-

Bitcoin does not have a bullish sentiment in the short term, but a move toward $67k could be likely.

Macro news events regarding September expectations may have dealt a bearish blow to BTC.

As a seasoned cryptocurrency investor with a decade-long journey under my belt, I must admit that the current market sentiment is a rollercoaster ride, but one I have grown accustomed to. Bitcoin’s dip in the short term doesn’t faze me, as I believe a move towards $67k could be likely if we consider the long-term trend.

Bitcoin (BTC) is often referred to as the “king” of cryptocurrencies not only due to its massive market capitalization, but also because it is the most established and resilient within the market. Over the last ten years, it has served as a compass, influencing the overall sentiment in the crypto world.

The fluctuations in its pricing significantly impact the broader cryptocurrency market, providing insights into why cryptos might be experiencing a downturn currently.

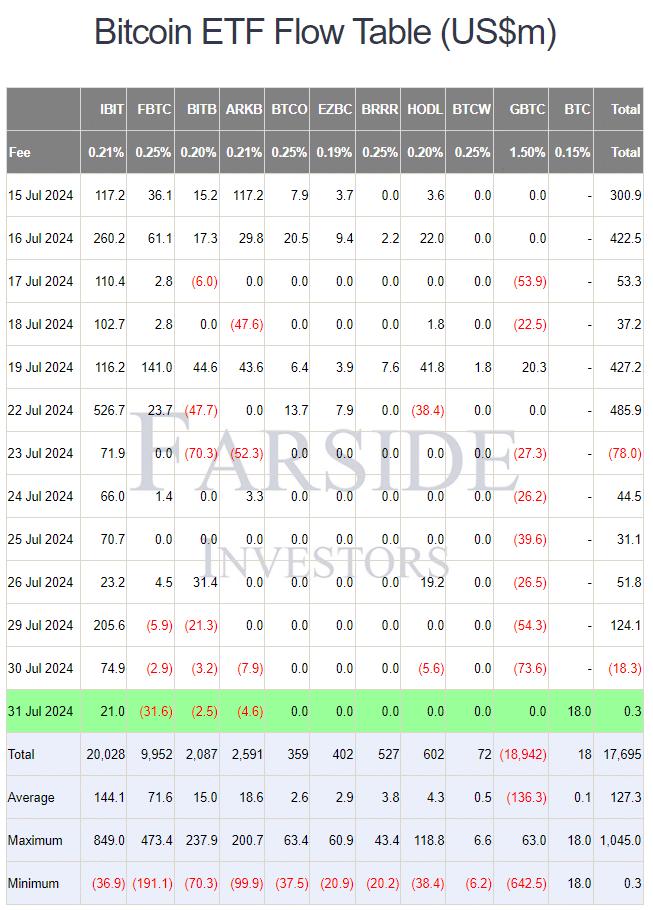

Over the last two days, there’s been a decrease in ETF activity, which could indicate temporary pessimism among investors. However, this short-term trend may not significantly impact the overall direction of the market in the long run. This is because liquidity and broader market sentiments play crucial roles.

The FOMC meeting threw a spanner in the works

The Federal Reserve in the United States kept its key interest rate, known as the federal funds rate, within the 5.25% to 5.5% bracket. Although this stability might have been encouraging, it didn’t offer any hints suggesting a potential rate reduction in September.

FOMC’s statement read,

“Inflation has eased over the past year but remains somewhat elevated.”

It continued,

“The Committee aims to attain optimal levels of employment and maintain a steady inflation rate around 2% in the long term.”

According to the data from the CME FedWatch, it appears that the financial market is now less likely to anticipate a rate cut in mid-September, as opposed to earlier predictions of a 0.25% reduction prior to the FOMC meeting.

This hawkish news might have led to Bitcoin’s prices tanking.

Clues from metrics and liquidation levels

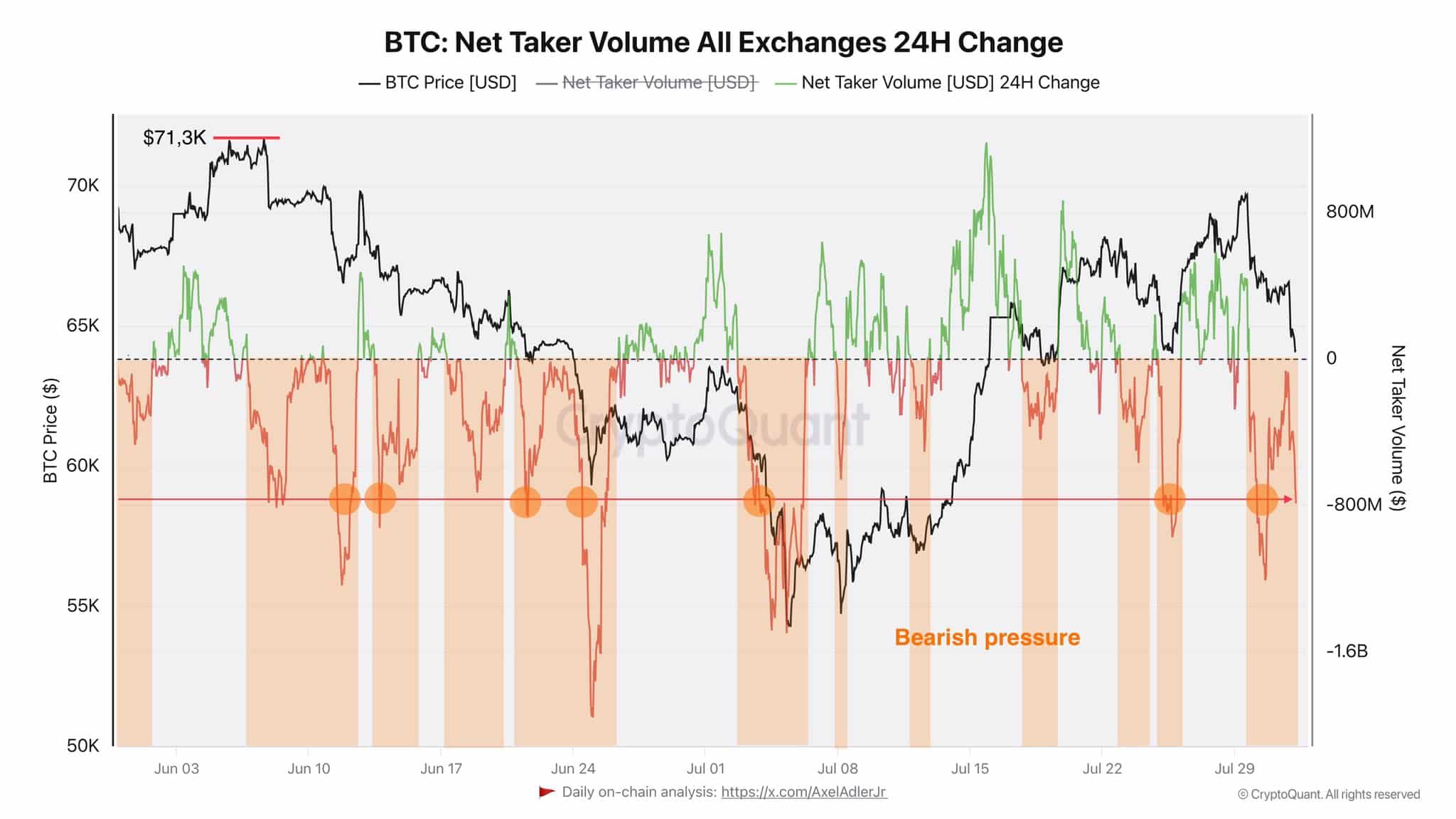

Crypto expert Axel Adler recently shared on platform X (previously known as Twitter), indicating that the overall trading volume has exhibited a predominantly downward, or bearish, trend over the last two months.

Analyzing the gap between trades initiated by buyers (taker buy orders) and those initiated by sellers (taker sell orders) can provide insights into the overall market sentiment. To clarify, when a market order is placed, it’s considered a taker order because it takes liquidity from the market; on the other hand, limit orders are maker orders as they add liquidity to the market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

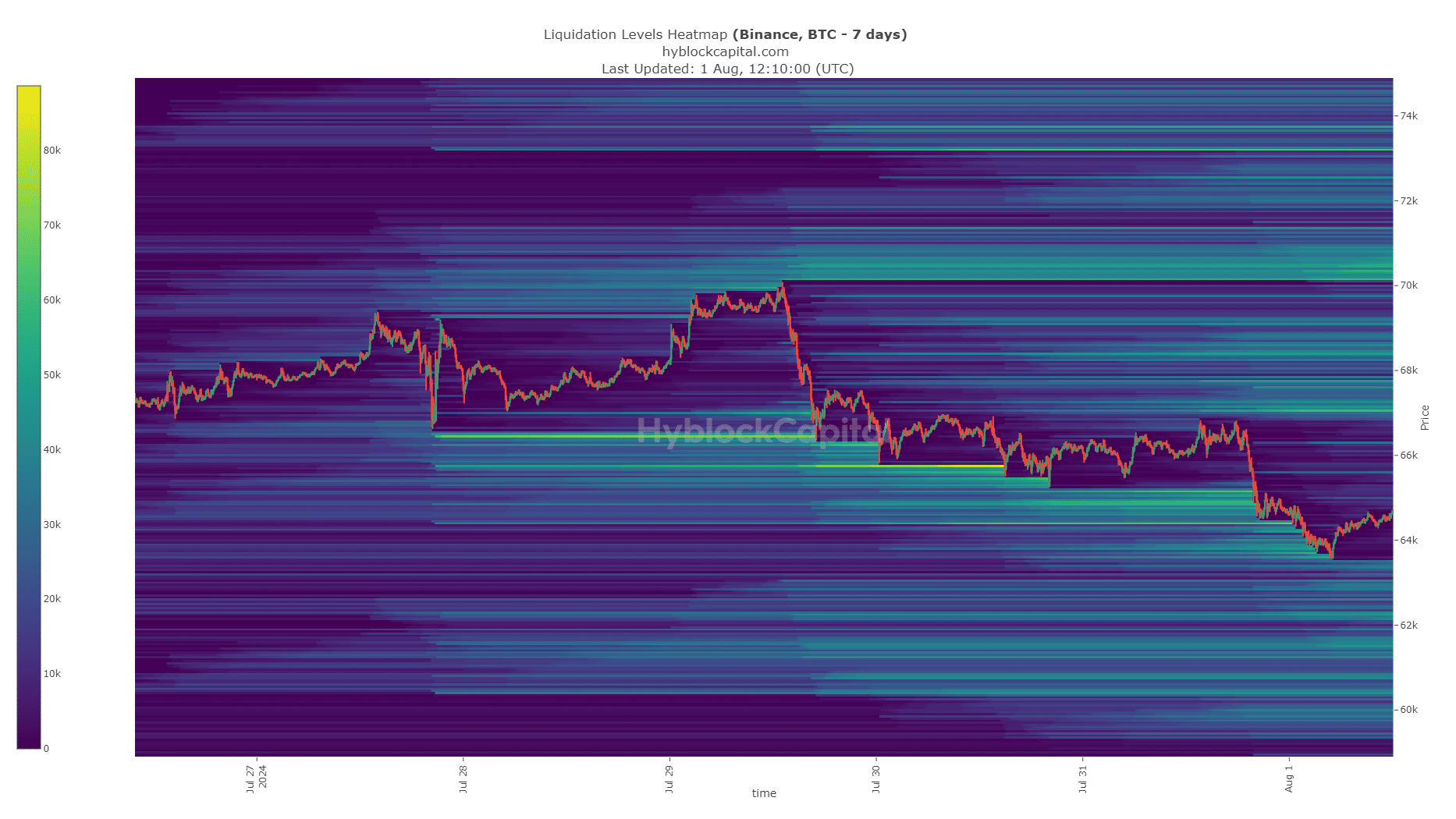

1. The price has touched a level of around $63,700 to $63,900 where significant selloffs occurred (liquidation cluster), and it’s now moving away from this point. The short-term liquidation map indicates that $67,000 could be the next price target.

In summary, the general attitude towards the market was pessimistic, and the anticipation for an interest rate reduction in September has diminished. Collectively, these factors contributed to the decline in cryptocurrency prices and negative sentiments observed over the last few days.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

2024-08-02 06:16