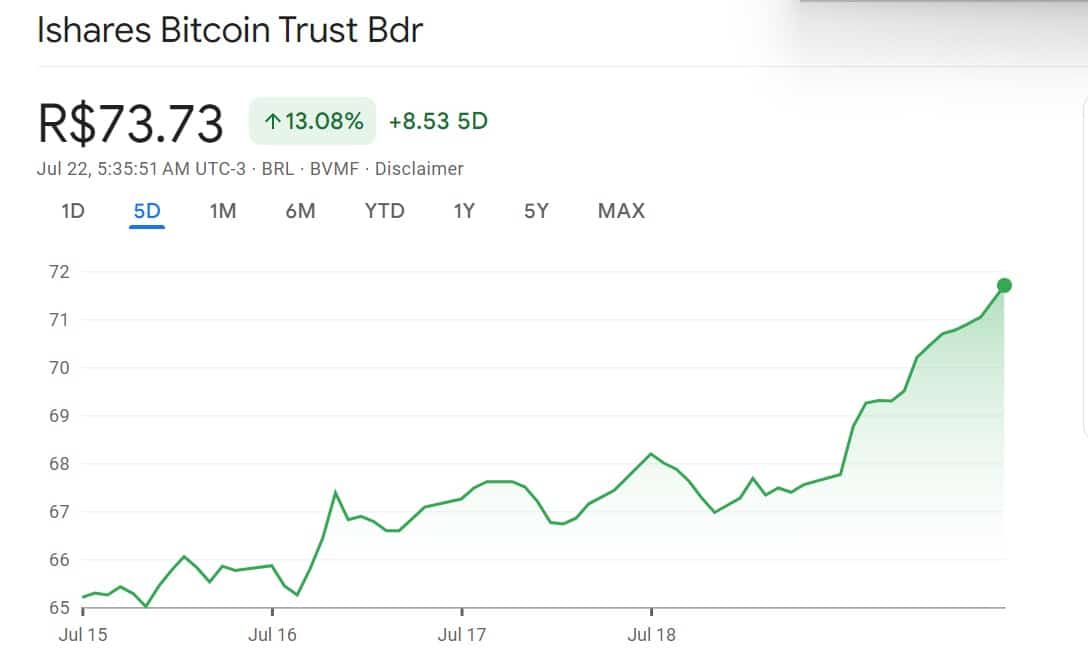

- iShares’ Bitcoin Trust stock rose by 13% in five days.

- Blackrock and Trump’s possible political partnership and ETF inflows are some factors driving the surge.

As a seasoned financial analyst with over two decades of experience in the industry, I have witnessed numerous market trends come and go. However, the recent surge in iShares’ Bitcoin Trust stock has piqued my interest like no other.

In the early part of the year, the value of iShares’ Bitcoin Trust (BTC) surged significantly due to the acceptance of Bitcoin spot Exchange-Traded Funds (ETFs). Furthermore, Blackrock reached an unprecedented milestone with a staggering $10.6 trillion in assets under their management.

The report states that the company contributed a total of $83 billion to Exchange-Traded Funds (ETFs). The CEO attributed this expansion to robust inflows into ETFs.

In contrast to the expansion of the company, the value of iShares’ Bitcoin Trust stocks has dropped by 1.69% over the past half-year, as indicated by Google Finance.

In contrast to recent downturns, the company’s stock has experienced significant gains in the last week and month. Specifically, there has been a 13.08% increase in the past five days, accompanied by a 13.68% rise over the past thirty days.

Recent developments have shifted the conversation towards iShares BTC Trust due to the recent increase in demand. This has sparked debate on the factors fueling this growth.

BlackRock CEO and Trump partnership

In the political landscape of the United States, crypto enthusiasts are making a significant impact as the nation gears up for the 2024 presidential election. Crypto is becoming a focal point in the political discourse.

In an unexpected shift, Donald Trump has emerged as a strong advocate for cryptocurrencies. Recent rumors suggest that he is seriously thinking about appointing Larry Fink, the CEO of BlackRock, as the next Treasury secretary.

As reported on various X (formerly Twitter) pages, as noted by Satyam Singh,

“Donald Trump is considering #BlackRock CEO Larry Fink as Treasury Secretary.”

As a dedicated researcher delving into the dynamic world of cryptocurrencies, I’ve come across an intriguing development: the buzz surrounding potential pro-crypto nominees for the Treasury secretary position has stirred considerable enthusiasm among key players within the crypto sphere. Many in this community firmly believe that such an appointment could mark the end of the ongoing tussle between the SEC and crypto, paving the way for a more constructive relationship between regulators and innovators in this field.

iShares BTC Trust: Increased inflow

As an analyst, I can assert that the approval of Bitcoin Exchange-Traded Funds (ETFs) has significantly transformed the investment landscape for institutional investors. Just last week, we witnessed a massive inflow of approximately $310 million into Bitcoin ETFs in a single day, with iShares taking the lead.

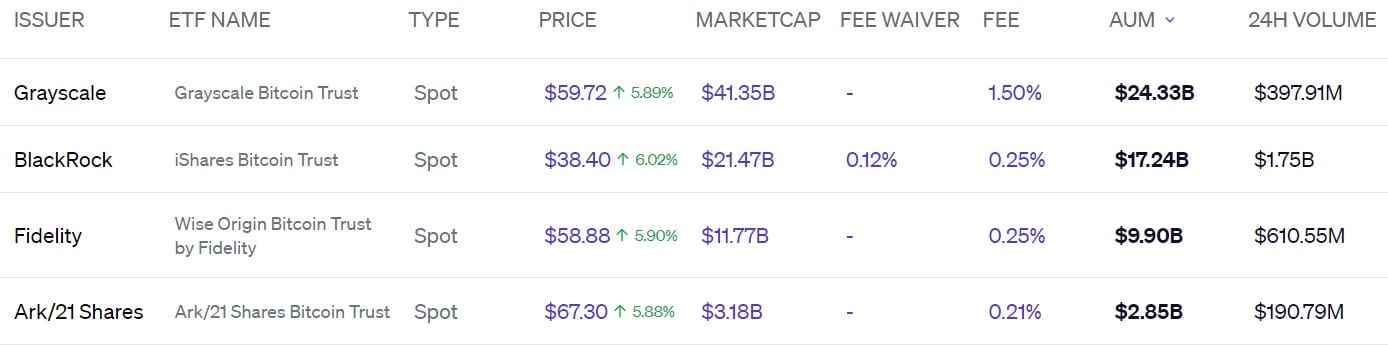

The iShares BTC Trust saw a significant rise in investments mainly due to its affordability, featuring a low expense ratio of 0.25%. This equates to an annual fee of $25 for every $10,000 invested.

Multiple investors have been drawn to the affordable price of iShares, causing some to buy while others, like Nvidia, have sold. Notably, several influential figures have recently acquired shares in the iShares Bitcoin Trust over the past week.

Initially, Ken Griffin from Citadel Advisors began purchasing shares of the iShares Bitcoin Trust following his decision to sell off NVIDIA’s holdings.

David Shaw and Israel Englander significantly increased their ownership of the iShares Bitcoin Trust by acquiring a substantial portion of its shares, placing it among the top investments.

As a researcher, I have observed an influx of assets that has brought our firm’s total asset under management up to an impressive $17.24 billion. Moreover, our daily trading volume now surpasses that of other firms by a significant margin, amounting to approximately $1.78 billion.

Bitcoin, a legitimate financial instrument?

Based on my extensive experience in the financial industry and observing market trends, I can confidently say that the institutional investor sentiment towards Bitcoin (BTC) has undergone a significant transformation. From being cautious observers to active participants, most institutions are now aggressively accumulating BTC, fueled by their belief in higher returns. This shift is a testament to the growing recognition of digital currencies as viable investment assets and their potential to revolutionize traditional finance.

For example, BlackRock has advocated for Bitcoin loudly, contributing to the surge in investments towards iShares Bitcoin Trust.

Read Bitcoin’s [BTC] Price Prediction 2024-25

During a CNBC interview, Larry Fink, the CEO of BlackRock, acknowledged that Bitcoin has a place as a valid financial asset.

Larry’s endorsement carries weight since it reassures potential investors about the merit of adding Bitcoin ETFs to their investment portfolios. The growing interest in iShares’ Bitcoin stock makes it a prime candidate for substantial growth, as an increasing number of investors look to enter this market.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-07-22 23:04