-

ETH has remained in the $3,200 price range.

Its RSI showed it was in a bear trend.

As a seasoned researcher with extensive experience in analyzing cryptocurrency markets, I’ve closely monitored Ethereum’s [ETH] recent price fluctuations and transaction patterns.

Recently, the price of Ethereum [ETH] has taken a downturn. Yet, amidst these price drops, there’s been a significant surge in the number of substantial transactions being processed.

An examination of the data uncovered if the recent increase in trading activity was mainly driven by buyers or sellers.

Ethereum sees large transactions

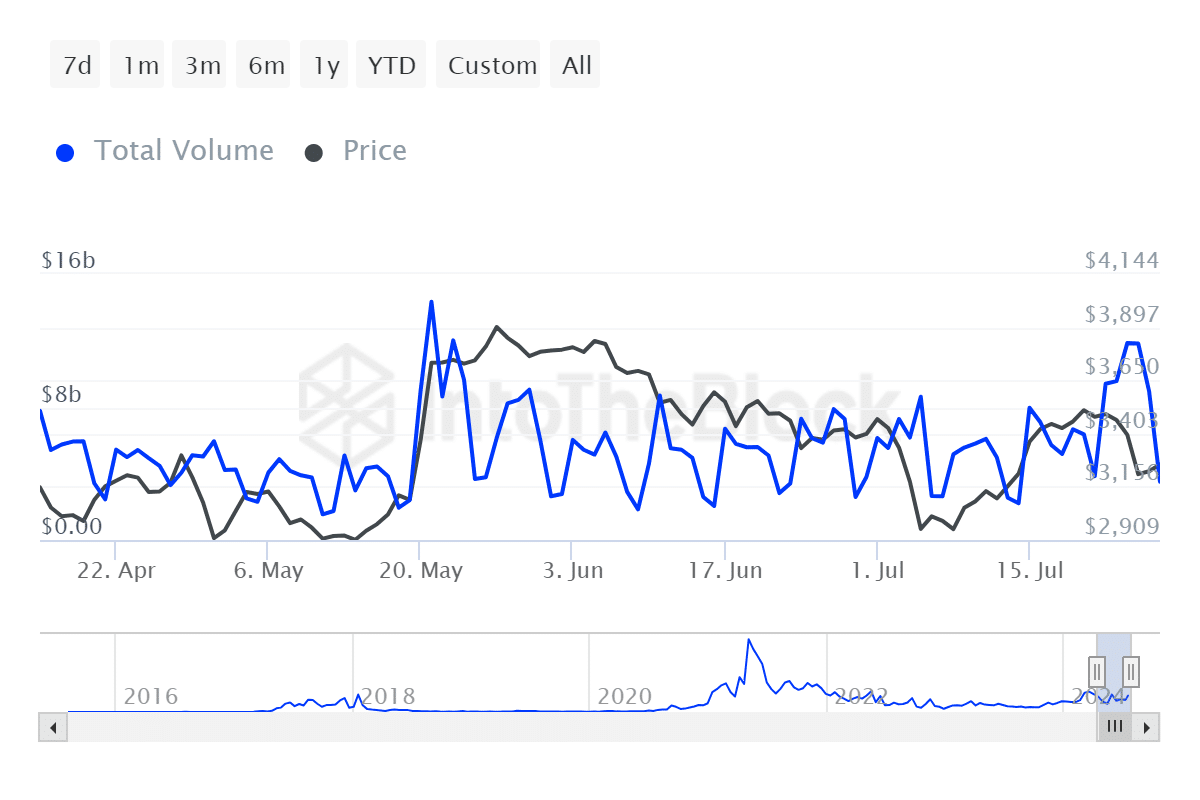

In the past month, Ethereum witnessed a significant surge in large transactions, totaling over $11.8 billion based on IntoTheBlock’s latest data.

The spike reached the greatest height among all monthly records and signified the most noteworthy event in more than two months, with the previous instance happening approximately in May.

The current volume stands at around $3.5 billion, which is a significant decrease from previous levels. Notably, this reduction in trading activity occurred concurrently with the regulatory approval of Ethereum-based Exchange Traded Funds (ETFs).

Institutional investors significantly ramped up their transactions of the asset following its approval, suggesting robust market activity.

ETF approval by institutions is a sign of increasing acceptance and can result in larger trading volumes as they become more active in the market.

What direction is the Ethereum volume going?

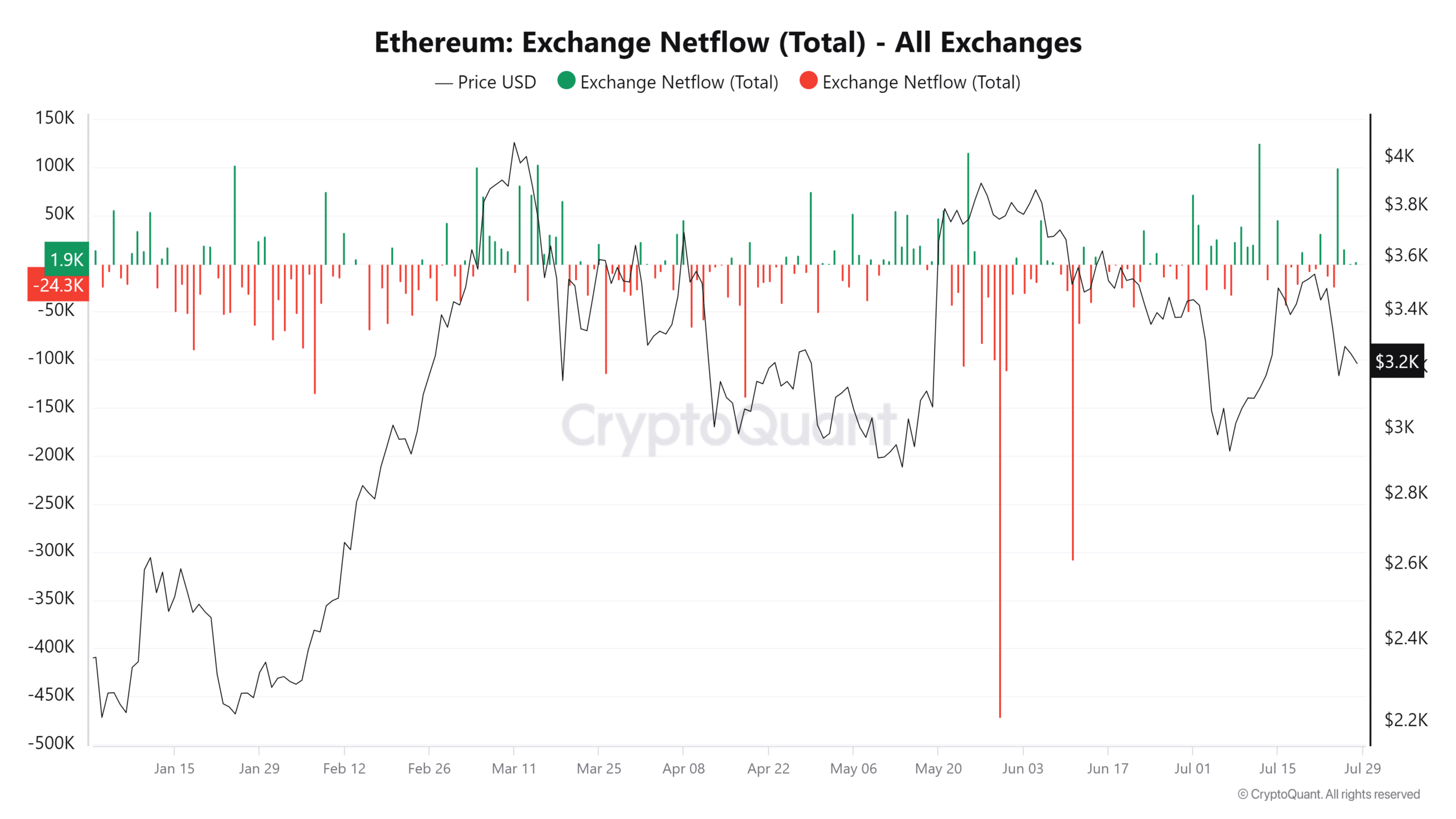

Based on data from CryptoQuant, Ethereum’s exchange outflow trend for the past month has shown more coins moving into exchanges than leaving them, suggesting a higher demand and increased trading activity.

The flow of Ethereum (ETH) into exchanges is greater than the outflow, implying that more holders may be planning to dispose of their tokens.

Also, the dominance is evidenced by spikes in these positive netflows observed throughout July.

Based on the most current information available, the netflow stands at around 2,000, indicating a recent equilibrium between incoming and outgoing flows.

As a crypto investor, I’ve noticed that the market dynamics for Ethereum have been more volatile than usual this month. One particularly notable event was a massive withdrawal of approximately 43,000 ETH from exchanges in a single day, which represents a significant sell-off. Conversely, there was also a large influx of over 125,000 ETH into exchanges on another day, indicating a considerable buying opportunity.

ETH sees further drops

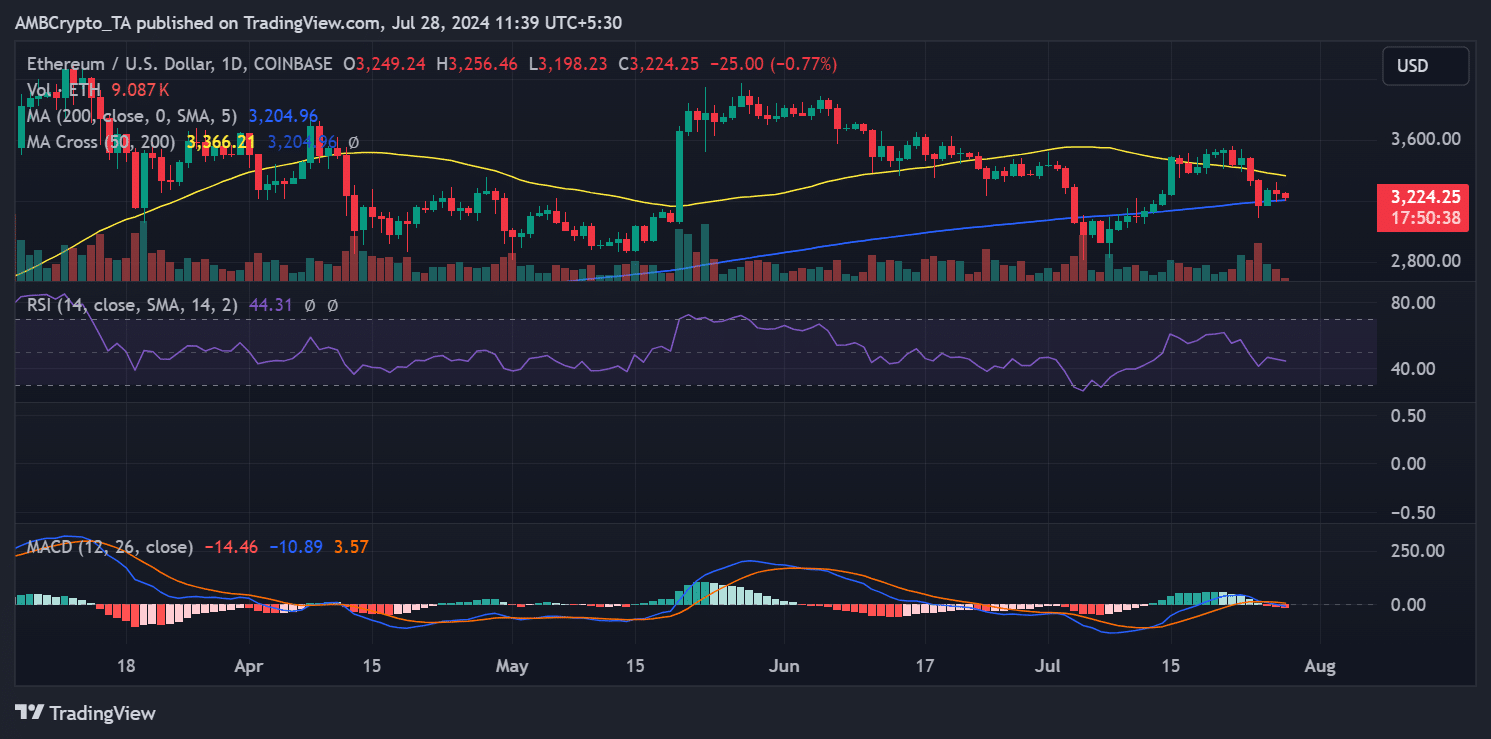

As a crypto investor, I’ve noticed that Ethereum has been trending downward lately. Based on AMBCrypto’s analysis, Ethereum was priced around $3,249 on July 27th, marking a minimal decrease of less than 1%.

The downward trend has persisted, albeit slightly, with ETH currently trading at around $3,224.

Read Ethereum (ETH) Price Prediction 2024-25

Significantly, the long-term moving average, indicated by the blue line on the graph, persists in serving as a floor for prices.

The distance between Ethereum’s present price and its moving average implies that a breakdown beneath this key support level might be imminent. Such an occurrence could potentially signal a reversal in the broader market direction for Ethereum.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- PGA Tour 2K25 – Everything You Need to Know

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-07-28 19:13