-

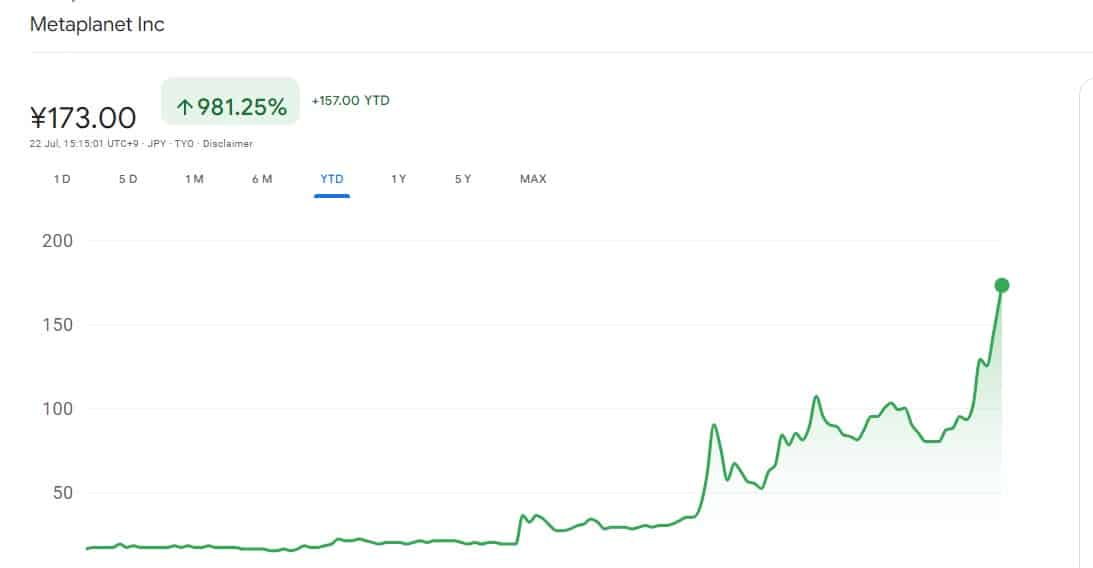

Metaplanet soared over 900% YTD as its BTC strategy paid off.

Metaplanet has been accumulating BTC over the last two months, totaling to 225.611 BTC

As a seasoned researcher with extensive experience in the financial industry, I have closely followed Metaplanet’s strategic moves in the Bitcoin market over the past few months. And I must admit, their bold decision to accumulate large amounts of BTC has paid off handsomely.

During the course of the year, numerous leading corporations have been utilizing Bitcoin (BTC) as a means to enhance their stocks. Metaplanet, a pioneering Japanese business, has played a pivotal role in fueling institutional investment in Bitcoin.

Metaplanet’s strategy pays off

For the past two months, Metaplanet has actively acquired Bitcoins, expanding its cryptocurrency reserves. On May 28, 2024, the corporation disclosed the acquisition of Bitcoins valued at approximately $1.6 million.

As a researcher, I’ve discovered that in the earlier part of the month, Metaplanet acquired 19.87 Bitcoins valued at approximately $1.7 million. Later in June, they made another purchase consisting of 23.25 Bitcoins, equating to around $1.59 million. The combined value of these two transactions reached a substantial total of $141.07 million.

So far in July, the company has acquired an additional 21.877 Bitcoins, adding to its existing stash, bringing the current Bitcoin holdings to a total of 245.611 BTC. This equates to a value of approximately $14.8 million at present market rates.

Metaplanet’s strategic BTC accumulation over the past months has seen its stock rise exponentially.

Metaplanet’s significant purchases have proven beneficial, now ranking as the 20th largest corporate Bitcoin holder based on CoinGecko’s latest report.

Over the last 24 hours, Metaplanet’s shares have experienced a significant increase of 19.31%, while the ownership of Bitcoin (BTC) has progressively grown, resulting in its value soaring exponentially.

Based on Google Finance’s data, their shares have experienced a significant increase of 51.75% in just the previous five days, and a remarkable jump of approximately 82% within the past month. This recent growth has propelled the year-to-date percentage to exceed 900%.

The rising value of their Bitcoin holdings indicates that their decision to adopt it as a primary reserve asset has been highly profitable.

Bitcoin as an alternative in Japan?

Among the developed and G-7 economies, Japan’s has endured greater hardships than any other.

To mitigate risks arising from a sluggish economy, Metaplanet has devised strategies.

As an analyst, I would express it this way: My current analysis reveals that Japan’s national debt stands at a substantial 261% of its Gross Domestic Product (GDP). This significant debt load has been putting pressure on the Japanese Yen. At present, one US dollar is equivalent to approximately 156.70 Japanese Yen in the foreign exchange market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Metaplanet decided to add Bitcoin to its corporate assets in their treasury, as a means of countering the substantial depreciation of the Yen over the past year.

Metaplanet intends to capitalize on Bitcoin’s anticipated continued expansion beyond $100k by 2024, in order to enhance its own stock value.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Quick Guide: Finding Garlic in Oblivion Remastered

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-07-22 17:12