Ah, the sweet scent of bull markets—Ethereum‘s back at it again, strutting its way to $3,000 like it’s auditioning for a role in the “crypto blockbuster of the decade.” Analyst whispers now tell tales of a dizzying $8,000 target by 2025. Hold onto your hats, because with Ethereum’s recent upgrades and staking rewards, we’re looking at the next digital revolution. Or is it? 🤔

ETH Price Rallies on ETF Surge and Technical Breakout

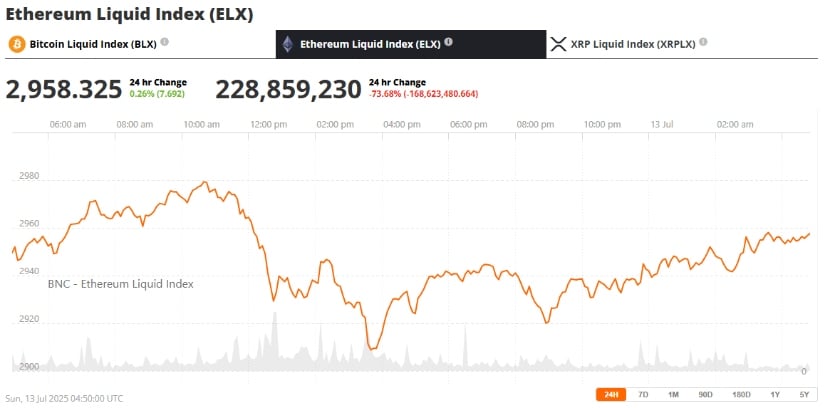

Ethereum is on fire—or rather, it’s sizzling, flirting with that sweet $3,000 mark, after a wild ride on the ETF surge. The surge in ETF inflows and a fresh wave of enthusiasm across the Layer-2 ecosystem helped ETH leap over $3,000 this week. By July 13, ETH was playing peekaboo with $2,951, up by more than 5% from the previous week. This price action marks a 30% recovery from June’s sob story of lows near $2,100, setting ETH up for what could be an even crazier ride to new highs by 2025. 🎢

What’s cooking? A crazy $907.99 million in Ethereum ETF inflows this week alone. That’s the highest since July 2024. “Three of ETH ETF’s top 10 inflow days happened this week,” says Nate Geraci, the analyst whispering sweet nothings about how institutional investors are falling head over heels for ETH. 📈

Market Overview: Key Resistance Levels and Technical Forecast

Ethereum has punched through key resistance at $2,836.5, and it’s now playfully teasing the $3,039 mark. Analysts have their eyes on $3,200 as the next Everest to climb. A clean break here? Well, they’re eyeing an 80% upside, with potential targets reaching between $3,629 and $8,000 by 2025. What’s that? A golden future? Maybe. Maybe not. 💰

Watch for a weekly close above $2,836 to signal a bullish trend. This would align perfectly with Fibonacci’s 161.8% extension—who knew math could sound so sexy? 🚀

Layer-2 Ecosystem Sees Explosive Growth

Beyond the charts and numbers, Ethereum’s Layer-2 (L2) ecosystem is expanding like the plot of an epic soap opera. Arbitrum, Optimism, and Base have all seen sharp increases in active users and Total Value Locked (TVL). And get this: combined L2 transactions are now surpassing the mainnet. Yes, it’s true—Ethereum’s scalability is finally growing up. 🎓

How’s this happening? Falling gas fees and improved user experience, thanks to upgrades like EIP-4844. Not to mention the anticipated “Pectra” upgrade in Q4 2025. Ethereum is ready to roll out the red carpet for dApp developers and users. But will they show up? 👀

Ethereum ETF News: Wall Street’s Growing Interest

On Wall Street, Ethereum is now the favorite child. BlackRock’s Ethereum ETF holdings have crossed 2 million ETH, worth over $300 million. In contrast, Bitcoin is… well, just chilling. The shift in institutional interest is as subtle as a wrecking ball. 🎯

“Institutions are buying more ETH than BTC,” says an analyst, as though it’s the crypto equivalent of switching teams mid-game. Ethereum is increasingly seen as a yield-bearing asset. Get in line, folks. Staking rewards, broad DeFi utility, and future upgrades make ETH an asset you might want to consider, unless you enjoy missing out. 😜

Ethereum vs Bitcoin 2025: Is a Flippening Possible?

Bitcoin might still be the crypto king, but Ethereum is pulling a fast one. The real appeal? Ethereum isn’t just digital gold; it’s programmable money that can pay you back. 💵

Final Thoughts: ETH Price Prediction and Future Outlook

Ethereum has dusted itself off and is coming in hot at $3,000. With institutional interest rising, ecosystem upgrades, and bullish indicators, Ethereum could be ready to hit the $3,200 mark in the short term, with dreams of $8,000 by 2025. But remember, folks, crypto is a fickle beast—watch the charts like your life depends on it. 📊

Ethereum’s role in DeFi, NFTs, and tokenization is solidifying its position in the crypto landscape. But don’t get too comfortable—keep an eye on the macroeconomics and regulations. They can turn the tide faster than you can say “blockchain.” 💡

Read More

- Best Controller Settings for ARC Raiders

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- How to Build a Waterfall in Enshrouded

- Meet the cast of Mighty Nein: Every Critical Role character explained

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- Best Werewolf Movies (October 2025)

- These Are the 10 Best Stephen King Movies of All Time

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

2025-07-13 21:24