- Injective’s latest update could have big implications for the protocol and INJ’s price

- At the time of writing, the altcoin’s price action was stagnant though

As a seasoned researcher with extensive experience in the blockchain and crypto space, I have closely followed Injective’s journey and its latest development is particularly noteworthy. The announcement of the first exchange-traded product (ETP) for Injective, AINJ, could indeed bring significant implications for the protocol and INJ’s price.

The Injective protocol made headlines today with its announcement of launching the first exchange-traded product (ETP) named AINJ. This ETP will be issued by 21Shares. This groundbreaking move could set a significant trend, enabling investors in conventional finance to gain exposure to blockchain and cryptocurrencies.

Based on the official statement, this achievement signifies a significant advancement for Injective as part of its strategy to merge with conventional financial sectors. Specifically, the unveiled Exchange-Traded Product (ETP) will enable traditional investors to reap the rewards of staking.

Impact on Injective protocol

Major institutions have the opportunity to invest in Injective’s protocol through the AINJ Exchange-Traded Product (ETP), which ensures transparency and adherence to regulatory standards.

If we’re able to tap into institutional liquidity from conventional investment markets, Injective would significantly accelerate its utility.

Will Injective ETP launch affect INJ’s price action?

The increase in institutional liquidity flowing into the Injective protocol via AINJ ETP can boost the protocol’s functionality and enhance the demand for INJ. Consequently, this development could push up the token’s price, making it an attractive investment for long-term holders. Ultimately, such a trend could result in sustained price growth.

Upon examining INJ’s price movements, it appeared that the announcement did not result in a substantial price increase. At the point of writing, INJ was priced at $26.85. However, this level seemed to present some resistance, indicating a decrease in demand compared to the heightened interest following its recent rebound from monthly lows.

Although INJ’s short-term results don’t reveal any significant influence from the AINJ Employee Training Program (ETP), the program’s effects could surface in the future.

Regarding the current situation, we analyzed INJ’s transaction and address interactions to determine the status of the network.

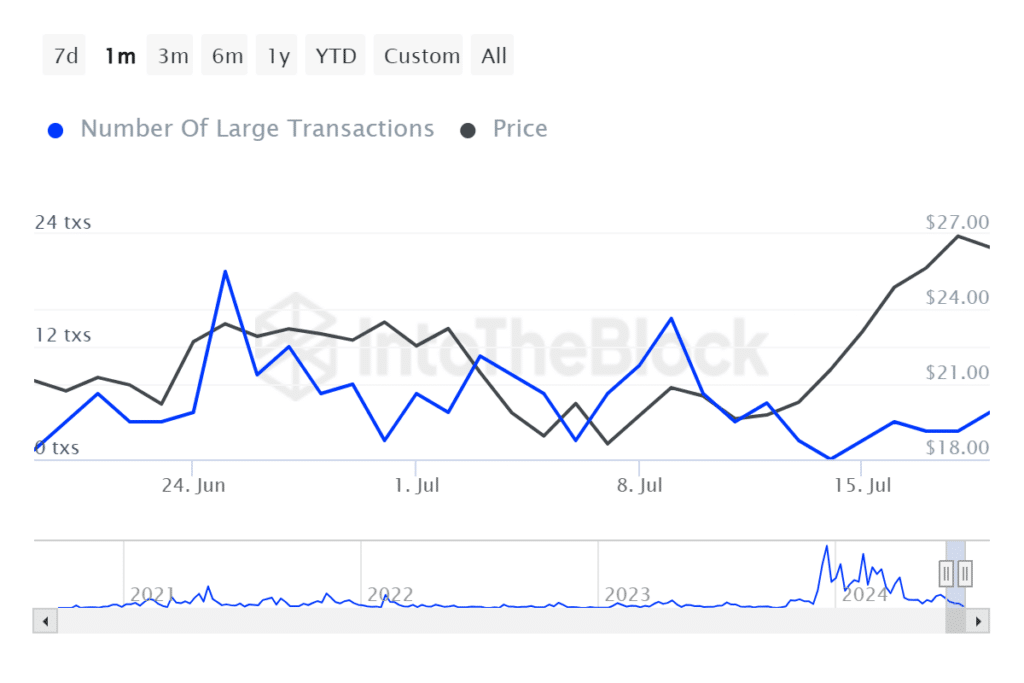

Since July 14th, there’s been a slight increase in the number of large transactions, valued over $100,000 each. However, the total count of these transactions has stayed relatively small, indicating a subdued transactional activity.

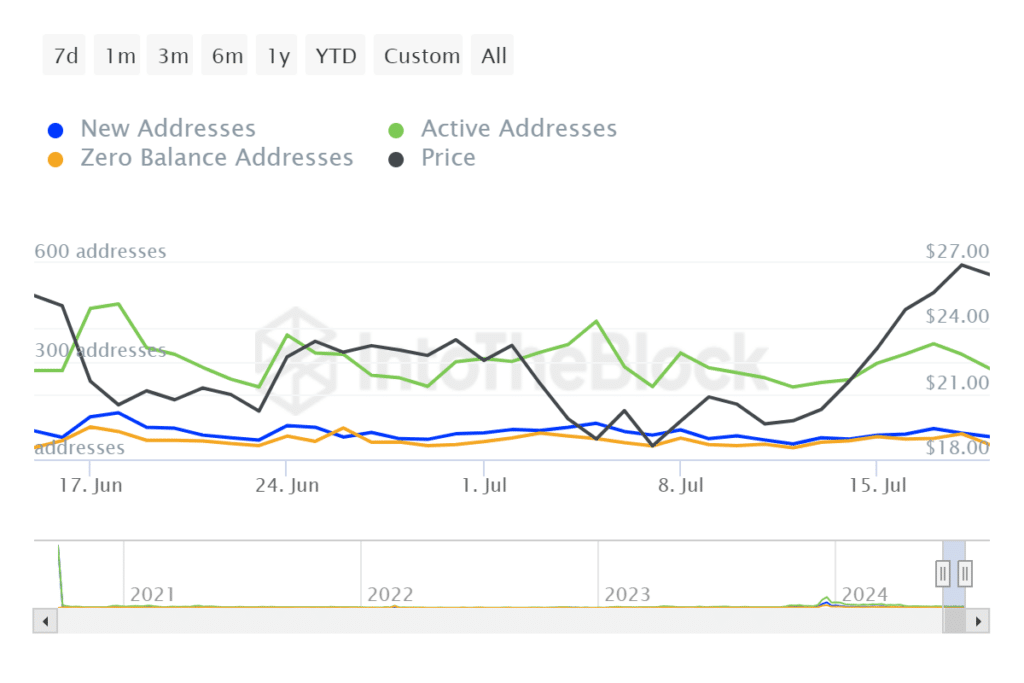

During the same week, we noticed a slight increase in both the total number of active addresses and the number of new addresses.

Nevertheless, the numbers remained within modest levels and even slowed down over the last 2 days.

In simpler terms, examining previousment mentioned blockchain statistics indicated a recuperation in INJ’s demand, though it’s a gradual process. This could potentially cap INJ’s gains in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-20 22:15