As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed the rise and fall of many asset classes. The latest developments in Bitcoin (BTC) have piqued my interest and here’s why.

Despite Bitcoin [BTC] not setting new record highs, cryptocurrency enthusiasts remain optimistic about its long-term growth prospects.

The head of VanEck predicts that the value of Bitcoin could rise to half the market value of gold, surpassing $350,000 per coin. Additionally, advisors from Morgan Stanley will start promoting Bitcoin ETFs offered by BlackRock and Fidelity starting August 7th.

As a seasoned investor with over two decades of experience in the financial markets, I am intrigued by the growing interest in cryptocurrencies, particularly the recent proposition by Donald Trump regarding Bitcoin debt. From my perspective, this development underscores the potential for significant growth and influence that crypto could have on our global economy.

Bitcoin mining difficulty hits new high

It was reported that Bitcoin mining difficulty and US money supply have hit new all-time highs necessitating more computational power, potentially affecting profitability.

As someone who has closely followed the rise of Bitcoin since its inception, I have witnessed the remarkable growth it has experienced over the years. With a market capitalization now surpassing $1.25 trillion and representing a significant portion of the world’s total wealth estimated at $900 trillion, I believe that the increased activity on the Bitcoin blockchain is not only a reflection of its growing popularity but also an indication of its potential to play a significant role in our financial future. As more institutions and individuals continue to allocate their resources towards this digital asset, I am confident that we are witnessing the emergence of a new era in global finance.

In the wake of $3 trillion worth of stock losses caused by economic downturn concerns, Bitcoin has demonstrated its robustness. Unlike conventional assets that are experiencing steep declines, Bitcoin continues to hold attention as a significant player.

Overlooking the significant growth possibilities of cryptocurrencies like Bitcoin, it’s currently a good idea to think about incorporating them into a varied investment portfolio with a focus on future benefits.

Bitcoin whales anticipate rally as BTC investment increases

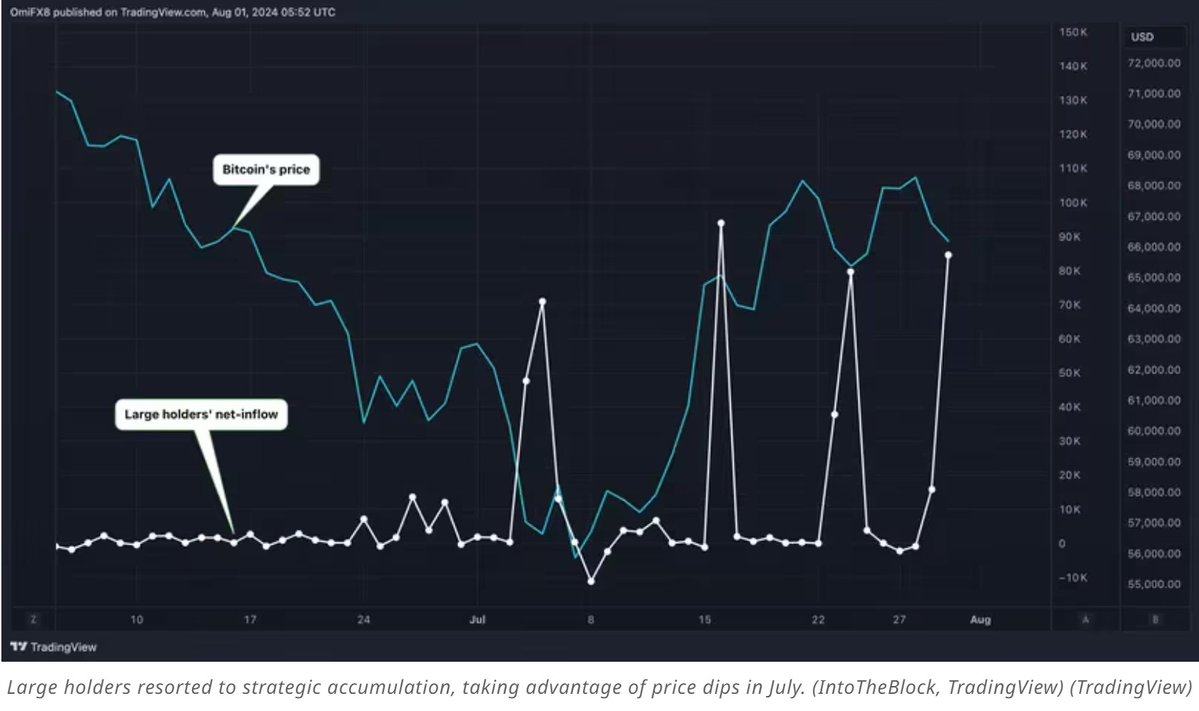

As an analyst, I observed a significant buying spree by Bitcoin whales in the month of July. They accumulated approximately 84,000 Bitcoins, which represents the largest purchase of this digital currency since October 2014. The total value of this transaction was a staggering $5.4 billion.

Despite numerous investors choosing to sell their Bitcoins, significant holders (those who own at least 0.1% of the total Bitcoin supply) have been steadily buying, as reported by IntoTheBlock.

As a crypto investor, I’ve noticed a substantial surge in holdings by large players, or ‘whales’, during market upheavals. This underscores their strategic maneuvers and faith in Bitcoin’s enduring potential, boosting my own confidence as well.

BTC potential downtrend

Examining the MACD of Bitcoin reveals a peak in 2024 that’s lower than its 2021 level, suggesting a descending trend and a sharp drop as prices remain elevated but potentially poised for a turnaround within a possible reversal area.

Based on my years of trading and market analysis, I have noticed that when a price trend starts to diverge, it can often indicate a potential bearish trend is imminent. This is particularly true when the price action forms successive equal highs. In my experience, this pattern has proven itself as a reliable warning sign for market reversals. As always, it’s important to confirm such analysis with other technical indicators and keep an eye on fundamental factors, but I have seen this divergence play out many times in the markets.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s new ATH in 2024 may have resulted from monetary inflation rather than true value growth.

The MACD’s bearish trend is a signal for the short-term traders that BTC may soon change direction targeting the critical support range of $28k – $37k.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- WCT PREDICTION. WCT cryptocurrency

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

2024-08-04 12:07