- Bitcoin saw higher exchange outflows compared to inflows as demand started to recover.

- Derivatives remained weak as Micro strategy led the charge in the spot market.

As a seasoned crypto investor with a decade-long journey through the wild west of digital assets, I find myself intrigued by the recent trends in Bitcoin [BTC]. The higher exchange outflows compared to inflows indicate a resurgence of demand, which aligns with my own observation that every major pullback in BTC is followed by a strong rebound.

As a crypto investor, I’ve noticed the recent selling pressure in Bitcoin (BTC) this week, but I’m optimistic it could be temporary. New insights indicate that the speed at which Bitcoin is being withdrawn from exchanges is picking up.

Previously, AMBCrypto’s assessment indicated a probable increase in purchasing interest for Bitcoin within the range of approximately $59,896 to $61,801.

Reflecting on the market, I noticed a pullback on the 1st of August, which to me suggested a surge in buying interest. Piqued by this observation, I delved into on-chain data, where it became evident that Bitcoin’s demand was on the rise yet again.

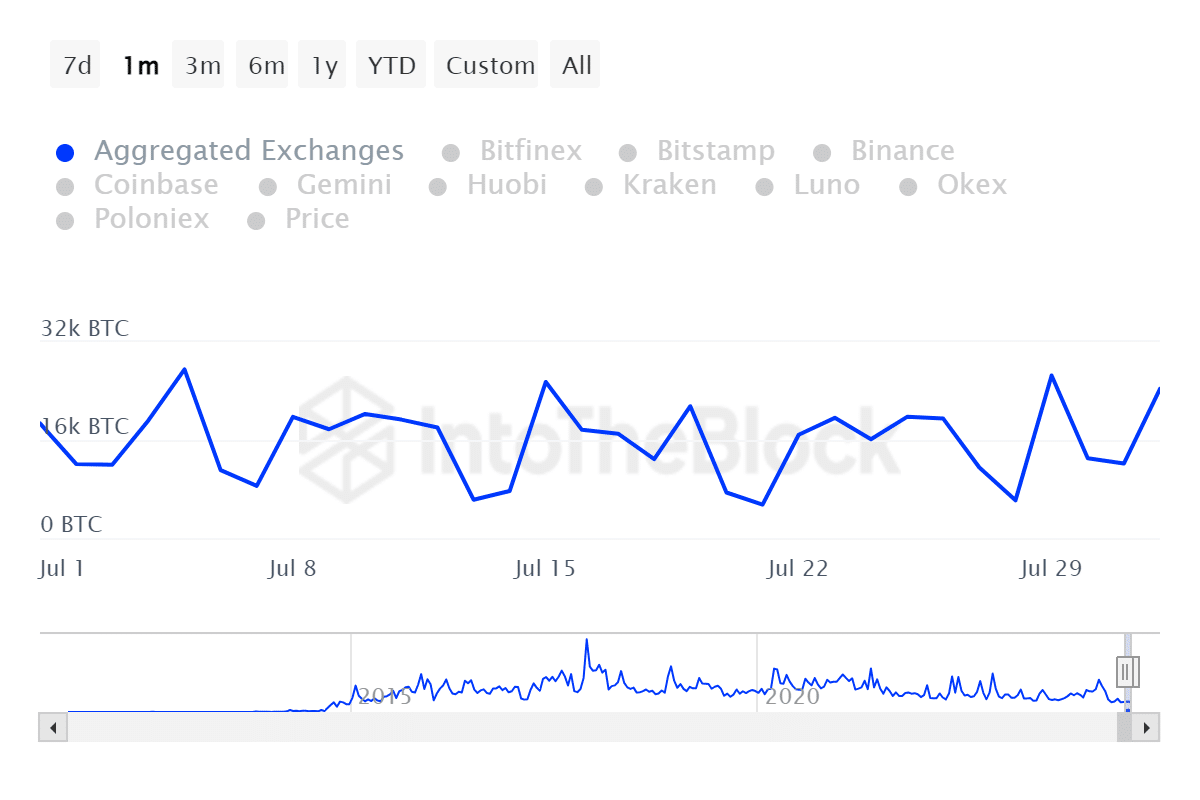

In the past day, the total Bitcoin withdrawals from exchanges reached a high of approximately 24,370 Bitcoins, as indicated by our analysis.

As a long-time cryptocurrency enthusiast with years of experience monitoring market trends and exchange activity, I have noticed that this week’s Bitcoin (BTC) exchange outflows are approaching levels not seen since July 29th, when they reached a high of 26,530 BTC. This could be an indication of large-scale investors moving their BTC holdings to cold storage or off-exchange wallets, which may suggest a bullish sentiment among them. However, it’s important to remember that the cryptocurrency market can be highly volatile and unpredictable, so I always recommend conducting thorough research and making informed decisions before investing.

In the latter half of June, I’ve noticed that the very same Bitcoin metric hit lower lows, suggesting that each successive wave of selling pressure might be losing steam since then.

If that’s true, it implies that Bitcoin’s maximum decline might be restricted. This scenario could open doors for further gains. Nevertheless, it’s essential to consider Bitcoin’s inflow volumes from exchanges in relation to this assessment.

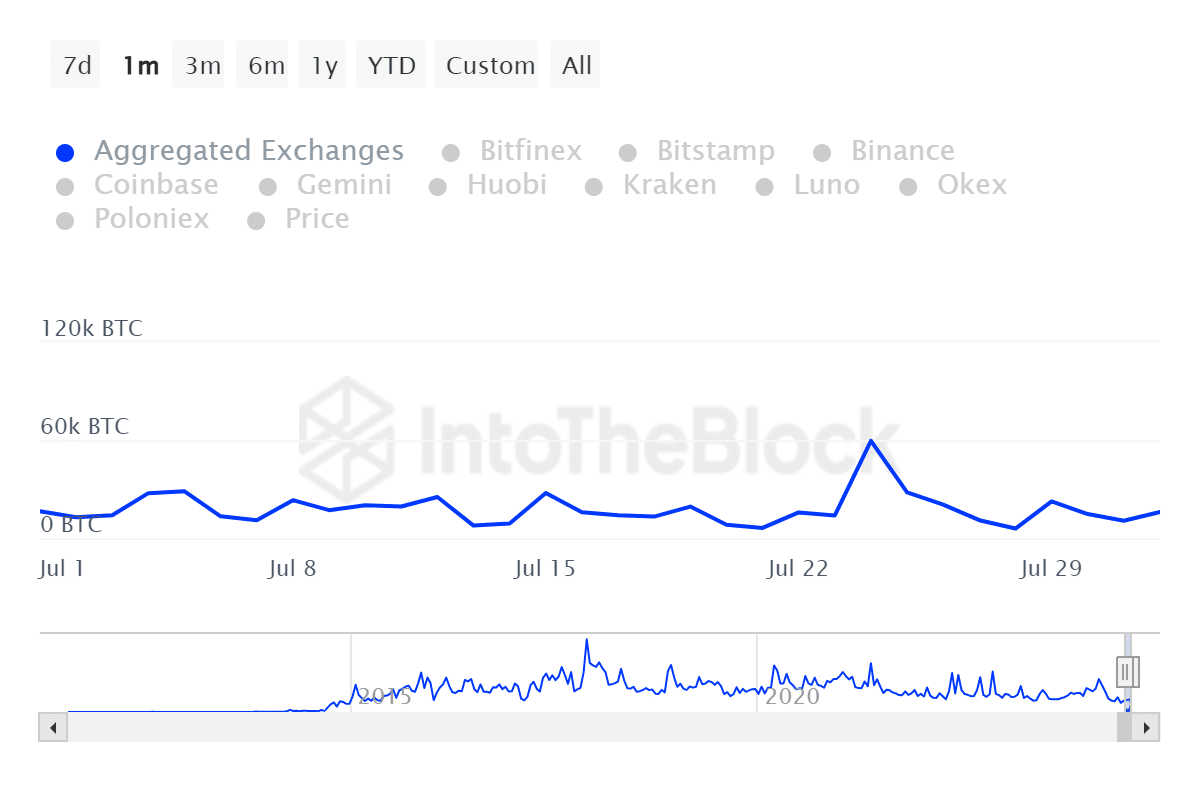

On the 24th of July, the total incoming volume of Bitcoin transactions through all major exchanges reached its highest point for the month at 59,460 Bitcoins.

According to the most recent figures, approximately 15,950 Bitcoins moved into exchanges. This suggests that more Bitcoin was being withdrawn from exchanges than deposited, resulting in a surplus of demand for the asset.

Who is buying?

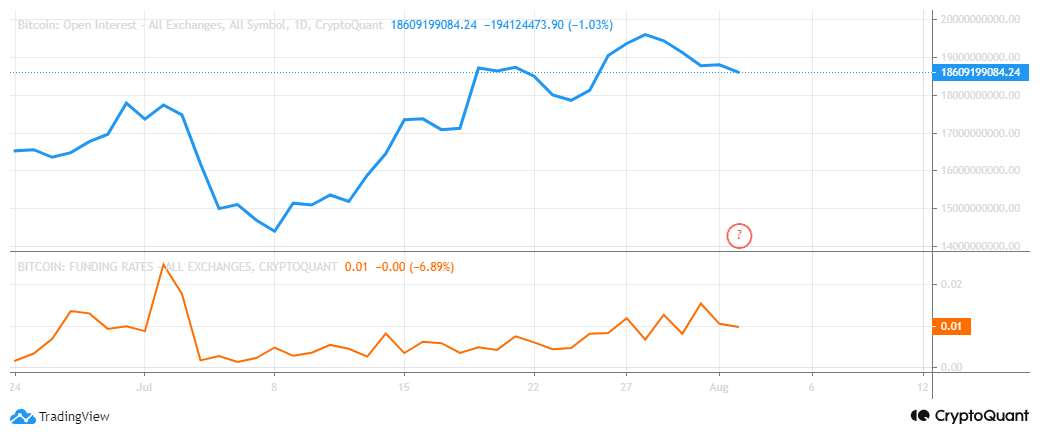

According to AMBCrypto’s analysis, the trends observed in the data align with a decrease in exchange reserves. Yet, the derivatives market suggests that demand remains relatively low.

At the observed moment, Open Interest continued to decline, suggesting a trend. Meanwhile, Funding Rates showed signs of deceleration, hinting at a degree of uncertainty regarding the price level at that specific instant.

It appears that the majority of the current demand is derived from the immediate market, as indicated by the observations. Notably, bullish entities such as MicroStrategy have been seizing opportunities presented by price drops.

More recently, it was disclosed by the company’s chairman, Michael J. Saylor, that they have acquired an additional 169 Bitcoins, increasing their Bitcoin holdings significantly. This means that the company now owns approximately 1.14% of all Bitcoins currently in circulation.

MicroStrategy further disclosed its intention to continue making Bitcoin acquisitions. To finance these future transactions, the firm plans to sell additional shares valued at approximately $2 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

While Bitcoin’s high demand may be masking it, there’s no denying that a substantial level of selling has occurred.

As a researcher delving into market dynamics, I can attest that certain bearish elements persist, capable of instigating sell-offs. For instance, governments divesting their Bitcoin reserves and fluctuating economic data serve as potential triggers for such market corrections.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Here’s What the Dance Moms Cast Is Up to Now

2024-08-02 18:48