- The rising leverage ratio and Open Interest might be holding Bitcoin back.

- The pitchfork and 200 DMA support failure pointed to a price drop below $60k.

As a seasoned crypto investor with battle scars from the infamous Mt. Gox hack and the infamous Tether controversy etched onto my digital wallet, I must say the current state of Bitcoin leaves me cautiously optimistic but not entirely comforted. The rising leverage ratio and Open Interest might be holding back our beloved BTC, much like an overeager toddler clinging to a parent’s leg at a playground.

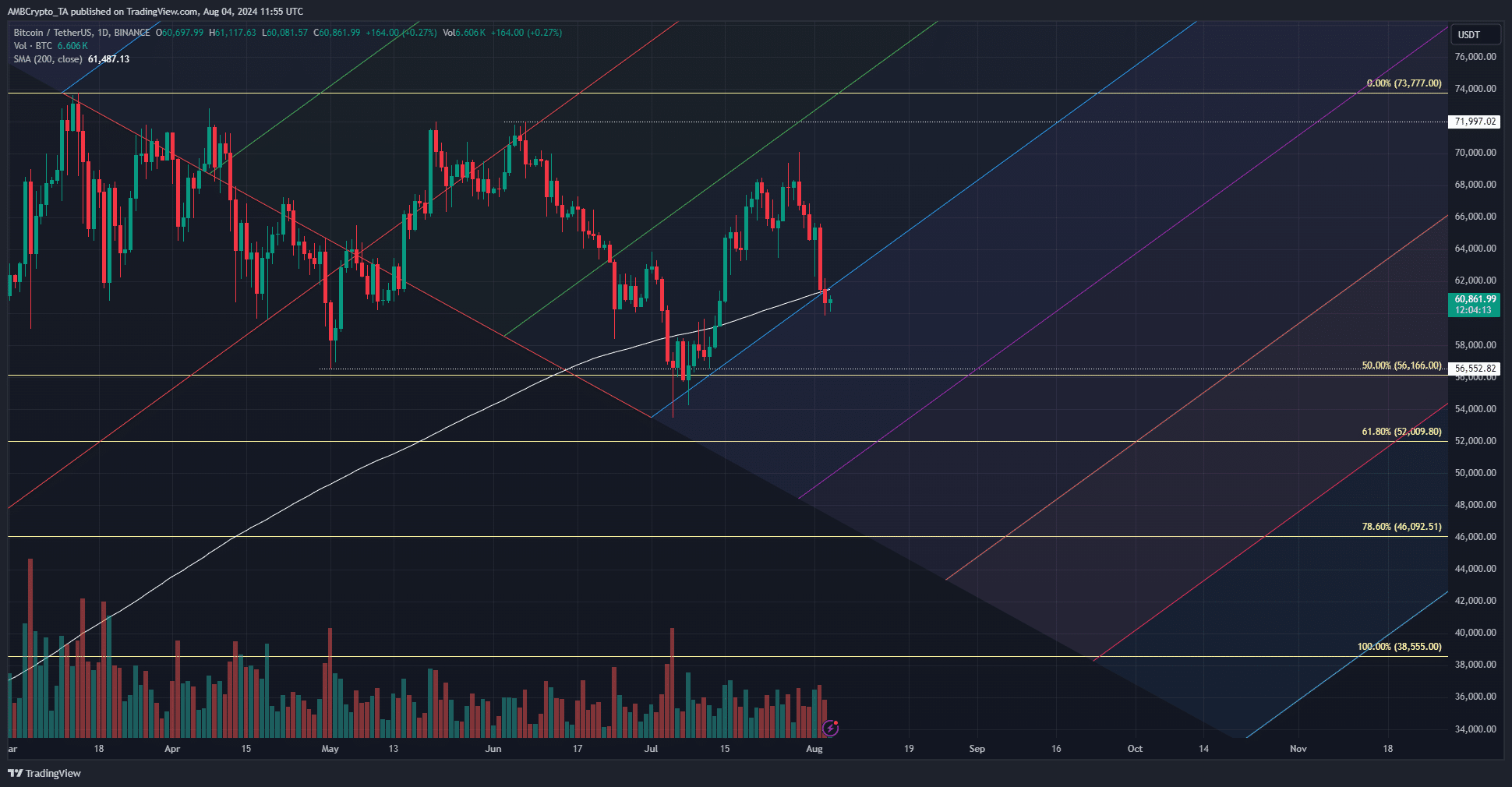

The price of Bitcoin (BTC) has dropped below its 200-day moving average. At the moment, it’s being traded between $60,000 and $60,500 as a support level. There’s a strong possibility that it could slide down to approximately $56,000, with the potential for further decreases.

As an analyst, I observed that according to CoinMarketCap, the Crypto Fear and Greed Index stood at 48, indicating a moderate level of fear among investors. With this bearish sentiment prevailing in the market, there’s a potential risk that traders might feel compelled to increase leveraged positions in an attempt to recoup their losses. However, it’s essential to remember that trading on margin can be quite volatile and may lead to significant losses if not managed carefully.

Is the Bitcoin bottom near?

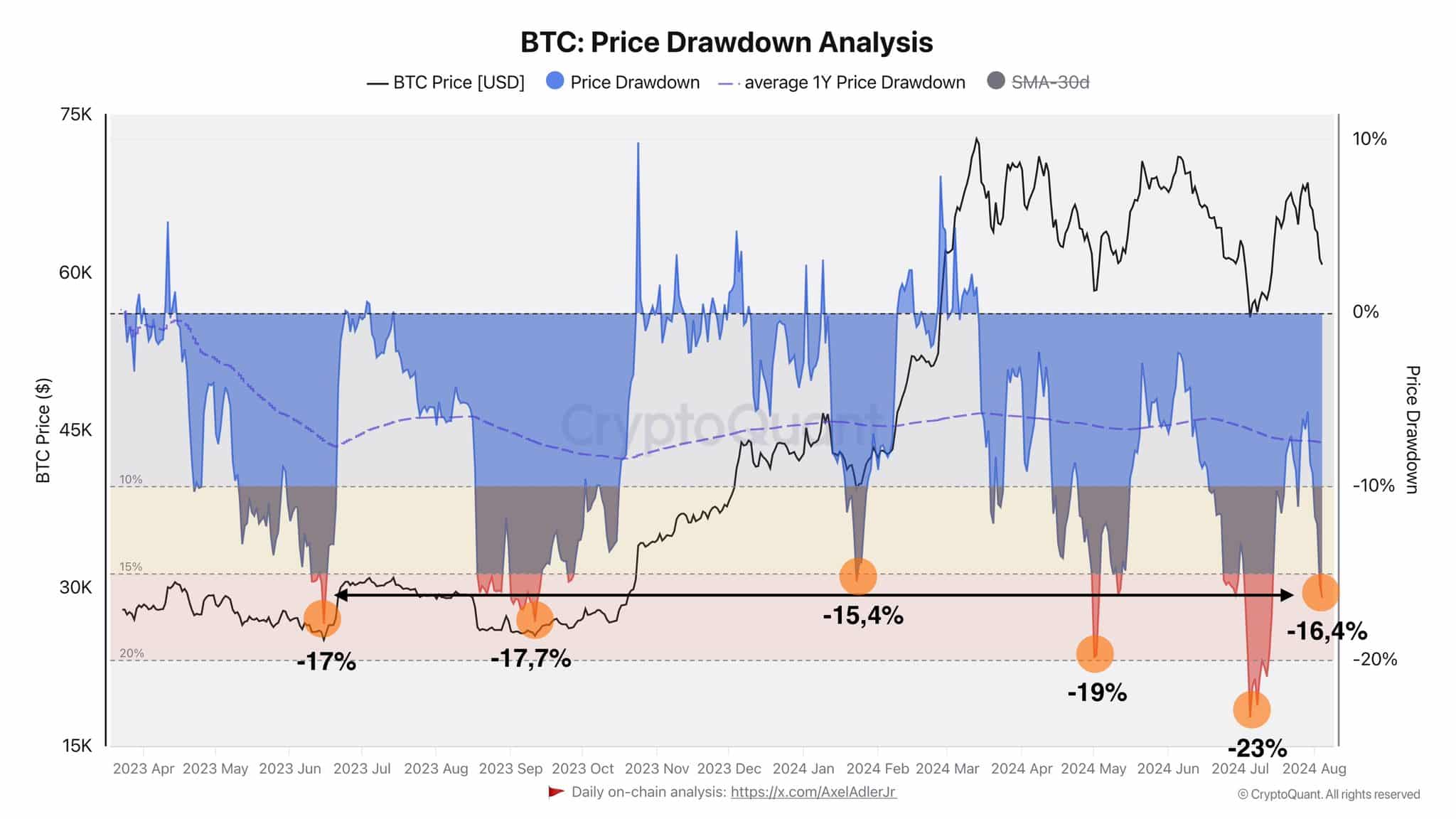

According to crypto analyst Axel Adler, the recent price drops starting from May 2023 showed a decrease ranging between 17% and 23%. Currently, this decline stands at 16.4%. Over the last year, it seems we might be approaching the bottom.

As an analyst, I find myself observing a significant point: the Fibonacci retracement level sits comfortably at the $56k mark. Interestingly, this level has previously functioned as support back in early July. However, the bulls’ failure to safeguard the 200-day simple moving average sends a strikingly bearish message.

Furthermore, the graph’s pitchfork line highlighted the $61.3k mark as a crucial juncture where it coincided with the 200-day moving average and the pitchfork’s support level. This convergence suggested that the breach of this point carried more weight.

Was the derivatives market too heated up?

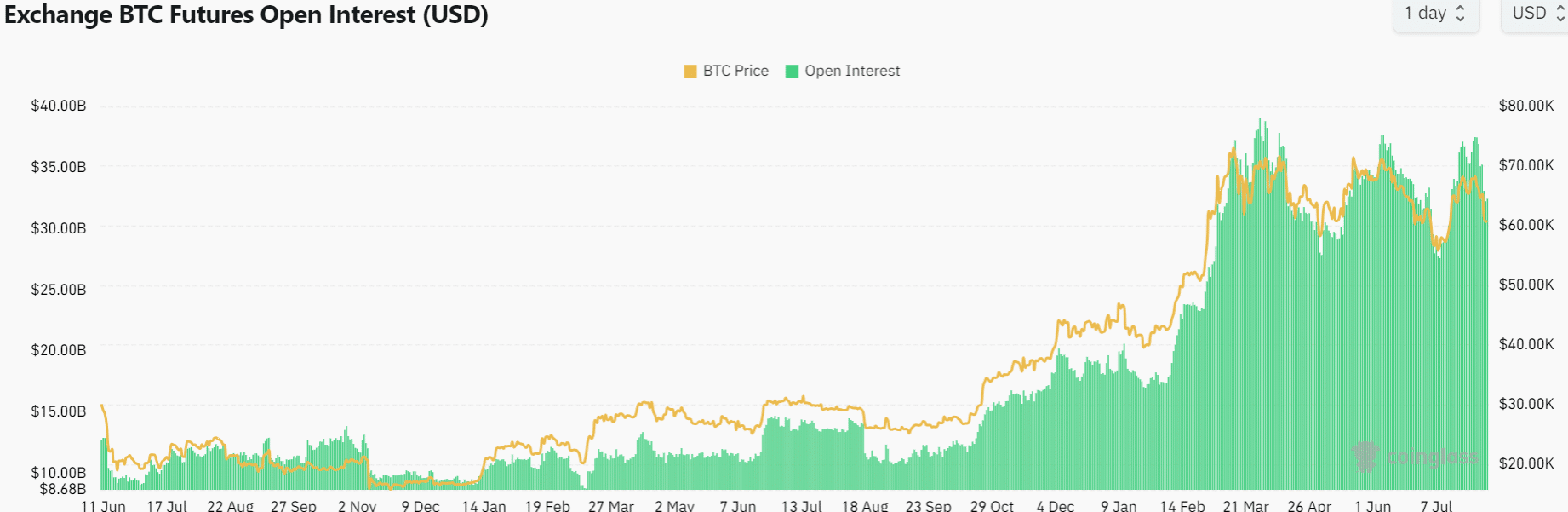

Over the past few months, starting from March, the $70,000 mark, nearly reaching its record high, hasn’t definitively surpassed. Meanwhile, during this timeframe, the Open Interest has consistently stayed within the range of $30 billion to $35 billion.

Over the past week, it has fallen by $4 billion to reflect bearish short-term sentiment.

In simpler terms, for a bull market to be healthy, there should be strong investor interest in stocks. If the futures market becomes excessively active, both optimistic ‘bulls’ and pessimistic ‘bears’ may feel discomfort due to price fluctuations, which can help correct the upward trend.

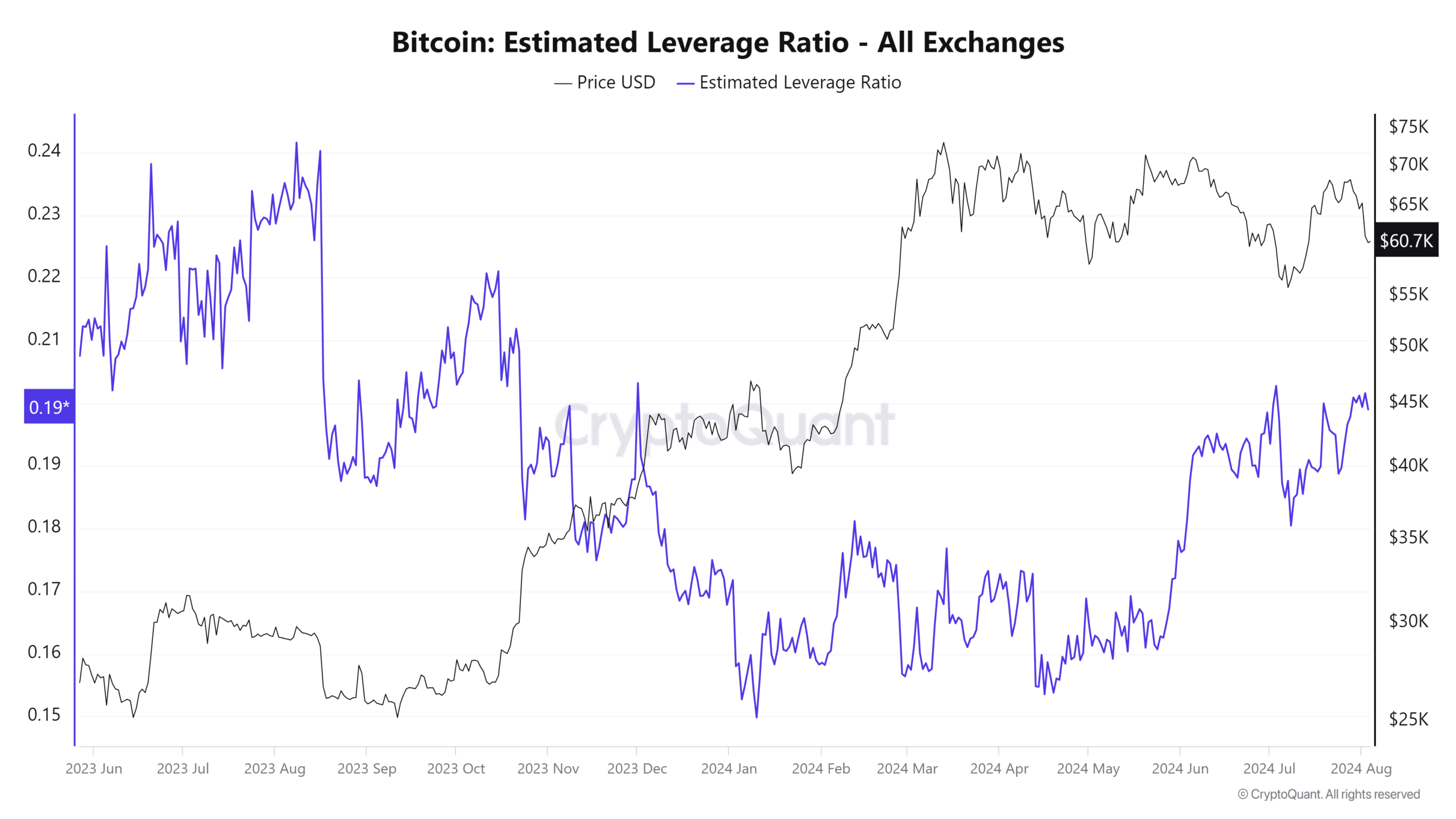

Since June, the projected risk level (leverage ratio) has steadily grown. A rise in this indicator suggests that investors are progressively assuming higher risks through leveraged trading. This might be because they’re optimistic about an upcoming market upturn or bullish breakthrough.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a seasoned trader with years of experience under my belt, I have learned that prices often move towards areas with high liquidation levels, which can negatively impact the chances of a breakout. This is because these levels are usually associated with a large number of short positions, and when the price hits them, many traders are forced to exit their positions, leading to a rapid drop in price. In my own trading career, I have witnessed several instances where this phenomenon has played out, resulting in significant losses for both myself and other traders. Therefore, it is crucial to be aware of these liquidation levels and adjust one’s strategy accordingly to minimize risk and maximize potential profits.

A previous analysis indicated a decrease in the rate of large investors selling Bitcoin over the past few weeks. While this suggests that the $60k price level could mark a temporary low, it’s important to note that further drops might occur due to broader economic events and widespread market anxiety, which cannot be completely disregarded.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-08-05 08:07