As a seasoned investor with over two decades of experience under my belt, I’ve seen countless crypto projects come and go. However, Raydium has piqued my interest due to its innovative approach to decentralized trading and liquidity provision.

One way to rephrase the given text could be: DeFi is made up of various components, with Raydium being one of them. It’s an automated market maker operating on the Solana blockchain. By allowing users to trade digital assets directly from liquidity pools instead of through traditional centralized exchanges, it fosters decentralized trading. Thanks to its integration with Serum DEX, it significantly enhances the Solana ecosystem by boosting its liquidity and trading capabilities.

Having worked extensively in the decentralized finance (DeFi) space, I can confidently say that this article provides a comprehensive overview of Raydium’s abilities as an Automated Market Maker (AMM). As someone who has navigated through various AMM platforms, I appreciate the depth with which it presents the intricacies of Raydium, making it easier for readers to understand its role in managing and utilizing currencies. The article is a must-read for anyone interested in understanding the dynamic world of DeFi and the significant role that platforms like Raydium play in shaping it.

Key Takeaways

-

With its incorporation into the Serum, RAY improves trading by providing liquidity and transaction efficiency.

Due to the token’s considerable volatility, investors in RAY tokens need to exercise caution and strategically plan to manage risks appropriately.

With its quick transactions, cheap fees, and strong liquidity, Raydium might be a good choice for those interested in decentralized finance.

Overview of Raydium

In the month of February 2021, a team led by an anonymous figure known as Alpharay introduced Raydium to the world. This platform quickly garnered attention due to its innovative methods for providing liquidity and fostering decentralized trading on the Solana blockchain.

As a crypto investor, I find it intriguing that Raydium leverages the Serum DEX to transform its liquidity into limit orders. This integration sets Raydium apart from other Automated Market Makers (AMMs), which typically provide liquidity pools. By tapping into Serum’s central limit order book, Raydium enhances trading efficiency and ensures robust liquidity across the Solana ecosystem, offering a more refined trading experience for me as an investor.

The RAY token serves multiple purposes, acting both as a utility and a management token within our platform, Raydium. Benefits for RAY holders include reduced protocol fees, staking rewards, access to Initial DEX Offerings (IDOs), and the ability to acquire Dropzone NFT tickets using RAY tokens. This versatile tool not only attracts users but also incentivizes liquidity providers to engage with our platform, thereby fostering Raydium’s ecosystem.

How Raydium Works

As a researcher studying the realm of decentralized finance, I’m constantly impressed by how Raydium operates. It leverages not one but two sources for initial liquidity: the Serum order book and its own liquidity pool. This dual setup significantly enhances the effectiveness of algorithmic trading. When a trade is executed, Raydium intelligently determines the optimal execution route, taking into account the available liquidity in both its pools and the Serum orderbook. In essence, Raydium boosts the trading depth and price discovery on Serum’s order books by converting liquidity into limit orders, thereby creating a more robust and dynamic market environment.

Key Components

To properly understand Raydium’s components, let’s examine some of its critical characteristics.

-

Raydium’s launchpad platform, AcceleRaytor, was created to assist new enterprises in obtaining early funding and distributing their tokens. This feature allows initiatives to take off and become more visible within the Solana Raydium ecosystem.

By locking up their Raydium token, customers can earn rewards through staking opportunities provided by Raydium. Staking contributes to the network’s stability and security and generates passive income.

By supplying liquidity to several pools, users can earn extra incentives through yield farming on Raydium. Because of these advantages, Raydium is a desirable choice for liquidity providers when generating RAY tokens and other incentives.

Raydium’s platform for releasing NFTs is called Dropzone (NFT Launchpad). Authors can mint and distribute their NFTs with the help of Raydium users and liquidity.

Thanks to Raydium’s integration with Magic Eden, an NFT marketplace is now available. This marketplace increases the usefulness of the Raydium platform by giving users a venue to exchange and gather NFTs.

Liquidity Provision

Liquidity Providers (LPs) play an essential part in the Raydium cryptocurrency environment. They offer assets to Raydium’s pools of liquidity, which facilitates easier trading for customers. In return, they receive a percentage of the transaction fees that users pay, serving as motivation for LPs to continue supplying these resources. These fees incentivize LPs to keep contributing to the ecosystem. By engaging in liquidity mining and participating actively, LPs can boost their earnings and generate RAY tokens as rewards.

By employing smart contracts for automated market formation and trade, Raydium’s system is designed to ensure on-chain liquidity and decentralized transactions. This approach advantages everyone contributing to a robust and vibrant trading ecosystem.

Fast Fact

A group of three unidentified innovators, known as AlphaRay, XRay, and GammaRay, lead the project called Raydium. Among them, AlphaRay, with a background in algorithmic trading, utilized his skills and knowledge to create Raydium.

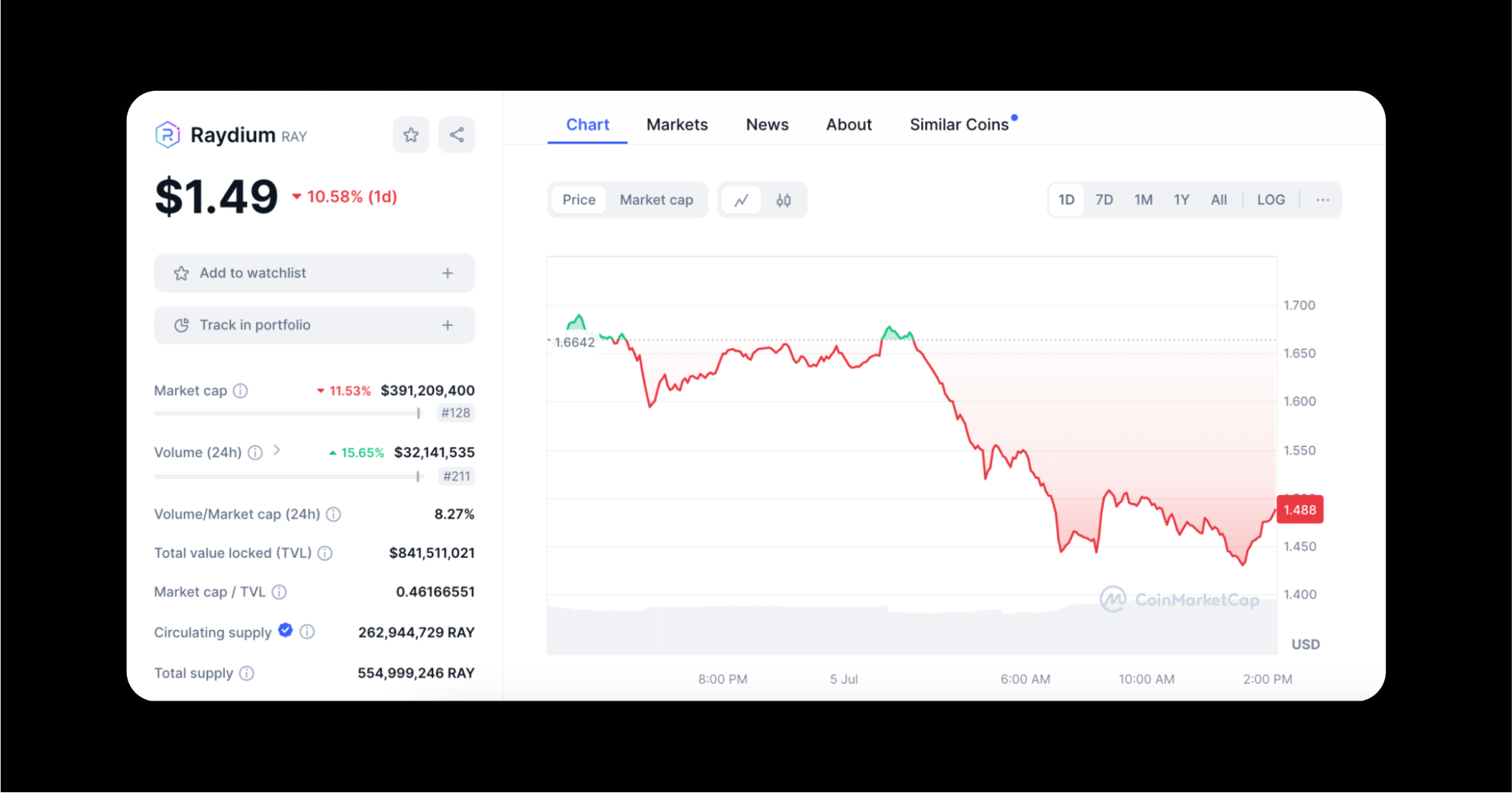

Raydium Price Analysis

Starting from August 5th, the price of RAY is approximately $1.49. In circulation, there are around 555 million RAY tokens, representing the entire supply of Ray cryptocurrency. Trade volume fluctuations have been noted on the Raydium exchange, these changes can be linked to broader market trends. The token’s recent behavior exhibits a combination of growth surges and corrections, a typical trait among DeFi tokens.

Short-Term Predictions

Assessing technical signals and market conditions play crucial roles when predicting short-term price fluctuations. For example, it’s expected that the value of Raydium could fluctuate between $1.60 and $1.70 over the next few days. If market trends are positive, RAY could potentially reach $1.80 within a month. Longer-term forecasts suggest that if there’s sustained interest and trading activity in the Raydium Decentralized Exchange (DEX), prices may rise to around $2.00 over the next three months.

Long-Term Forecasts

Looking ahead, Raydium’s future outlook suggests that investing in cryptocurrency involves risk. By 2025, analysts at WalletInvestor expect a significant surge, potentially reaching as high as $3.62. However, more conservative predictions estimate the price to hover around $2.28. On the optimistic side, RAY could reach an impressive $12.24 by 2030. Conversely, some forecasts are less optimistic and suggest a lower price of approximately $2.13 for Raydium.

Technical Indicators

As a researcher delving into the dynamics of the Raydium market, I’ve found that critical technical indicators provide valuable insights into its behavior. Specifically, Moving Averages (MAs) help uncover patterns by presenting the average price over a designated timeframe. For instance, the 200-day MA is instrumental in identifying long-term trends, while the 50-day MA serves as a short-term indicator. In the case of Raydium, the 200-day MA indicates a steady long-term outlook, whereas the 50-day MA suggests a potential upward surge might be on the horizon.

The Relative Strength Index (RSI) measures how quickly and significantly prices are changing, as well as the extremes to which they rise and fall. When the RSI exceeds 70, it suggests the market is overbought, meaning prices have risen too much and may soon fall; on the other hand, an RSI below 30 indicates the market is oversold, signaling that prices have fallen too much and could potentially rise. At present, Raydium’s RSI shows a neutral reading, suggesting a stable or balanced market condition.

Grasping potential price limits (floors and ceilings) involves being mindful of support and resistance thresholds. In Raydium’s case, there are significant support points around $1.50 and resistance points around $1.80 and $2.00. These points serve as guides for traders to decide whether to buy or sell, thereby boosting the trading volume and market liquidity.

Investment Considerations

As an analyst, I’ve noticed that the high volatility of RAY tokens presents substantial risks for investors. The swift and unpredictable fluctuations in price can temporarily impact the worth of investments. Given this volatility, it’s crucial to maintain a vigilant watch and be ready to adapt to market changes promptly.

Looking at the positive aspects, it offers several benefits such as fast transactions, lower costs, and solid cash flow. It’s an appealing choice for decentralized trading due to these characteristics.

A potential danger lies in the possibility of manipulation by centralized entities in the trading process, which might destabilize the market. With the increasing availability of RAY tokens, there’s a growing risk for investors to incur losses on their investments.

At present, there’s a mix of views among investors regarding investments in Ray Coin. To measure investor sentiment, we often use the Fear & Greed Index, which indicates differing levels of confidence. By considering these sentiments, an investor might be better equipped to make informed decisions.

Investors need to understand the risks of investing in cryptocurrencies like Raydium coin. Diversifying portfolios is crucial for reducing risk and avoiding making more significant investments than one can afford to lose.

To minimize potential losses, make use of stop-loss orders and regularly evaluate and adjust your investment strategies based on market changes. Keeping yourself informed about regulations and market fluctuations can aid in creating an effective long-term plan.

As someone who has made mistakes in my own investments, I cannot stress enough the importance of doing thorough research and seeking advice from a financial expert before making any investment decisions. My personal experiences have taught me that investing can be both exciting and profitable, but it also carries risks. It’s essential to approach it with caution and a well-informed mindset. So, remember, this information is intended for educational purposes only, not as financial advice. Always do your due diligence and consult with an expert before putting your hard-earned money at stake.

Conclusion

RAY, which offers several benefits, integrates with the Serum order book to enable decentralized trading. Our demonstrated price analysis focuses on current patterns and forecasts, while the investing considerations discuss benefits, dangers, market volatility, and strategic insights.

Exploring the opportunity with Raydium comes with both pros and cons. Thoroughly research and consult with financial experts before taking action.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-08-05 14:31