-

INJ bulls might be running out of steam.

A breakout past $29.68 would be a sign of another impulse move higher, but was unlikely.

As a seasoned financial analyst with extensive experience in the crypto market, I have closely monitored Injective [INJ] and its recent price movements. Based on my analysis of the charts and technical indicators, I believe that INJ bulls might be running out of steam.

The price of INJ was sitting at $27.5 or lower, falling short of the 50% resistance level of Fibonacci at $29.6. Simultaneously, Bitcoin experienced a surge from $57,300 to $67,600.

Traders specializing in buying stocks (injective traders) are optimistic about upcoming price increases. The stock’s price surpassing the previous resistance level at $24.27 has shifted the trend, making it bullish. Consequently, there was a push towards the channel’s resistance line.

Will the descending channel yield in the face of bullish pressure?

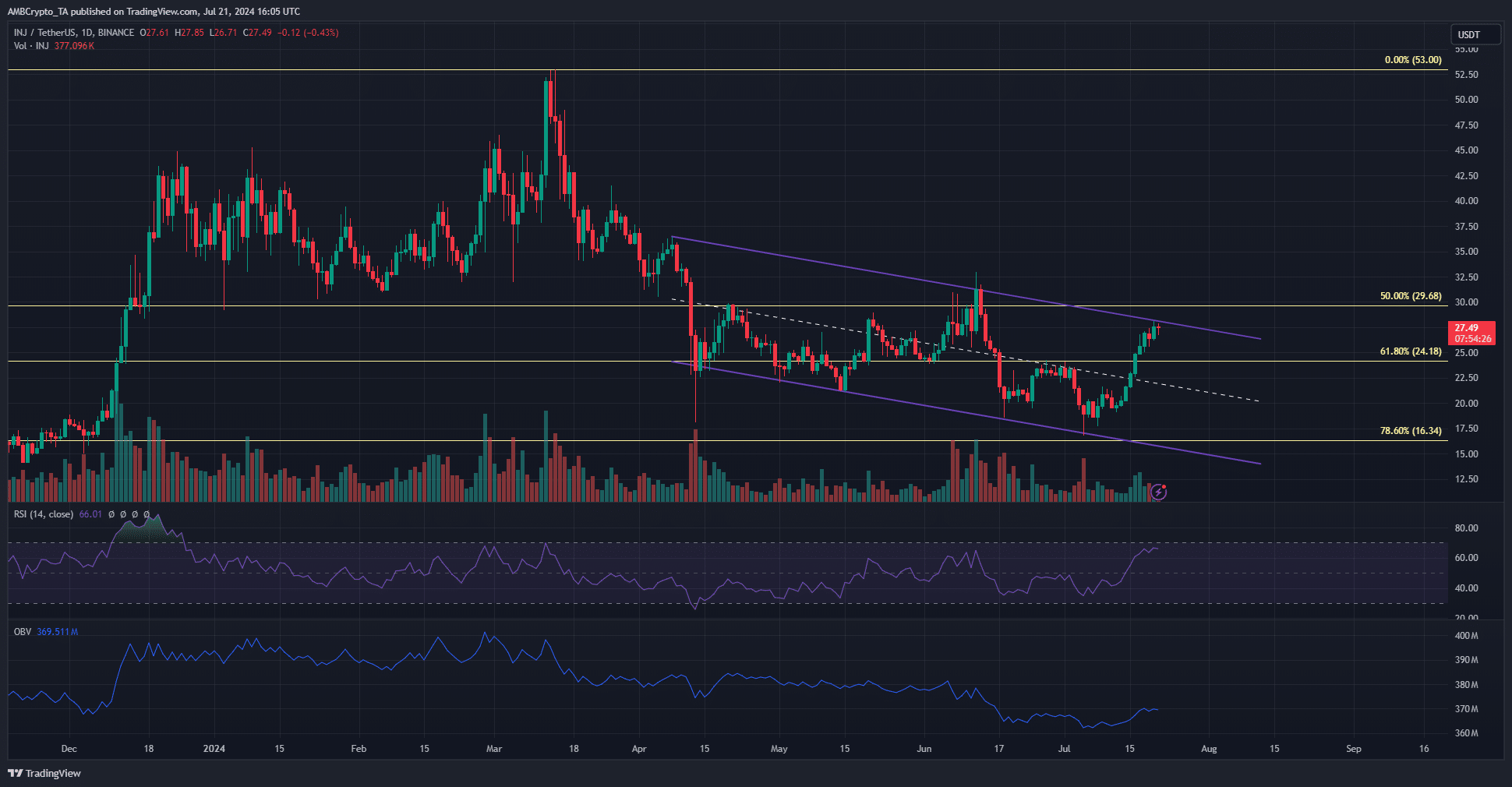

On the daily chart, INJ has been forming a downward trendline channel since early April, as indicated by the purple line. As of now, this channel is being put to the test at the resistance level of $28.2. An additional potential obstacle for buyers lies at the overhead Fibonacci retracement level.

As a crypto investor, I’ve noticed that defending the $20 level for the past two months was reassuring. However, the overall trend has been bearish since the price declines in late March. The brief rallies during this downtrend feel like temporary respites rather than genuine market structure breaks.

The observation that persistent weakness among buyers and potential price surges being caused by market liquidity rather than genuine demand was supported by the analysis of On-Balance Volume (OBV). This volume indicator showed a continuous decrease in trading activity, suggesting it was highly unlikely for there to be a significant breakout above the established resistance levels.

In the southern sector, the prices may rebound from the $21.5-$22 area or the $24.18 mark if they encounter resistance at the $27.5 level.

Accumulation signals are in place but Injective traders must beware of this

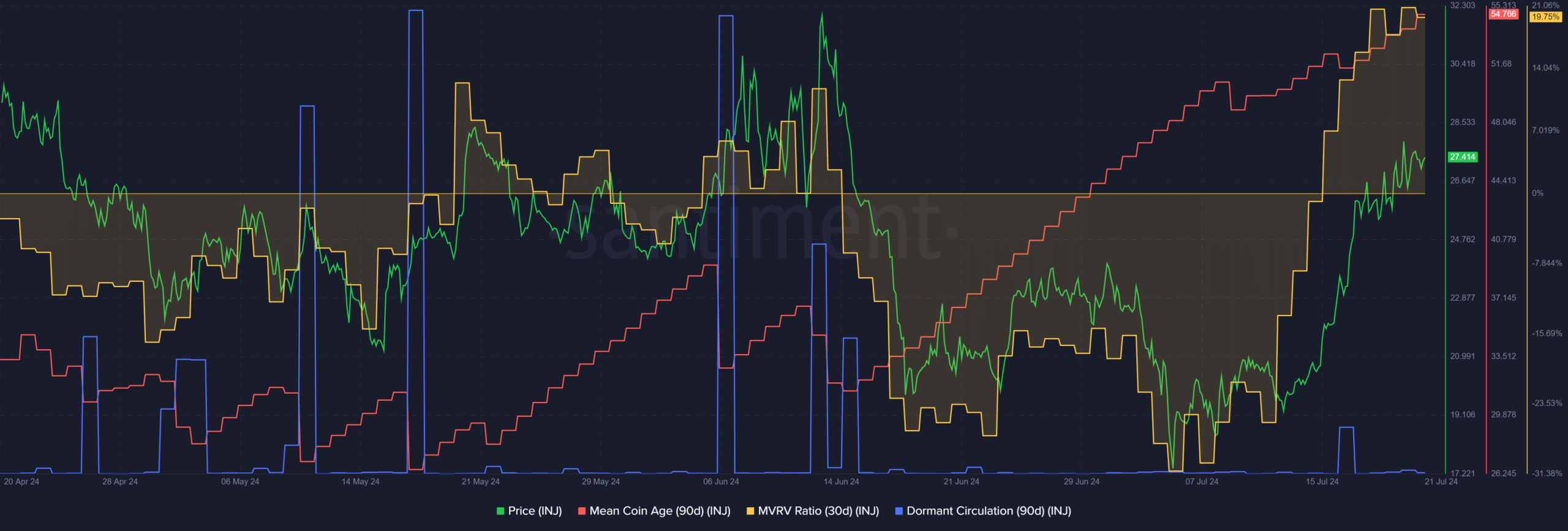

The 30-day MVRR (Moving Average Realized Value) ratio stood at a substantial 19.75% gain for INJ holders, indicating they had reaped significant profits in a short time frame. This profit taking could potentially trigger a selling spree. Conversely, the increasing average coin age indicated that the network as a whole was accumulating more coins.

Since mid-June, the circulation, which had previously been dormant, has remained at a comparatively low level. A significant increase in this indicator could be an early warning sign for a surge in selling activity.

Realistic or not, here’s INJ’s market cap in BTC’s terms

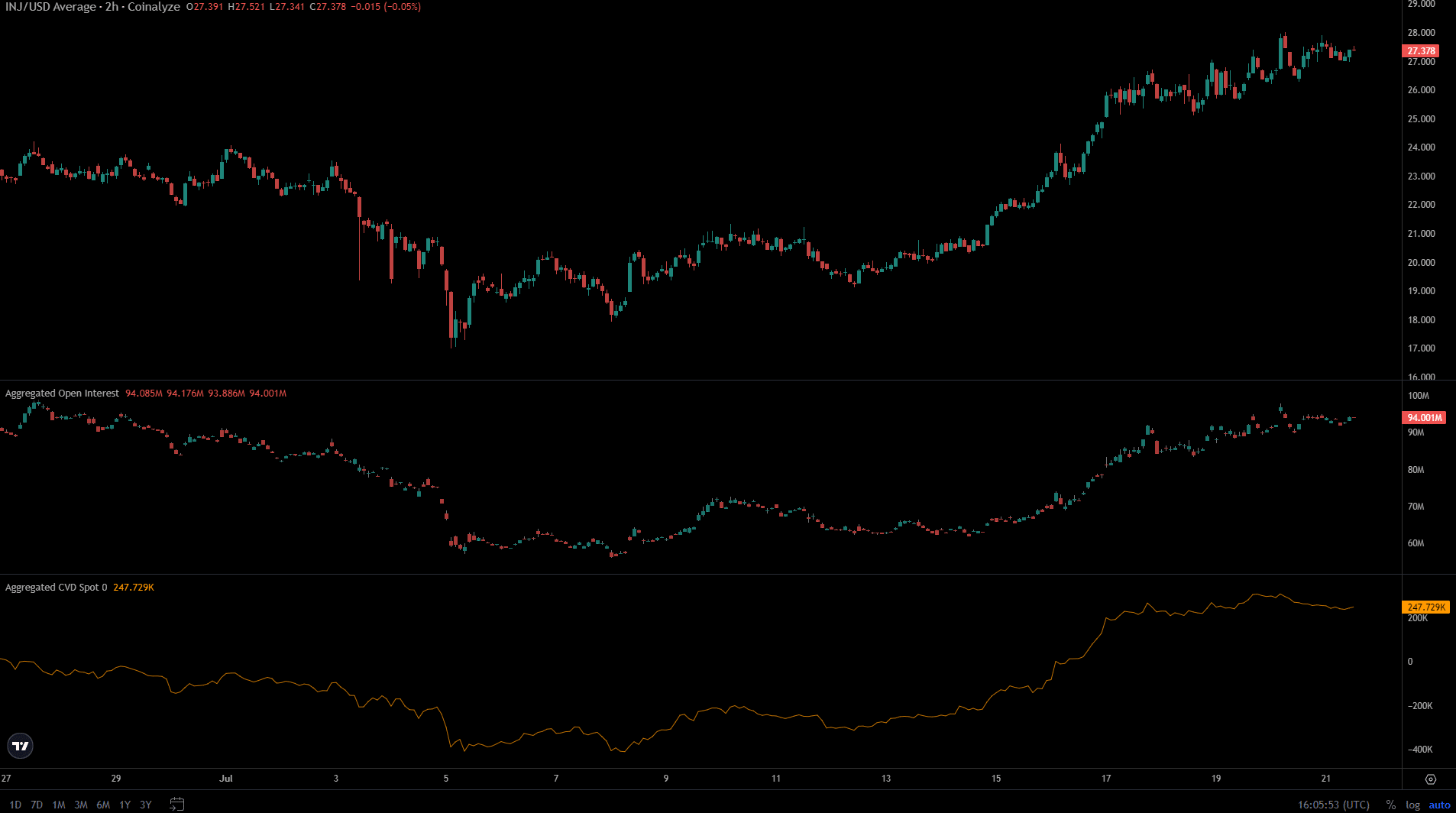

The Open Interest continued to increase but its growth rate has decelerated since the 17th of July. Similarly, the CVD spot prices have halted their advancement over the previous four days. This pattern implies that the demand pushing the markets higher has lessened.

Although the positive signals were building up, there were signs of waning short-term optimism and decreased demand, suggesting that a market correction might be imminent.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

2024-07-22 08:07