- Dogecoin may have tanked for seven consecutive days, but there is light at the end of the tumbling tunnel.

- We explored key metrics in the quest to establish the likelihood of an explosive breakout.

As a seasoned analyst with over two decades of market observation under my belt, I must say that the current Dogecoin [DOGE] situation presents an intriguing scenario. Despite the seven-day downtrend, the potential for an explosive breakout remains tantalizingly within reach.

As an analyst, I am observing a promising potential for Dogecoin (DOGE) to surge in value, perhaps even surpassing the impressive rally it experienced from February to April of this year.

If that is the case, then its latest bearish retracement could be seen as a great opportunity.

Earlier this year, a surge in Dogecoin’s value demonstrated its continued popularity among investors. However, over the past few months, supporters of Dogecoin (DOGE) have found it challenging to reclaim control over the market.

For DOGE holders, this result could appear disheartening, yet it’s essential to remember that the interpretation depends on one’s viewpoint.

Although the linear graph of Dogecoin’s price didn’t stand out much, its logarithmic graph presented a distinct view instead.

As an analyst, I’ve been monitoring the trends, and based on the log chart analysis, it appears that Dogecoin (DOGE) is currently sitting within a significant breakout range. This potential breakout could occur at any point in the near future.

The same chart suggested that the memecoin might have a bigger bull run this time, than what we saw in the last 2 bull runs.

The log-based analysis suggested that a 7200% rally could be on the cards, possibly sending Dogecoin as high as $10.

Are buyers flocking in to buy Dogecoin?

To address this query, let’s examine the various categories of Dogecoin investors and their performance over the past three months instead.

The logic was that doing so would provide a rough idea of who has been adding to their bags.

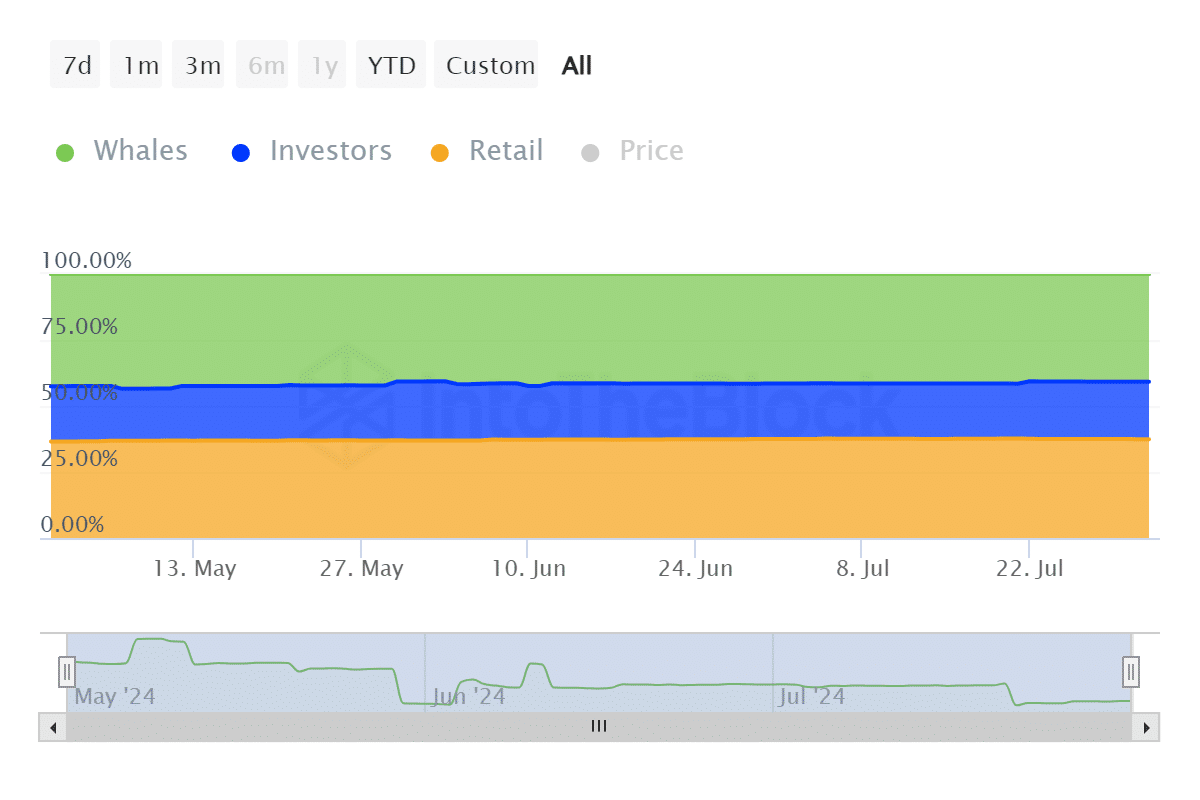

At the beginning of May, whales possessed approximately 64.84 billion Dogecoins, representing around 42.57% of the total supply. However, by August 1st, their holdings had decreased to roughly 63.47 billion Dogecoins, equating to about 40.79% of the supply.

At the onset of the three-month period, investors owned approximately 31.81 billion DOGE, which represented around 20.88% of the total supply. As we moved into this month, their holdings expanded to roughly 33.92 billion DOGE, now accounting for about 21.8% of the total supply.

In the beginning of May, retail sector’s Dogecoin assets started at approximately 55.68 billion coins, accounting for 36.55%. However, by the end of the month, these assets had significantly increased to 58.19 billion tokens, which represented around 37.4% of all Dogecoin holdings.

In other words, the market.

The information provided shows that whales (large investors) have been selling their holdings, which is putting downward pressure on the market price. On the other hand, individual traders and larger investors are taking advantage of reduced prices to make purchases.

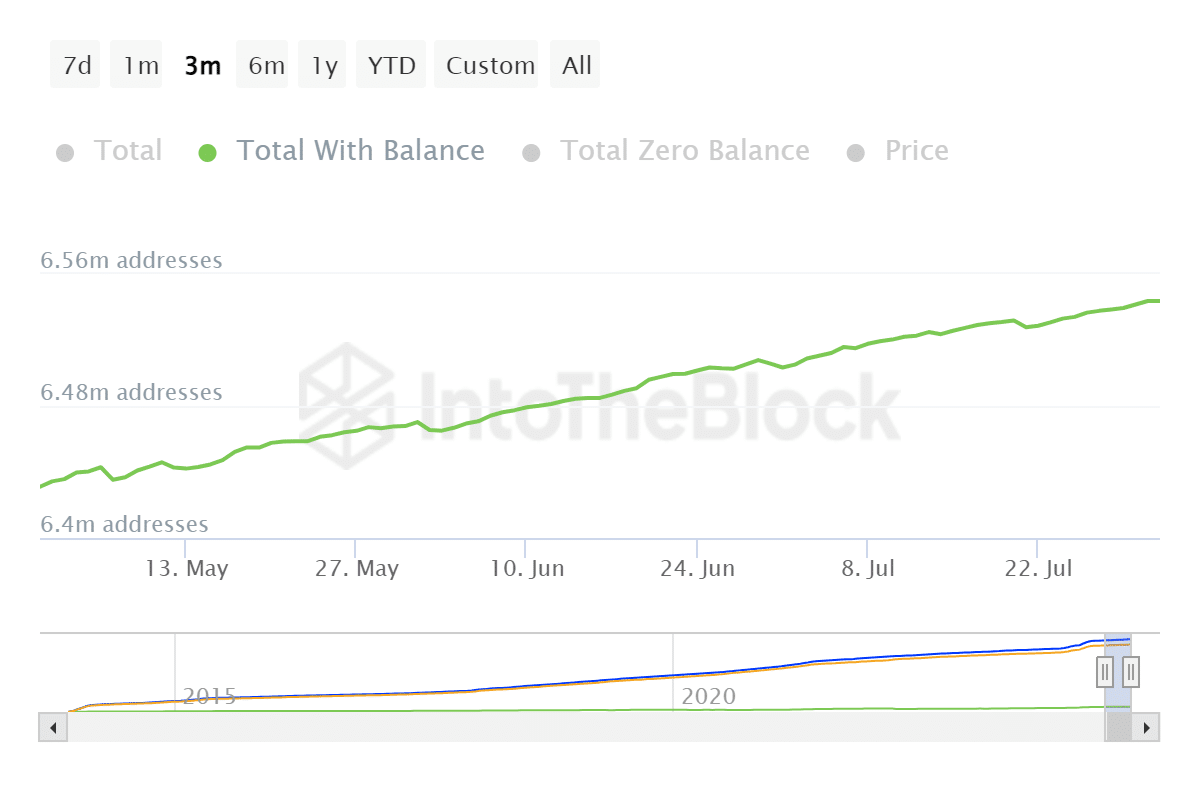

During a span of three months, the number of Dogecoin (DOGE) addresses increased from approximately 6.43 million to about 6.54 million.

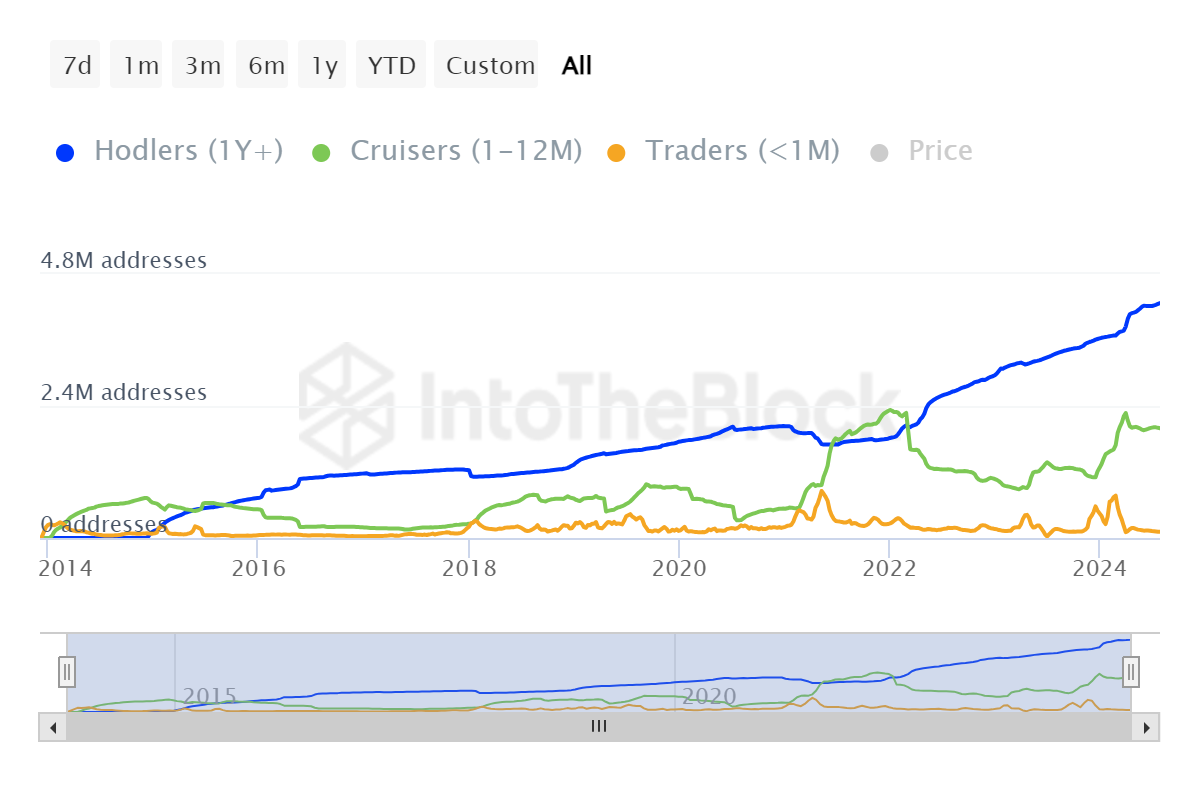

Check out this intriguing finding: The peak number of HODLers has hit a record 4.26 million wallets. Conversely, the number of active traders has noticeably decreased since February.

The results supported our prediction of a rapid price increase. With fewer traders involved, there was more potential for buying demand to drive up prices while selling pressure remained low.

However, low participation from whales could be the missing ingredient for an explosive rally.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-03 06:15