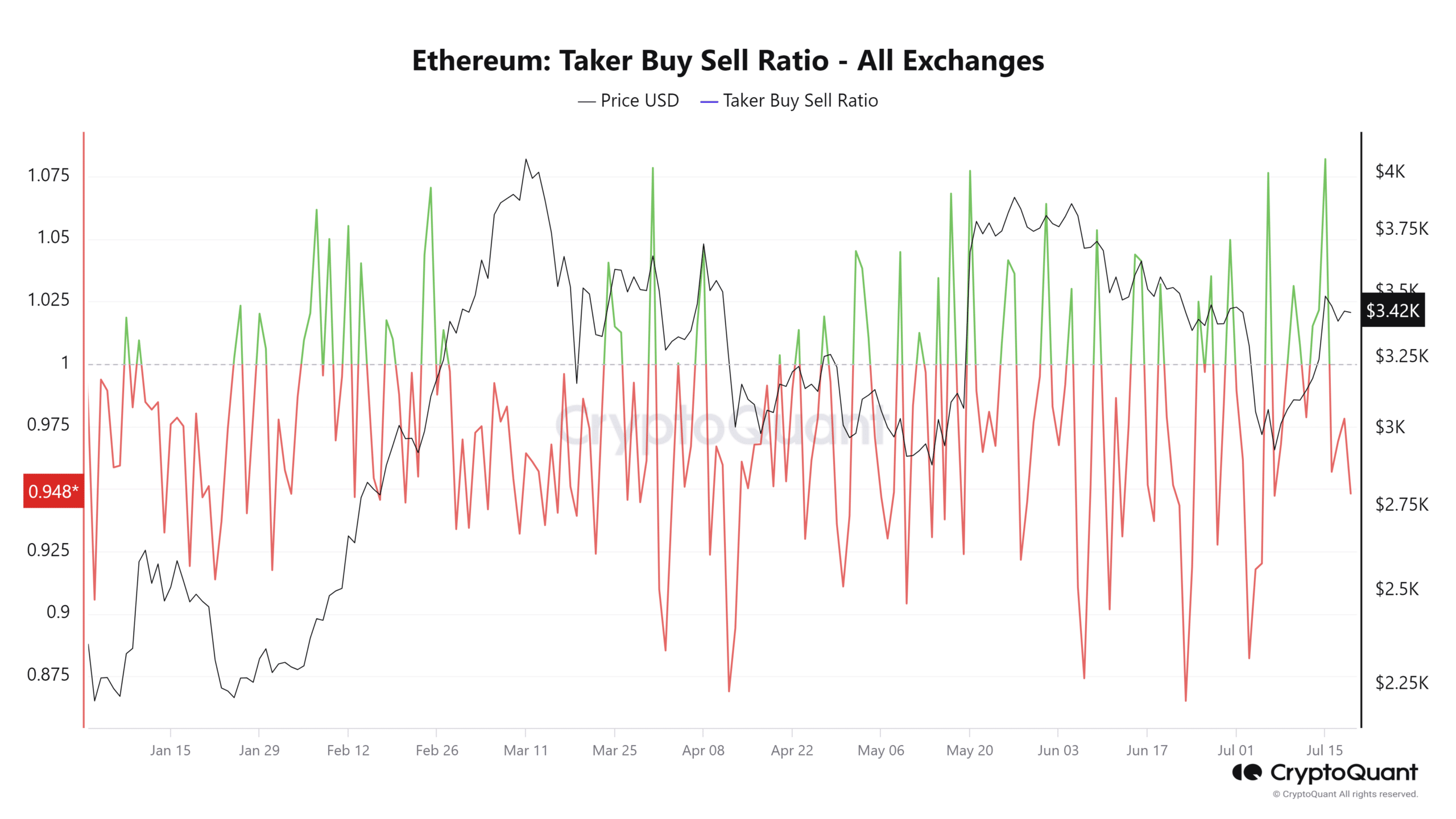

An examination of Ethereum’s Taker Buy Sell Ratio on CryptoQuant showed heightened activity. Lately, this ratio has seen considerable surges above the number 1 mark, signaling changes in market behavior.

One way to rephrase this in clear and conversational English is: A Buy Sell Ratio greater than 1 implies active buying from bulls. This signifies that buyers are leading the charge in market transactions, which typically results in price increases.

Lately, surges in this ratio have coincided with the instigation of ETH price growth, indicating heightened demand from buyers.

At present, the Taker Buy Sell Ratio is showing a slight decrease, hovering just under 1. This change could signify that there is less demand for purchasing assets or a heightened interest in selling them.

If the increase in the Taker Buy Sell Ratio continues, CryptoQuant indicates that this could be a sign of an ongoing mid-term bull market for Ethereum.

With continuing optimism among investors, it’s probable that prices will continue to climb higher.

Ethereum’s Open Interest shaping up

As a researcher examining Ethereum’s market trends on Coinglass, I’ve observed an intriguing development in recent days. The Open Interest for Ethereum has shown a substantial growth, rising from approximately $12 billion to over $14.2 billion, starting around July 9th.

Additionally, there has been a sharp rise in Ethereum’s Funding Rate.

An increase in the Funding Rate signifies that long position holders are paying extra to maintain their trades relative to short position holders. This situation reflects a prevailing optimistic outlook among traders who have taken long positions.

The surge in Open Interest and the elevated Funding Rates indicate an uptick in market action and net deposits from purchasers.

“The trend for Ethereum is strongly suggested by this alignment with other positive signs, such as the Taker Buy Sell Ratio.”

ETH’s growing bull trend

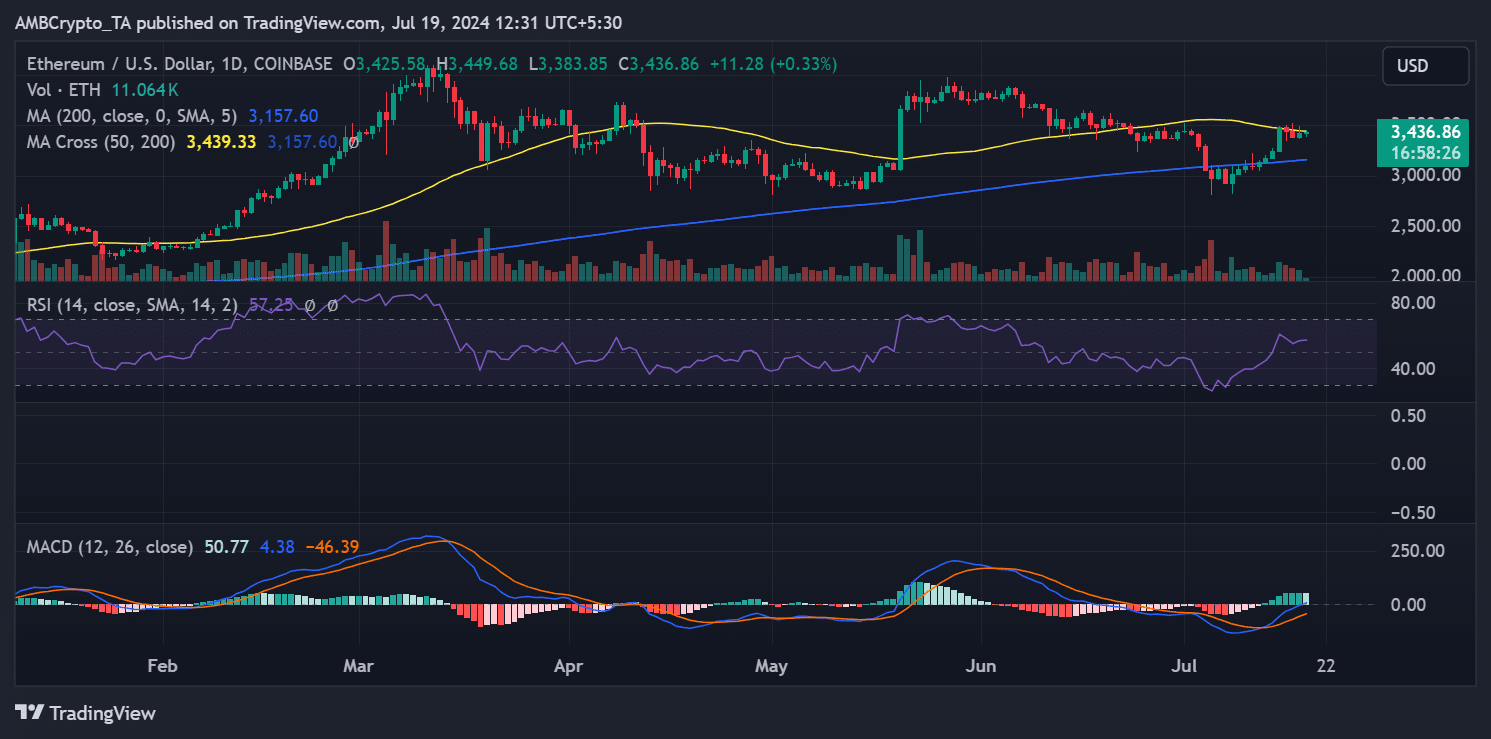

As of press time, Ethereum was trading at approximately $3,436, marking a less than 1% increase.

In the previous trading day, there was a noticeable upward trend that built upon a major surge of over 1%, causing the price to approximate $3,425.

Read Ethereum’s [ETH] Price Prediction 2024-25

From my perspective as a researcher studying Ethereum’s price movements, AMBCrypto’s analysis of its Moving Average Convergence Divergence (MACD) offered valuable insights into the cryptocurrency’s market behavior. At present, I observe that the ETH MACD hovers above the zero line, which is generally indicative of a bullish trend.

As an analyst, I’d interpret the current chart setup as follows: The bullish trend is present, but its strength has yet to fully materialize based on the indicator lines’ placement, which are situated slightly below the zero mark.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-19 21:12