-

On the 25th of July, Marathon Digital purchased $100M worth of Bitcoin.

The firm turns to a HODL strategy, reflecting the long term value of BTC.

As a seasoned researcher with a deep understanding of the Bitcoin market and Marathon Digital’s business strategies, I strongly believe that Marathon Digital’s recent $100M purchase of Bitcoin and commitment to a HODL strategy is a bold move that reflects confidence in the long-term value of Bitcoin.

On July 25th, Marathon Digital, the leading Bitcoin miner, disclosed a $100 million acquisition of the digital currency. Currently, the company owns more than 20,000 Bitcoins, valued at approximately $1.3 billion.

In addition to continued mining and market purchases, the firm is committed to the HODL strategy.

As an analyst, I would interpret this strategy as meaning that Marathon deliberately holds onto its Bitcoins without cashing them out, with the expectation of a surge in demand and subsequent price increases in the future. Marathon explicitly shared this perspective.

“Embracing a complete ‘buy-and-hold’ approach signifies our strong belief in Bitcoin’s enduring worth. We view Bitcoin as the optimal reserve asset globally, advocating for sovereign wealth funds to incorporate it into their portfolios. Our recommendation extends to governments and corporations alike, urging them to consider holding Bitcoin as a valuable addition to their reserves.”

What this strategy means for Bitcoin

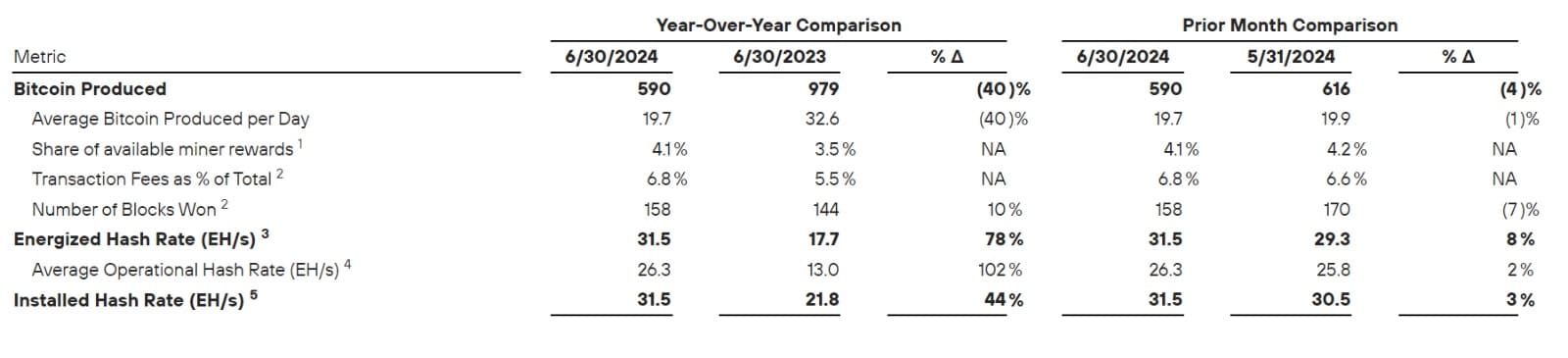

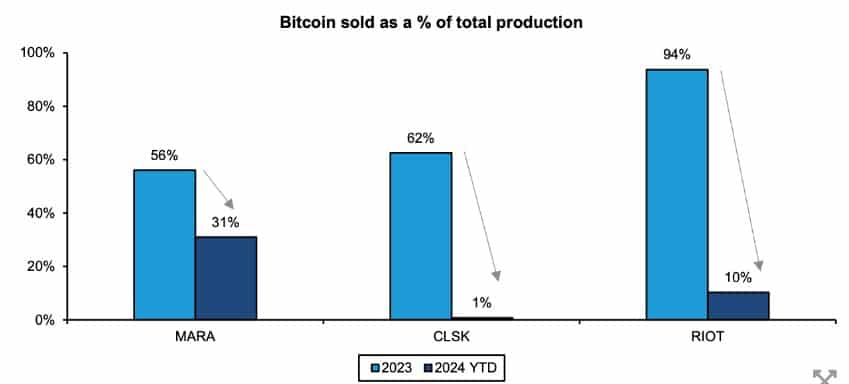

As an analyst, I have observed that Mara significantly scaled back its Bitcoin sales over the past months. Based on Bernstein’s report, Mara decreased its total sales from 56% in 2023 to only 31% in 2024.

With the HODL strategy in place, MARA will have zero sales, as it did prior to 2023.

Regarding Bitcoin, the leading cryptocurrency, it’s projected to increase by approximately 16% of its present value each year, resulting in a market capitalization surpassing $60 trillion.

Due to the projected expansion, MARA’s stock is expected to experience significant growth. Given that its Bitcoin holdings are valued at around $1.3 billion based on the current price, this growth could result in a 208% increase from their current 20,000 BTC holding each year.

The business is expected to persist in its strategic initiatives involving open markets and mining operations, potentially leading to an annual increase in profits of over $500 million.

The decrease of 11.56% in year-to-date stock value is a consequence of persistent Bitcoin sales, resulting in an immediate impact on its market worth.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Investors who adopt Marathon Digital’s strategy of just holding onto Bitcoins could potentially reap rewards, given Bitcoin’s reputation for delivering significant returns to long-term investors.

While I can provide information, please keep in mind that I’m not providing investment advice. Just like with any cryptocurrency, it’s crucial for you to conduct your own research before making any investment decisions.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-07-27 09:46