-

Crypto whales accumulated 5,900 BTC worth $397 million from CEXs amid the price drop.

BTC’s trading volume surged by 65%, signaling higher participation from traders and investors.

As a seasoned researcher with years of experience in the cryptocurrency market, I find this recent trend intriguing. The U.S government moving $2 billion worth of Bitcoin and subsequent price drops have been common occurrences in this rollercoaster ride we call crypto. However, the surge in trading volume amid the drop, coupled with whales accumulating 5,900 BTC, paints a picture of a market that’s both fearful and greedy – a classic case of “buy the dip” mentality.

On the 29th of July, the U.S. administration transferred approximately 2 billion dollars’ worth of Bitcoin into fresh digital wallets. This significant action attracted considerable attention from cryptocurrency aficionados, causing a substantial ripple effect throughout the market.

After this event, Bitcoin was approximately at the $66,520 mark and saw a decrease of 4.6% in its value over the past 24 hours. Despite the price drop, there was a significant increase of 65% in investor and trader involvement, suggesting possible “buy the dip” tendencies.

Whales scoop up 5,900 Bitcoin

As a researcher, I’ve observed that both whales and institutions seized this price decline as a chance, amassing a substantial amount of Bitcoin in the process.

On the 30th of July, I came across a post by on-chain analytic firm spotonchain (previously on Twitter), suggesting that four significant investors, or “whales,” have transferred approximately 5,900 Bitcoin (BTC) worth around $397 million from Centralized Exchanges (CEXs) within the past 24 hours.

According to a recent report by SpotOnChain, a significant amount of Bitcoin (BTC), approximately 4,500 BTC valued at around $303 million, was taken out from Binance by the whale address “12QVs”. This withdrawal was made at an average price of roughly $67,298. Interestingly, a substantial portion of this, about 3,500 BTC or $233 million, was withdrawn shortly after the Bitcoin price experienced a sharp decline.

Simultaneously, it appears that a group of three whales, possibly acting together, removed approximately 1,400 Bitcoin (worth around $94 million) from Bitfinex, with each transaction averaging roughly $67,185.

Furthermore, starting from the 12th of June, they’ve taken out approximately 3,910 Bitcoins at an average value of about $65,764 each, accumulating an unrealized profit of more than $4.59 million.

Bitcoin technical analysis and upcoming levels

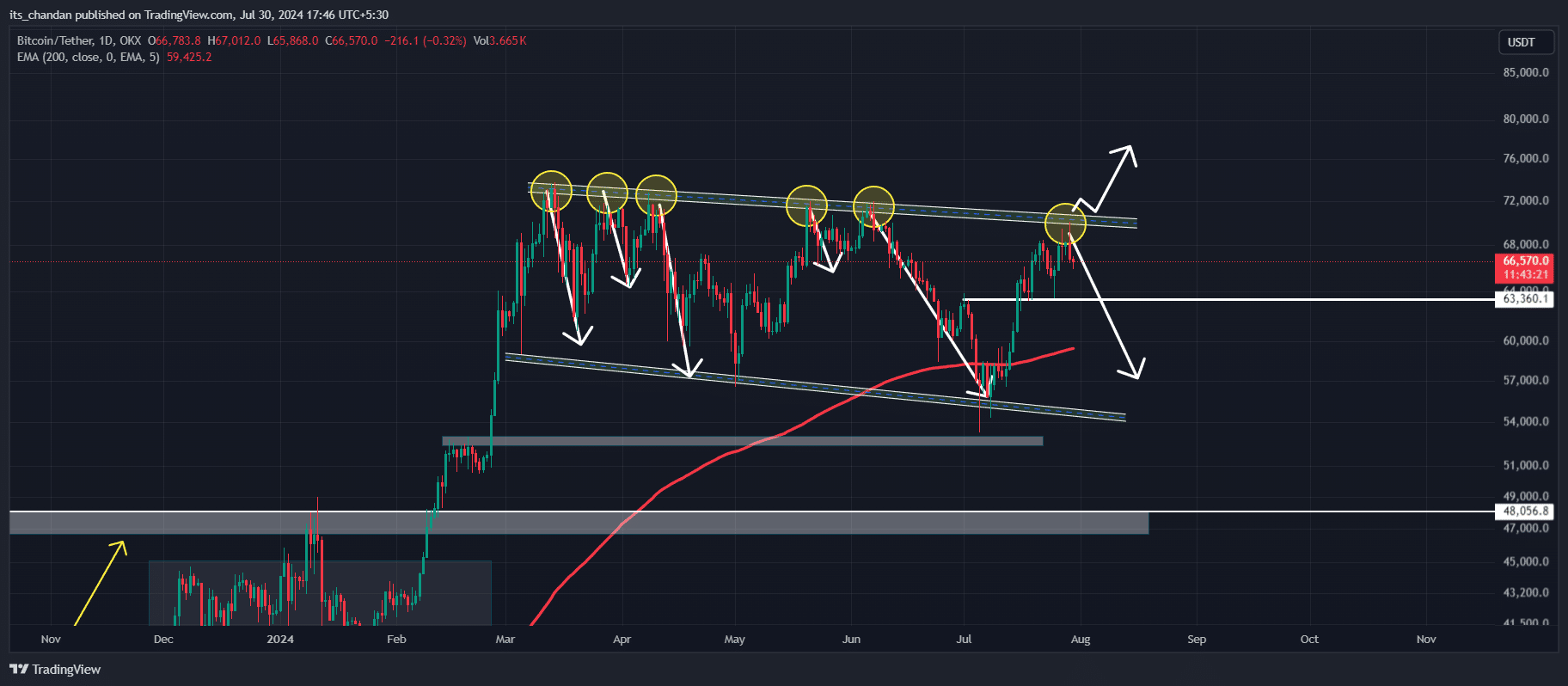

As a crypto investor, I’ve noticed that based on expert technical analysis, Bitcoin (BTC) seems to be following a downward channel pattern. Right now, it appears to be encountering strong resistance at its current level near the top of this channel.

Historically, when Bitcoin (BTC) hits this specific level, it tends to plummet significantly. Starting from March 2024, BTC has touched the peak of this channel pattern formation on five occasions, followed by a downward price correction each time.

Should the underlying feeling persist, it’s likely that Bitcoin might dip down to approximately $63,350 and potentially drop further.

To achieve positive price movement (upward momentum), Bitcoin needs to break free from this current downtrend (downside channel) and close the day with a robust candle above the $71,800 level.

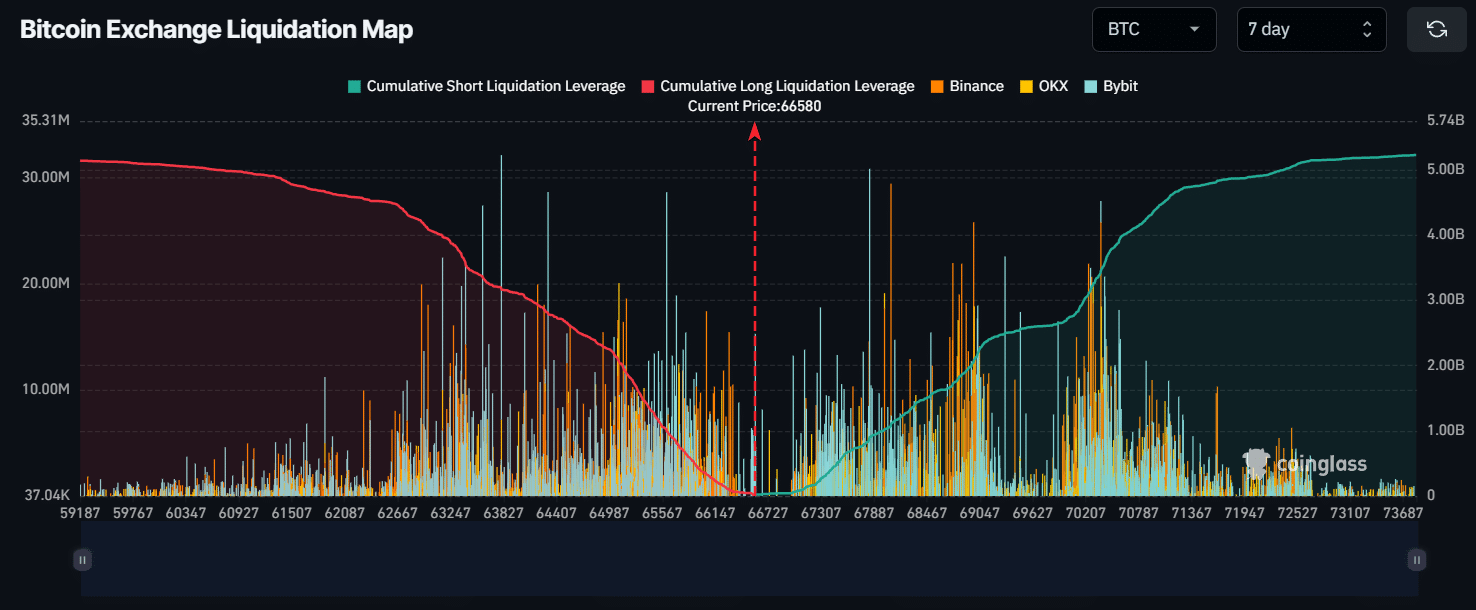

BTC’s major liquidation level

Over the past week, I’ve noticed two significant support and resistance points emerging. On the upper end, these levels appeared around the $70,330 mark, while on the lower side, they were visible near $63,800.

Should history repeat itself and Bitcoin’s price drops to around $63,800, approximately $3.20 billion in long position holders may face liquidation.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If Bitcoin’s price increases and reaches $71,800, approximately $3.3 billion worth of short positions will need to be closed or “liquidated.”

As a researcher examining the cryptocurrency market, I’ve noticed a drop of approximately 6% in Bitcoin (BTC) futures Open Interest (OI) over the past 24 hours. This decrease in OI could indicate a reduced level of engagement from traders and investors, suggesting a potential shift in sentiment towards a more bearish outlook.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-07-31 12:09