- Toncoin volume indicators conflicted, but the higher timeframe trend remained bearish.

- The momentum and market sentiment recently signaled that further losses were likely.

As an analyst with years of experience in this volatile market, I must say that Toncoin [TON] is currently showing a bearish outlook. The trend across multiple timeframes has been steadily downward, and recent reports suggest that the bearish momentum is strengthening.

Over several time periods, Toncoin (TON) was on a downward trajectory. However, recent findings suggest that the negative trend is growing stronger. Yet, the data from the Futures market offers a glimmer of optimism.

Despite anticipation for a bullish September, Bitcoin [BTC] has experienced downward pressure instead. Similarly, the overall sentiment caused TON to drop below the range it established back in early June.

Prices are headed below the $6 level

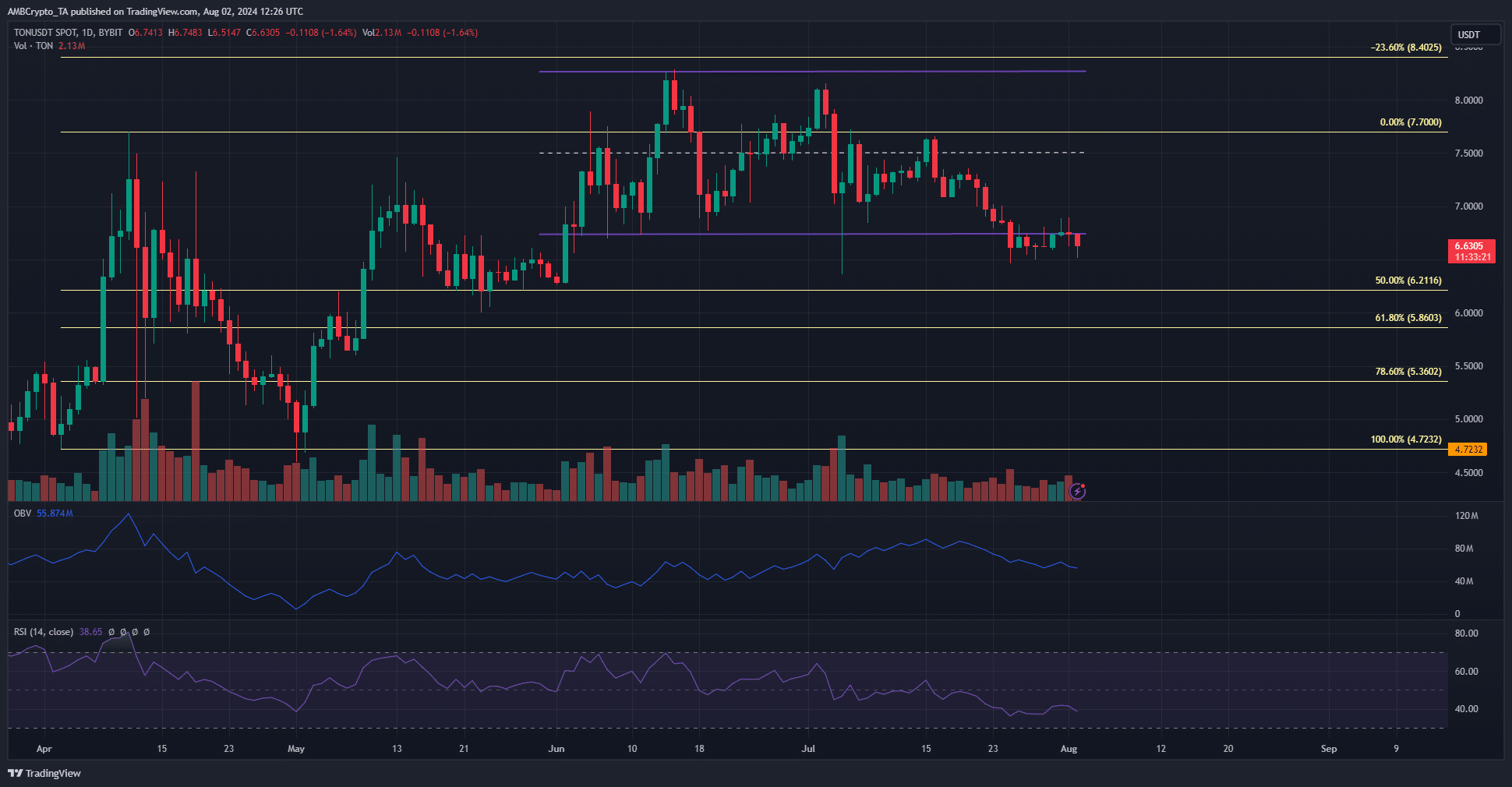

For about a month now (since early June), Toncoin has been trading between $6.74 and $8.27. However, during the last seven days, the lower boundary of this range has been surpassed and turned into a resistance area instead.

Following this event, the OBV (On-Balance Volume) trend persisted in falling, suggesting this decline might not be an anomaly, but rather an extension of the previous month’s descending pattern.

Today’s relative strength index (RSI) showed a bearish trend as well. The Fibonacci retracement levels have indicated potential support zones at $6.21, $5.86, and $5.36. If the price action fails to hold within the lower range boundaries, it seems probable that we might see a drop below the $6 mark in August.

What will revive TON’s bearish bias?

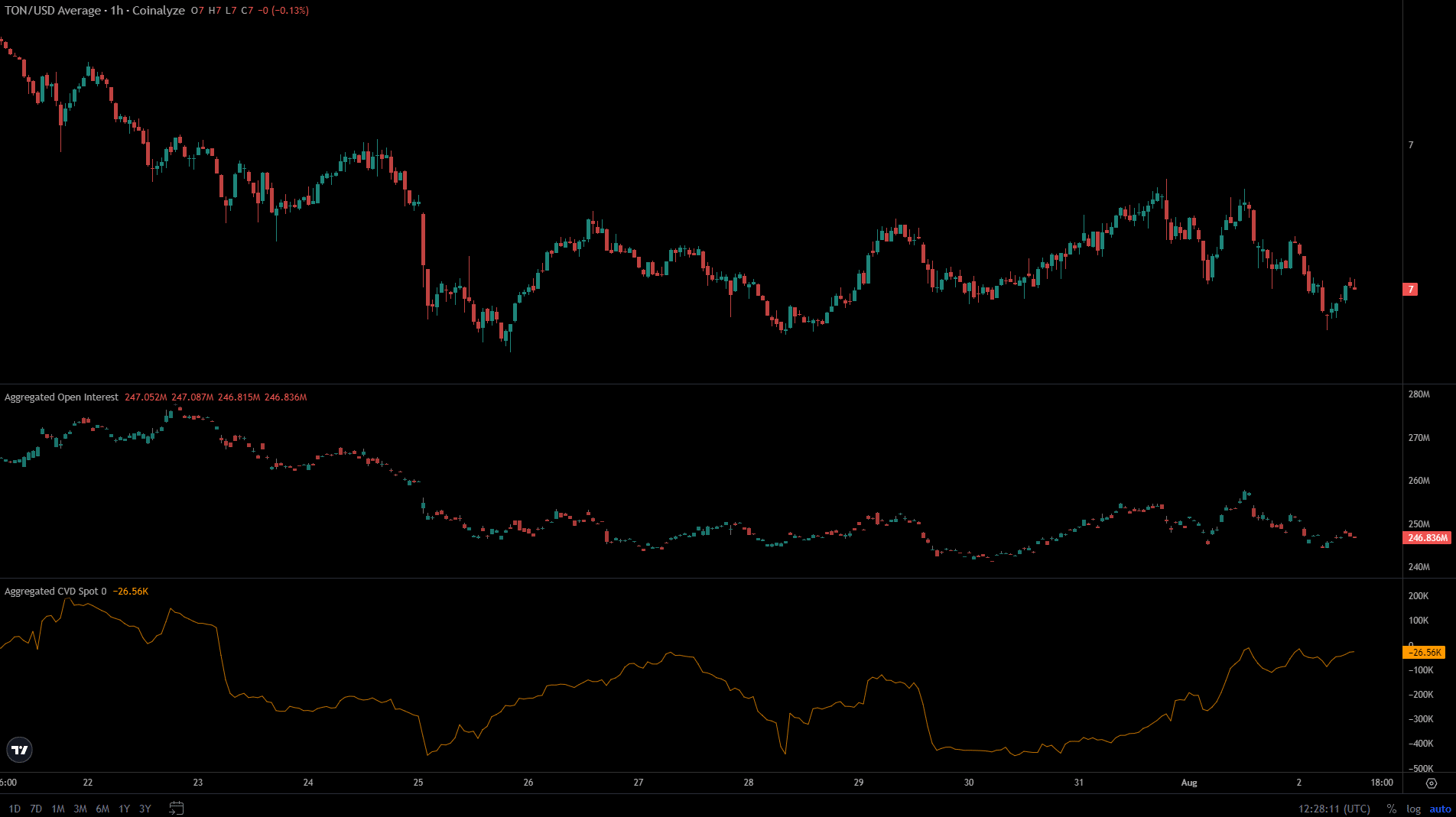

Over the last two days, the Open Interest has decreased from $257 million to $246 million. This drop occurred concurrently with Toncoin being turned down at a short-term resistance level of $6.84, a region that has acted as resistance since July 26th.

To date, all the elements suggested a downward trend for TON. Yet, surprisingly, its market value (CVD) has been steadily climbing up.

As an analyst, I’ve found that my analysis contradicts the OBV’s findings. The recent surge in buying pressure over these last few days may not be sufficient to trigger a full-blown price recovery, but it could potentially spark a short-term rebound towards the $6.8 zone.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-03 10:15