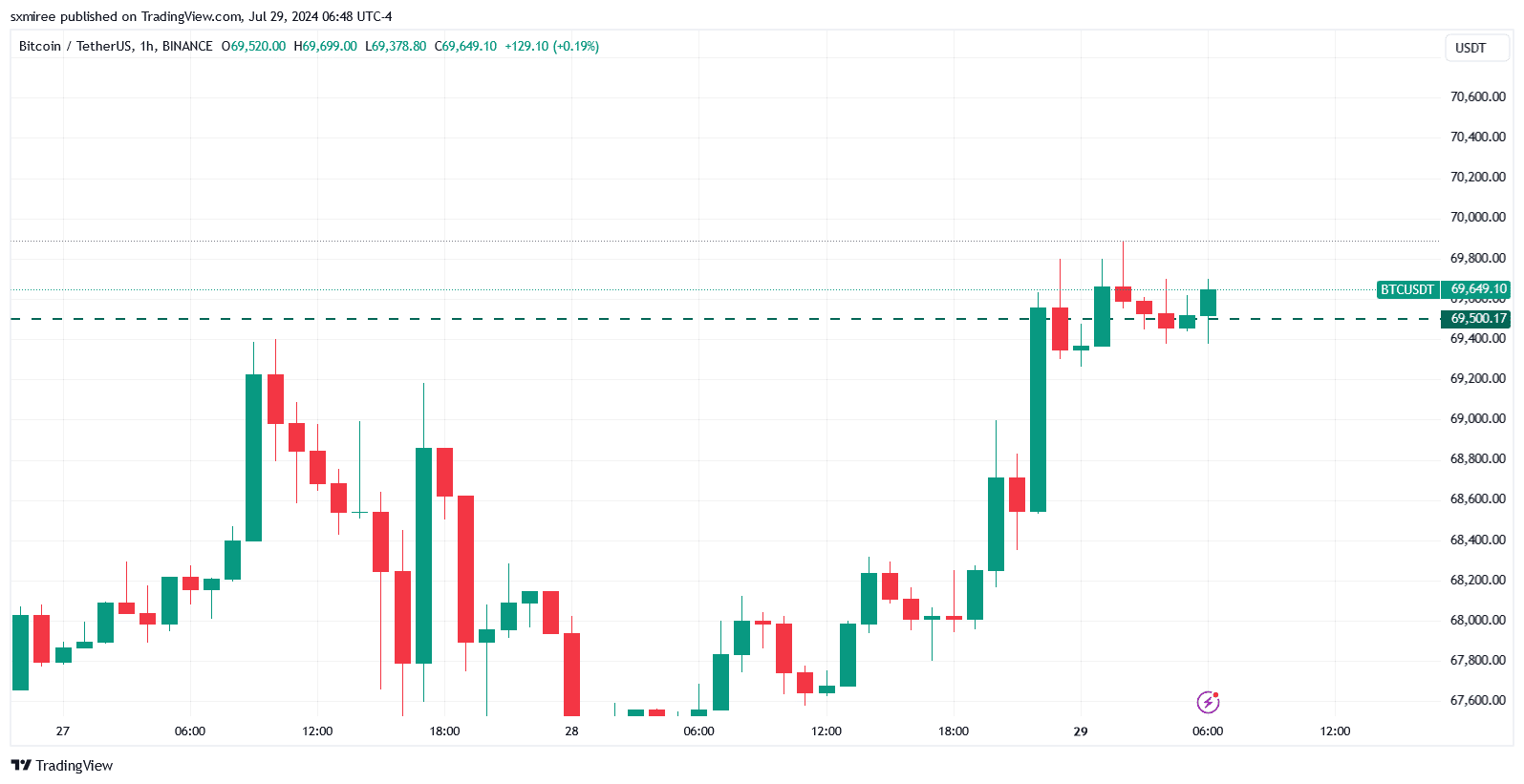

- Bitcoin neared the crucial $70,000 mark on the 29th of July, where the price previously saw rejection.

- Strong technical indicators and renewed sentiment favored additional gains ahead of July’s monthly close.

As a seasoned researcher with years of experience tracking and analyzing the crypto market, I have witnessed both its dizzying highs and crushing lows. The recent surge in Bitcoin’s price towards $70K is a testament to the resilience and potential of this remarkable digital asset.

1) This week, Bitcoin (BTC) has made a promising beginning, with its robust showcase on July 29th significantly boosting its value near $70,000.

The leading cryptocurrency surged above $69,000 with a significant jump, reaching a seven-week peak of $69,851 according to CoinMarketCap figures. At this moment, Bitcoin is just 5.76% below its previous all-time high in March of $73,750, as reported at the time of writing.

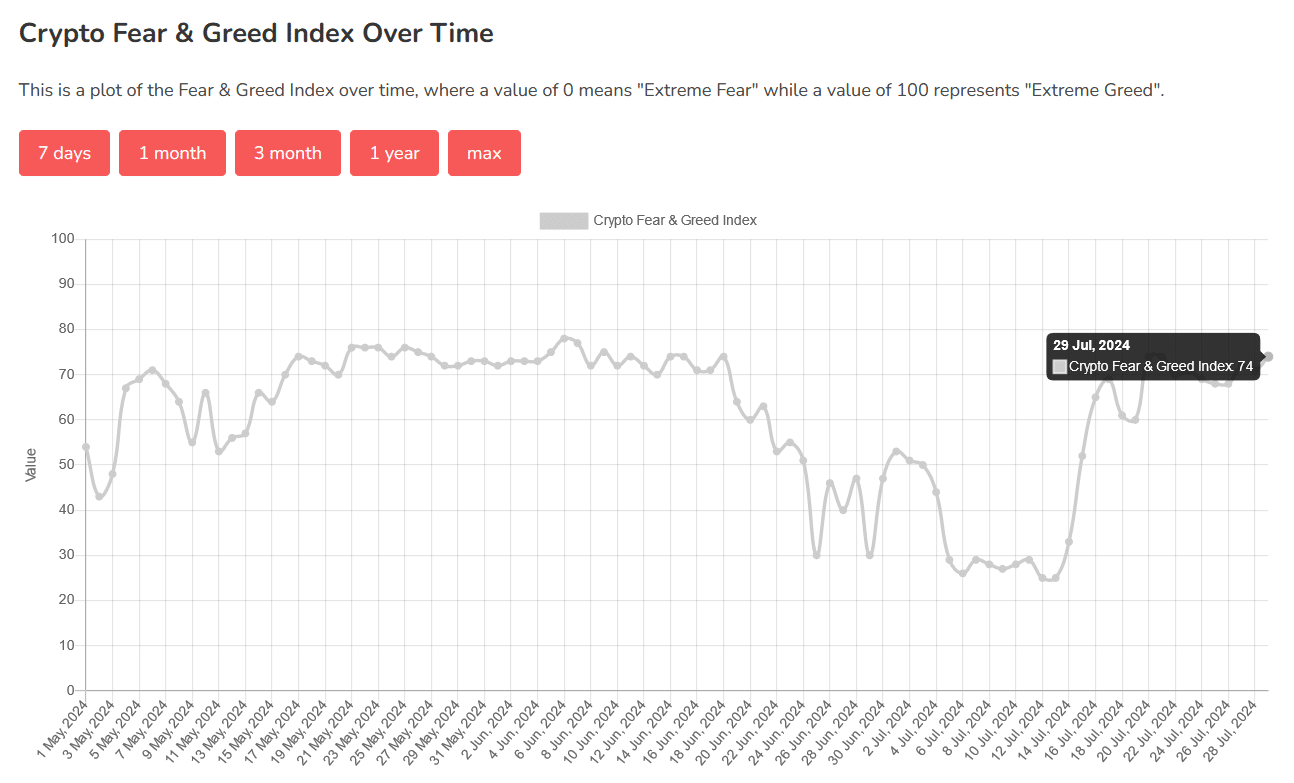

Currently, the Crypto Fear & Greed Index remains high, sitting at a reading of 74 out of 100 – a significant increase from its previous level of 52 on the 15th of July.

After a lively battle, bulls secured a minor reprieve as Bitcoin posted modest gains of 0.22% in the recently finished seven days.

So far this month, the leading crypto has tracked 9.2% in monthly gains per Coinglass data.

Renewed positive sentiment

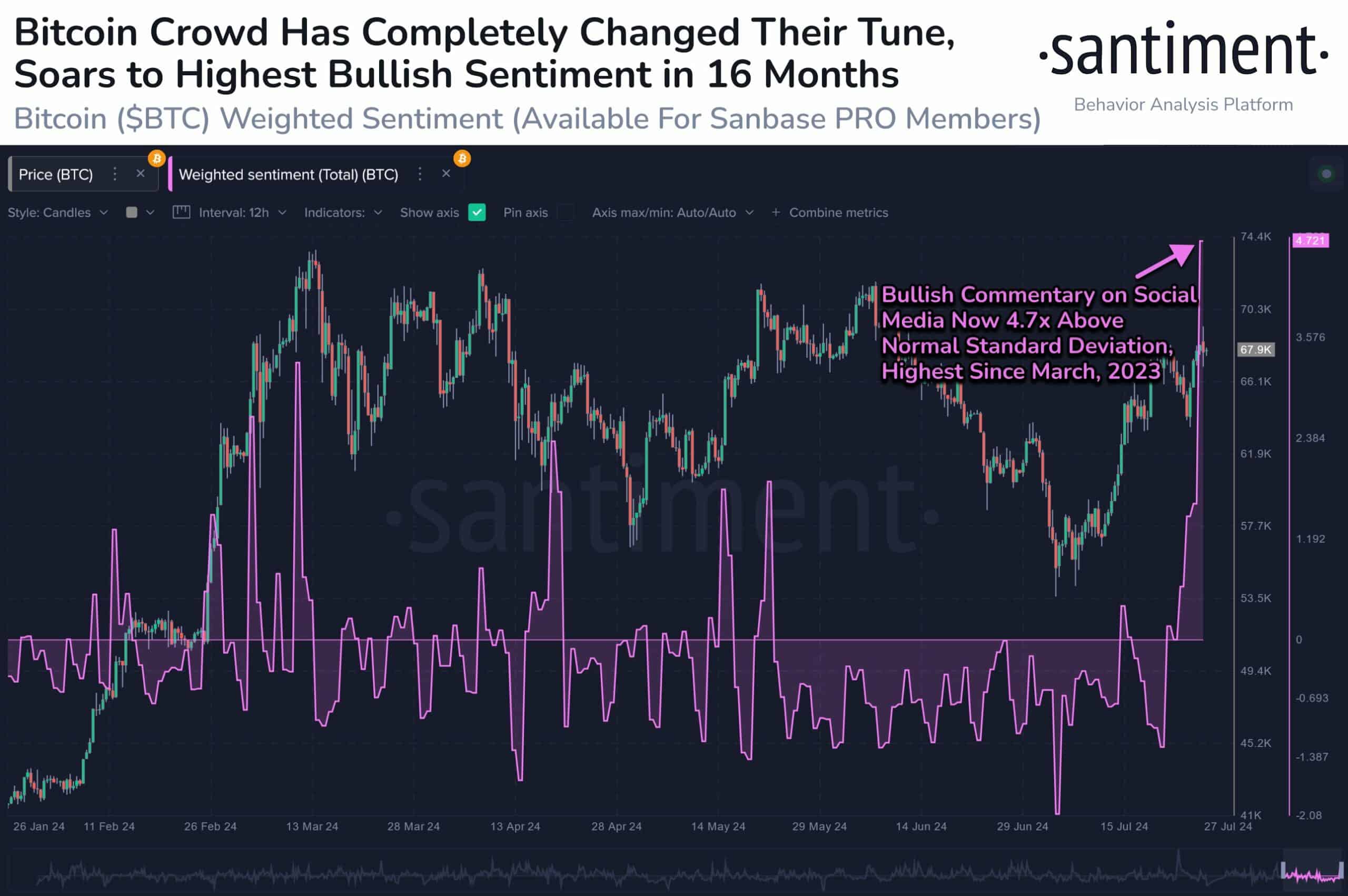

According to market intelligence platform Santiment, Bitcoin’s price surge over the past three weeks has heightened speculator enthusiasm to levels exceeding those at the beginning of the month.

1. The recent positive trend in Bitcoin is due to the conclusion of the Bitcoin 2024 Conference held in Nashville on the 27th of July.

During their presidential campaigns, Donald Trump and Robert F. Kennedy Jr. expressed strong support for cryptocurrencies. They pledged to create a national Bitcoin reserve for the United States.

Macro influences

In the larger context, it’s more advantageous to invest in riskier assets like cryptocurrencies. However, investors should stay vigilant about upcoming major events this week that may cause sudden price fluctuations.

1. On July 31st, federal policy-makers will reveal their choice regarding interest rates following the predicted Federal Open Market Committee (FOMC) gathering. The consensus appears to be that the current interest rates won’t change.

The decision made by the Federal Open Market Committee (FOMC) is crucial in influencing Bitcoin’s monthly closing price, as Bitcoin tends to yield favorable results during July based on historical data.

10X Research wrote in a research post dated the 28th of July,

As a researcher studying cryptocurrency markets, I am anticipating a potential surge in Bitcoin’s price. However, for this breakout to occur, Bitcoin may require external support in the form of projected Federal Reserve rate cuts or another round of reduced inflation. The upcoming FOMC meeting on July 31 and the US CPI report due on August 14 will be pivotal events that could significantly impact Bitcoin’s price trajectory.

100 days have now passed since the fourth Bitcoin halving occurred on April 20th, reducing block mining rewards from 6.25 BTC to 3.125 BTC. This week signifies the completion of this 100-day period.

1. Reductions by half typically indicate a bullish trend, as historical data suggests that price growth tends to pick up pace approximately 100 days following such events.

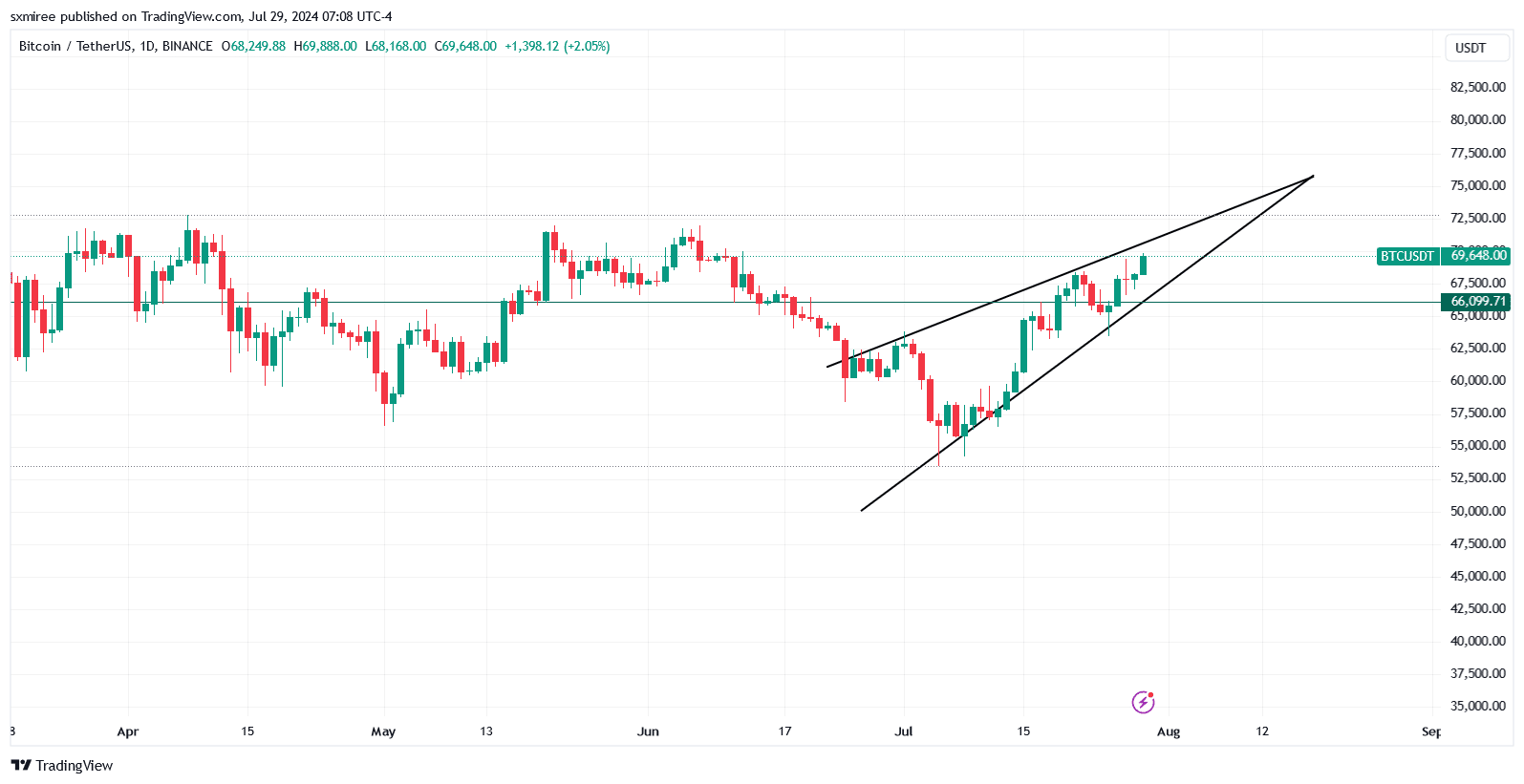

BTC/USDT technical analysis

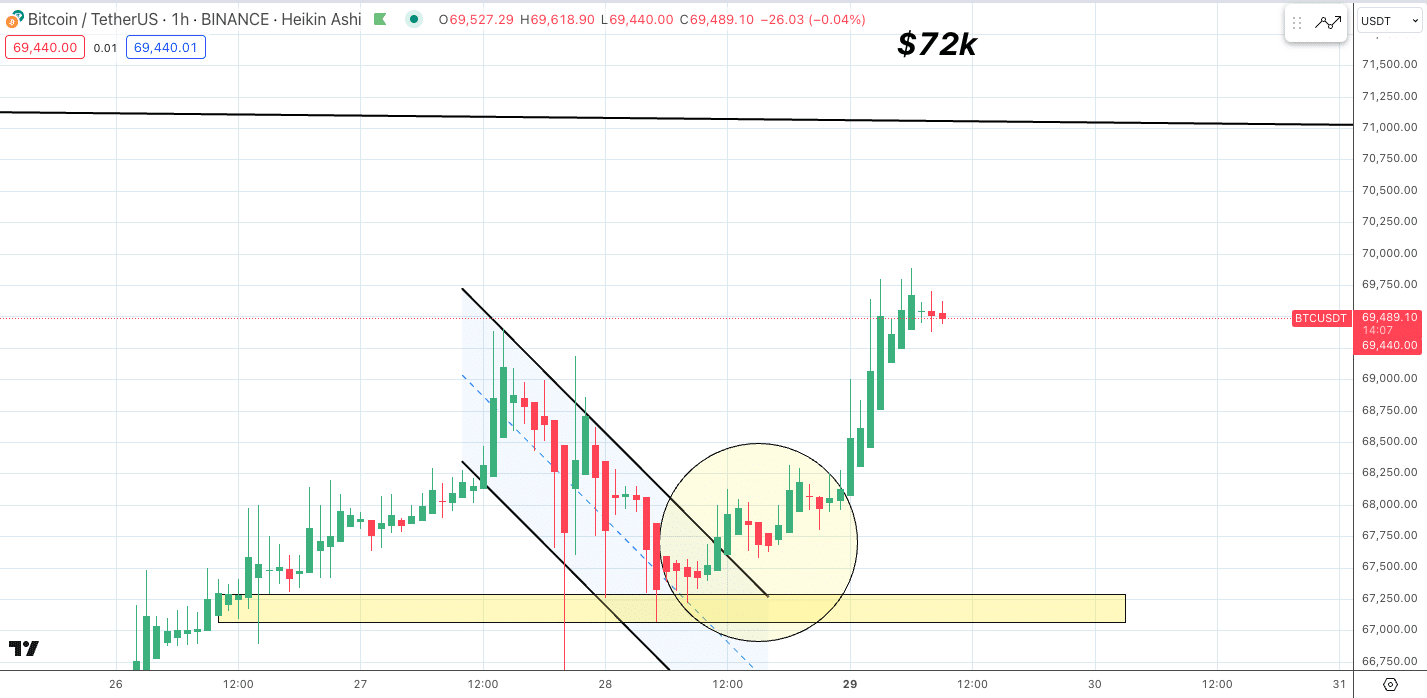

1. Bitcoin experienced a period of selling around its peak price of $69,850, as shown by the extended wicks on the hourly chart.

Overcoming the barrier at $70,000 would potentially open the path towards the $72,000 mark, a level that pseudonymous futures trader Satoshi Flipper referred to as “programmed,” in a post made on X (formerly Twitter) on the 29th of July.

The analyst was referencing a bullish descending channel on the daily chart.

The upward sloping wedge formation on the daily chart suggests a possible surge in price direction towards $74,000 – a point where the trendlines of this pattern intersect.

If we observe a drop beneath the lower trendline of the wedge, it could initiate a corrective move towards the $66,000 price point.

Read Bitcoin’s [BTC] Price Prediction 2024-25

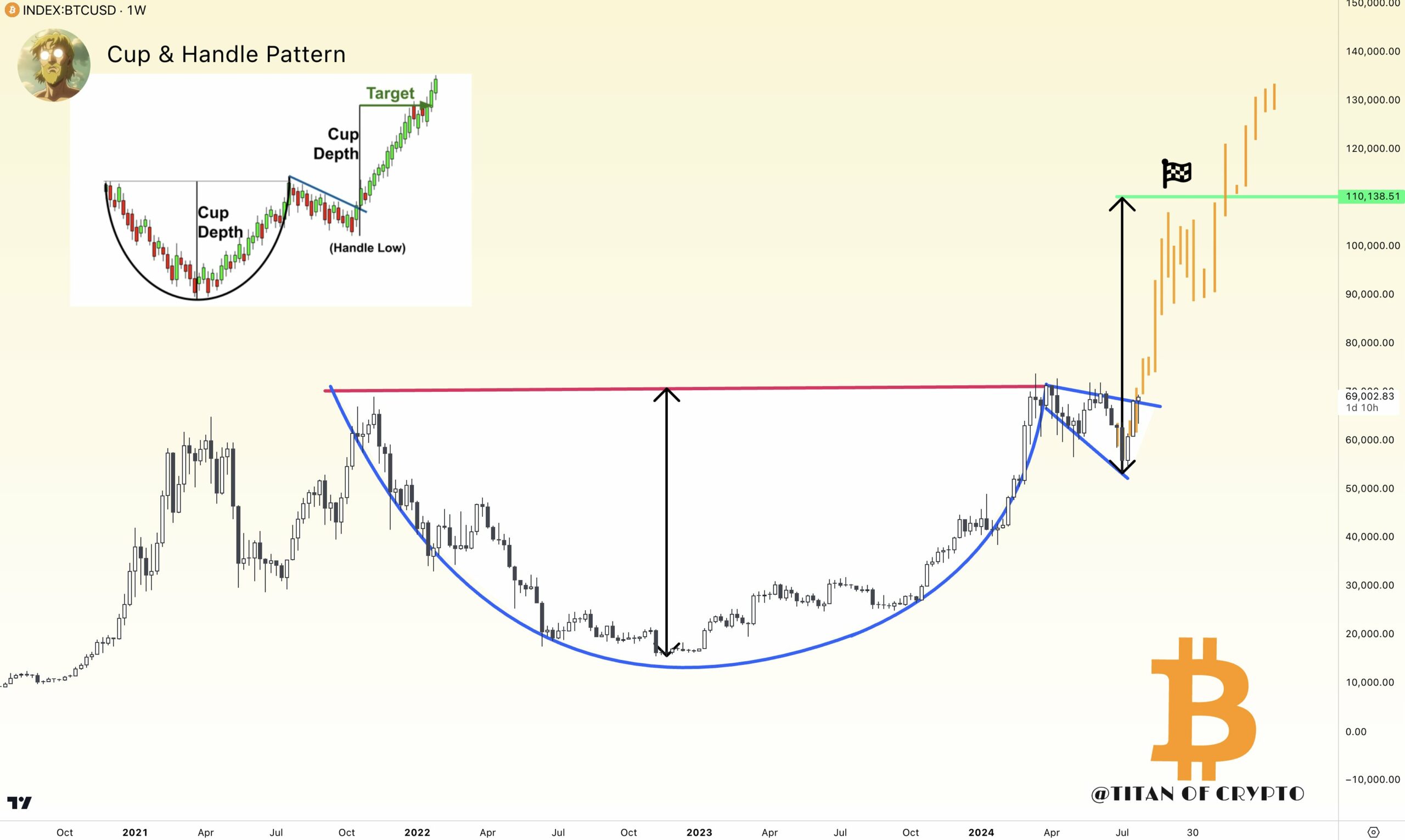

As an analyst, I’ve been observing the BTC/USDT market over an extended timeframe, and I notice that its price action seems to deviate from the typical cup and handle chart pattern. Instead, it appears to be forming a new trend.

A successful “breaking out from the handle” would set up Bitcoin on the path to $100,000.

Read More

2024-07-30 01:12