-

XRP has been consolidating inside the bull pattern since last year.

The token might retest the pattern before beginning a bull rally.

As a seasoned researcher with extensive experience in the cryptocurrency market, I’ve closely monitored XRP‘s price movements and trends over the past year. And based on my analysis of the current situation, I believe XRP is showing signs of a potential bull rally.

As a crypto investor, I’ve noticed that the market took a breather in the past 24 hours with minimal price fluctuations, and my XRP holdings didn’t buck the trend.

It’s possible that XRP‘s weekly price chart is showing signs of a prolonged bullish trend, which could lead to a significant price surge in the near future. This could be a prelude to a more intense market movement.

XRP’s bullish breakout

XRP’s price showed minimal change in the last week according to CoinMarketCap data. Currently, XRP is priced at $0.6024 and boasts a market cap exceeding $33 billion, placing it as the seventh largest cryptocurrency by market capitalization.

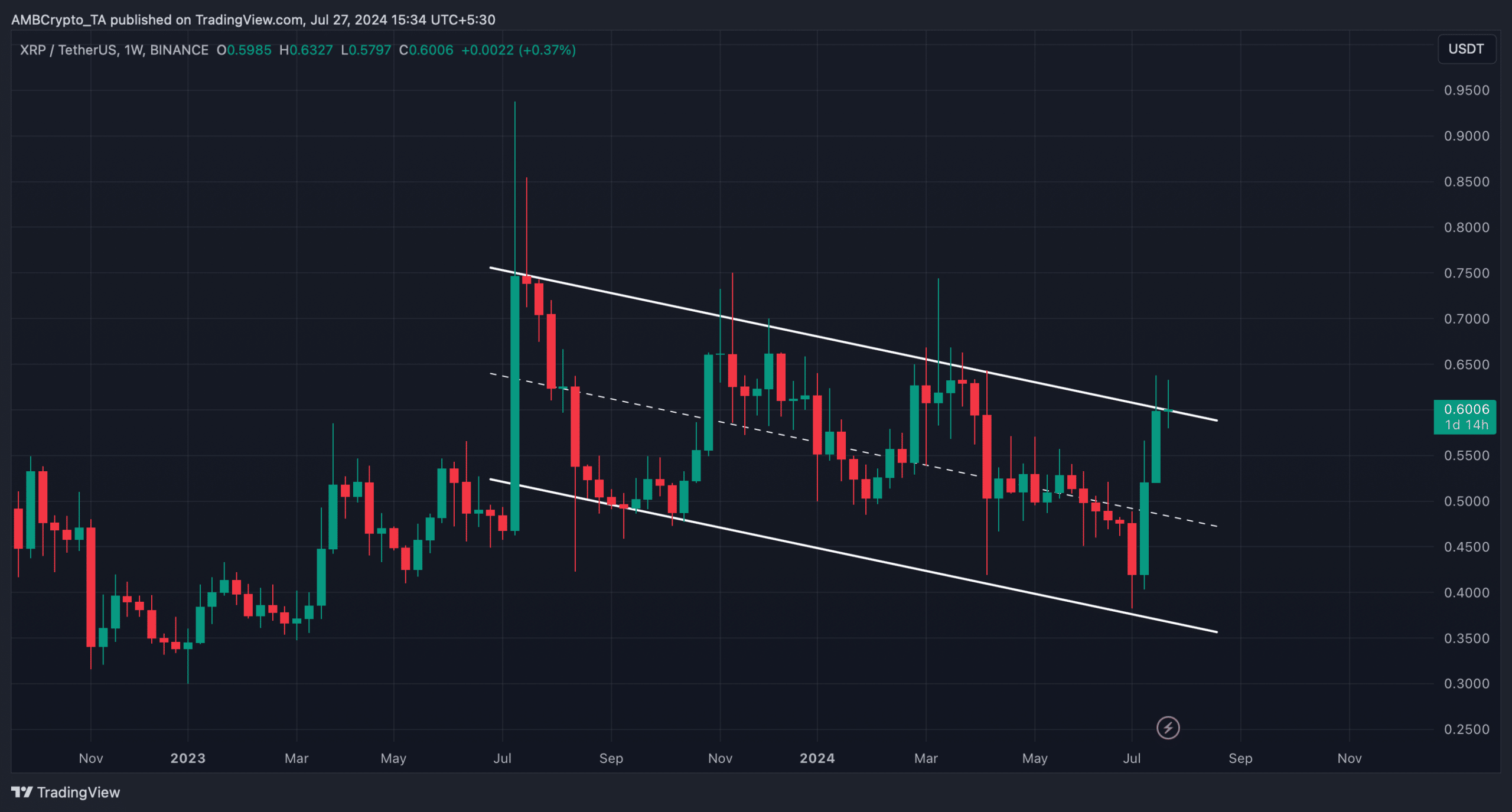

AMBCrypto’s analysis of XRP’s weekly chart revealed a long-term descending channel pattern.

Last summer, around July, a distinct pattern became apparent in the token’s weekly price chart. Ever since that point, its price has been confined to this pattern, with no significant breakthroughs occurring.

At the point of composition, XRP had surpassed the earlier established trendline to bring more optimistic signs. Should this trend hold true, it could potentially lead investors towards a revisit of the token’s 2023 peak levels within the upcoming months.

Will XRP begin a bull rally?

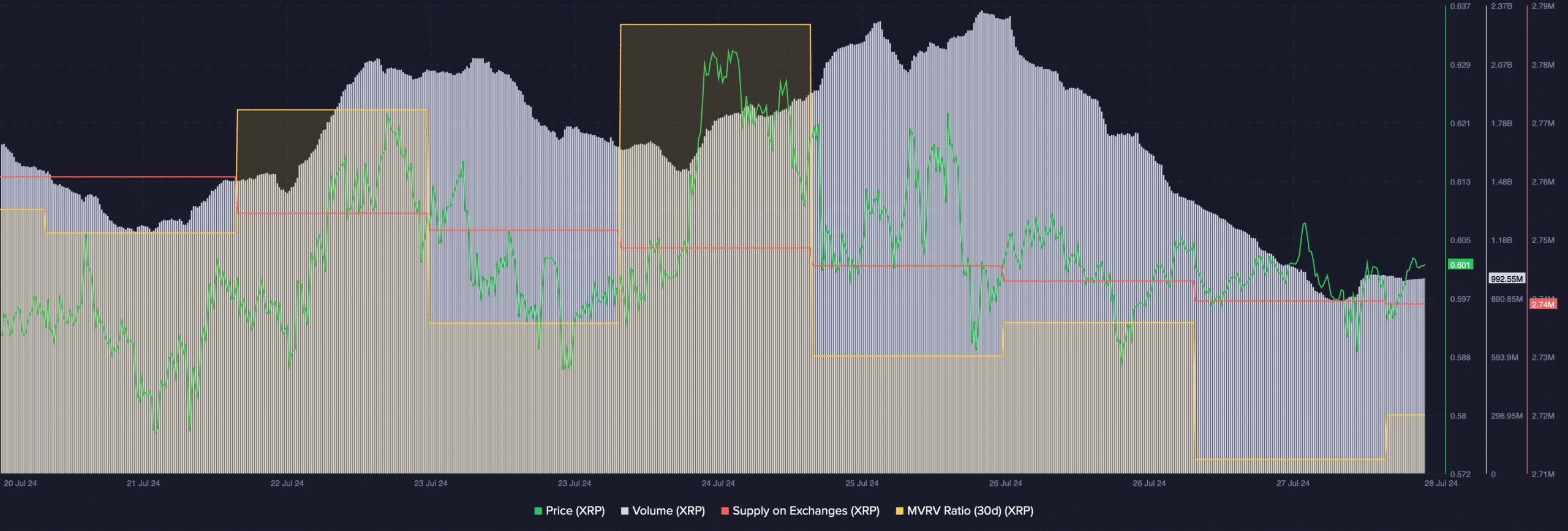

XRP’s on-chain data was examined by AMBCrypto to assess if it signaled an impending bull market. According to our interpretation of Santiment’s statistics, both the XRP trading volume and price experienced a decrease.

This suggested that investors were reluctant to trade XRP at a lower price.

Another interpretation: The amount of this asset available on exchanges kept decreasing, implying strong demand. Yet, a cause for concern emerged in the form of the MVRV ratio, which declined, potentially foreshadowing a significant price drop.

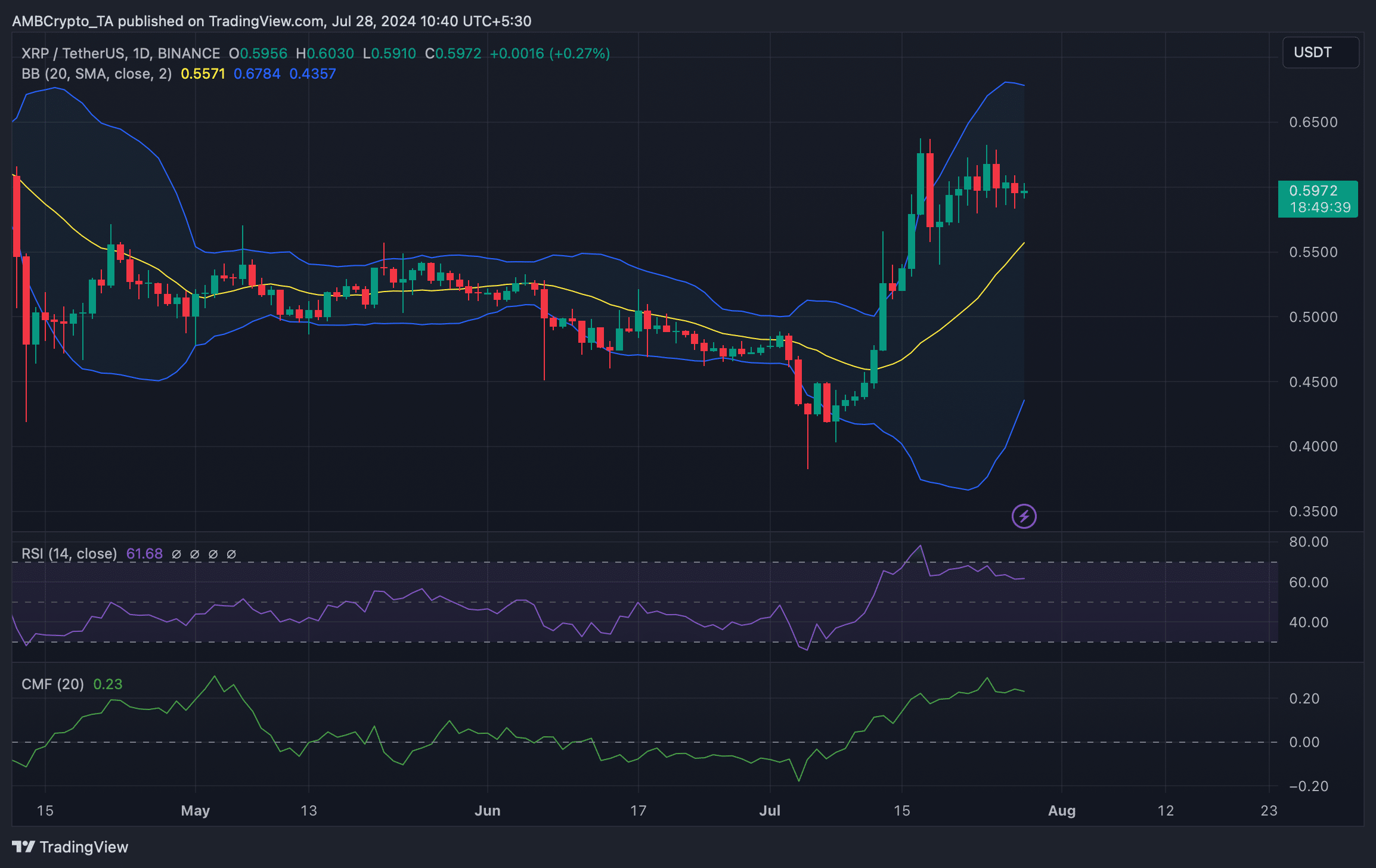

At present, XRP‘s fear and greed index stood at 62%, indicating that the crypto market was experiencing a “greedy” sentiment.

As an analyst, I observe that when the metric reaches this specific threshold, it signals a significant likelihood for a price adjustment. Similar to other market indicators, their readings also appeared pessimistic.

In simpler terms, both the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) indicators showed a decrease in their values.

Read Ripple’s [XRP] Price Prediction 2024-25

Moreover, the token’s price had touched and retracted from the upper limit of the Bollinger Bands.

As a crypto investor, I understand that recent metrics and indicators for XRP may have given cause for concern. However, it’s important to keep in mind that these signs might merely indicate a retest of the bullish breakout. If this is the case, then XRP’s price could potentially surge during the coming days, initiating a new bull rally.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-28 14:50