-

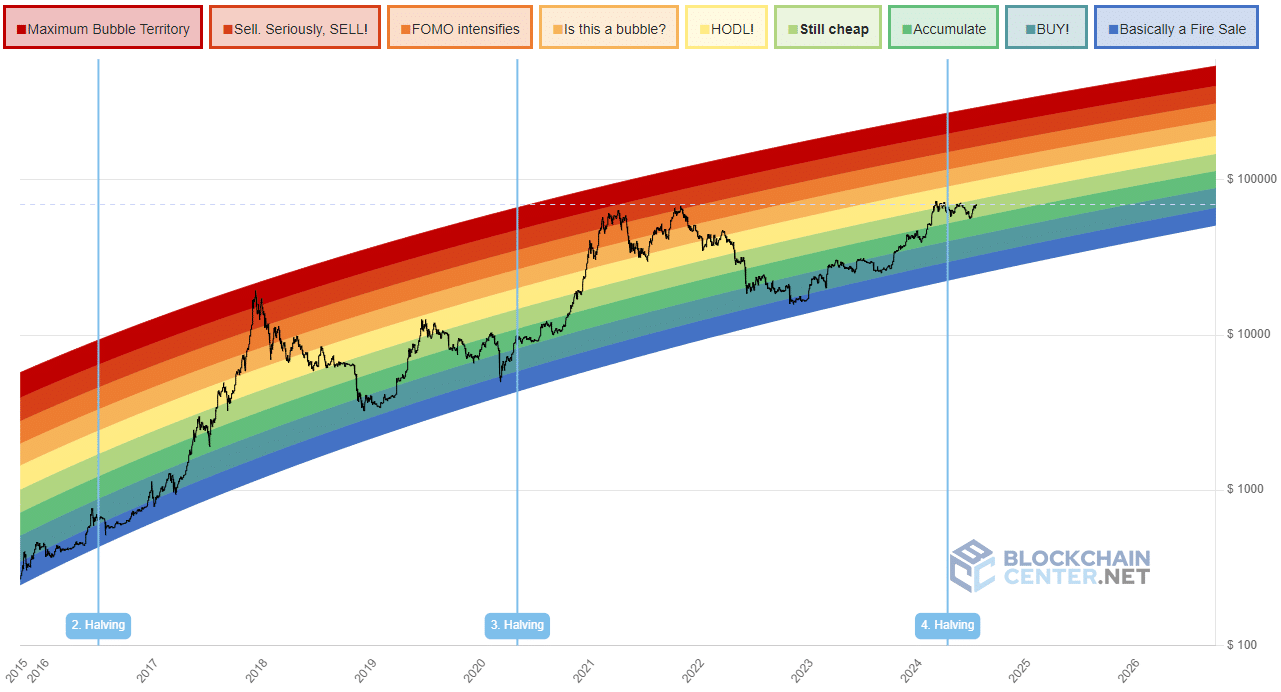

The Bitcoin rainbow chart showed intense bullishness for BTC over the next 12–18 months

Market sentiment was lukewarm and public frenzy hasn’t gotten rolling, even though prices were just below ATH.

As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely followed the Bitcoin rainbow chart and its predictions for quite some time now. Based on my analysis of the chart and other relevant metrics, here’s my take:

1. The Bitcoin Rainbow Chart serves as a lighthearted, simplified tool for investors to gauge the current stage of the Bitcoin cycle.

I was developed in the year 2014, and I utilize a logarithmic chart to extrapolate Bitcoin’s previous price trends as a means of projecting its future performance.

As a researcher studying the cryptocurrency market, I would explain it this way: By using distinct color-coded bands, we can visually represent Bitcoin’s price fluctuations over the last decade. This visualization helps tame the intense volatility and offers investors an instant understanding of prevailing market sentiment.

However, this is only for multi-year holders and not for day traders.

What does the Bitcoin rainbow chart project for 2024, and when should holders seek to take profits?

Bitcoin is still cheap!

Reflecting on the previous two halvings, it’s clear that prices typically require several months to ignite a bull run following the halving event. However, this pattern deviated from the norm seen in earlier instances.

The price rapidly increased before the halving, and set a new all-time high just a month after it.

In spite of these advancements, the cost remained reasonably priced within the accrual range. This was incredibly heartening for proprietors and those with a long-term investment outlook.

According to a well-known cryptocurrency trader, we have passed significant fear-inducing events in the past, such as the collapse of Mt. Gox, the German government’s actions, and the U.S. government’s Bitcoin sales.

The general opinion towards this matter is neither hot nor cold, and present prices are just shy of their all-time highs. However, there’s a strong possibility that things could become more optimistic within the next twelve months.

Based on previous trends, if the bitcoin market follows a similar pattern as before, then the next cycle top could be expected around October 2025 – approximately 546 days after the last halving event.

If this factor comes into play, the price range could fall between $144,000 and $184,000 – provided that the “strong sell signal” threshold is not triggered instead.

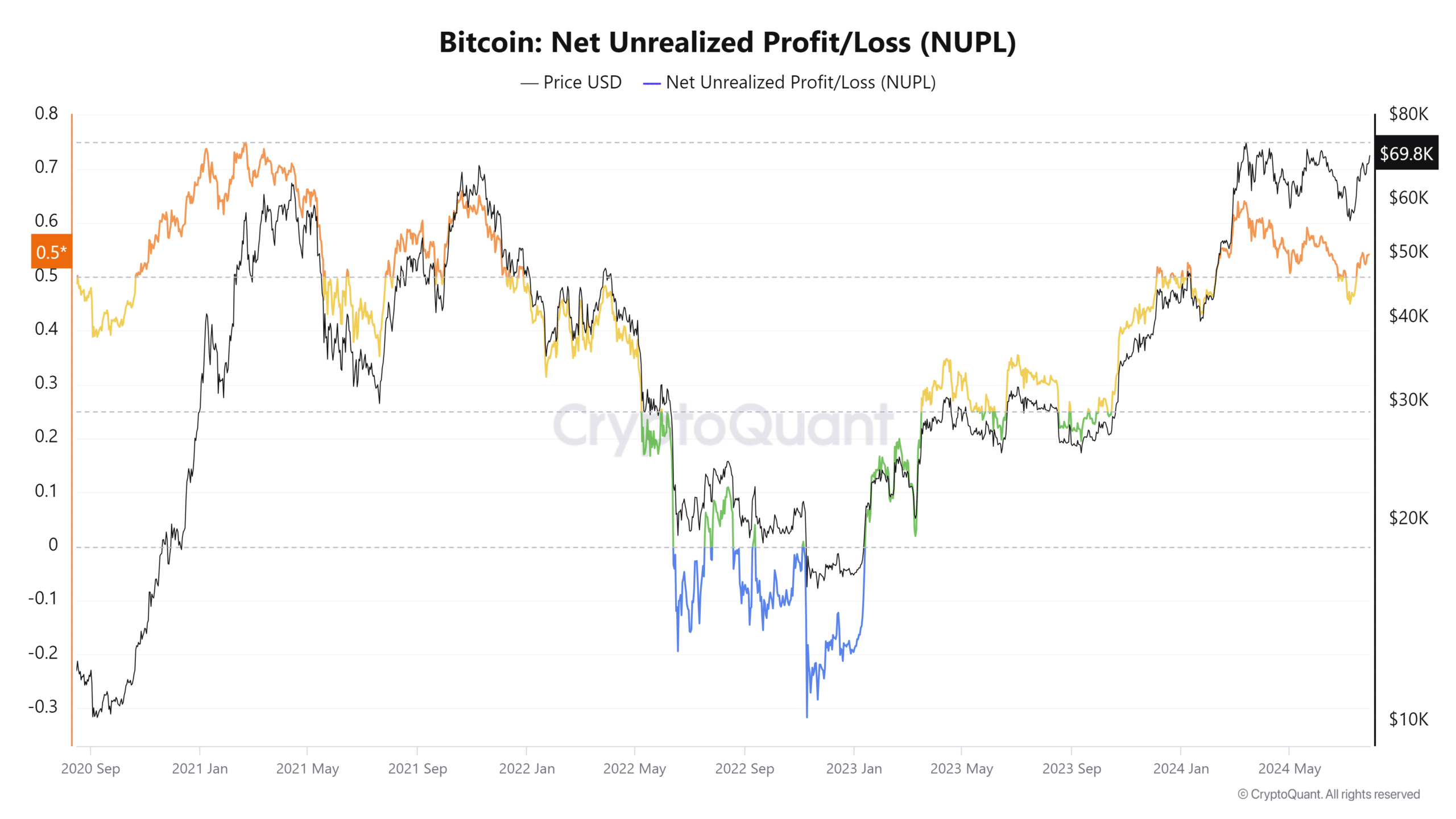

Insights from on-chain metrics

In simpler terms, AMBCrypto examined the Net Unrealized Profit/Loss ratio for all cryptocurrencies in their portfolio. A value greater than 0.7 for this metric is typically an indicator of a market peak.

In March 2024, the NUPL metric hit a high of 0.62, signaling overheated market conditions and heightened profit-taking, resulting in increased selling pressure. Yet, this metric has been on a steady decline since then.

This showed a decrease in selling.

1. It’s possible that prices may continue to rise further. Moreover, the NUPL has been staying above 0.5 for extended periods, as seen in late 2020, and this trend might persist into 2024 as well.

1. For long-term investment purposes, one option is to gradually amass more Bitcoin (BTC) or simply maintain ownership of the existing holdings, often referred to as “HODLing.” While further price growth may be on the horizon, it might take several additional months for these gains to materialize.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-07-30 06:16