- World’s largest altcoin dropped below $3,000 on the back of negative market sentiment

- Receding outflows could be key now

As a seasoned researcher with a background in cryptocurrency markets and a keen eye for trends, I find myself intrigued by this recent development. The tapering of Grayscale outflows from ETHE could potentially be a positive sign for Ethereum’s price, if one looks at historical patterns with GBTC as a guide. However, the market sentiment remains cautious, and the altcoin is currently testing the $3k level once again.

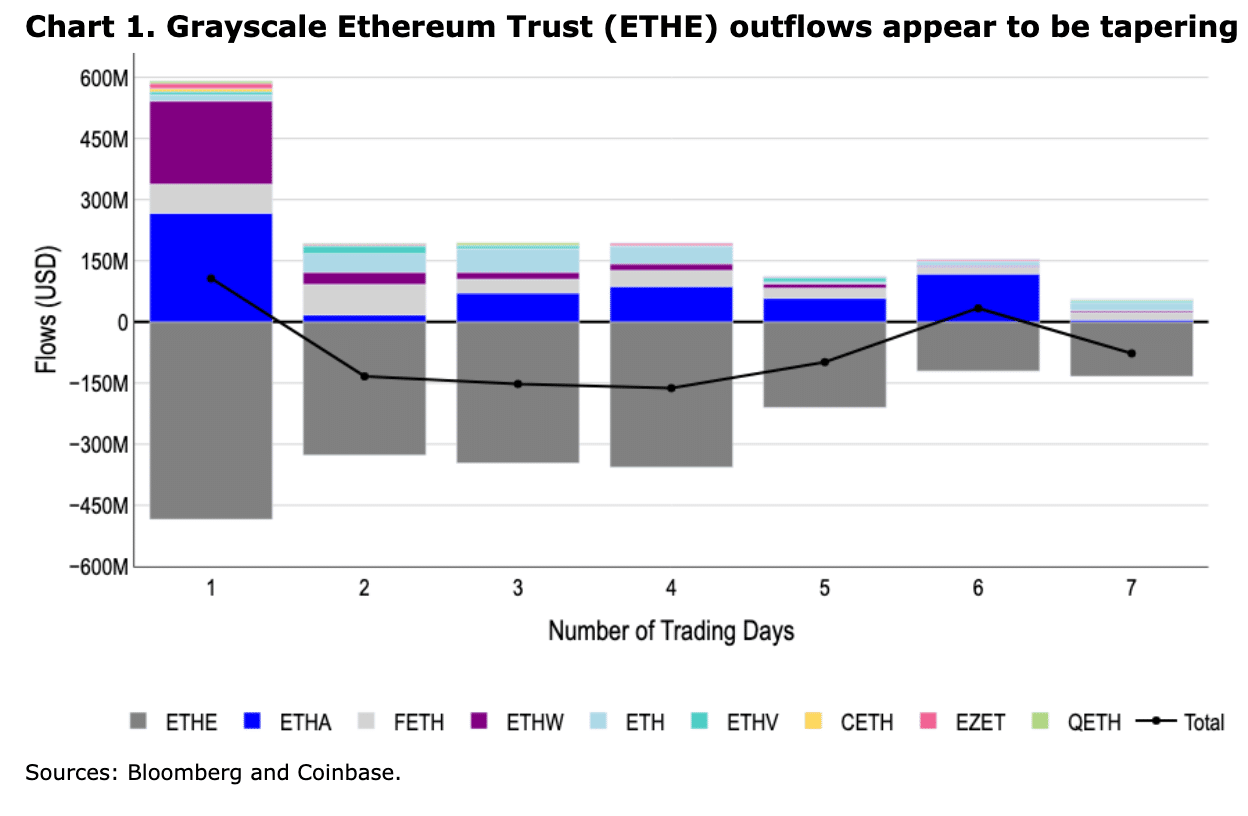

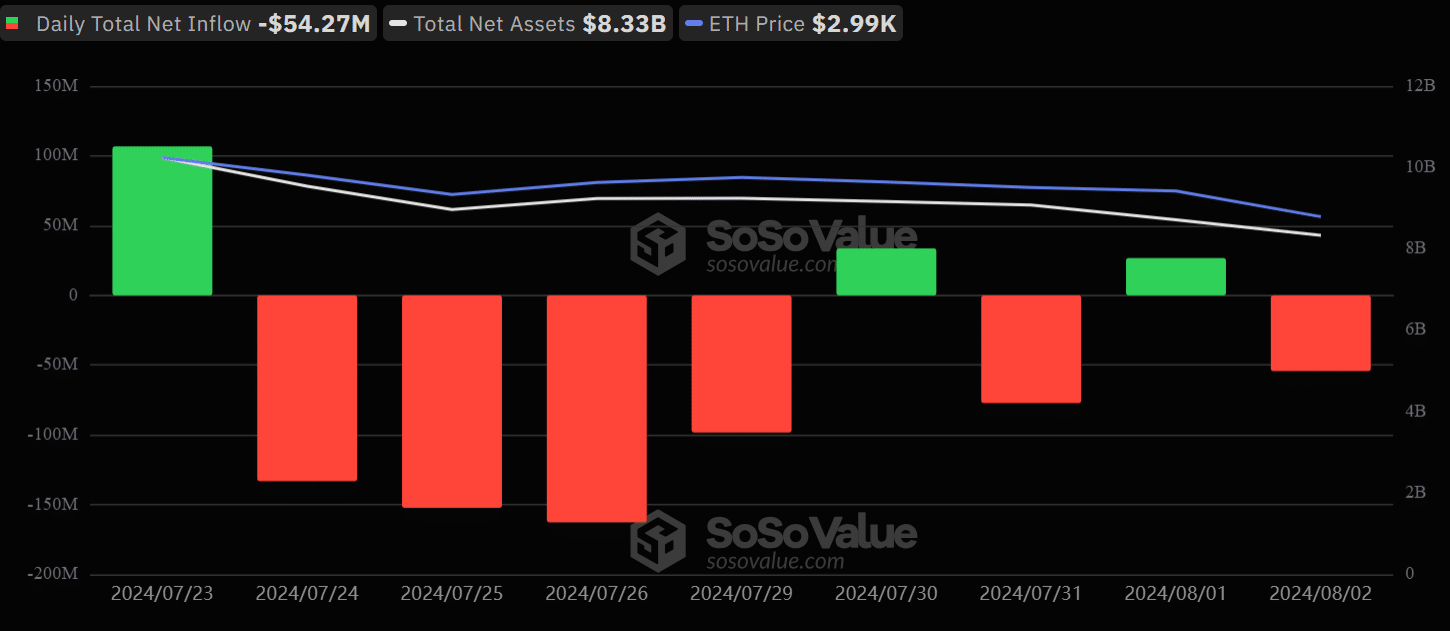

In the second week of trading, there was a substantial decrease in withdrawals from U.S.-listed Ethereum Exchange Traded Funds (ETFs), contrasting their initial week. During the first week, these funds experienced total outflows amounting to $341.3 million, with this trend primarily due to losses in Grayscale’s ETHE and Mini Trust (ETH) products.

Specifically, during the initial trading week, ETHE triggered a $1.5 billion withdrawal. Yet, the rate of disposal diminished in the subsequent week, suggesting that the outflow of funds from ETHE might be slowing down, as suggested by Coinbase’s analysts.

“Observe that the ETHE outflow rate has been decreasing steadily. This trend supports our assumption that these outflows were more concentrated at the start, similar to the distribution pattern we observed with the Grayscale Bitcoin Trust (GBTC) earlier this year.”

Will tapering Grayscale outflows help ETH’s price?

As a crypto investor, I’ve noticed that during the initial week, there was a significant withdrawal of funds from Grayscale, amounting to approximately $1.94 billion. Specifically, $1.5 billion was withdrawn from ETHE, while a substantial sum of $448 million was offloaded from the Mini Trust related to ETH.

During the second week, Grayscale’s ETHE experienced withdrawals totaling $603 million, while ETH lost $175.5 million. As a result, the amount of money leaving ETHE dropped below $800 million during this period. In summary, the large-scale departure of investors from Grayscale seemed to slow down as the second week progressed.

As a researcher, I’ve observed that my earlier predictions suggested a potential easing of Grayscale ETF outflows around the second week. This prediction was based on a comparison of their trends with those exhibited by GBTC.

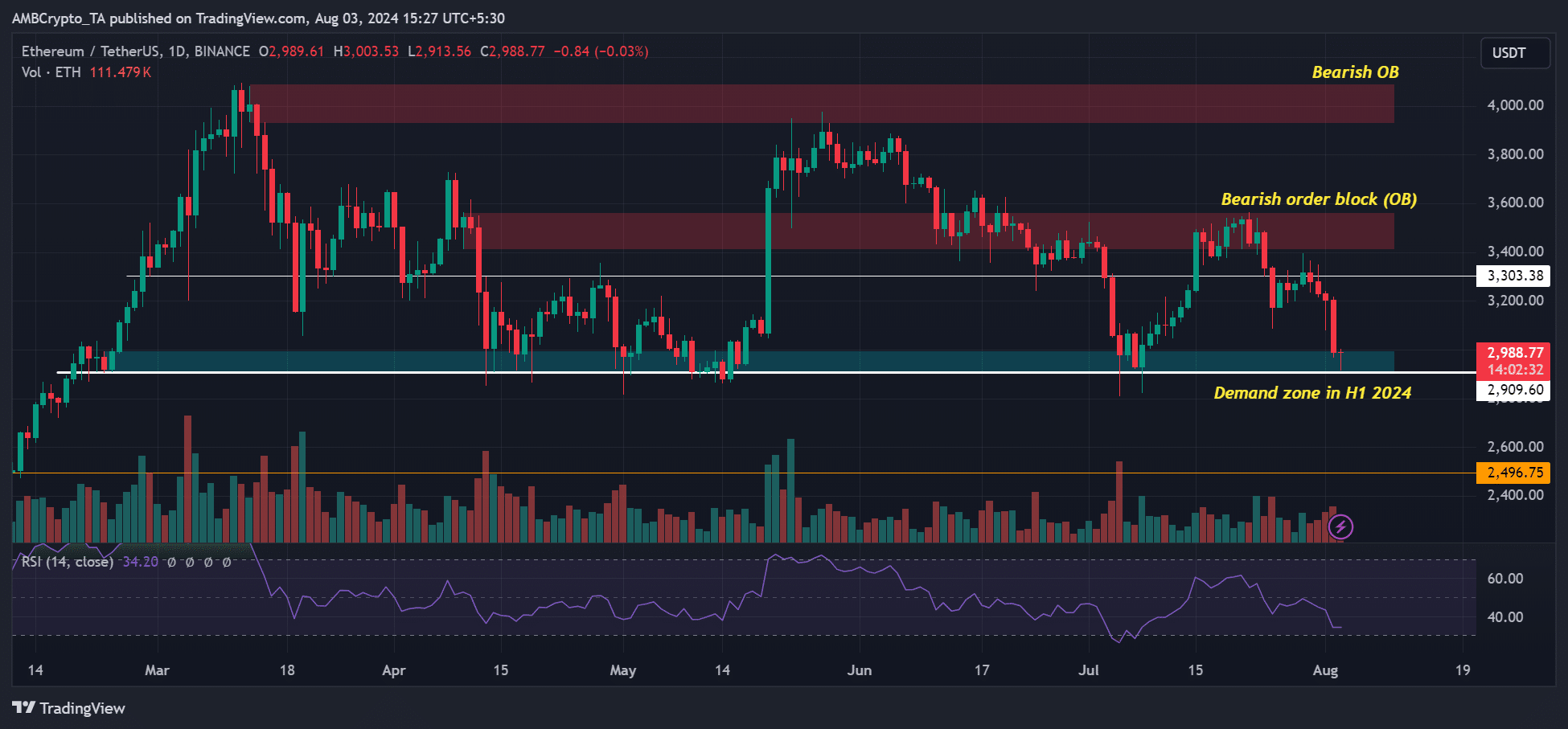

As I observe the current market scenario, I find that Ethereum’s price appears to be holding steady despite a general air of caution among investors in both the U.S and Asian markets. This suggests a restrained optimism or perhaps a wait-and-see approach, which could influence ETH‘s price movement in the coming days.

Leaving out ETHE, the exchange-traded fund (ETF) based on Ethereum (ETH) has accumulated more than $1.5 billion, as reported by Farside Investors. Unfortunately, due to a widespread bearish market attitude, the price of Ethereum has fallen below $3k.

Currently, Ethereum (ETH) appears to be attempting another run at approximately $3,000 according to market charts. This price point served as a significant support area in 2024, and it was reinforced five times. Consequently, this revisit has erased all the gains ETH made in July.

It’s uncertain if the decrease in outflows from Grayscale will trigger an increase in demand, as time will tell.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

2024-08-04 00:07