-

Morgan Stanley is set to pave the way for the wirehouse adoption of BTC ETFs

Only aggressive risk-tolerant clients with over $1.5M will be eligible

As a seasoned crypto investor with over two decades of experience under my belt, I must say that the news about Morgan Stanley paving the way for wirehouse adoption of Bitcoin ETFs is nothing short of exhilarating. Having witnessed the crypto market’s ups and downs, I can confidently state that this move signifies a significant milestone in our journey towards mainstream acceptance.

Morgan Stanley, a wealth management company, is now enabling certain clients to purchase U.S. Bitcoin Exchange-Traded Funds (ETFs) as an investment option.

As a researcher, I’ve come across a piece of intriguing news: Based on a CNBC report, a certain firm is set to commence the distribution of its financial products starting from 7th August. The report, citing sources privy to the situation, suggests this development.

Approximately 15,000 financial consultants at the company will be able to invite suitable clients to invest in two publicly traded Bitcoin funds, starting from Wednesday onwards.

Is BTC ETF second-wave adoption here?

As an analyst, I’m currently reporting that Morgan Stanley is exclusively providing access to two Bitcoin investment products: BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC). It’s important to note that only clients with a high risk tolerance will be permitted to invest in these funds.

“We only target individuals who meet specific criteria for our Bitcoin ETF promotion. These individuals should have a personal wealth of more than 1.5 million dollars, be comfortable with taking substantial financial risks, and express an interest in making high-risk investments.”

In simpler terms, this implies that they will be the initial significant Wall Street company to provide Bitcoin ETFs to their customers. This move could signify the start of the eagerly anticipated second phase of widespread acceptance.

To provide some context, it’s worth noting that the significant surge in demand during the first half of 2024 primarily came from individual investors, hedge funds, professional asset managers, and venture capitalists.

Matt Hougan, CIO at Bitwise, referred to the initial wave of adoption as an ‘advance payment’, implying that larger financial institutions like Morgan Stanley, Wells Fargo, UBS, JPMorgan, Goldman Sachs, and Credit Suisse will eventually follow suit. These wirehouses primarily serve high-net-worth individuals and institutional investors.

As per Bloomberg’s ETF analyst James Seyffart, these financial institutions manage approximately $5 trillion in client assets. Given their influence, they might serve as the strongest indicators in favor of Bitcoin ETF acceptance.

A ‘playbook’ for ETF Adoption?

Following completion of their thorough examination, significant corporations are expected to introduce Bitcoin Exchange-Traded Funds (ETFs) either in the third or fourth quarter. In addition, Robert Mitchnick, head of BlackRock’s Digital Assets, anticipates that many of these firms will launch such products by the end of this year.

“As of now, the large financial institutions and private banking systems haven’t made their platforms accessible to their advisors. However, it seems quite probable that they will do so this year.”

In May, as a researcher examining the data provided by Bitwise, I found that professional investors managed approximately 7% to 10% of the total assets (AUM) in Bitcoin ETFs, which were valued at around $50 billion at that time. This translates to an investment range of roughly $3-$5 billion. At that point, it was clear that retail investors held the majority of the AUM. However, as wirehouses enter the scene, according to Hougan’s analysis, this dynamic could shift, potentially leading to a more balanced distribution between institutional and individual investors.

Approximately six months following the initial distribution, numerous companies start distributing assets across their entire client base. The distribution amounts typically range between 1% and 5% of the total portfolio.

This is the playbook to watch out for as wirehouses join the party.

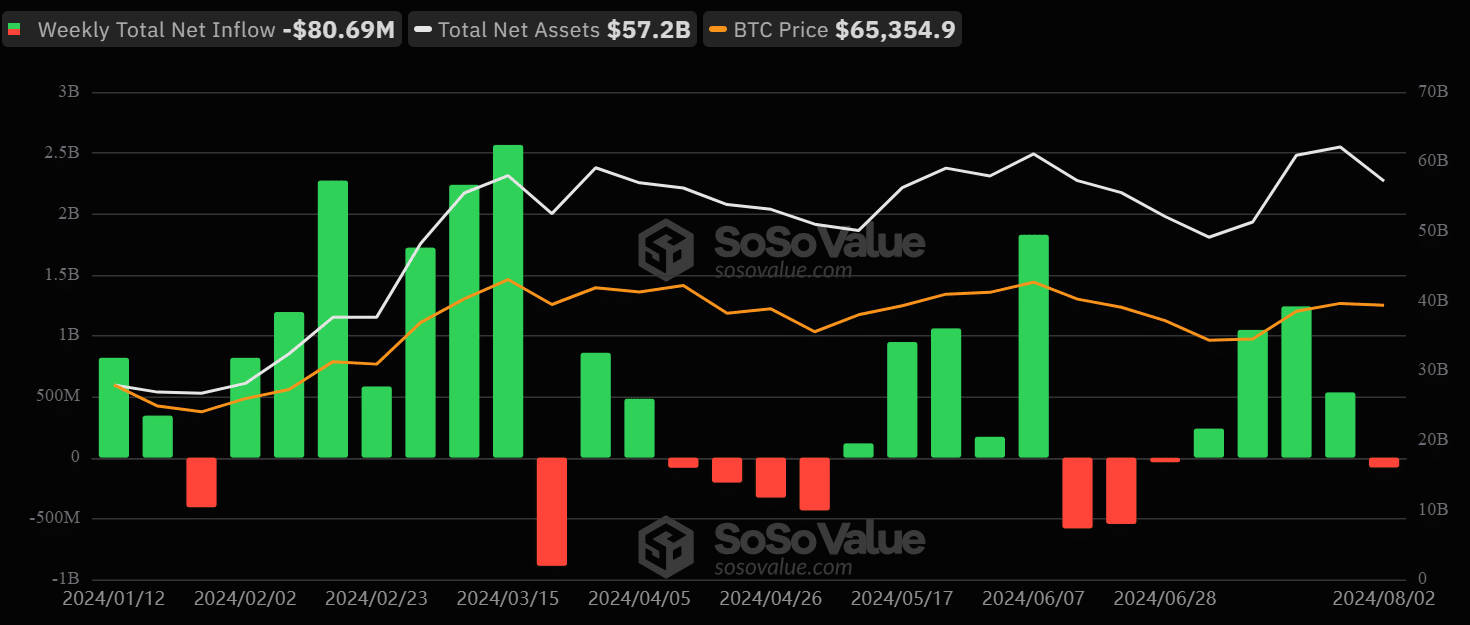

As of now, the total Assets Under Management (AUM) amounted to $57.2 billion, indicating a weekly decrease of $80.69 million. This suggests that investors have adopted a more cautious approach this week. It remains unclear whether an increase in wirehouses will reverse the current market trend and potentially boost Bitcoin’s price.

Read More

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-03 13:12