-

Ripple nears SEC lawsuit resolution, hinting at a bullish future for XRP and an ETF launch by 2025.

Whales buy $84 million in XRP, boosting confidence as technical indicators show bullish momentum.

As a seasoned crypto investor with years of experience in this dynamic market, I find the recent developments surrounding Ripple (XRP) particularly intriguing. Having weathered through multiple market cycles and regulatory uncertainties, I’ve learned to keep a close eye on both company news and broader regulatory trends.

As a researcher studying the cryptocurrency market, I’ve noticed some intriguing advancements that may indicate a potential price increase for XRP. The latest company updates from Ripple and the evolving regulatory landscape are fueling optimism among investors in this digital asset.

As an analyst, I’ve been closely monitoring the developments surrounding Ripple and its native digital asset XRP. The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) has seen some significant progress, which is one of several indicators pointing towards a potentially bullish future for XRP. Furthermore, the possibility of an XRP exchange-traded fund (ETF) being launched is another promising sign that could significantly boost the asset’s value and liquidity in the market.

During an interview with Bloomberg, Ripple CEO Brad Garlinghouse provided insights into the progress of the ongoing legal action brought by the Securities and Exchange Commission (SEC).

Ripple has invested more than $150 million in lawsuits to settle the ongoing courtroom battle over the definition of XRP‘s status in legal terms.

According to Garlinghouse’s statement, there’s a possibility that a private discussion with the SEC on July 25th could resolve the issue at hand. Judge Torres’ recent ruling adds weight to Ripple’s argument that XRP is not classified as a security during secondary sales and transactions conducted via exchanges.

Garlinghouse underscored the importance of clear regulations and called on SEC Chairman Gary Gensler to provide clarity on the ongoing uncertainty. Although he couldn’t discuss a possible settlement explicitly, Garlinghouse hinted at the possibility.

“we can expect a resolution soon.”

The announcement has brought renewed hope among XRP backers, possibly shaping the market’s perspective and potential impact on prices.

Prospects of an ETF

As a crypto investor, I’ve been closely following the developments surrounding Ripple and its native digital asset XRP. In a recent interview with Fox Business, Ripple’s CEO Garlinghouse dropped a hint about a potential XRP Exchange-Traded Fund (ETF) launch in the United States by 2025. Hearing this news firsthand has ignited a wave of anticipation and excitement within our community.

An XRP ETF proposal holds promise, possibly leading to heightened institutional engagement and financial commitment.

The SEC’s decision to greenlight Bitcoin ETFs this year significantly boosted Bitcoin’s value. Some observers anticipate a comparable price surge for XRP once an ETF is approved.

The anticipation of an XRP ETF adds another layer of optimism for XRP’s future price performance.

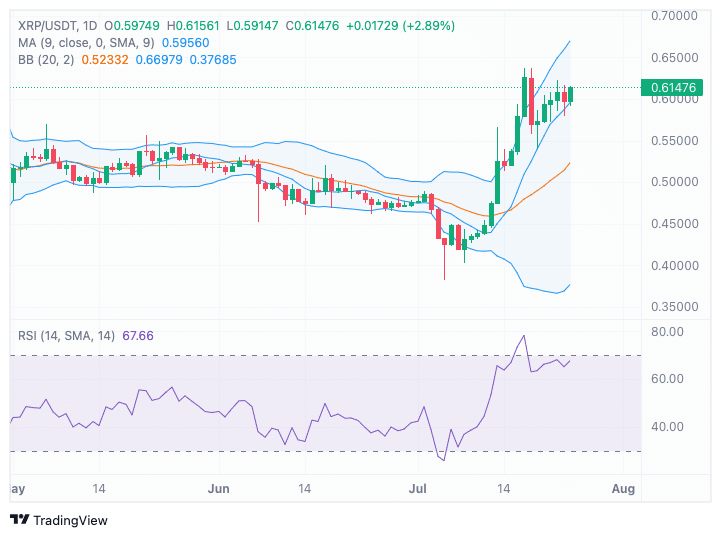

At the moment of publication, XRP was priced at $0.6131, and its trading volume over the past 24 hours reached an impressive $1,812,382,624. This figure marks a noteworthy 1.75% rise compared to the previous 24-hour period.

The moving average for the past nine days is currently at 0.59560 on the technical charts, implying that the market trend remains upward. However, the Bollinger Bands signal heightened volatility, as the price previously spiked up to nearly 0.65 before settling around 0.61.

With a Relative Strength Index of 67.66, the market signal is showing significant buying power, moving closer to the overbought zone but not yet reaching extreme levels. This signifies a robust bullish trend, implying potential for additional gains.

Keeping a close eye on RSI and support indicators is crucial for identifying possible price adjustments or trend shifts.

Whales snap up $84 million in XRP

According to Ali’s latest report from the crypto sphere, there has been notable whale behavior, as they acquired around 140 million XRP, equivalent to around $84 million, within the last week.

The significant build-up of XRP holdings by major investors indicates their belief in XRP’s prospects for future profits.

Realistic or not, here’s XRP market cap in BTC’s terms

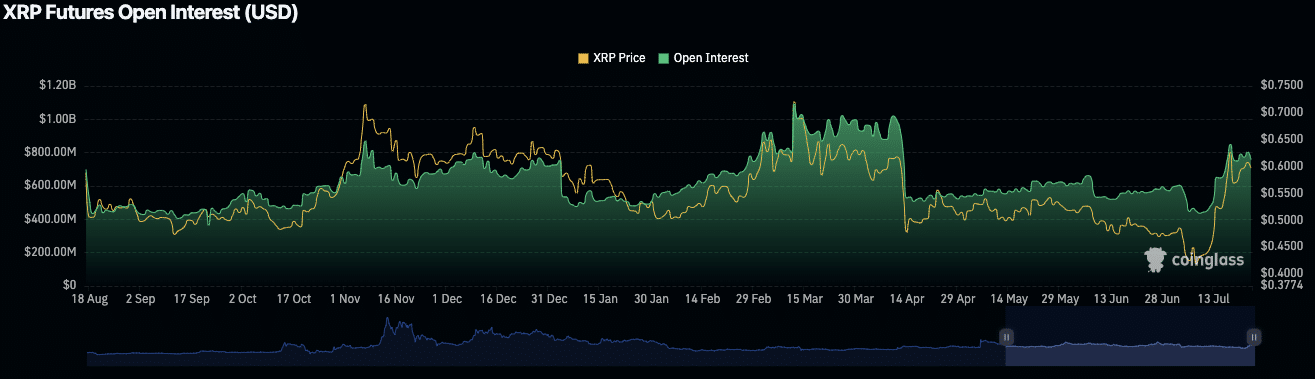

Additionally, the XRP futures open interest amounts to $793.29 million at present, representing a minimal decrease of 0.50%. The options volume reaches $584.98 million, signifying a substantial decline of 46.56%, implying decreased trading activity or waning investor interest.

historically, open interest has reached high points around mid-November and early April, coinciding with substantial price fluctuations.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Solo Leveling Season 3: What Fans Are Really Speculating!

2024-07-25 01:12