-

PEPE maintained a bearish structure despite the gains in the second half of July.

Traders should beware of a short squeeze in the near term.

As a seasoned researcher with years of experience in the cryptocurrency market, I have learned to navigate its volatile waters with caution and patience. The recent trend of PEPE (PEPE) has caught my attention, and I must share my insights based on the analysis of its price action and technical indicators.

Pepe (PEPE) saw a drop in price following its rejection at the $0.000013 resistance level. Interestingly, a large investor, or “whale,” transferred 400 million PEPE tokens, equivalent to approximately $4.22 million, from an unknown source to Binance.

The increase in transactions heading to exchanges seems to indicate selling activity. Given this trend along with market movements, the outlook for Pepe Coin appears bearish, but there’s still potential for a bullish comeback.

The fair value gap could rescue trapped bulls

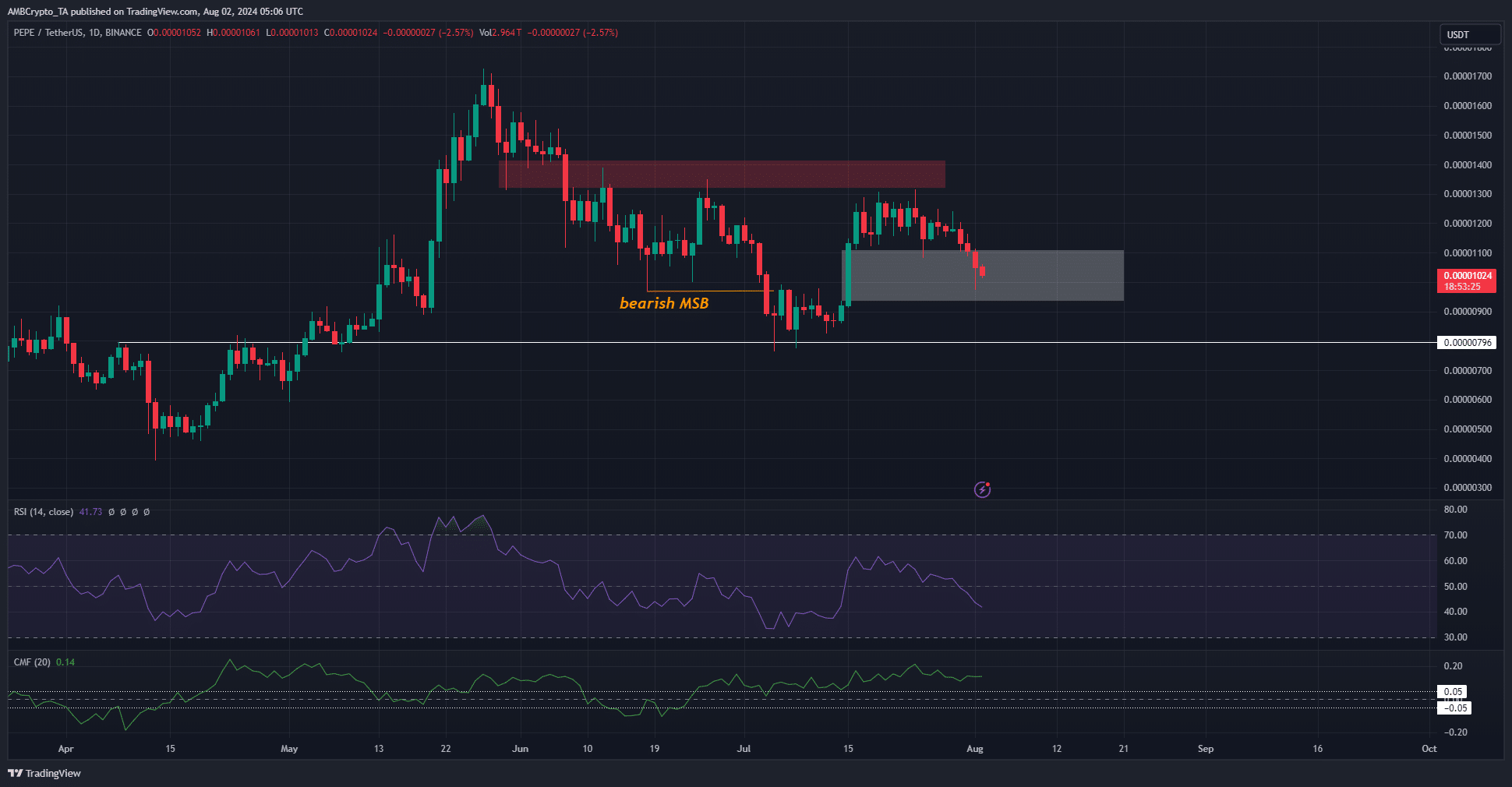

Around mid-July, PEPE experienced a significant surge, increasing by approximately 52% over just five days. This swift rise created a noticeable disparity on the daily chart, as indicated by the white highlighting. As we speak, the meme currency is being traded within this support region.

During the first week of July, a bearish trend emerged, as the market structure broke. Previously, on June 26th, there was a significant drop in price that had not been surpassed until the PEPE investors pulled back from the $0.000013 mark.

As a researcher examining market trends, I noticed that the Relative Strength Index (RSI) dipped below the neutral 50 mark today, suggesting a strong bearish momentum. Yet, the Chaikin Money Flow (CMF) continued to hover significantly above +0.05, indicating substantial accumulation of money by buyers.

The indication suggested significant buyer interest, potentially leading to a change in direction for the price, moving away from the range between 0.000009 and 0.00001 cents.

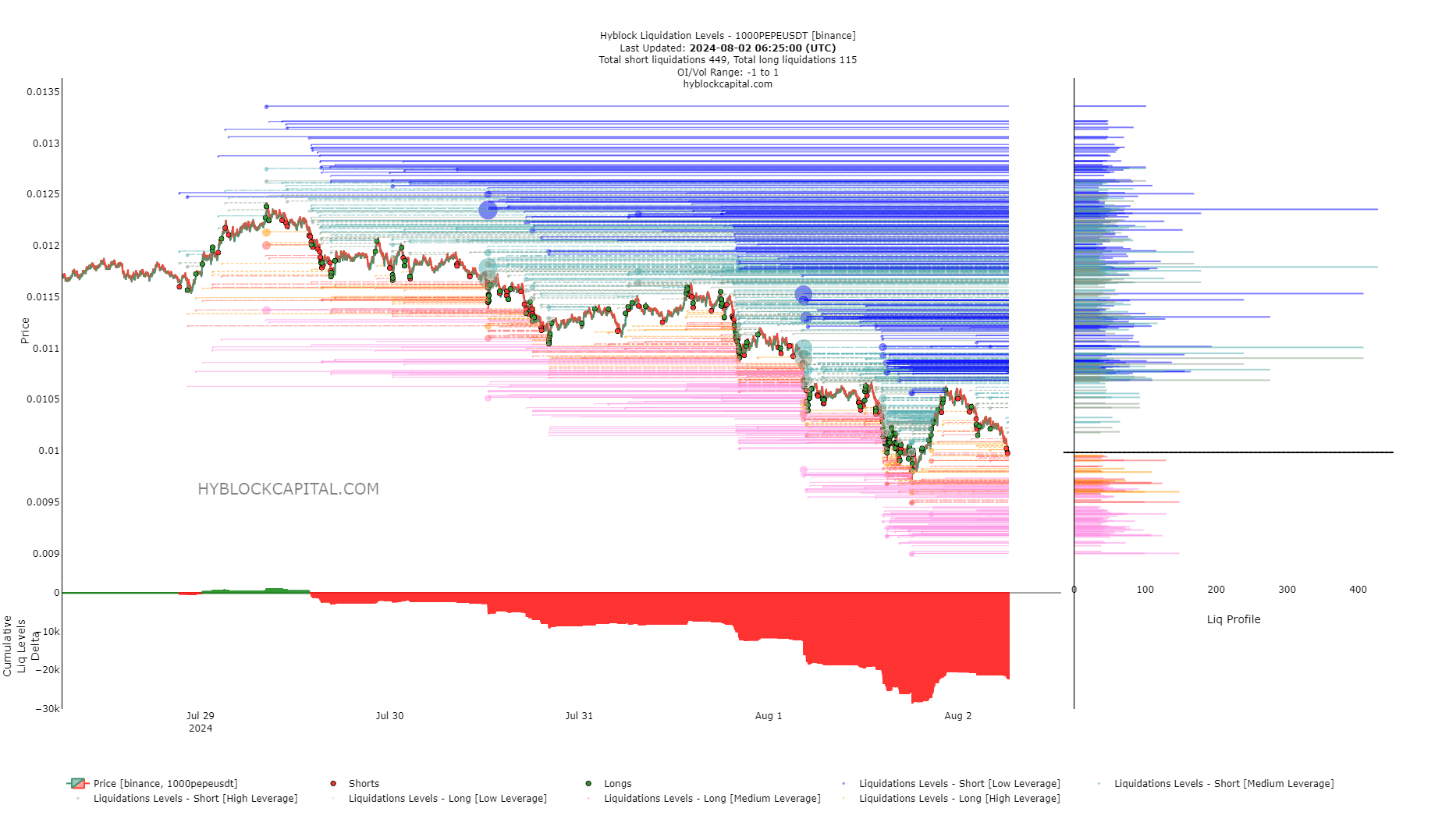

The chances of a short squeeze increase

In simpler terms, the total value of assets sold exceeded the total value of assets bought significantly, suggesting that more traders were betting on a decrease in price (short selling). However, this imbalance might lead to an increase in price as it encourages other traders to buy in order to capitalize on the short sellers’ positions.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

In the northern region, the prices at approximately $0.000011 and $0.0000115 had a significant number of sell orders stacked up.

There’s a chance that the price of PEPE might reach these heights before it starts declining again. This upward trend could be an opportunity for swing traders, who might consider selling their holdings considering the longer-term bearish pattern in the market.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-02 12:09