- A key indicator suggested that Ethereum might touch $5k in the coming months

- Nonetheless, a few of the other market indicators turned bearish and flashed red

As a seasoned researcher with a deep understanding of the crypto market and its intricacies, I have closely monitored Ethereum’s [ETH] recent price movements and trends. The hype surrounding Ethereum ETFs has created a buzz in the market, fueling investors’ expectations of new bullish heights for the king of altcoins.

The excitement surrounding Ethereum [ETH] ETFs has been building up lately, as the anticipated launch date approaches. Many investors harbor high hopes for this leading altcoin, believing that its value could surge significantly following the debut of Spot ETFs.

Ethereum ETFs create buzz

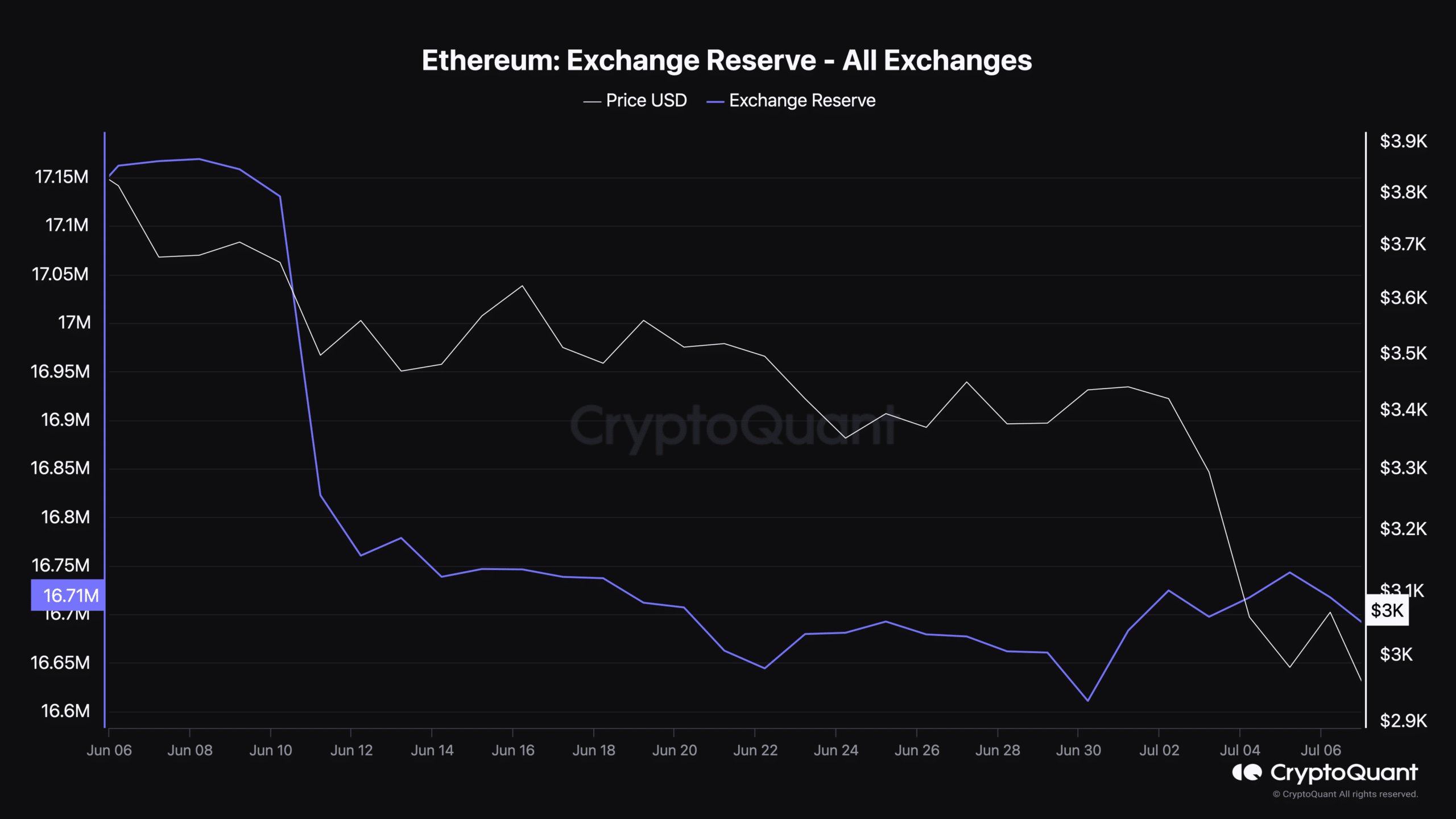

In the current scenario, IntoTheBlock drew attention to an intriguing observation through a recent tweet. Based on data from their on-chain analytics platform, approximately $126 million in Ethereum was taken out of exchanges this past week. This figure implies that investors may have been contemplating purchasing more ETH.

According to AMBCrypto’s interpretation of CryptoQuant’s data, there was a significant decline in the amount of the token held on exchanges. This decrease indicated an increase in demand for the token, leading to higher buying pressure.

Significantly, this occurrence has transpired in the lead-up to the highly anticipated Spot Ethereum ETF debut. By considering the facts, traders may be bracing for a substantial increase in Ethereum’s value following the launch.

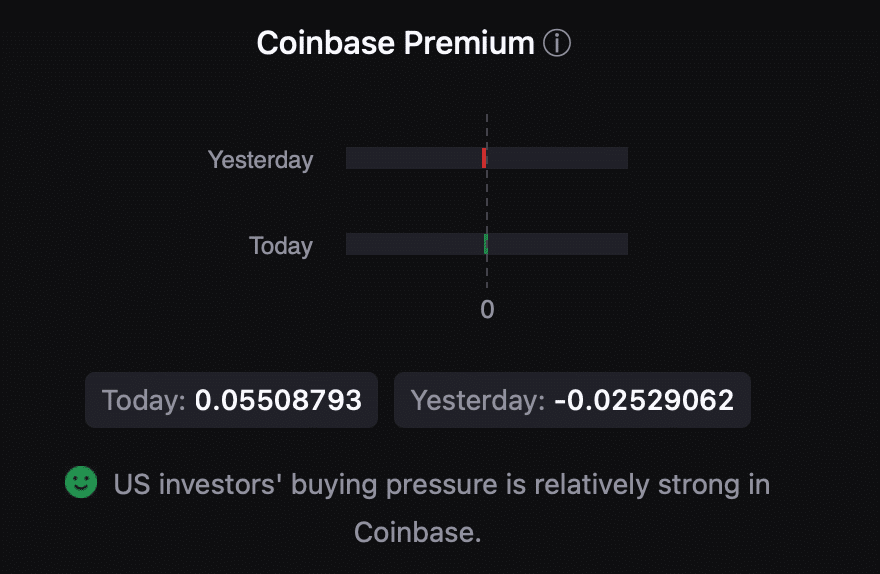

Additionally, the premium on Ethereum’s Coinbase platform was positive for US investors, signaling robust demand.

In addition to this, AMBCrypto mentioned earlier that investors have been demonstrating faith in Ethereum (ETH). Notably, ETH’s taker buy-to-sell ratio has shown significant increases beyond the mark of 1 in recent weeks. This ratio being above 1 signifies robust buying activity from bulls.

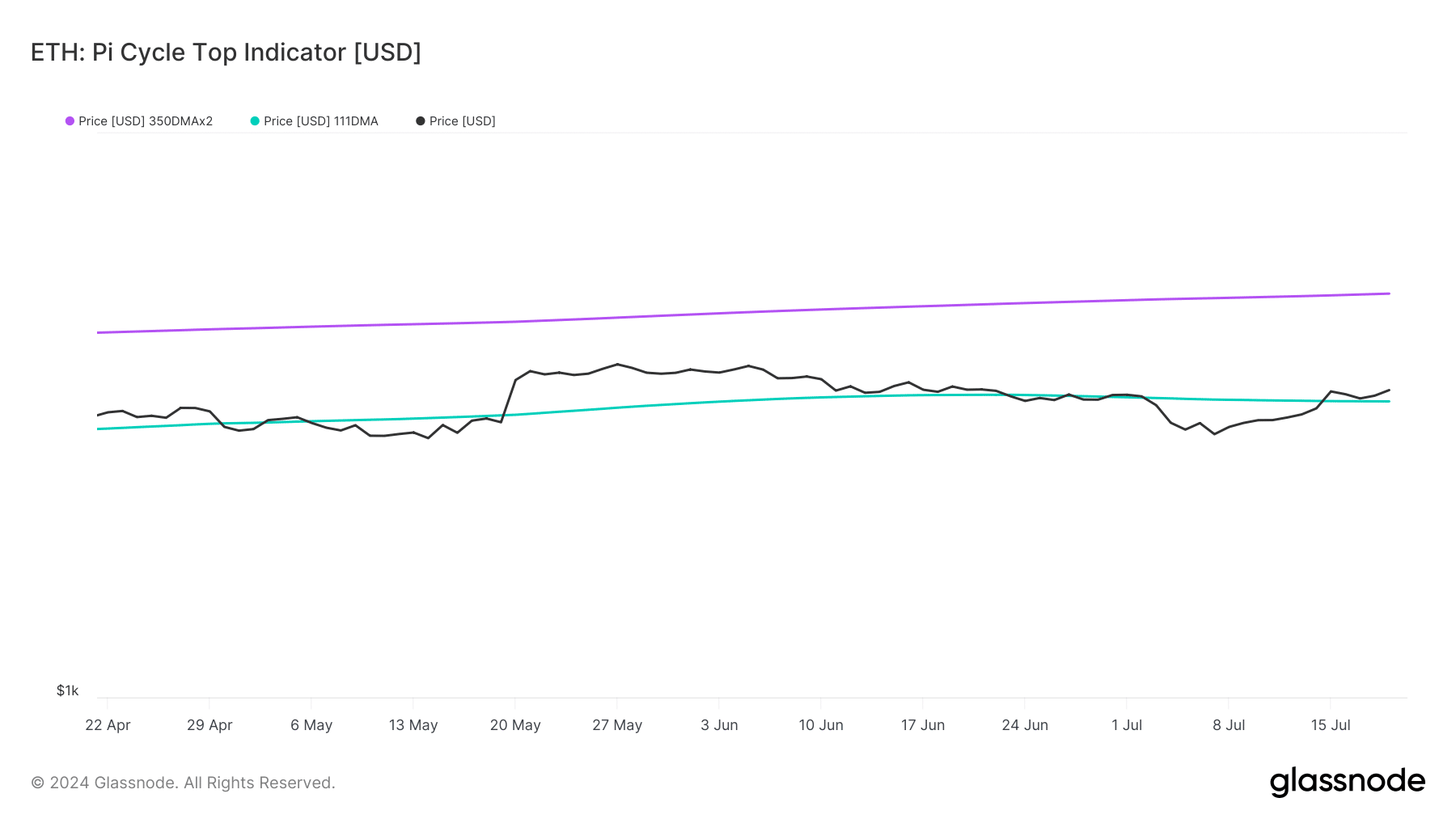

After examining the information provided by Glassnode, we considered potential directions for Ethereum’s price trend should the current bull market persist.

As a researcher studying cryptocurrency trends, based on the Pi Cycle Top indicator, it appears that Ethereum’s (ETH) price has begun to rise above its potential market bottom. If this indication holds true, then ETH could reach $5,000 in the upcoming months.

Is a further uptrend likely?

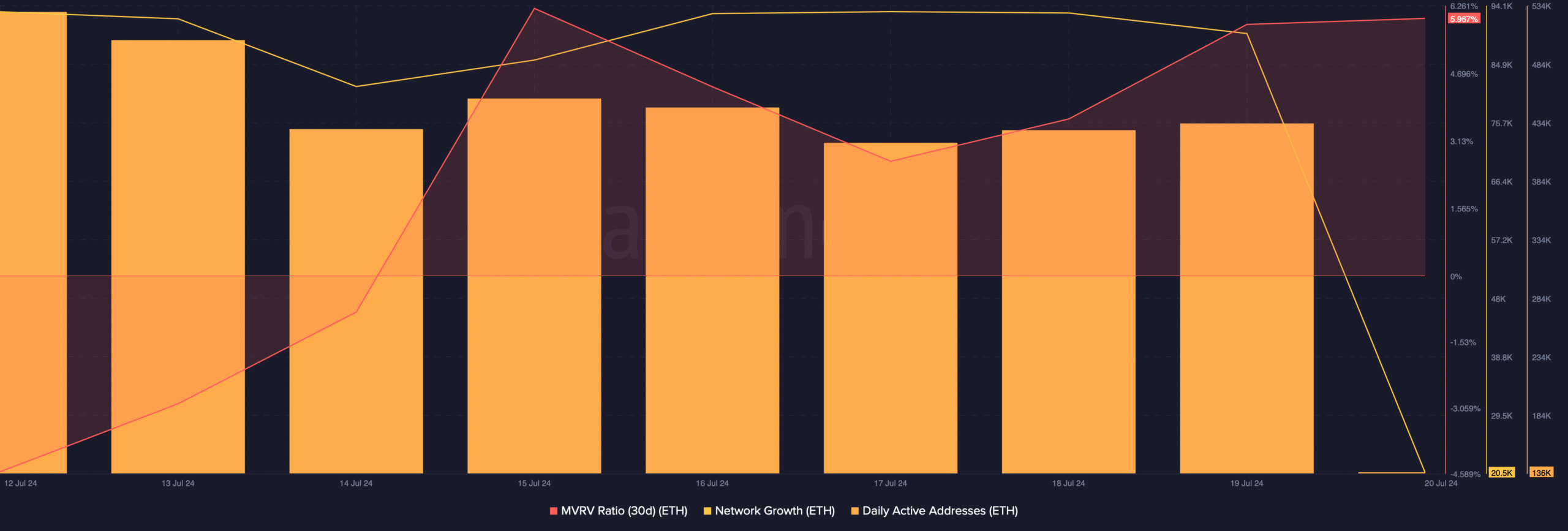

As a researcher at AMBCrypto, I delved into Santiment’s data to evaluate the possibility of Bitcoin reaching $5k in the near future. Upon examination, I noted a significant increase in their MVRV (Market Value to Realized Value) ratio. This upward trend is often considered a bullish indicator.

As of the moment this article is being published, Ethereum’s MVRV (Major Value Realized vs Realized) ratio stood at more than 5.97%. This figure suggests that a significant portion of Ethereum tokens have been sold at prices higher than their previous purchase prices. Furthermore, Ethereum’s network expansion was notable, signifying an increase in the number of new addresses being utilized to transfer the token. Moreover, last week saw consistent activity from daily active addresses, demonstrating a strong level of engagement within the Ethereum network.

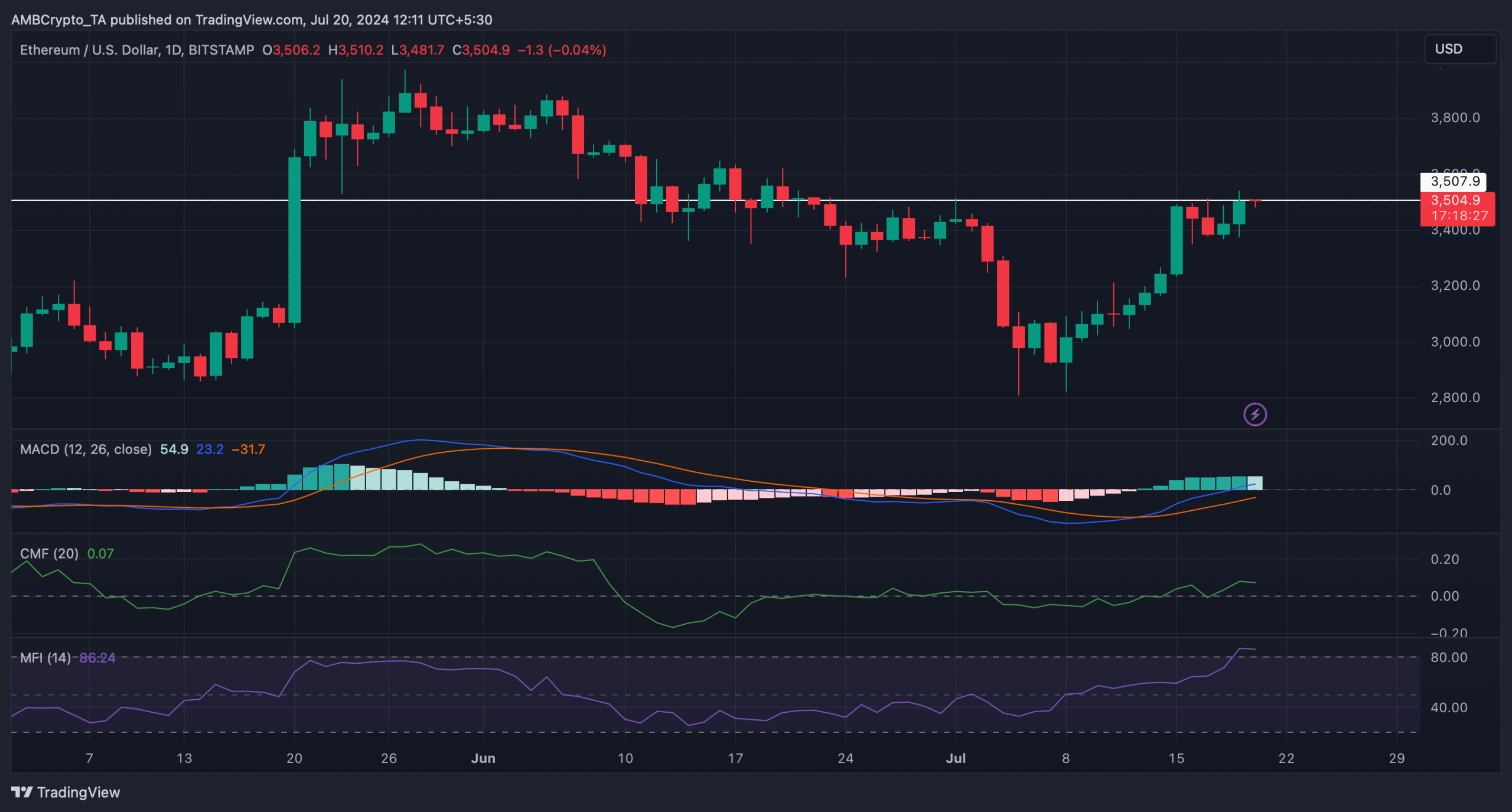

Based on my extensive experience in analyzing cryptocurrency markets and studying technical indicators, I can confidently say that during my observations, the MACD (Moving Average Convergence Divergence) indicator has shown a distinct bullish edge for Ethereum (ETH). However, at this very moment, Ethereum is facing a significant resistance level. In order for Ethereum to maintain its upward momentum and continue its bull rally, it must manage to surpass this hurdle. My personal experience in following the market trends has taught me that a strong breakthrough above such crucial resistance can lead to substantial gains.

The Money Flow Index (MFI) indicated that the asset was overbought, potentially leading to increased selling activity in the near future.

Read Ethereum’s [ETH] Price Prediction 2024-25

Additionally, the Chaikin Money Flow (CMF) also registered a downtick.

Based on the combined analysis of these signs, it seemed that Ethereum may require additional time before surpassing its resistance mark on the graphs.

Read More

- DOP PREDICTION. DOP cryptocurrency

- STOG PREDICTION. STOG cryptocurrency

- LDO PREDICTION. LDO cryptocurrency

- MOCHI PREDICTION. MOCHI cryptocurrency

- FLUX PREDICTION. FLUX cryptocurrency

- KAI PREDICTION. KAI cryptocurrency

- CATHEON PREDICTION. CATHEON cryptocurrency

- VEXT PREDICTION. VEXT cryptocurrency

- BRETT PREDICTION. BRETT cryptocurrency

- Whales fuel PEPE: Short-term gains for sure, but what about the long-term?

2024-07-20 20:08