- Ripple Labs released its Q2 report for 2024 on 2 August

- Report highlighted a 65% decline in on-chain transactions, 168% hike in transaction costs

As a seasoned analyst with over two decades of experience in the financial industry, I have seen my fair share of market fluctuations and regulatory battles. With Ripple Labs releasing its Q2 report for 2024, I find myself both intrigued and cautious, given the current climate of intense regulatory pressure on crypto firms.

In simpler terms, Ripple Labs, a company specializing in blockchain technology, recently published their report for the second quarter of 2024. This report provides insights into various market developments, income, regulatory successes, and significant advancements within the industry.

It’s crucial that we pay attention to the timing because this report arrives amidst significant scrutiny of cryptocurrency businesses by regulators. Interestingly, even entities like Ripple are facing intense regulatory challenges from the U.S. Securities and Exchange Commission (SEC).

What did the report say?

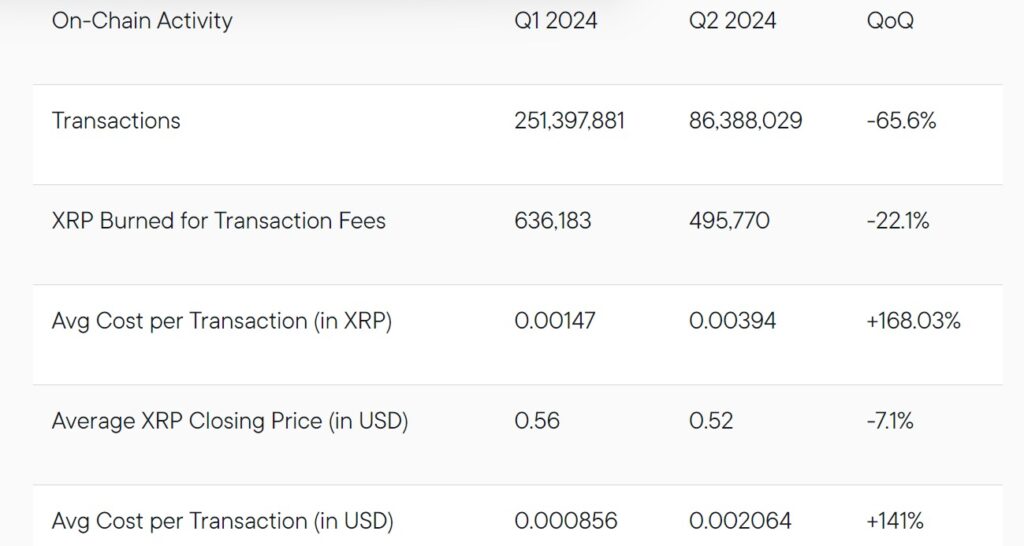

As per Ripple Labs’ report, there was a substantial impact on the on-chain activity of XRPL during the last quarter. Notably, they observed a drop of approximately 65% in transaction numbers from Q1 to Q2.

During Q1 2024, XRPL had a figure of 251,397,881. However, it soon declined to 86,388,029 in Q2.

Underlining the same in its the official report, Ripple Labs claimed,

In the second quarter, there was a general decrease in activity across many protocols. Just like other platforms, XRPL saw a significant drop in on-chain activities during this period, with activity levels from Q2 being lower than those of Q1.

The company explained that the drop in transactions was due to an upward trend in typical transaction expenses, which significantly rose from 0.00147 to 0.00394 – a staggering 168% increase.

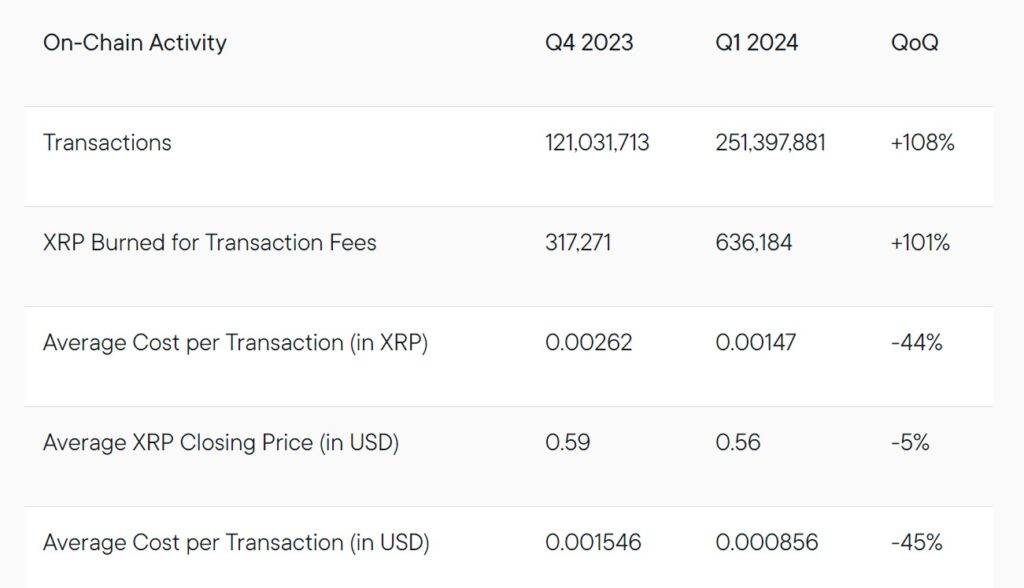

As someone who has spent years analyzing market trends, I have to say that the recent surge in XRPL on-chain transactions during Q3 2023 was a surprising development. It defied the downward trend that most analysts had anticipated for both Q1 2024 and Q4 2023. In my career, I’ve seen many market trends come and go, but this one stood out due to its significant increase of 108% in transactions. It just goes to show that the crypto world is full of unexpected twists and turns, and it always pays to stay vigilant and adaptable.

Tokenized US T bills on XRPL

As a crypto investor, I’ve noticed the dip in on-chain transactions, but I remain optimistic about XRPL. The platform is actively working to expand its ecosystem and incorporate real-world assets into its operations. A prime example of this is their recent announcement to launch tokenized U.S treasury bills. This move signifies Ripple’s intent to bridge the gap between traditional finance and DeFi, which I find exciting.

Additionally, they will create a fund with $10 million earmarked for treasury bills. Consequently, the issuance of tokenized T-bills on the XRP Ledger is among the institution’s upcoming projects. This move enables users to mint tokens using Ripple USD once it becomes available this year.

Regulatory concerns and developments

Despite the persistent downturn in the crypto market, Ripple and XRP are currently embroiled in a legal dispute with the U.S. Securities and Exchange Commission (SEC). In fact, this matter is so significant that the company is investing $50 million to influence policy changes, as detailed in their Q2 2024 report.

1) Option A: This investment aims to back exclusively political figures who are crypto-friendly during the upcoming elections. Moreover, it’s important to mention that Ripple Labs have voiced worries about the unclear regulations in the U.S, claiming that other nations are benefiting from this ambiguity.

Impact on price charts

As I pen this analysis, XRP is currently trading at $0.5754, marking a 1.22% surge in the past 24 hours. This daily growth can be attributed to the recent report that’s been circulating. However, on a weekly basis, it’s important to note that the altcoin has seen a decline of more than 4%.

Will the altcoin build on this brief hike though?

Following the release of the Q1 2024 report, XRP‘s price increased significantly and held steady for approximately 48 hours. Subsequently, its value started to fall, continuing over a period of nearly two months until it reached $0.43 on June 19th.

Hence, nothing can be said with much certainty.

Even with the impressive gains I’ve experienced, I can’t ignore the persistent dip in the altcoin’s price chart that I’m seeing. For example, AMBCrypto’s analysis showed that the Directional Movement Index suggested a downward trend. In this case, the negative index of 32.96 was significantly higher than the positive index of 23.35, which is typically a clear sign of a robust bear market.

As a seasoned trader with years of experience under my belt, I can confidently say that the Aroon indicators provide valuable insights when analyzing market trends. In this specific instance, the Aroon Down being at 100% and sitting above the Aroon Up line at 78.57% suggests a strong upward momentum in the market. This alignment has historically proven to be a reliable bullish signal for me, indicating that it could be an opportune time to consider entering long positions. Nonetheless, I always urge caution and remind myself that no single indicator can predict market movements with absolute certainty. It’s essential to use multiple technical analysis tools in conjunction with fundamental analysis before making any trading decisions.

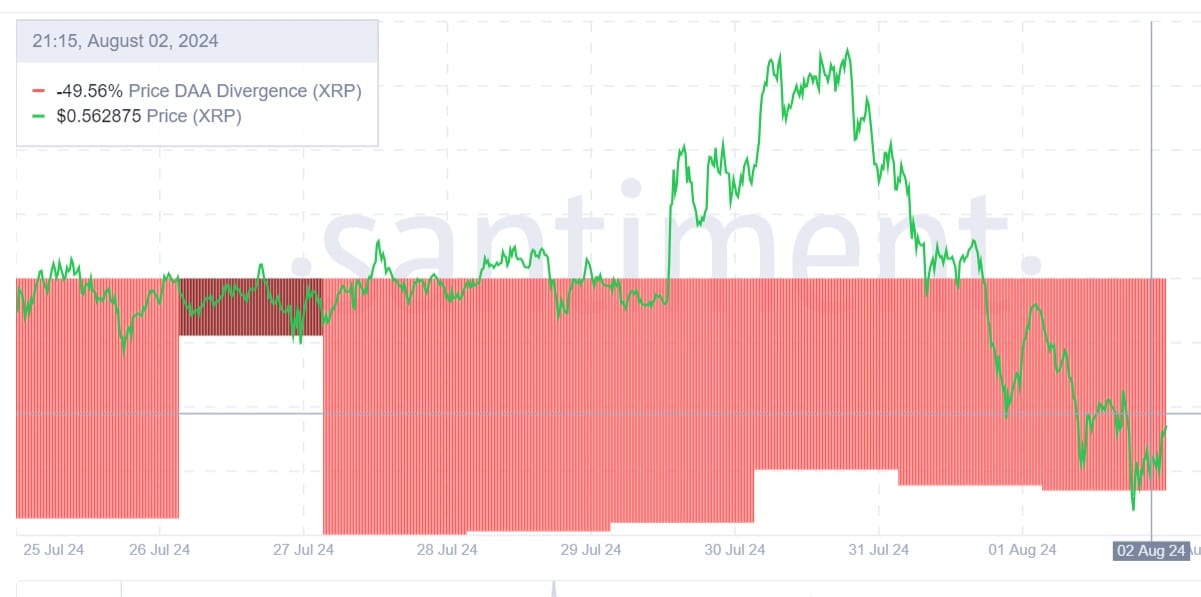

According to AMBCrypto’s analysis using Santiment, a negative Price DAA divergence of -49.56% was observed. This implies that the daily price increases were primarily fueled by speculative activities rather than genuine demand from users.

Thus, the price might decline because it’s not supported by growth in on-chain activity.

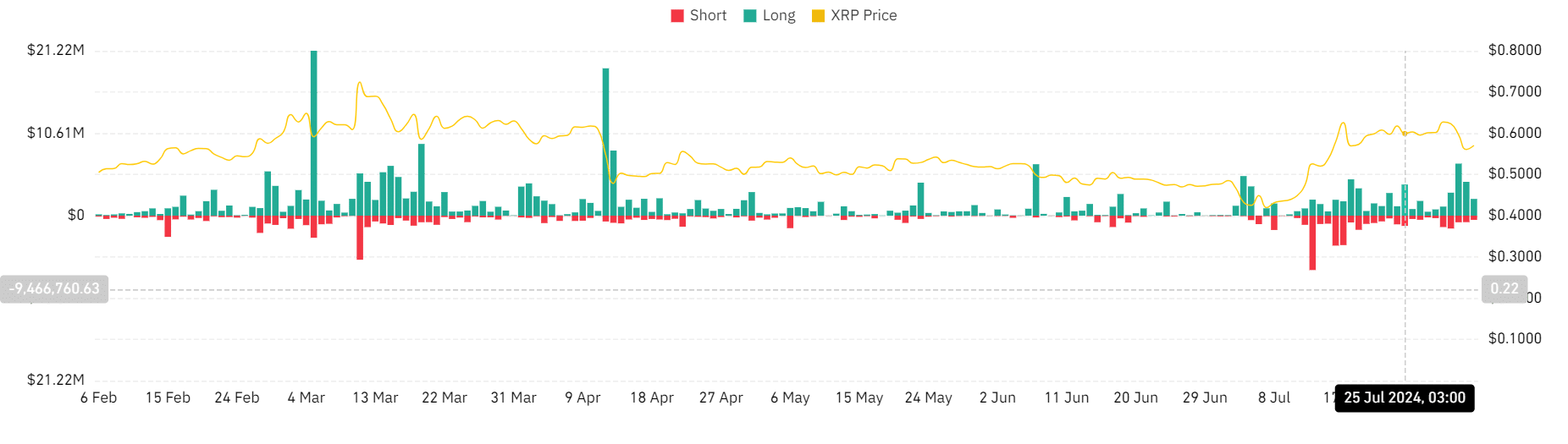

In the end, the Coinglass data indicated higher liquidations for bullish positions. An increase in liquidations for bullish positions suggests that investors were excessively optimistic about price rises, causing them to exit their investments.

Consequently, while XRP has seen an increase in its daily prices after the Q2 report was published, it’s likely that the general market outlook will stay negative in the short run.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- BLUR PREDICTION. BLUR cryptocurrency

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-08-03 17:12