- Bitcoin ETFs saw strong inflows, with $298M net inflow on the 31st of July.

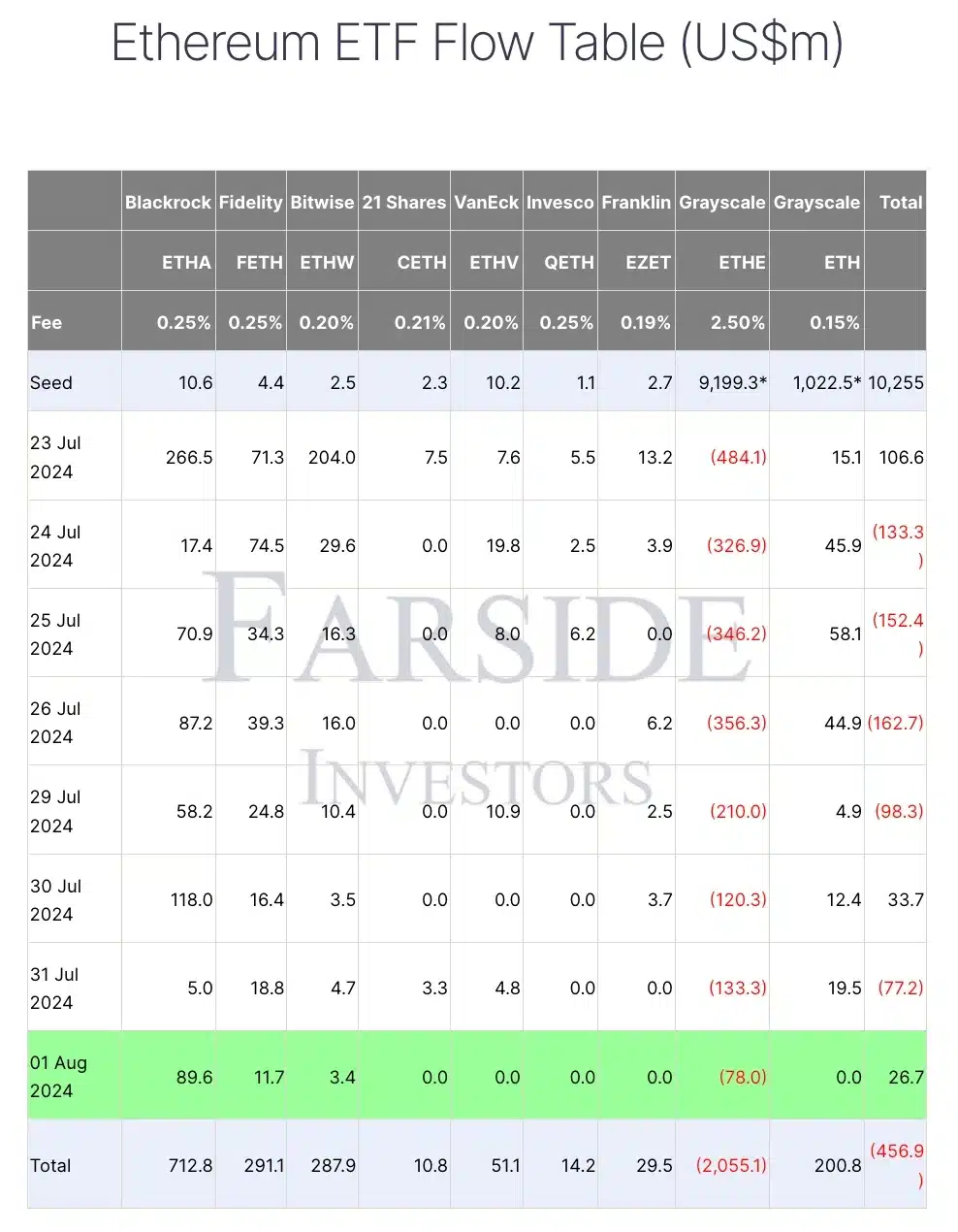

- On the other hand, Ethereum ETFs experienced outflows of $77.2M on the 31st of July.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find the recent trends in Bitcoin and Ethereum ETFs fascinating. The inflows into Bitcoin ETFs, particularly the significant surge on the first day of August, are reminiscent of a gold rush, albeit a digital one. BlackRock’s IBIT ETF leading the charge is a testament to institutional interest in Bitcoin, a trend that seems unabated despite brief downturns like the one in early June.

On August 1st, there was a substantial increase in investments towards Bitcoin Exchange-Traded Funds (ETFs), as approximately $50.6 million flowed into these spot Bitcoin ETFs.

As an analyst, I’d like to highlight that I was particularly intrigued by the significant lead shown by BlackRock’s IBIT ETF. According to Farside Investors, it managed to attract a substantial inflow of approximately $25.9 million.

Bitcoin ETF flow analysis

The increase in Bitcoin ETF holdings of Bitcoin is indicative of a larger trend that’s been ongoing, even during a temporary dip in early June. However, since the beginning of July, there has been a significant upsurge in inflows, outpacing the rates seen in the two months prior.

Indeed, on July 31st, Bitcoin ETFs experienced a total inflow of approximately $298 million. This included an investment of about $17.99 million in the Grayscale Mini ETF BTC and $20.99 million into BlackRock’s IBIT, as reported by SoSo Value.

The well-known crypto information platform, previously known as Twitter’s X, recently posted an update expressing hopefulness about future developments.

“Wow, it’s quite a ride with those fluctuations! It’s intriguing to observe the varying trends in the Bitcoin ETFs.”

Impact on BTC

I observed a downturn in Bitcoin’s price trajectory on August 1st, with its value dipping to approximately $62,000.

By the end of the reporting period, the price bounced back to approximately $64,000. However, the day’s trend chart showed a minimal 0.30% drop in value from the previous 24 hours, with the overall chart still indicating a negative direction.

Ethereum ETF analysis

Interestingly, the performance of BTC ETFs contrasted sharply with that of Ethereum [ETH] ETFs.

On August 1st, there were inflows of $26.7 million into the ETH ETF, but the day before, on July 31st, it experienced outflows amounting to $77.2 million.

Due to recent developments, the day’s Ethereum price graph displayed red candles, signifying a drop. Currently, Ethereum has decreased by around 1% in the last 24 hours, being traded at approximately $3,142.

Remarking on the same, George from StepFinance noted,

As a seasoned cryptocurrency investor with years of experience in the digital asset market, I have come to appreciate the unique qualities that each coin offers. For those seeking a reliable store of value and a strong narrative as sound money, Bitcoin (BTC) is hard to beat. Its decentralized nature, limited supply, and proven track record make it an attractive choice for many investors.

In this context, George is emphasizing that Ethereum may not have a distinctive or essential role when compared to a market where Bitcoin and Solana [SOL] are predominant.

It’s interesting to see if Ethereum ETFs will eventually outperform Bitcoin ETFs, or if Bitcoin will remain dominant in this exchange-traded fund competition as more investments flow in.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-08-02 16:09