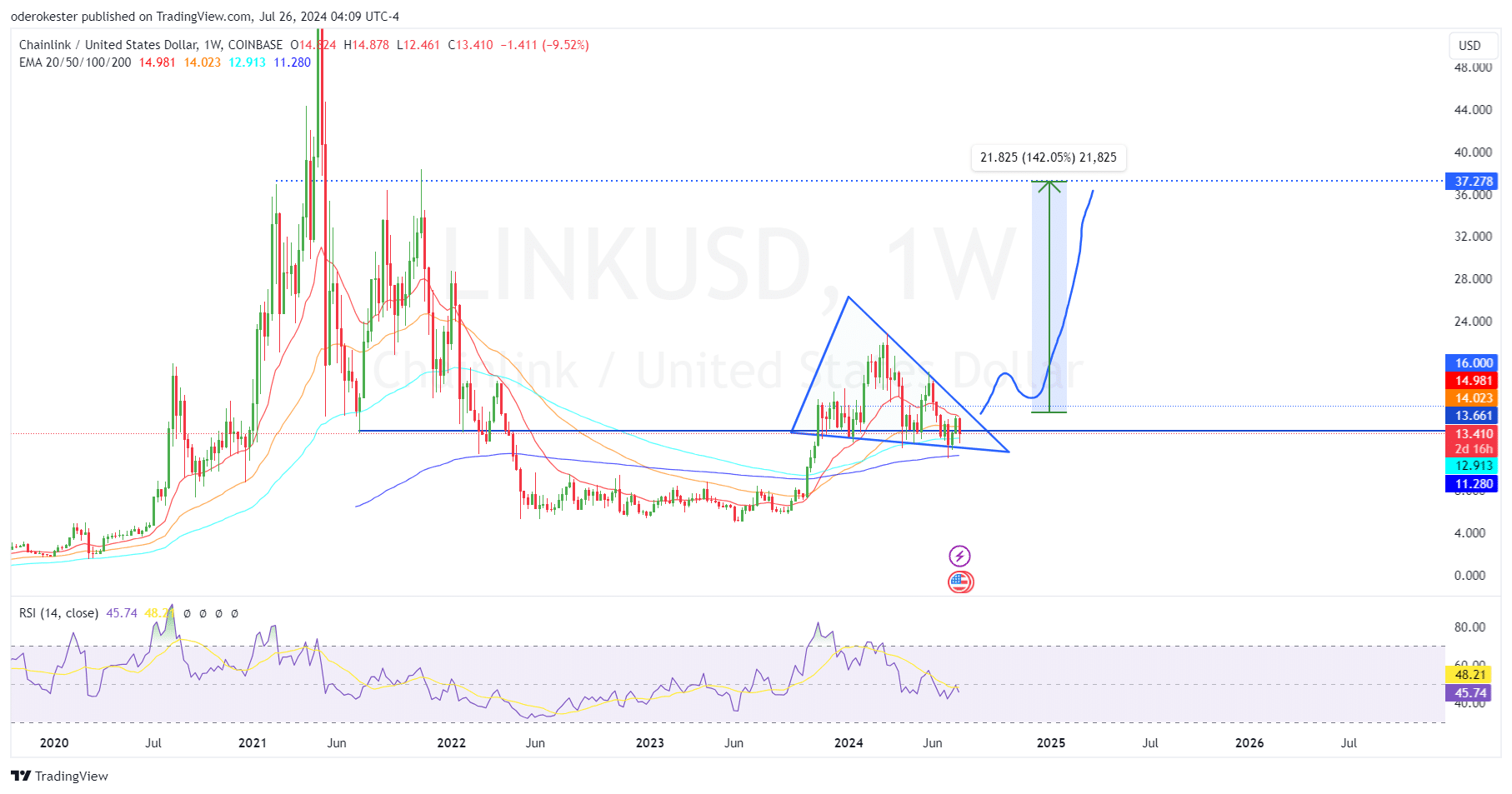

- Chainlink’s symmetrical triangle pattern suggested a potential bullish breakout.

- Breaking the $16 resistance could lead to a significant price surge, with a target price of $37.278.

As a seasoned financial analyst with over a decade of experience in cryptocurrency markets, I’ve witnessed numerous price patterns and trends. The symmetrical triangle pattern emerging on Chainlink’s [LINK] weekly chart is one that I’ve seen many times before, and it usually signals a potential bullish breakout.

At present, the price of Chainlink (LINK) on major cryptocurrency platforms was reportedly $13.42 based on recent market data from Coingecko, representing a noteworthy gain of approximately 3.07% over the previous 24-hour period.

On the weekly chart, a distinctly symmetric triangle formation is apparent. This pattern was formed by connecting the high of $22.87 on March 11th and the low of $11.01 on July 1st.

This pattern suggested a high probability of a bullish breakout.

During his analysis on platform X (previously known as Twitter), cryptocurrency expert Ali pointed out that the TD Sequential indicator signaled a purchase opportunity on the 4-hour chart, further fueling optimistic feelings.

As an analyst, I would anticipate that if LINK successfully breaches the $16.0 resistance level, there could be a significant price increase. Specifically, I estimate this surge could reach as high as 143%, resulting in a projected price of around $37.278.

A potential surge in this coin could indicate a substantial rise in its value, mirroring robust market demand and faith in Chainlink.

Technical analysis and resistance levels

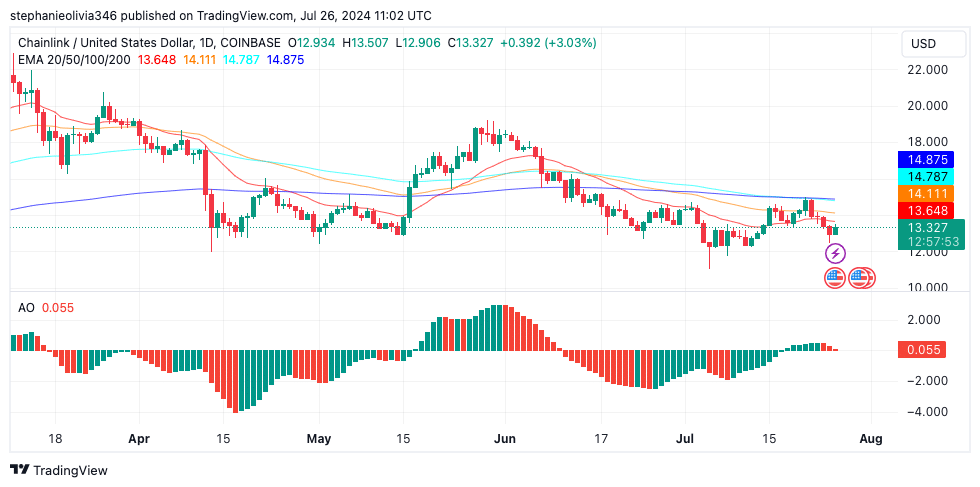

Throughout the first and second quarters of this year, the price of LINK has encountered significant opposition at the $13.66 mark. This resistance has deepened the downtrend, pushing the price down to the supportive trendline at $12.08.

Over the past few days, LINK has rebounded from its support level and reached a new high of $13.42. This price movement aligns with important moving averages (Exponential Moving Averages 20, 50, 100, and 200). Should these levels remain intact, LINK may surge by approximately 27.6%, potentially reaching the weekly resistance at $16.22 once more.

Currently, the Relative Strength Index (RSI) on the daily chart is slightly below the 50 mark, and the Awesome Oscillator (AO) is mirroring this trend.

For a bullish comeback, both indicators must stay above their mean levels.

As an analyst, I would interpret a prolonged upward trend in these indicators as significantly bolstering the ongoing market rally for LINK. This bullish momentum could potentially propel the price of LINK towards the formidable resistance level at $16.22.

Potential downside and key price levels

Even with a positive forecast, a weekly closing price below $11.04 for LINK might undermine the bullish perspective.

In this situation, a significant drop in price for LINK could occur, reaching approximately 60.9% below the current level and touching the weekly lows of $4.996, last seen on June 19, 2023.

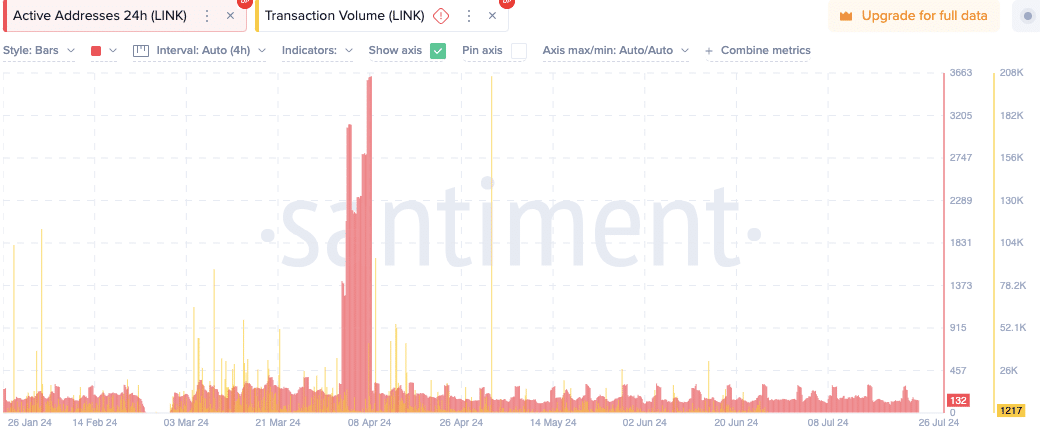

The number of active addresses and transaction volume on the Chainlink network displayed a consistent pattern with the odd surge.

Realistic or not, here’s LINK’s market cap in BTC’s terms

Around the 8th of April 2024, there was a noticeable spike in both measurements, indicating a brief period of heightened activity.

After reaching a peak in April, the metrics have since remained relatively constant, suggesting a period of stability prior and post the surge.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

2024-07-27 07:36