- Avalanche prices are likely to climb higher in the coming weeks.

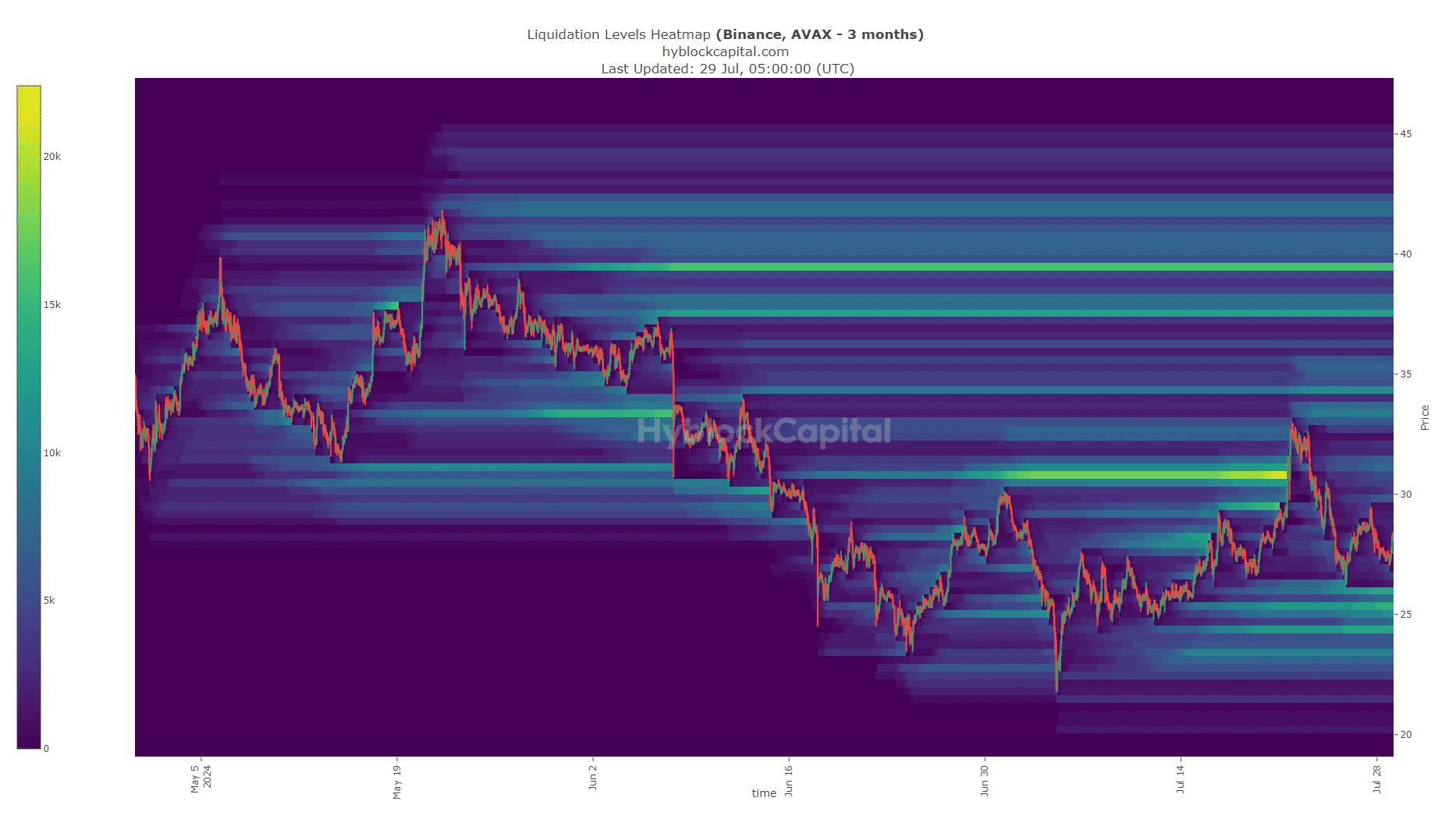

- The higher timeframe price chart and the liquidity pockets underlined the potential areas for a trend reversal.

As a seasoned researcher with extensive experience in the crypto markets, I have witnessed the volatility and unpredictability of prices, especially in the case of Avalanche (AVAX). Based on my analysis of the charts, I believe that AVAX is poised for further price gains in the coming weeks.

Avalanche’s [AVAX] price had started to regain ground after suffering setbacks in May and June. Its recent surge above the $30 mark suggested a strong buying interest, implying further upward momentum could be on the horizon.

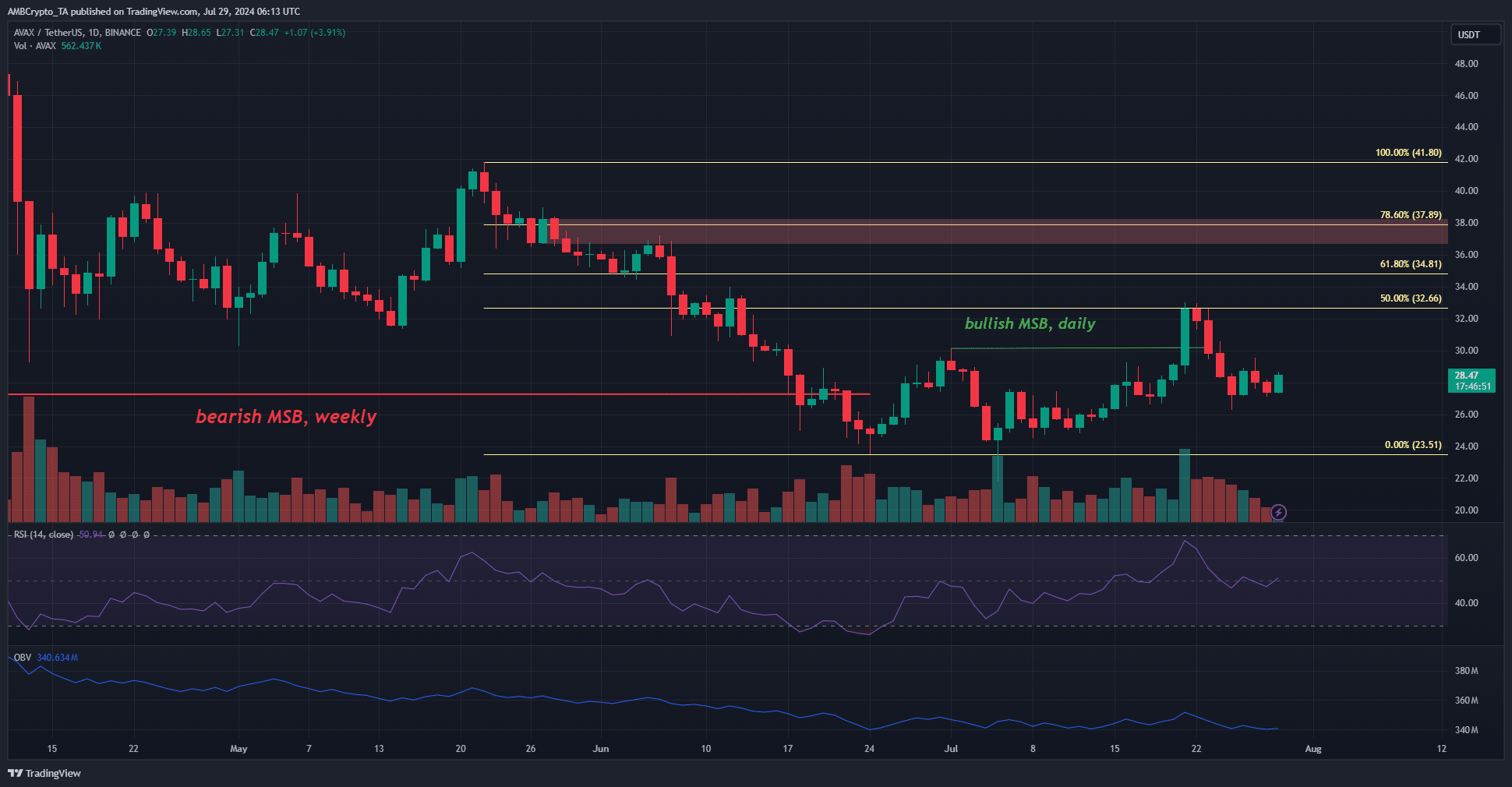

Despite the current alignment of higher timeframe trends, long-term investors may face unfavorable conditions at present. Insights from Fibonacci levels offer potential indications regarding possible price movements ahead, as well as potential subsequent developments.

AVAX bulls need to be ready to take profits

As of the current report, the daily market trend was positive and bullish, indicating a potential increase in price up to $40. However, the weekly chart showed a bearish pattern, signaling an impending downturn after this rise.

With the decline in price during May and June, a series of Fibonacci retracement levels were generated. The 50% mark, located at $32.66, has previously acted as a resistance point.

In simpler terms, the Daily RSI stood at 51, indicating only slight gains following last week’s market downturn. Additionally, the On-Balance Volume (OBV) remained mostly stable in June, implying that the Avalanche bulls may lack the power to launch a significant rally at this time.

The magnetic zones and hints of the reversal’s location

Based on my extensive experience in cryptocurrency analysis, I believe that earlier this month, the attractive liquidity pool at $30.8 exerted a significant pull on the price of AVAX, drawing it toward that level. The token surged to reach a high of $33 before subsequently experiencing a decline. Looking ahead, my forecast indicates that the targets for AVAX lie further up the price ladder, specifically at $34.3, $37.5, and $39.5.

Is your portfolio green? Check the Avalanche Profit Calculator

The prices in these areas might hover above the $30 mark but could also be at risk of dropping further, thereby increasing the availability of assets for purchasing.

The alignment of the price movement with the previously mentioned Fibonacci retracement levels is quite noticeable. Consequently, as long as the $38 threshold remains intact, swing traders should consider the established structure of the weekly chart to remain valid.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-07-29 20:08