- FLOKI could see a short squeeze and a price bounce of close to 8% over the weekend

- Price action since April gave clues for a FLOKI consolidation around $0.00014

As a seasoned crypto investor with battle-scarred fingers and a battle-hardened heart, I find myself standing at the precipice of uncertainty once more. The market has been unforgiving, and FLOKI, like many other large-cap altcoins, has felt the brunt of the bearish sentiment sweeping through the crypto world.

As a researcher studying the cryptocurrency market, I’ve observed that my project FLOKI, like many other large-cap altcoins, experienced significant declines in value. This downward trend can be attributed to several factors, chief among them being the steep drop in Bitcoin‘s [BTC] price. This decrease was influenced by bearish expectations and potential indications of an approaching economic recession, which in turn fueled a wave of fear among investors.

As we speak, the memecoin is being traded slightly over a crucial support point that’s been reliable since late April. Could purchasers intervene once more, or will sellers be too powerful in this instance?

Fibonacci level could see a FLOKI price consolidation

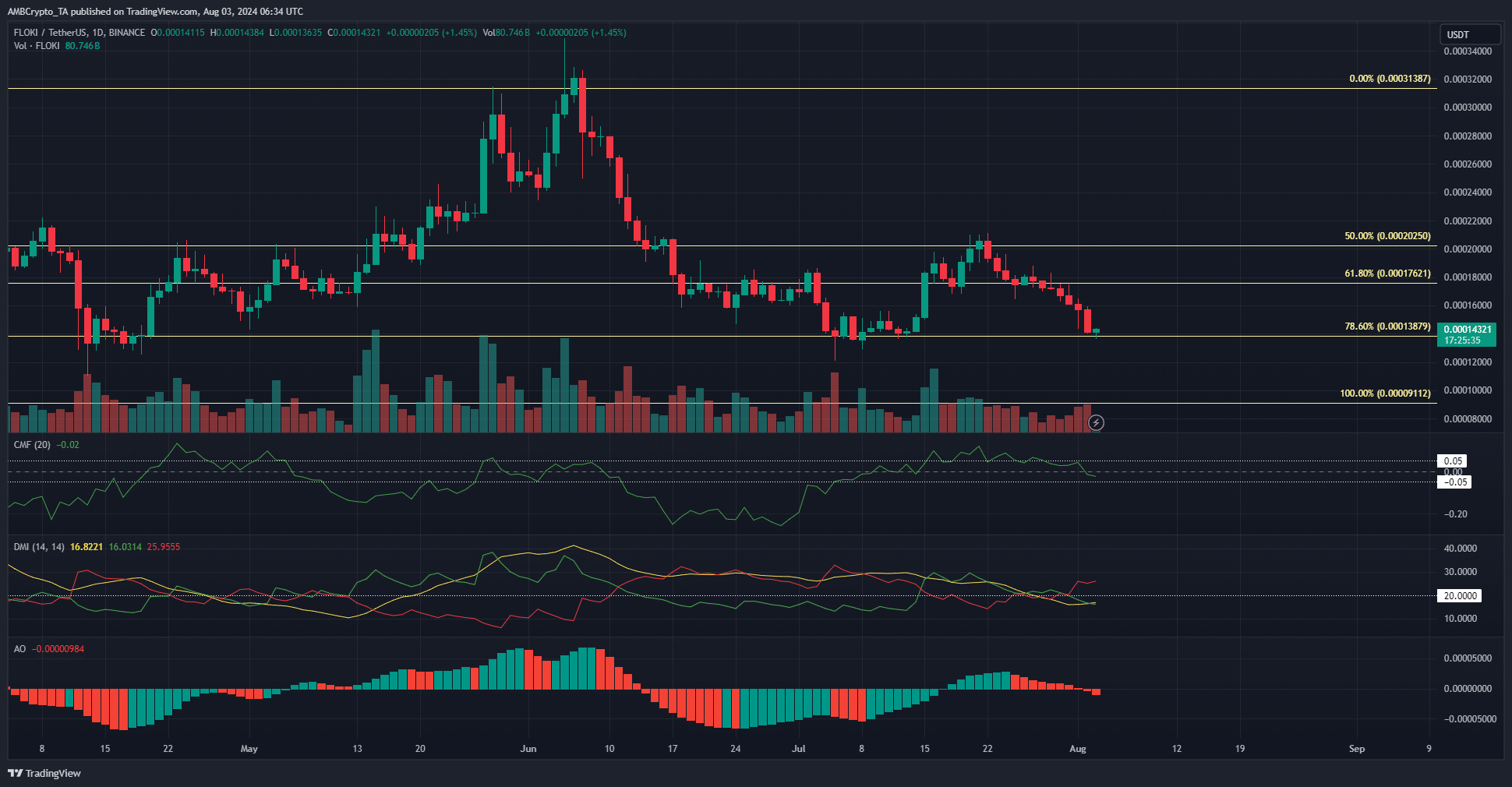

Over the last few months since April, the price has approached and tested a significant resistance level at $0.000138, which represents a 78.6% retracement. Interestingly, during the previous two instances when this level was tested, the price did not bounce back immediately as anticipated. Instead, it paused for several days near this Fibonacci level before eventually rising due to increased trading activity.

Currently, a downward trend is leading the market. The red line (-DI) on the DMI indicator has moved above the green line (+DI), indicating a potential shift in momentum towards bears. Additionally, the Awesome Oscillator dipped below the neutral zero level, suggesting that bearish forces are becoming more pronounced.

In simpler terms, if the Capital Movement Factor (CMF) is currently at -0.02, it means there’s a slight outflow of capital from the market. If it falls below -0.05, this would suggest a more significant exit of funds from the market. At the moment, since the CMF reading is neutral, it indicates a potential pause or consolidation in the market.

Low Open Interest showed traders were not convinced of a price recovery

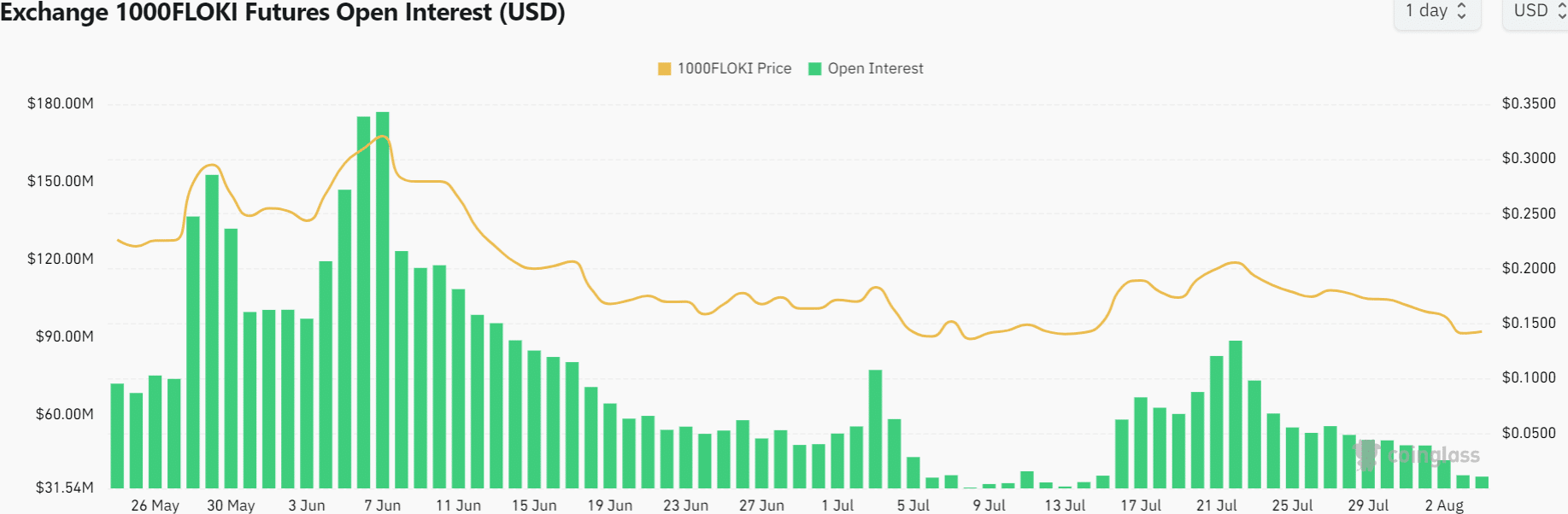

In July, FLOKI’s price surged from $0.000135 to $0.000206, and the Open Interest increased from $36 million to $88.6 million. However, since then, both the Open Interest and the price have been on a downward trend, indicating a pessimistic outlook among investors.

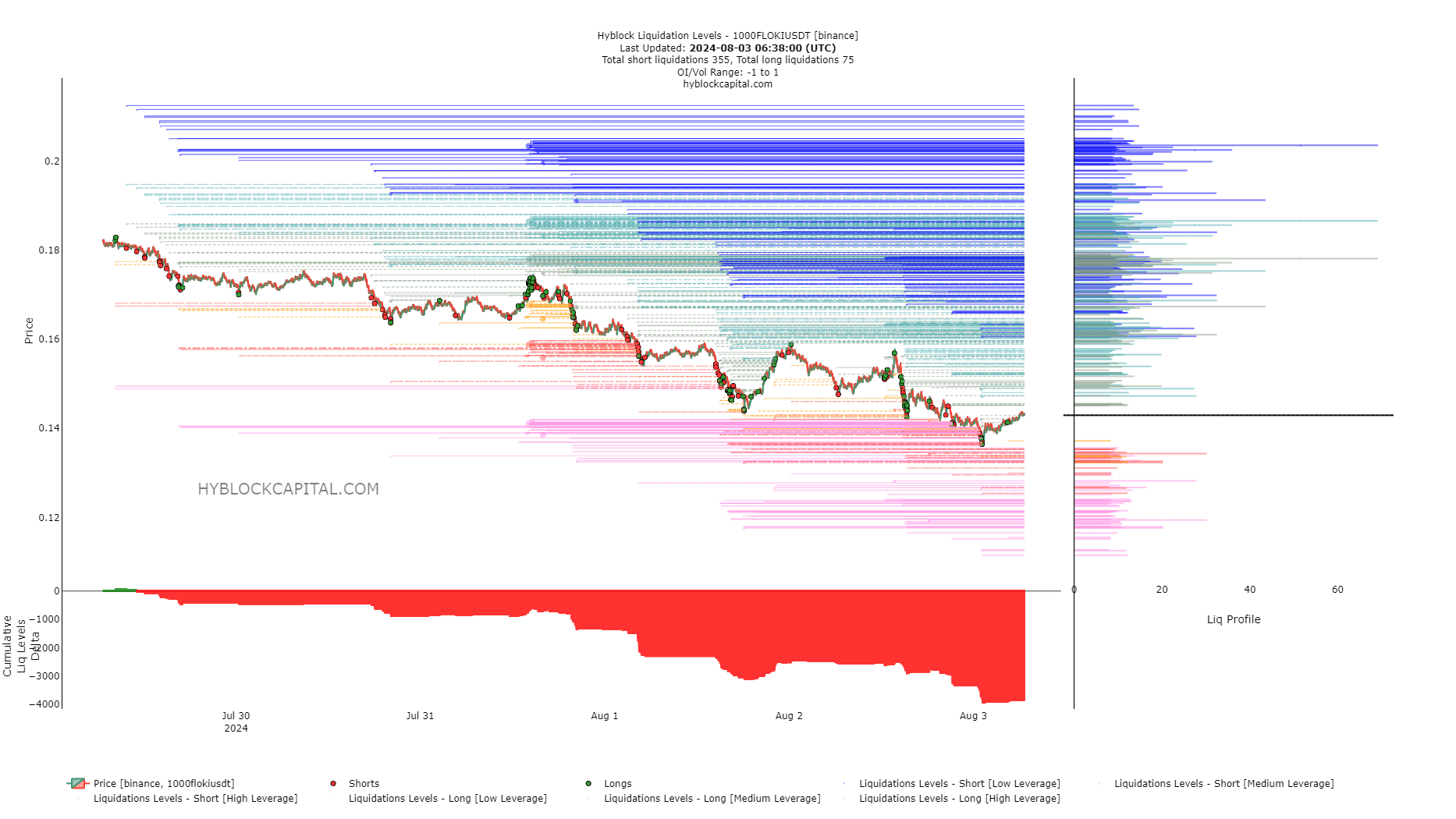

Over the past couple of days, I’ve observed that there have been significantly more short positions being liquidated compared to long ones. This trend suggests that futures traders were anticipating a continued price decline, setting the stage for a potential short squeeze scenario.

Is your portfolio green? Check the Floki Profit Calculator

The largest amounts of money (liquidity) were found at $0.000178 and $0.000186, making these prices potential goals for bulls (investors expecting prices to rise). But if there’s a price increase (bounce), the resistance at $0.00015 might push the bulls back, causing FLOKI (the asset) to enter a period of stability or consolidation.

Read More

2024-08-03 22:15