-

ADA declined by over 4% in the last 24 hours, despite a minor recovery

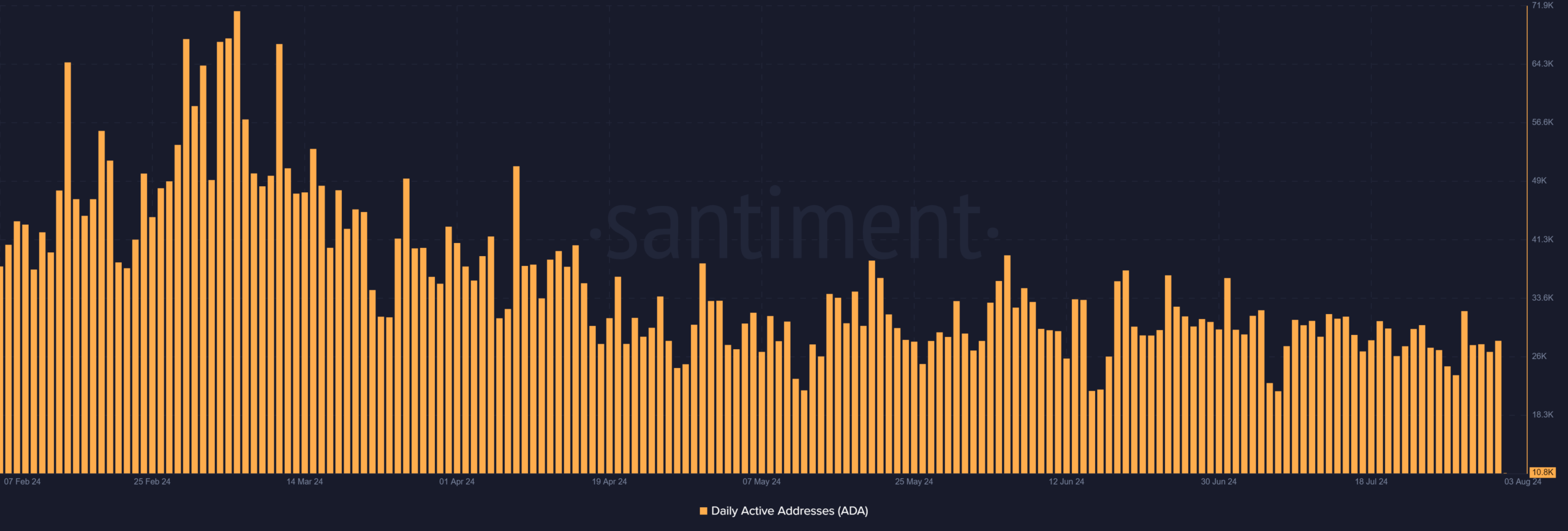

Trend of active addresses remained steady despite this decline

As a seasoned crypto investor with battle-scarred fingers from navigating through countless market fluctuations, I find myself standing at the crossroads yet again, staring into the eyes of Cardano (ADA). Over the years, I’ve learned to read between the lines of price charts and user activity graphs.

Recently, the price trend of Cardano (ADA) has been going downwards, which may hinder any recovery plans it was preparing. Furthermore, this decline could lead to considerable consequences, especially since the number of active wallets hasn’t shown much change during this timeframe.

Cardano crashes and burns

Examining the day-by-day graph for Cardano (ADA), we noticed a substantial decrease in its price trend. Particularly on August 2, ADA experienced a steep drop of approximately 7.38%. However, there was a short-lived rebound on the charts immediately following this decline.

As a crypto investor, it’s clear that the recent dip in price has undeniably affected the trajectory of the yellow short-term moving average for Cardano (ADA). This trendline now seems to be acting as a more formidable resistance level, holding steady around $0.4.

In simpler terms, the function of this moving average serving as a resistance indicates that there needs to be significant buying power for Cardano (ADA) to surpass this point, which could trigger a possible change in direction or a new trend.

Even though ADA‘s altcoin has seen a slight uptick in the past few hours, it’s important to note that its Relative Strength Index (RSI) is nearly 40, suggesting a strong bearish trend prevailing in its market.

Cardano’s active addresses stay steady

Investigating Cardano’s daily active address statistics using Santiment revealed that there is typically little change in user engagement, with the figures fluctuating around the 26,000 to 27,000 mark.

Based on my years of experience observing user behavior within various networks, I have found that a consistent yet unremarkable level of activity often indicates a steady engagement among users. This can be likened to my own life; when I maintain a steady routine, it shows that I am actively involved and committed, even if the results may not always be spectacular.

On August 2nd, there was a small but significant increase in activity, with around 28,125 active addresses. Although this spike was brief, it might indicate a short-term rise in transactions or interactions within the network.

It’s worth noting that as I write this, the number of active addresses has also seen a substantial decrease, dropping approximately to 10,000.

A slight hike in volume

Finally, an interesting pattern seemed to emerge when analyzing Cardano’s volume.

In recent times, the trading volume for ADA has experienced a substantial increase. Initially, it hovered around $280 million at the start of the month, but following a decline in its price on August 2, the volume surged past $400 million.

The increasing trend in this volume, along with a consistent number of active users, indicates that ADA owners are maintaining their positions. This means they aren’t massively selling off, and there’s no significant surge in new investors purchasing at reduced rates.

In simpler terms, investors might be looking for clear indicators suggesting whether the altcoin will experience a recovery or continue to drop in value.

Read More

2024-08-03 21:11