- Drop in long-term holder active sales meant sellers might be exhausted

- Increase in the largest whales’ holdings while prices plummeted may be seen as a sign of confidence

As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the recent developments in Bitcoin (BTC). The rapid drop from the $69k-$70k resistance zone has been a common occurrence in cryptocurrency markets, but the current bearish structure on the weekly timeframe is particularly concerning. The FOMC meeting’s decision to slash hopes of a September rate cut added fuel to the fire.

In simpler terms, the price of Bitcoin (BTC) plunged quickly after hitting the $69,000 to $70,000 resistance point. The weekly chart shows a bearish pattern, and the Federal Open Market Committee (FOMC) meeting has dampened expectations for a reduction in interest rates by the Fed in September.

Additionally, the Sahm Rule seemed to support economic instability and hint at a potential recession. This caused a flurry of market fear and Bitcoin dipped further down.

In simpler terms, the area around $60,000 serves as a crucial point of resistance, but it doesn’t mean the buyers will definitely hold their ground here. To get a better idea about the long-term investors’ feelings towards this asset, AMBCrypto has taken a closer look at some on-chain data.

Long-term holder sell pressure has fallen

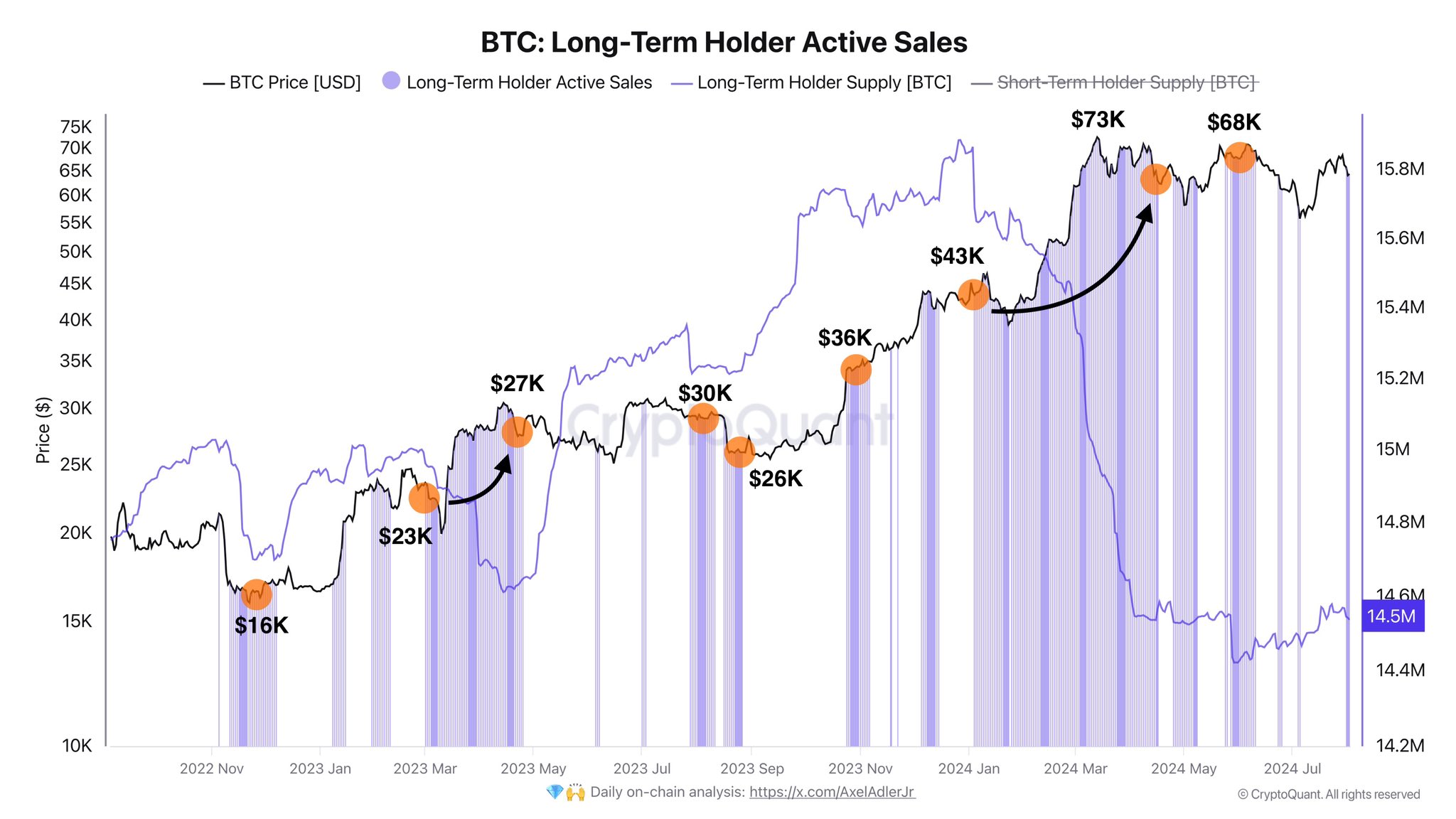

On the platform X (previously known as Twitter), crypto analyst Axel Adler noted a decrease in long-term holder transactions where they were actively selling. Contrasting with early June, the selling pressure originating from this group of holders was almost non-existent.

As a cryptocurrency investor, I witnessed a significant decrease in long-term supply, indicating heavy profit-taking when Bitcoin was hovering near the $68k-$70k range. This hinted at strong doubts among investors about breaking past the $70k mark.

From my perspective as an analyst, this could potentially be good news since it suggests that the selling pressure seems to have run its course.

Whale cohort’s behavior is exciting news

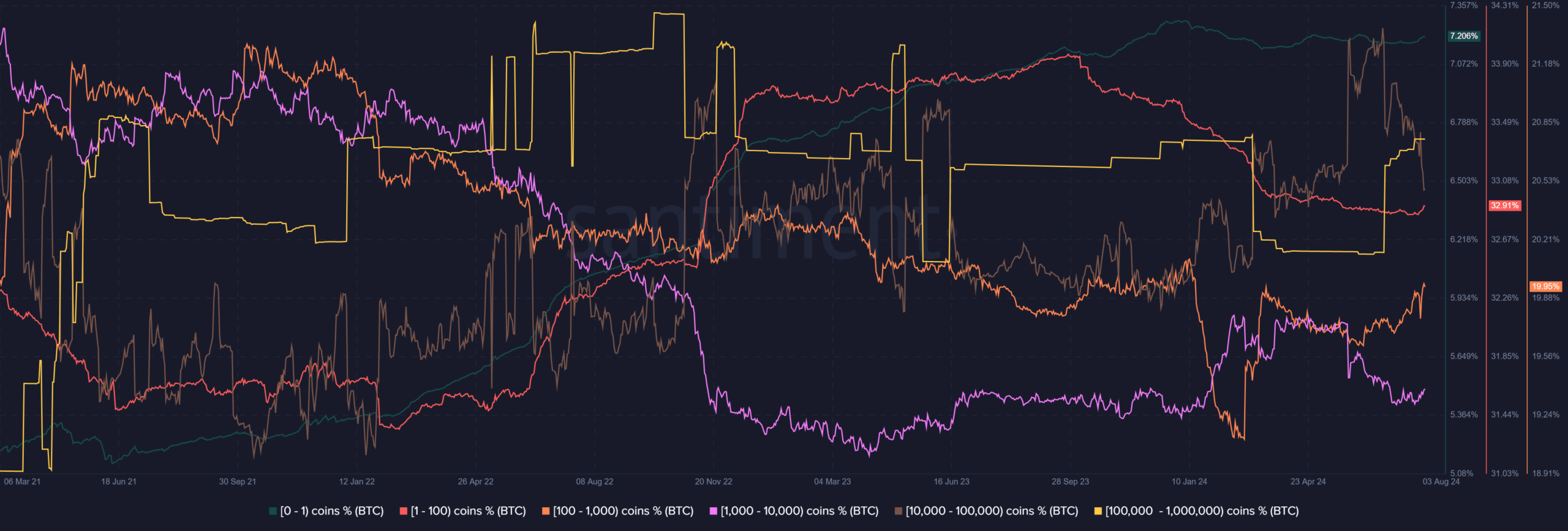

The proportion of Bitcoin wallets holding between 100,000 and 1 million BTC has risen significantly relative to the overall total. This rapid increase last occurred in May 2023, a time when Bitcoin was breaking through the $26k price barrier.

Although it’s heartening to see an increase in whale ownership, some other whale groups have recently been disposing of their holdings. Notably, the 1k-100k group has experienced a significant decrease in their holdings over the last fortnight, suggesting that these whales are exerting selling pressure.

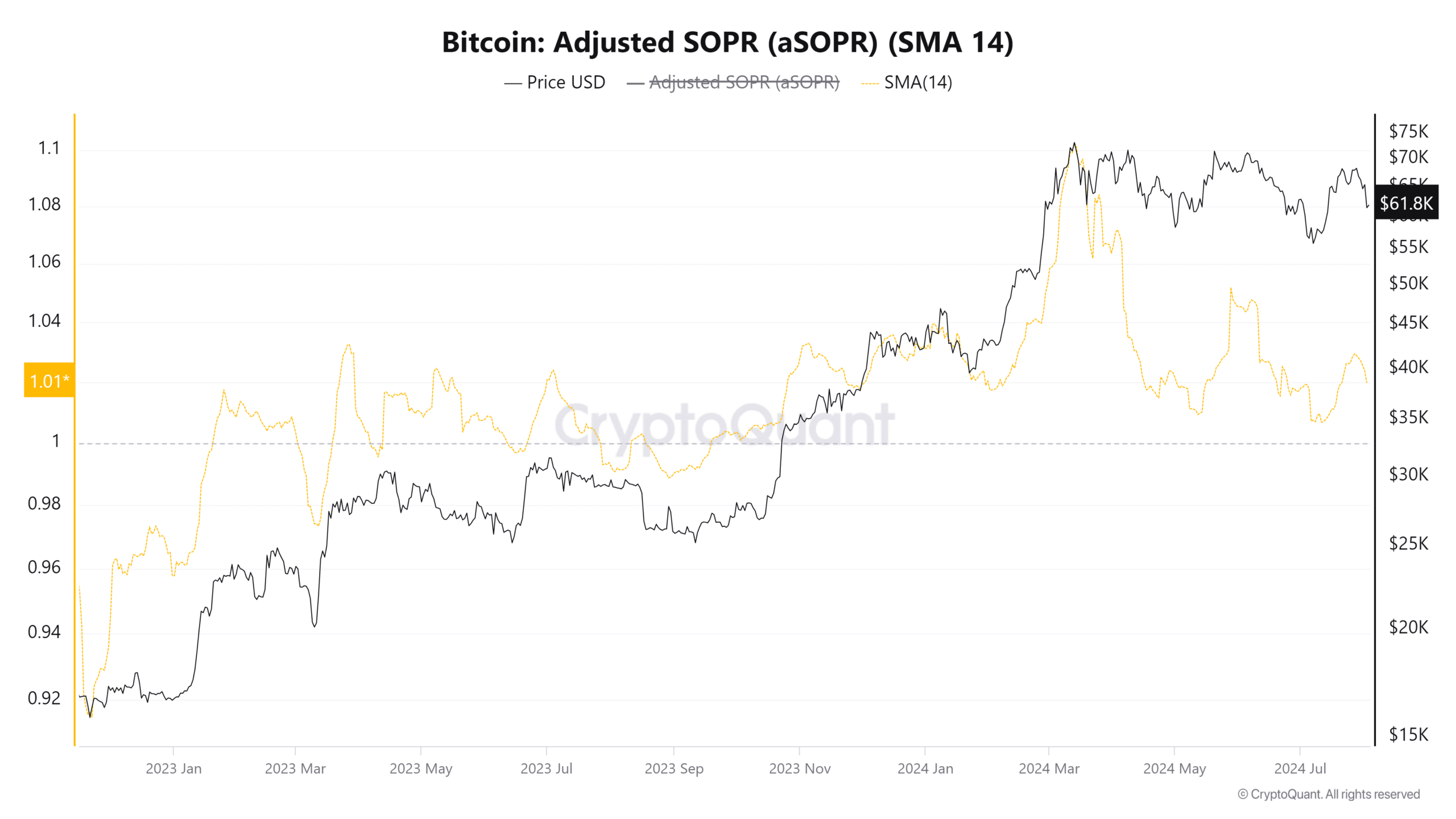

Over the last few months, signs of pessimism have been evident through the modified SOPR as well. This indicator, when it’s greater than 1, indicates that on average, coins were more likely being sold at a gain rather than a loss.

Alas, the falling aSOPR trend since March has been a bearish signal.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In summary, less activity in long-term holder sales and an increase in holdings by large investors offers a promising sign. Nevertheless, it’s likely that Bitcoin may find it tough to rebound during August, given the prevailing pessimistic sentiment across the entire market.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-04 08:07