-

POPCAT had a strongly bullish market structure at press time

A retest of the $0.71 demand zone would yield buying opportunities, if it plays out

As a seasoned analyst with extensive experience in studying cryptocurrency markets, I have witnessed numerous price movements and trends over the years. Based on my observations of POPCAT‘s recent market structure and price action, here is my take:

POPCAT’s bulls successfully guarded the $0.722 support level, causing prices to escalate further. Currently, the market value is recorded at $0.933. The memecoin segment has experienced significant growth in the last week, with the leading coins reporting impressive double-digit percentage increases.

The optimistic projections made in the latest report have been proven correct so far. But after approaching the $1 resistance level, it’s reasonable to ponder if the rally may have lost its momentum.

Should traders brace for a pullback?

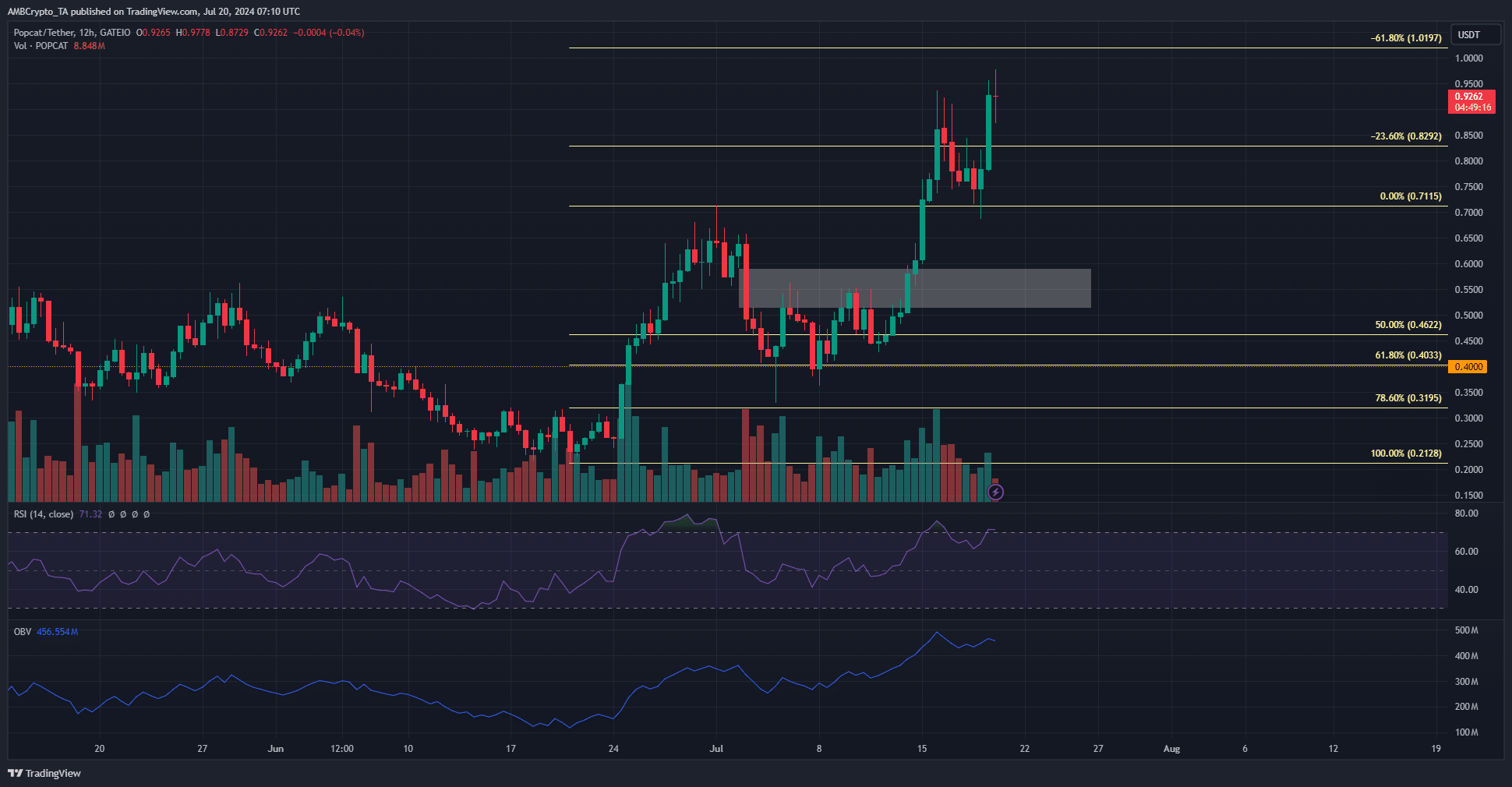

Based on the significant price increase from $0.2128 to $0.711 between mid-June, Fibonacci retracement and extension levels were calculated. On Monday, 15th July, POPCAT surpassed the resistance area of $0.5-$0.55.

With robust optimism, the price surged to reach $0.9778, slightly falling short of the 61.8% extension mark at $1.02. Over the weekend, a pullback from the $0.98-$1.02 range seemed plausible.

As a crypto investor, I’ve been closely monitoring the market indicators, and I’m pleased to report that they’ve been signaling bullish trends lately. The Relative Strength Index (RSI) has been reading at an impressive 71, which is a clear indicator of strong upward momentum. Additionally, the On-Balance Volume (OBV) has not shown any signs of letting up over the past three weeks. This consistent uptrend in OBV suggests that there’s been steady buying pressure from investors, which bodes well for potential price increases.

After a test at either the 23.6% or 61.8% Fibonacci resistance levels, which occur approximately 23.6% or 61.8% of the way up from the previous local low, prices often retreat back towards their previous peak. In this specific instance, that peak is marked at $0.711.

Data supports an extended rally for POPCAT

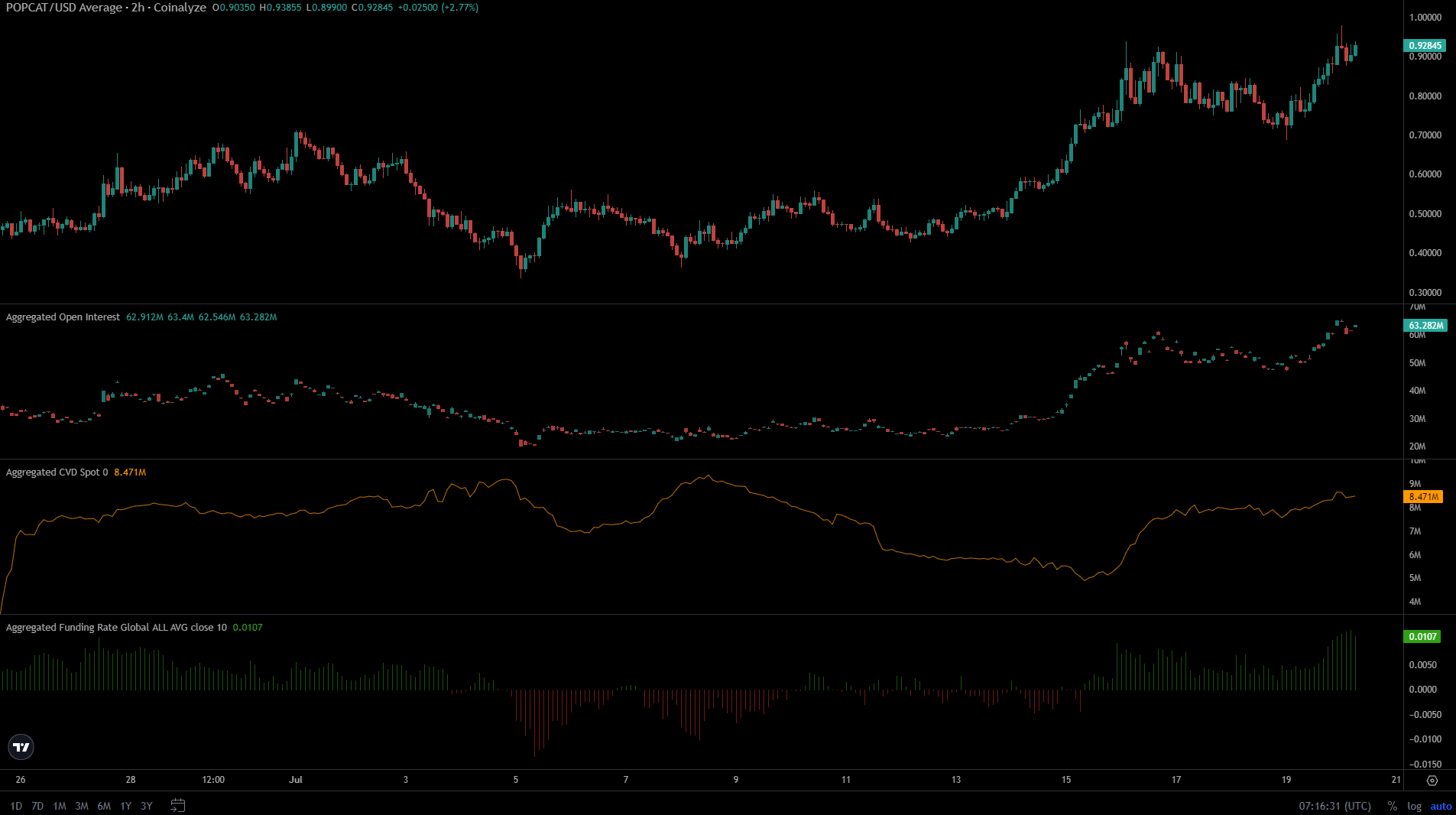

On July 13th, Open Interest stood at $29.4 million. By the time of this press release, however, it had surged to an impressive $63.28 million. This significant jump in both price and Open Interest indicated strong speculator interest and confidence in the ongoing rally. Furthermore, the spot Contracts for Difference (CVD) followed suit, mirroring the increased demand in the spot markets.

Realistic or not, here’s POPCAT’s market cap in BTC’s terms

Finally, the funding rate pushed higher as more long positions piled on.

As a researcher, I would advise that this situation could result in a prolonged squeeze followed by a correction. It would be wise for buyers to curb their fear of missing out (FOMO) and hold off on entering until crucial support levels are retested once more.

Read More

2024-07-20 17:11