-

Ethereum’s daily active addresses have decreased to around 395,000.

An address moved over 19,500 ETH to Binance in the last 48 hours.

As a seasoned researcher with years of observing and analyzing market trends under my belt, I must admit that Ethereum’s recent developments have piqued my interest. The decrease in daily active addresses from over 700,000 to around 395,000 is indeed a noticeable shift, one that echoes the ebb and flow of market dynamics I’ve witnessed countless times before.

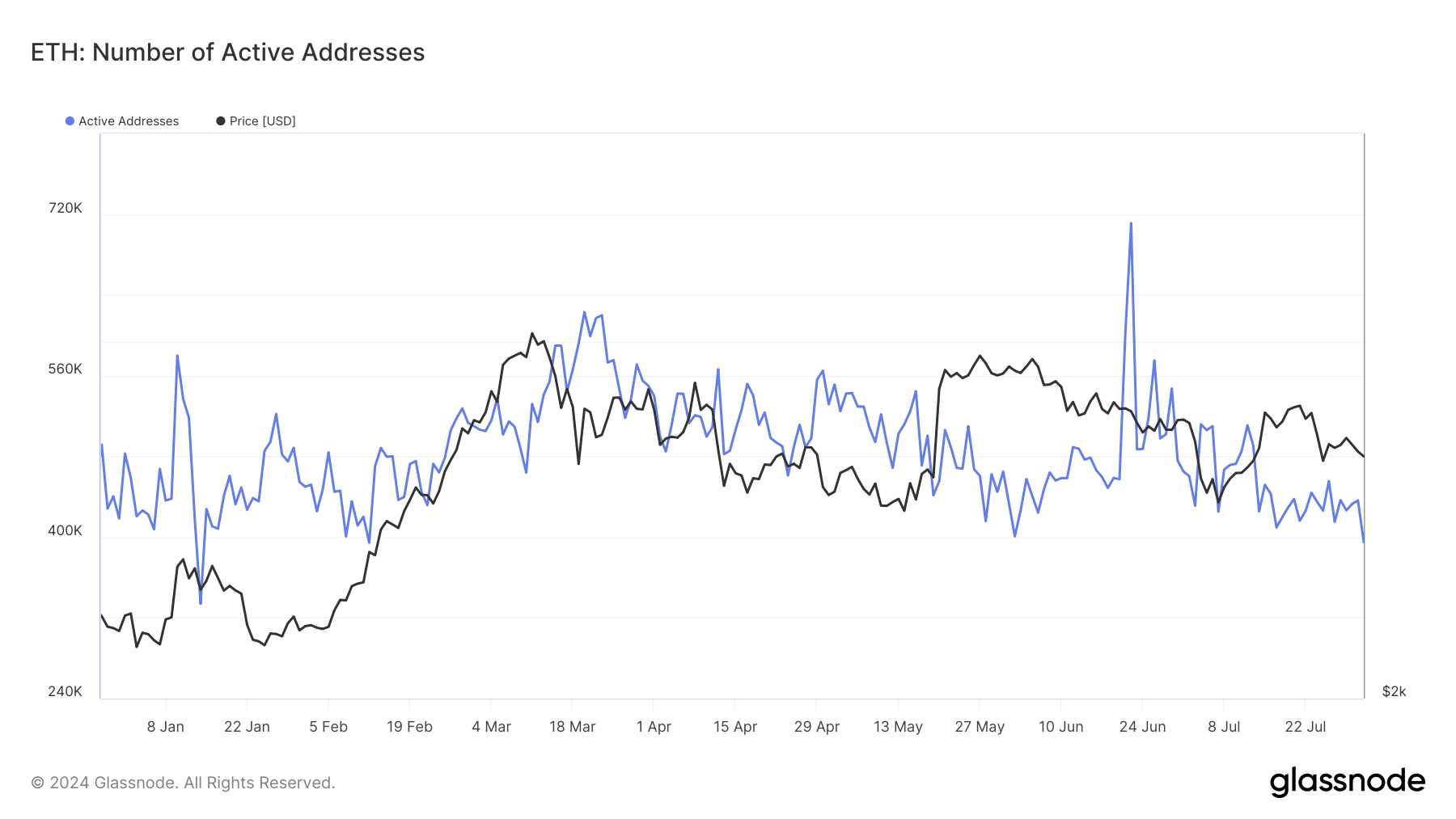

Over the past year, there’s been a notable rise in the number of daily active users interacting with the Ethereum blockchain [ETH], suggesting a higher level of activity and involvement within its community.

On the other hand, it appears that the number of actively used addresses has been decreasing as per recent tendencies, potentially indicating a potential decrease in overall activity.

Concurrently with this decline, there’s been a distinct change in market behavior, as sellers have taken the lead in trading transactions.

Ethereum’s volatile active addresses

Based on Glassnode’s data, there has been a significant jump (an increase of approximately 127%) in the number of daily active Ethereum addresses this year.

The main factor fueling this significant expansion, according to the report, is increased action on Layer 2 (L2) systems.

A detailed examination of the “active addresses” statistic on Glassnode revealed a spike, surpassing 700,000 per day in June.

Over the past few weeks, I’ve noticed a declining pattern in our metric of interest. Following a substantial surge that peaked at approximately 510,000 active addresses in July, there seems to be a tapering off. This trend is something I’m currently investigating further to understand its potential implications.

By the close of July, I observed that the number had dwindled to roughly 436,000. According to the most recent figures I’ve gathered, it has since dropped even more, now standing at approximately 395,000.

Ethereum sellers appear more active

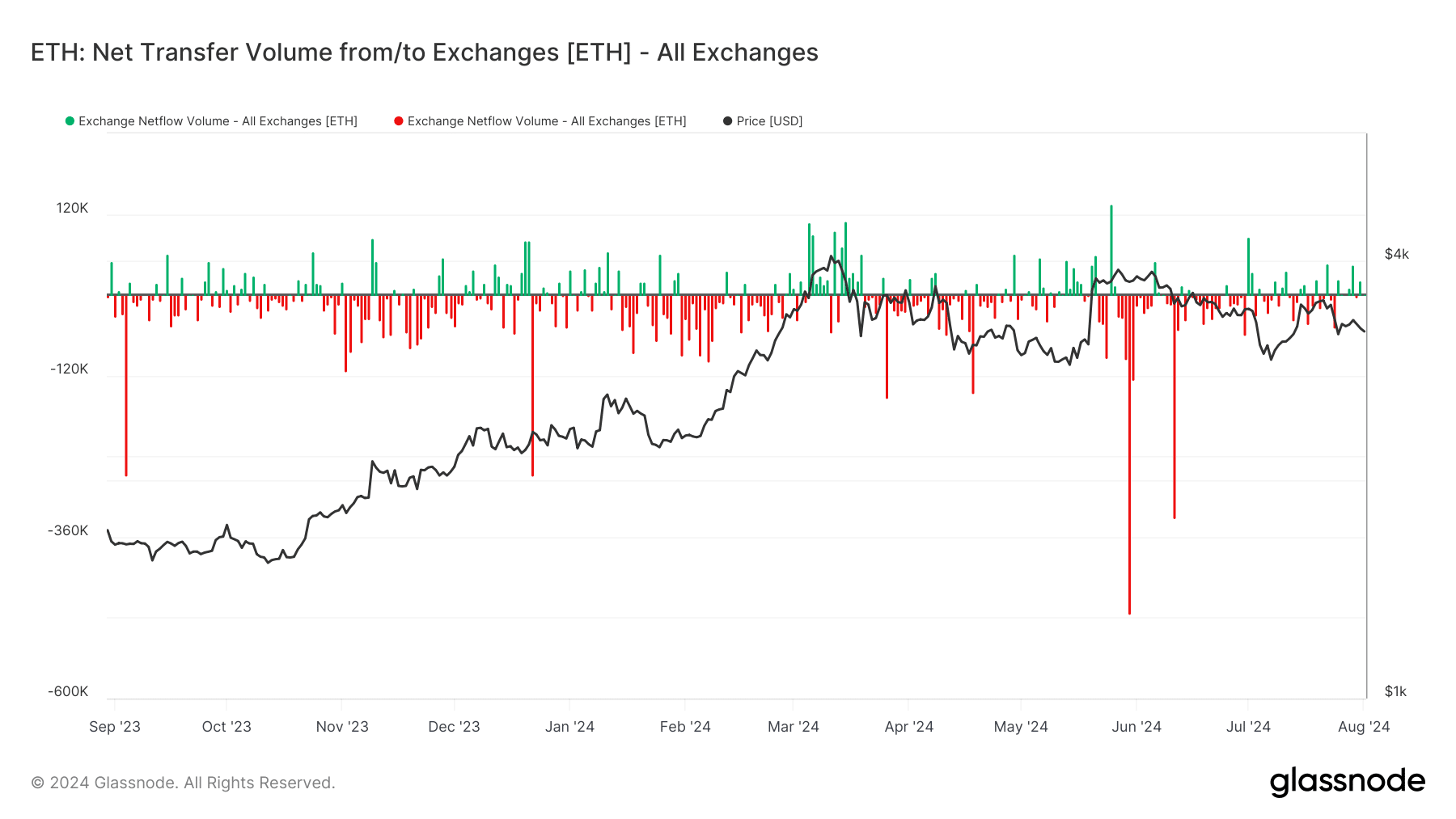

As an analyst, I’ve recently observed an intriguing pattern while examining the netflow of Ethereum on Glassnode. This trend indicates that a higher volume of Ethereum is being deposited onto exchanges compared to the amount being withdrawn.

The move suggested a predominance of selling activity among holders. Over the past month, this trend culminated with a significant influx of over 22,000 ETH into exchanges.

Deepening the pattern observed, findings from Lookonchain suggest certain accounts have shown high activity in moving Ethereum to exchange platforms.

Over just the past two days, these accounts collectively transferred around 19,500 Ether, equivalent to approximately $64 million, to the Binance platform.

Major transfers to exchanges often signal a willingness to offload holdings, thereby increasing the overall supply available for trade on the market.

The surge of Ethereum into exchanges has happened concurrently with, and probably amplified, the recent drop in Ethereum’s value.

With more Ethereum getting listed for sale on these trading platforms, there might be an escalation of sellers which could push the price lower. This is particularly possible if the demand fails to match the newly increased supply.

RSI shows increasing bear trend

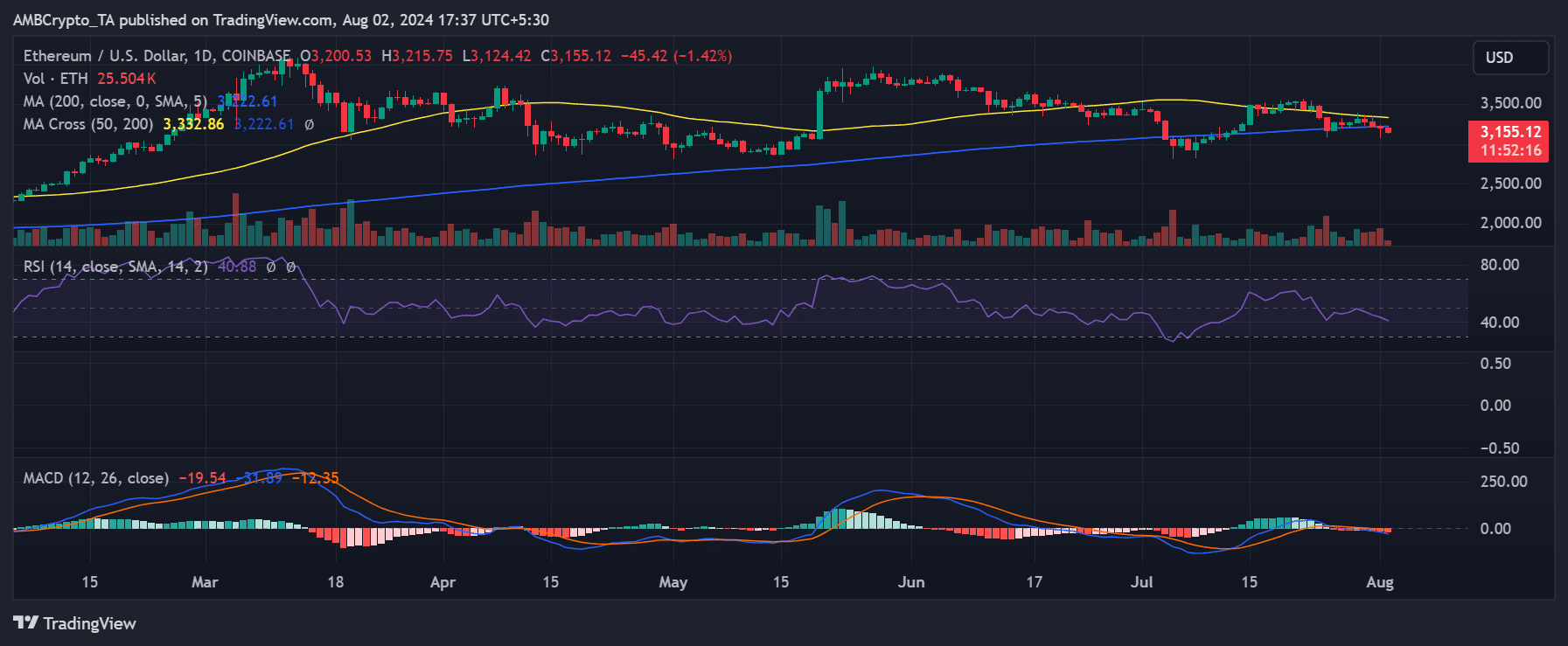

Upon examination of Ethereum’s daily price fluctuations, it showed a drop of more than 1.4%, with the current price standing around $3,154. This is the fourth straight day we’ve seen a decrease in its value.

Based on AMBCrypto’s report, Ethereum started a continuous drop around the 30th of July. Currently, the Relative Strength Index (RSI) stands at approximately 41, suggesting an increasingly dominant bear market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-08-03 01:06