-

STX has defied market trends recording a 16.71% in 30 days.

Positive market sentiment sees analysts eyeing $2.4.

As a seasoned researcher with a deep understanding of the crypto market dynamics, I find myself intrigued by Stacks [STX] current performance and the mixed sentiments surrounding it. Over the past few months, we have witnessed a turbulent crypto market, with altcoins often following Bitcoin’s lead in experiencing high lows. However, STX has defied this trend, maintaining an impressive uptrend for six weeks, recording a 16.71% surge over the last 30 days.

As a crypto investor, I’ve noticed that while many altcoins have been volatile, following Bitcoin‘s declines over the past few months, Stacks [STX] has managed to maintain an upward trajectory for six consecutive weeks. During this timeframe, the market value of STX has risen significantly, and its prices have consistently climbed higher.

Despite Bitcoin’s recent surge past $69,000 and the crypto market’s recovery, Stax seems to be faltering in its progress. Some market analysts are worried by this trend and believe a reversal may be on the horizon, while others remain hopeful.

STX’s prevailing market sentiment

For the past month, STX has consistently seen an upward trend. At the same time, there’s a general feeling of confidence and hopefulness among investors regarding this stock.

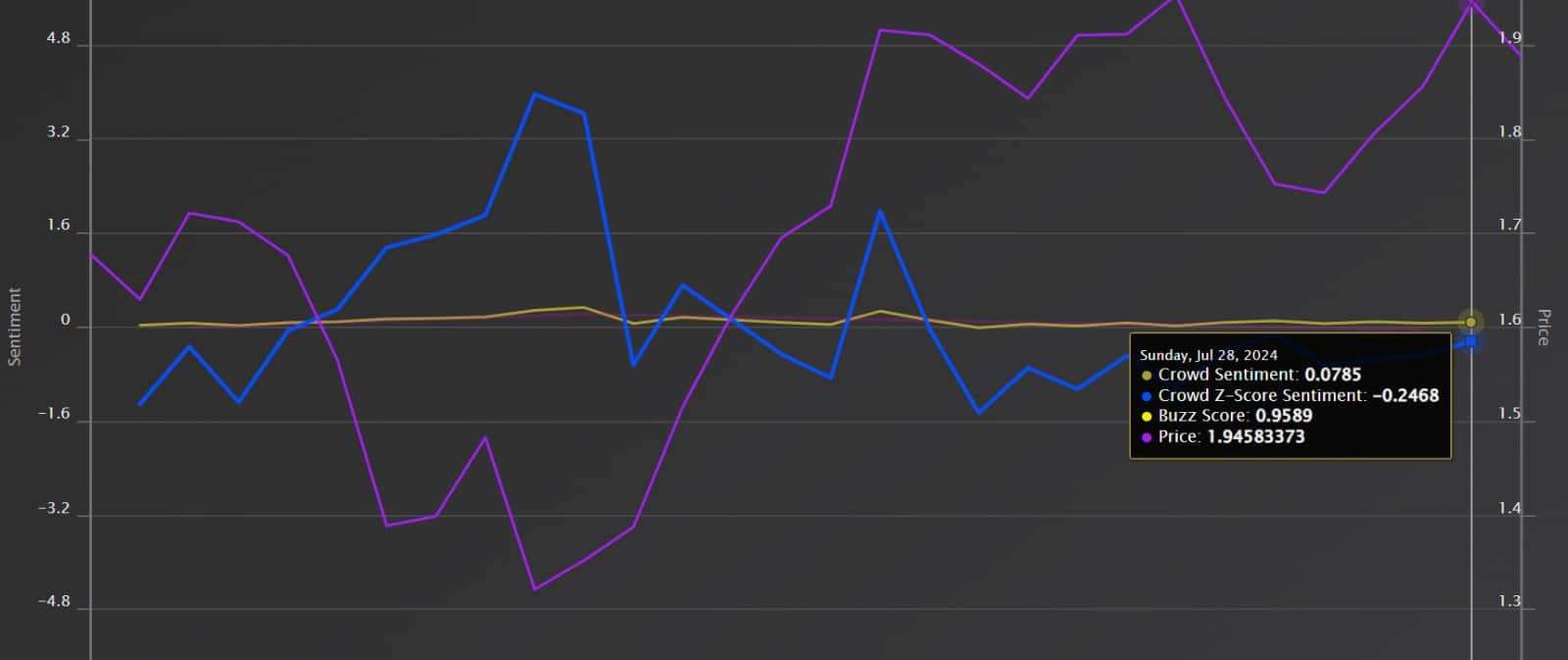

Based on Market Prophit’s analysis, the sentiment towards STX is favorable with a crowd feeling of 0.0785 and a crowd excitement level of 0.9589. Analysts are upbeat about the stock, predicting a possible breakthrough and ongoing price growth.

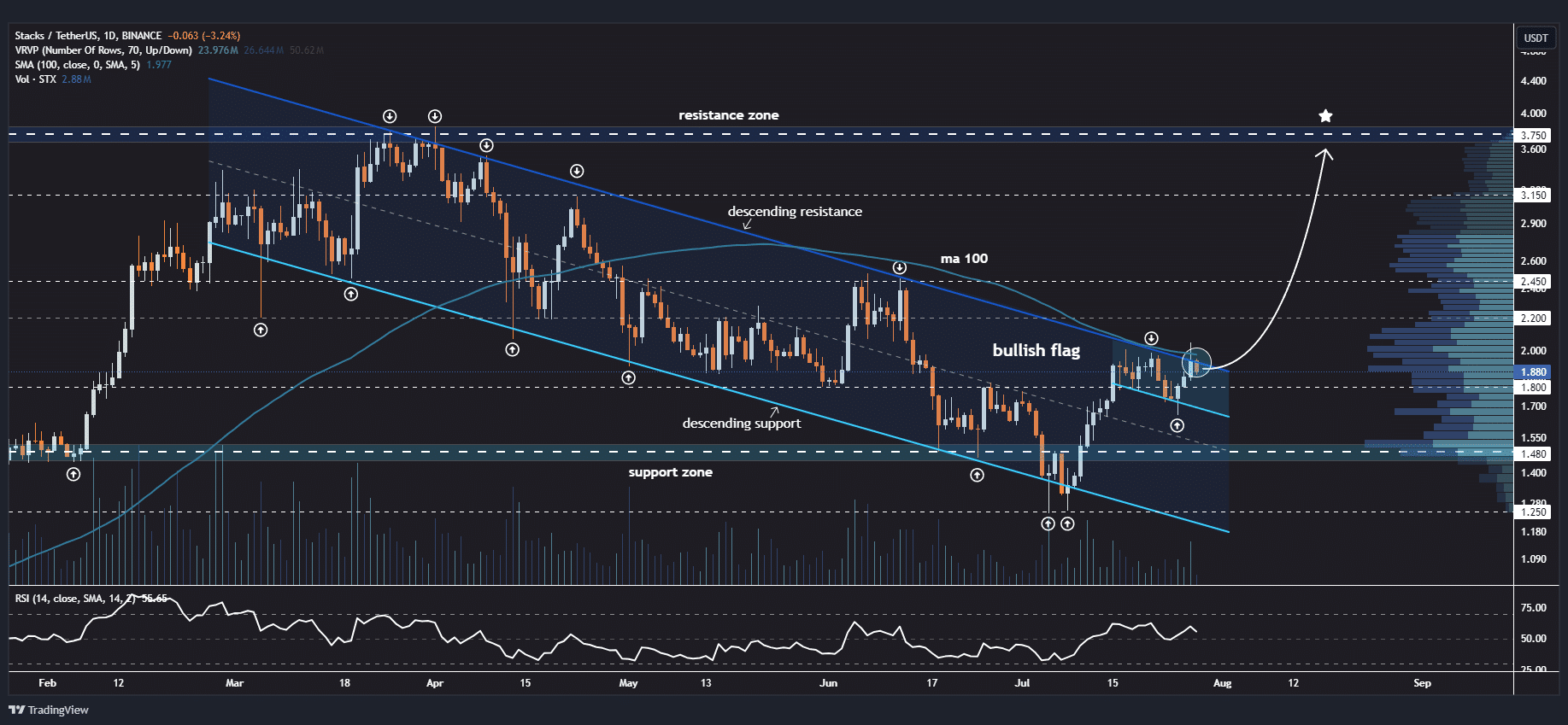

Jonathan Carter shared his prediction on his X page, suggesting a bull run of $3.75. He noted that,

On larger charts, the price action of #STX Stacks is shaping as a bearish channel with an uptrend below it. A breakout from this pattern could occur soon, so keep a close eye on it. Potential targets if this occurs are at $2.20, $2.45, $3.15, and $3.75.

Similarly, LilaMIa expressed her positive outlook, suggesting that STX could witness an uptrend if it manages to break through its current resistance levels. She pointed out this potential development as a significant indicator.

“Despite ongoing efforts to clear the descending channel, there’s optimism for a substantial bullish wave if the channel is successfully breached.”

Furthermore, Whales Crypto Trading expressed their anticipation for a bull market reaching a peak at approximately $2.4.

On the 8-hour timeframe, Stacks appears to be shattering its downward trending channel. A surge above this channel could potentially ignite a significant upward trend, pushing the price towards approximately $2.40.

What STX price chart Indicates

Significantly, according to AMBCrypto’s assessment, the price trend of STX was robust and could potentially carry on rising. At the time of penning down, the coin was valued at $1.94 following a daily increase of 3.24%. Over the past month, there had been a notable rise of 16.71% in the value of this altcoin.

1. Examining STX‘s Directional Movement Index (DMI), it reveals a robust bullish trend among altcoins. The affirmative index stood at 25.98, whereas the negative index stayed below 16.51, indicating that the upward pressure is significant.

85.71% for the Aroon Up line contrasts with a 71.43% for the Aroon Down line, suggesting that the ongoing trend’s power is substantiated by this difference.

TheRelative Vigor Index (RVI), which gauges the strength of an asset’s price trend, stands at 0.027, showing a strong positive sign. Following its line, the RVI has recently undergone a bullish crossover event.

This shows that closing prices are higher than opening prices, suggesting a bullish momentum.

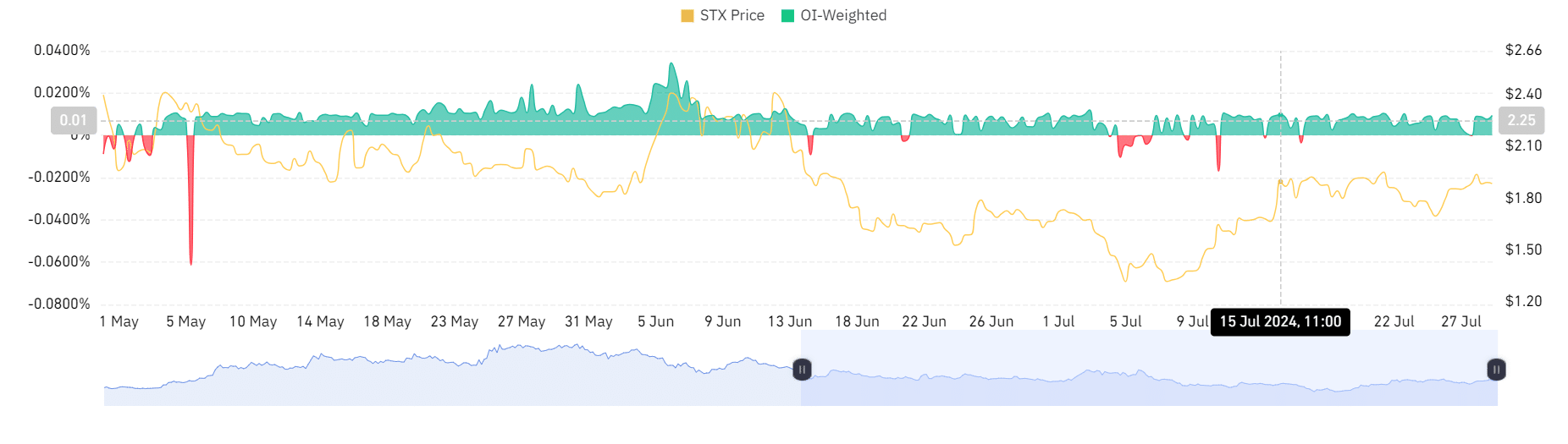

An in-depth examination of Santiment data by AMBCrypto revealed a positive funding rate of 0.01, which signifies that long position holders are compensating short position holders. This suggests that traders are prepared to pay a premium to maintain their positions.

In this situation, it appears that investors have faith in STX‘s future course and expect the stock price to rise.

1. In recent weeks, STX‘s OI-weighted funding rates have consistently shown a positive trend. This suggests that investors holding long positions are prepared to pay a higher price to maintain their positions, which underscores their confidence in the asset’s potential growth.

Based on my interpretation of the Santiment data, I believe the ongoing trend in the crypto market will persist.

STX reversal or breakout?

As of the current reporting, STX recorded a weekly increase of 3.68%. Moreover, our examination indicates a favorable outlook for this altcoin, as it appears that the market is largely controlled by buyers, leading to a positive trend in investor sentiment.

Read Stacks [STX] Price Prediction 2024-25

If the present market trends continue, the altcoin is expected to surpass the significant barrier at $2.04. Overcoming this hurdle will pave the way for the crypto to confront the resistance at $2.47.

Should the bullish energy start to wane, I foresee a shift in trend heading downwards, potentially reaching the nearby support level of $1.80.

Read More

2024-07-30 00:08