-

Bitcoin leads the crypto space despite market-wide uncertainty on the price front

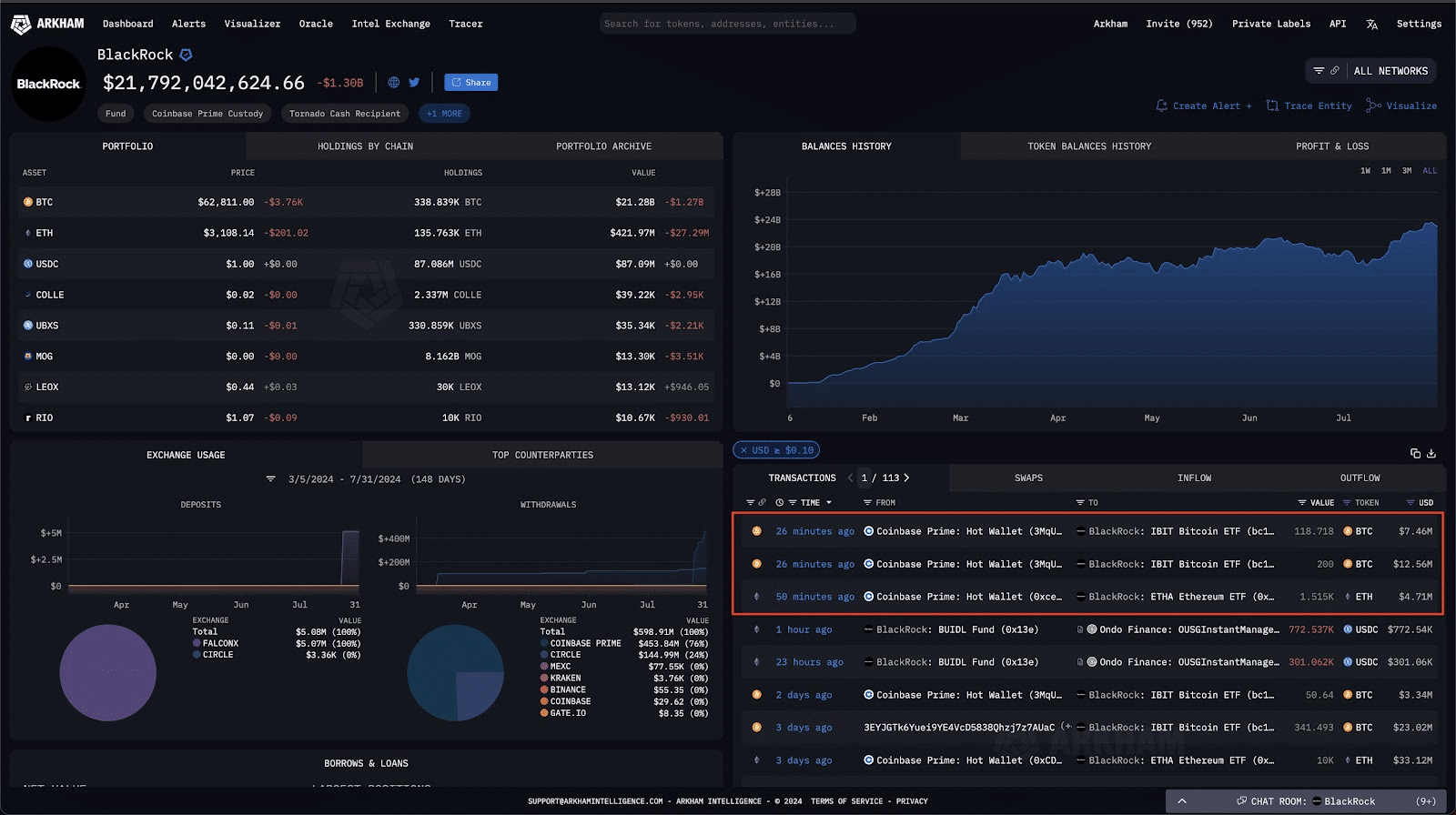

Blackrock is continuing to buy more BTC, despite weak hands capitulating

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. In the world of cryptocurrencies, I find myself continuously intrigued by the unpredictability and rapid pace at which this space evolves.

Over the past few days, some of the market’s leading cryptocurrencies have experienced an intriguing period, notably Bitcoin recovering on the charts following a brief dip. At present, it is being traded slightly above $64,000, showing a minor decrease of nearly 0.5% over the last day.

Even altcoins in the market weren’t exempt from this sluggishness; Ethereum (ETH), Solana (SOL), and Ripple (XRP) were trading near their respective prices of $3159, $164.59, and $0.5966 at the moment when the press release was issued.

Regardless, the overall attitude toward cryptocurrencies still leans towards cautious optimism. However, Dogecoin (DOGE) and Shiba Inu (SHIB) are currently trading in areas that warrant caution as indicated by their chart positions.

Blackrock’s influence on BTC’s future price

Blackrock’s growing presence within the cryptocurrency world, even amidst recent price drops, represents a calculated strategy aimed at profiting from market trends, especially when the balance between fear and greed dominates.

The situation is becoming more significant as numerous businesses, educational institutions, and even large Bitcoin investors like whales, have been accumulating thousands of Bitcoins according to well-known analyst Lark Davis.

The timing is especially crucial here since it comes after Russia’s new bill on Bitcoin mining and crypto payments for international trade with strict regulations.

Accumulated influences like investments and market sentiment might cause significant fluctuations in Bitcoin’s price over time.

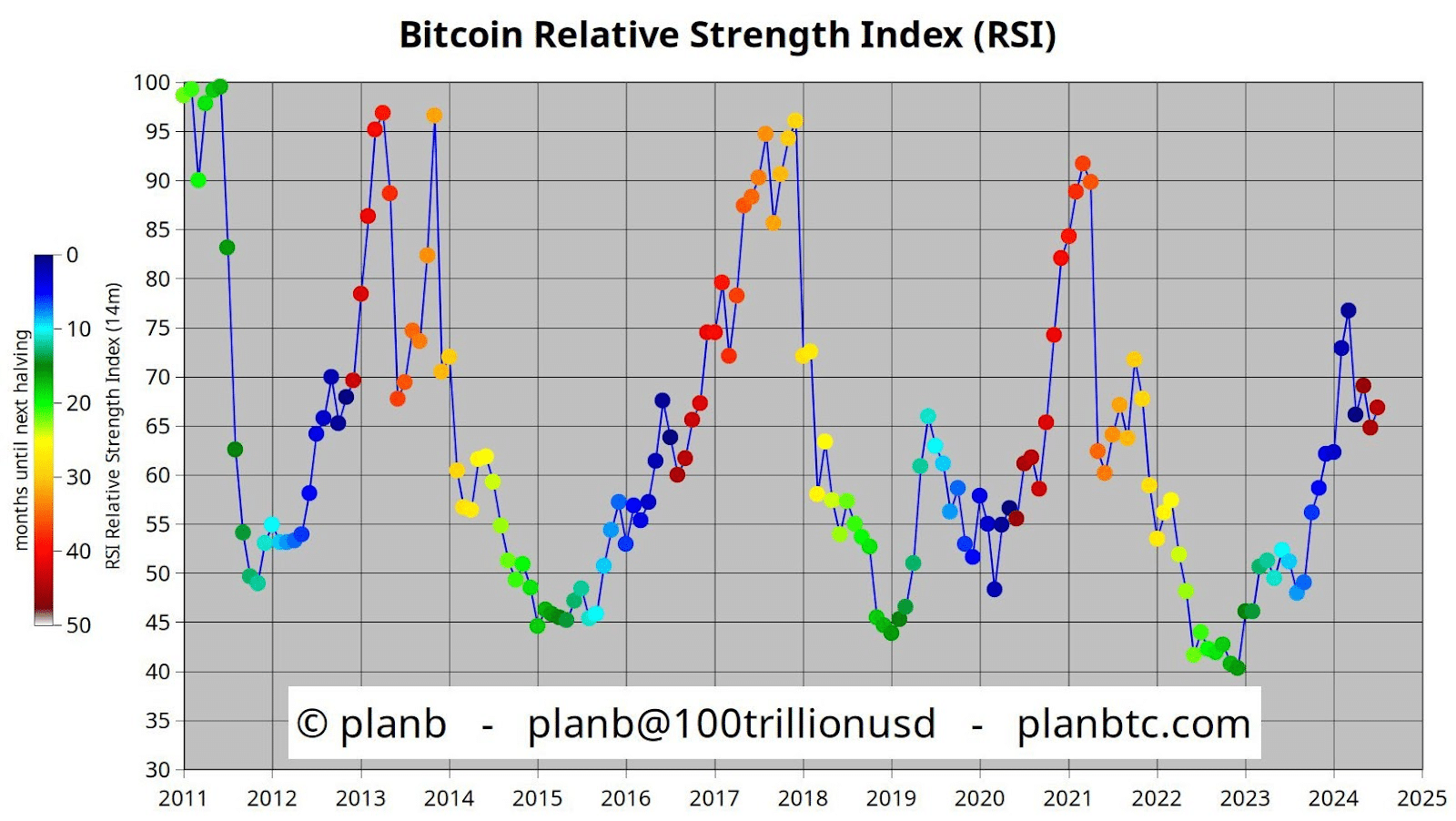

RSI analysis suggests 2017 run could repeat itself

Right now, when I’m typing this, Bitcoin’s Relative Strength Index (RSI) was roughly at 65. In simpler terms, this could mean that a significant upward trend or “bull rally” might be imminent.

In the past, Relative Strength Index (RSI) values have frequently been employed to anticipate the future price movements of an asset, as observed by crypto analyst Quinten when he analyzed X based on this significant indicator.

Monitoring Bitcoin’s RSI trends will be crucial here.

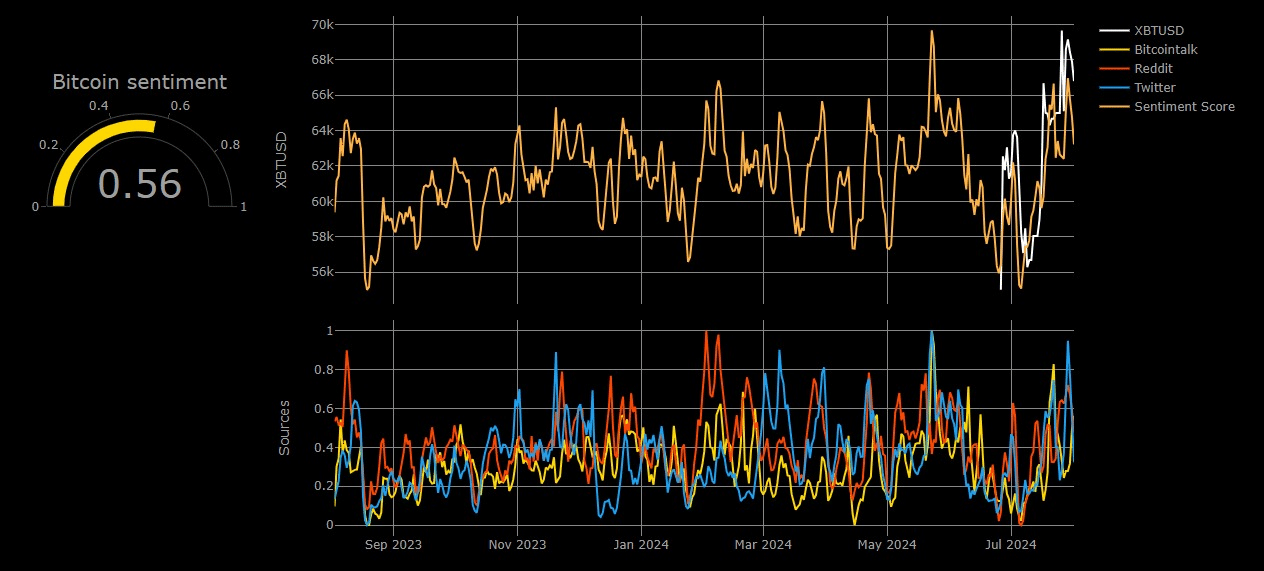

Bull & bear index shaping the future price of BTC

Here, it’s worth looking at other datasets too. On-chain metrics such as wallet activity and transaction volumes, for instance, revealed heightened accumulation by long-term holders.

Moreover, the Bull & Bear index also showed a value of 0.56 – Indicating Bitcoin might be in an accumulation period.

Frequently, this pattern is seen before an asset experiences a rise in its market value, suggesting a possible increase in price in the near future, based on current assumptions.

What a wedge breakout means for BTC’s price

In simpler terms, the predicted downward break in Bitcoin’s ascending triangle (rising wedge pattern) has occurred, just as we had foreseen, causing a drop that follows the placement of stops below the trendlines.

In the fourth quarter, this action could confine the bears and potentially push the cryptocurrency’s price back over $70k. Interestingly, recent chart patterns suggest that the market may be gearing up for an uptrend following some early indications.

Breaking above the $70k key resistance zone could spur a run towards the $100k psychological level.

According to various factors such as technical signals, blockchain data, and Blackrock’s participation, there’s a possibility that Bitcoin could mimic its past price trends.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-08-03 05:11