As a seasoned investor with years of experience under my belt, I’ve seen the evolution of various investment vehicles, from traditional mutual funds to the more modern Exchange-Traded Products (ETPs) and Exchange-Traded Funds (ETFs). My journey has taught me that understanding these financial instruments can greatly enhance one’s investment strategy.

Have you realized that the contemporary investing sphere is teeming with thousands of Exchange-Traded Funds (ETFs)? It’s possible you’re already aware, but let me share an interesting fact: The realm of Exchange-Traded Products (ETPs) extends further, presenting numerous investment possibilities.

If you’re not acquainted with these investment tools just yet, that’s alright. This article is designed to clarify the complexities surrounding Exchange-Traded Funds (ETFs) and Exchange-Traded Products (ETPs).

As a researcher, I’m eager to delve into the crucial features of these two options, with the aim of helping you integrate them effectively into your investment plans. So, let’s get started!

What are Exchange-Traded Products (ETPs)?

Investment tools known as Exchange-Traded Products (ETPs) can be bought and sold on the stock market, much like individual shares (although it’s important to note that ETPs are not the same as stocks). These products offer investors a way to access a diverse range of assets such as stocks, cryptocurrencies, commodities, and bonds without having to purchase each asset separately.

Essentially, Exchange-Traded Portfolios (ETPs) bring together several investments into a single portfolio, allowing investors to access a broad spectrum of assets in a way that resembles stock trading on significant exchanges. The primary purpose of ETPs is to provide diverse exposure, maintain high liquidity, ensure transparency, and offer cost-effectiveness.

These types of investments, known as passive, aim to mimic the overall performance of a particular market. They do this by following a leading index and usually trade close to their Net Asset Value (NAV), which reflects the total value of the assets in the fund minus its liabilities.

The main types of ETPs include:

-

Exchange-Traded Funds (ETFs);

Exchange-Traded Notes (ETNs);

Exchange-Traded Commodities (ETCs).

Each of these has different structures and focuses on different types of investments.

What are Exchange-Traded Funds (ETFs)?

Exchange-Traded Funds (ETFs) are a specific type of exchange-traded product (ETP).

Exchange-Traded Funds (ETFs) are bundles of various financial assets that can be purchased and sold like individual stocks. Unlike owning the individual securities within the ETF, investors hold shares of the fund itself. The appeal of ETFs lies in their ease and efficiency; they allow investors to acquire a broad, diversified investment in an entire index or market sector with just one transaction.

A fundamental distinction exists between Exchange-Traded Products (ETPs) and Exchange-Traded Funds (ETFs): whereas all ETFs fall under the umbrella of ETPs, not all types of ETPs qualify as ETFs.

ETP vs. ETF: What Are The Key Differences?

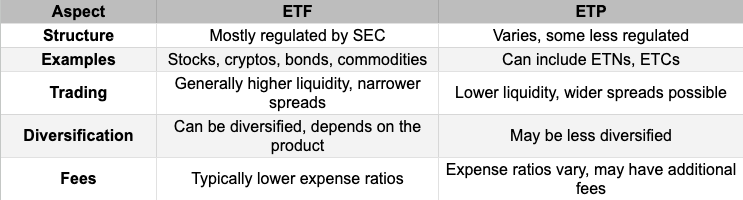

After examining each Exchange-Traded Product (ETP) and Exchange-Traded Fund (ETF) in detail with some relevant points of comparison, let’s shift our attention to a comprehensive comparison between the two.

Initially, it’s important to note that both Exchange-Traded Funds (ETFs) and Exchange-Traded Products (ETPs) are traded on exchanges, providing investors with a diverse range of asset options. However, they do have some notable distinctions. To put it simply, every ETF belongs to the ETP family, but not all ETPs can be classified as ETFs.

But that’s not all, and we will present further the key differences between these two.

ETP vs. ETF: Structure and Regulation Differences

Generally speaking, Exchanged-Traded Products (ETPs) resemble Exchange-Traded Funds (ETFs), which are registered with the Securities and Exchange Commission (SEC). As such, they are governed by the Investment Company Act of 1940, ensuring a greater degree of supervision and transparency.

Exchange-Traded Funds (ETFs) typically concentrate on equities, fixed income instruments like bonds, and debt securities. To qualify as an ETF, they need to fulfill specific diversity rules. Being listed on the stock market gives them a high level of liquidity and flexibility.

While both Exchange-Traded Funds (ETFs) and other Exchange-Traded Products (ETPs), such as ETNs, function similarly in trading, they differ significantly when it comes to regulation. ETFs are required to adhere to stringent rules and are supervised by a board of directors and the Financial Industry Regulatory Authority (FINRA). In contrast, ETNs don’t have board oversight and operate under less rigorous regulations, making them potentially riskier compared to ETFs.

ETP vs. ETF: Trading and Liquidity Differences

In terms of trading flexibility and accessibility to funds, Exchange-Traded Funds (ETFs) typically outperform other exchange-traded instruments (ETPs).

Exchange-traded funds (ETFs) and exchange-traded products (ETPs) are both traded on stock markets, but ETFs generally provide greater liquidity and tighter bid-ask spreads compared to ETPs. This makes it easier and quicker for investors to buy or sell ETFs with less impact on the market price.

A few factors influence the higher liquidity of ETFs.

Initially, Exchange-Traded Funds (ETFs) often contain a diverse collection of investments like stocks, bonds, cryptocurrencies, and various other assets. This mix increases their ability to be easily bought and sold, enhancing their liquidity.

After this, ETFs (Exchange-Traded Funds) typically handle greater daily trading activity than other Exchange-Traded Products (ETPs). This increased volume signifies that a larger number of shares are bought and sold on a daily basis. Consequently, investing in or withdrawing from these positions becomes simpler for investors due to the high liquidity.

In simple terms, the bid-ask spread refers to the significant gap between the highest price an investor is prepared to pay (bid) and the lowest price another investor is ready to sell (ask), for Exchange Traded Funds (ETFs).

Because ETFs are traded on stock exchanges just like individual shares, the bid-ask spread serves as a crucial measure of trading expenses and market liquidity. In other words, popular ETFs with large trading volumes often have tighter bid-ask spreads due to the increased number of active buyers and sellers, which keeps the prices more aligned.

In contrast, Exchange-Traded Funds (ETFs) that invest in highly liquid assets such as large-cap stocks usually have smaller price differences (spreads) compared to those that hold less liquid or more volatile assets.

ETP vs. ETF: Diversification and Risk Differences

Investment tools like Exchange-Traded Funds (ETFs) and Exchange-Trusted Products (ETPs) can help you spread out your investments and handle risks effectively. However, the extent of diversification for each tool depends on the particular product and the assets it’s linked to.

In simpler terms, Exchange-Traded Commodities (ETCs) provide a means to invest in commodities such as gold or oil, allowing for diversification of your investment portfolio beyond the usual options of stocks and bonds.

As a crypto investor, I find it beneficial to consider ETFs like iShares Core ETFs as a complement to my investment strategy. These ETFs are specifically designed to aid in creating balanced portfolios tailored for long-term aspirations. Unlike certain ETPs that might concentrate on particular industries or commodities, these ETFs generally follow a broad spectrum of underlying assets, offering a more extensive level of diversification, which can help mitigate potential risks and increase overall portfolio stability over time.

On the other hand, not having a diverse portfolio could pose a risk for both ETFs (Exchange Traded Funds) and ETPs (Exchange Traded Products). If these investments heavily concentrate in a single sector or commodity, you might experience substantial losses if that specific sector or commodity experiences poor performance.

As a researcher studying exchange-traded funds (ETFs), I’ve found that leveraged or inverse ETFs, which are designed to boost returns or profit from market declines, carry unique tax implications because of their daily resets. This could lead to unforeseen taxable gains or losses, making it crucial for investors to carefully consider these potential financial impacts.

ETP vs. ETF: Fees

Generally, ETFs tend to offer lower fees compared to other investment options. This is because they usually charge just one primary fee, known as the expense ratio, which represents a yearly percentage of the fund’s total assets. This fee is used to cover administrative and operating expenses.

The cost ratios for Exchange-Traded Funds (ETFs), particularly index ones, tend to be quite minimal. However, you may encounter transaction fees when purchasing or selling ETF stocks. Fortunately, numerous brokerages now provide commission-free transactions for ETF shares.

The cost structure for Exchange-Traded Products (ETPs) can sometimes be intricate because the expense ratios differ based on the type of ETP and its operational aspects. For example, ETCs that follow commodities via derivative contracts tend to have higher costs due to the management expenses related to these contracts. On the other hand, ETNs may have expense ratios similar to those of ETFs, but certain ones might include extra fees for features like leverage or to account for the credit risks taken by the issuing bank.

In simpler terms, when comparing Exchange-Traded Products (ETPs), particularly those with less frequent trading activity, you might find a bigger gap between the buying and selling prices (bid-ask spread). This difference could affect your overall earnings. Some ETPs may also charge additional fees, such as performance fees, which are based on the ETP’s own returns.

Other Types of ETPs

As we already mentioned, there are also other types of ETPs in addition to ETFs.

In addition to Exchange Traded Funds (ETFs), there are other types of investment instruments traded on exchanges, such as Exchange Traded Notes (ETNs) and Exchange Traded Commodities (ETCs).

Exchange-Traded Notes (ETNs)

ETNs combine the characteristics of bonds with the ease of trading stocks.

While Exchange-Traded Funds (ETFs) own physical assets, Exchange-Traded Notes (ETNs) are debt securities issued by financial institutions. These notes promise to deliver returns related to the performance of a specific market index or benchmark, minus any associated fees, when they mature.

Exchange-Traded Commodities (ETCs) do not fall under the jurisdiction of UCITS regulations, which means they are not bound by its rules regarding diversification. This flexibility often leads to increased risks compared to Exchange-Traded Funds (ETFs). The primary reasons for this higher risk include credit risk and insufficient asset backing.

There are two types of Exchange-Traded Notes (ETNs): collateralized and uncollateralized.

- Collateralized ETNs – provide partial or full protection against counterparty risk.

- Uncollateralized ETNs – are entirely exposed to it.

Consequently, it’s crucial for investors to fully grasp the underlying risks involved in an Exchange-Traded Note (ETN) before deciding to invest.

Benefits of Exchange-Traded Notes (ETNs)

- Price Tracking – ETNs are designed to closely follow the performance of their underlying index or benchmark without experiencing the tracking errors that can affect ETFs.

- Tax Efficiency – ETNs can offer tax advantages in certain scenarios. Since they do not distribute dividends, investors may not incur taxes until the ETN is sold or matures, potentially deferring tax liabilities.

- Market Exposure – ETNs provide access to a wide range of assets, including commodities, emerging markets, private equity, and specific investment strategies that might be difficult or expensive to access directly.

- Diversification – ETNs can offer diversification by providing exposure to niche markets and alternative investment strategies that are not typically available through traditional investment vehicles.

- Flexibility – ETNs allow investors to gain exposure to different asset classes and strategies without the need to directly invest in those assets, providing a flexible way to diversify their portfolios.

- Accessibility – ETNs trade on major exchanges, making them easy to buy and sell, similar to stocks, and providing investors with straightforward access to diverse investment opportunities.

Risks of Exchange-Traded Notes (ETNs)

- Credit Risk – As debt instruments, the value of ETNs depends on the creditworthiness of the issuing bank. If the issuer encounters financial trouble, the ETN could lose value regardless of the performance of the underlying index.

- Liquidity Risk – Some ETNs may have lower trading volumes compared to ETFs, which can lead to wider bid-ask spreads and make it harder to buy or sell the ETN at desired prices.

- Issuer Risk – Since ETNs are unsecured debt obligations, they carry the risk that the issuer may default on its obligations, impacting the ETN’s value and return.

- Market Risk – ETNs are subject to market risk, meaning their value can fluctuate based on the performance of the underlying index or benchmark. Poor performance of the underlying asset can result in losses for the investor.

Exchange-Traded Commodities (ETCs)

ETCs provide exposure to commodities like metals, energy, and agricultural products without requiring direct investment in physical commodities or futures contracts.

Exchange-Traded Commodities (ETCs) follow the cost fluctuations of an individual product or a collection of goods in the market, providing investors with a way to enter commodity trading through a stock exchange-listed security.

Some of the most popular ETCs include SPDR Gold Shares (GLD) and iShares Silver Trust (SLV).

There are distinct differences between ETCs and commodity ETFs. Commodity ETFs, regulated under the Investment Company Act of 1940 in the U.S., are structured as funds. They hold either physical commodities (such as gold or silver) or futures contracts on commodities. These ETFs are considered equity products and are regulated similarly to mutual funds and other ETFs.

Instead, ETCs function like debt securities, much like exchange-traded notes (ETNs). They differ from conventional funds, as they’re not categorized as such. These financial instruments are debts issued by one entity, which implies potential credit risks associated with the issuer.

ETCs can be broadly classified into two categories:

-

Physical ETCs – These ETCs hold physical commodities, such as gold or silver bars, in secure vaults. Investors in physical ETCs have a claim on the underlying metal, and the ETC’s value is directly tied to the price of the physical commodity.

Synthetic ETCs – Instead of holding physical commodities, synthetic ETCs use derivatives like futures contracts to replicate the performance of the underlying commodity. This approach allows for exposure to a broader range of commodities, including those that are difficult or impractical to store physically.

Benefits of Exchange-Traded Commodities (ETCs)

-

Direct Commodity Exposure – ETCs provide a straightforward way to invest in commodities, offering a potential hedge against inflation and a means of diversification beyond traditional stocks and bonds.

Variety – Investors can select from a range of commodities, including gold, silver, oil, and agricultural products, based on their investment goals and market perspectives.

Transparency – ETCs offer clear insights into their holdings and pricing, with the ETC’s value closely mirroring the price of the underlying commodity or commodities.

Ease of Trading – ETCs are traded on stock exchanges, making them easily accessible to investors through regular brokerage accounts. This convenience allows for simple buying and selling during market hours.

Liquidity – ETCs typically offer high liquidity, allowing investors to quickly enter and exit positions without significantly impacting the market price.

Cost Efficiency – ETCs often have lower management fees compared to actively managed funds, making them a cost-effective option for gaining exposure to commodities.

Risks of Exchange-Traded Commodities (ETCs)

-

Volatility – Commodity markets are often highly volatile, with prices affected by factors like geopolitical events, weather conditions, and changes in supply and demand.

Counterparty Risk – Synthetic ETCs may involve counterparty risk, as their performance relies on the issuer’s or counterparty’s ability to meet their obligations under the derivative contracts.

Credit Risk – Since ETCs are unsecured debt instruments issued by a single entity, they carry credit risk. If the issuer encounters financial problems, the ETC could lose value regardless of the underlying commodities’ performance.

Storage and Insurance Costs – For physical ETCs, there may be additional costs associated with storing and insuring the underlying physical commodities, which can affect the overall returns.

Most Common Types of ETFs

- Stock Index ETFs – These ETFs mirror major stock market indexes like the S&P 500, Nasdaq 100, or Dow Jones Industrial Average, providing exposure to a broad range of stocks.

- Industry and Sector ETFs – Focused on specific industries or sectors, such as technology or financial services, these ETFs track the performance of companies within those particular areas.

- Bond ETFs – These ETFs follow indexes of government, corporate, or municipal bonds, offering investors a way to gain exposure to fixed-income securities.

- Commodity ETFs – These track the prices of commodities like gold, silver, oil, and grains. They may hold physical commodities or use futures contracts and other derivatives.

- Currency ETFs – Designed to track foreign currency exchange rates, these ETFs provide exposure to various international currencies.

- Inverse ETFs 0 These ETFs are structured to deliver returns that are opposite to the performance of their benchmark indexes, allowing investors to profit from market declines.

- Leveraged ETFs – Aimed at amplifying returns, these ETFs seek to deliver two to three times (or more) the daily performance of an underlying index or asset, both positively and negatively.

- Crypto ETFs – These ETFs focus on major cryptocurrencies like Bitcoin or Ethereum. They may either directly hold cryptocurrencies or use derivatives to offer exposure to the crypto market.

How ETPs and ETFs Compare to Mutual Funds?

Investment choices like Exchange-Traded Products (ETPs), Exchange-Traded Funds (ETFs), and mutual funds enable multiple investors to combine their resources. This shared investment offers the benefits of diversification and skilled management. However, each one has its unique characteristics.

Picture a basket brimming with various financial offerings. This basket symbolizes the underlying assets, such as stocks, cryptocurrencies, or bonds, that these investment options contain. Some professionals carefully select the contents of the basket for certain funds (actively managed), while others automatically follow a set plan (passively managed).

The key difference lies in how you buy and sell your share of the basket. ETFs and ETPs trade throughout the day on stock exchanges, just like individual stocks. The price you pay will depend on what other investors are willing to spend at that moment. Mutual funds, on the other hand, are like a restaurant basket you can only buy at closing time. The price is determined after the market closes, reflecting the value of everything in the basket at that specific time.

As a seasoned investor with years of experience under my belt, I have come to appreciate the versatility that Exchange-Traded Funds (ETFs) and Exchange-Traded Products (ETPs) offer in terms of investment strategies. While both can be passively or actively managed, what truly sets them apart is their flexible structure – whether fixed or constantly evolving. This adaptability has been a game-changer for me when navigating the ever-changing market landscape.

When pondering over where to put your financial resources next, consider whether you’re drawn more towards the freedom offered by exchange-traded options or the possibly reduced costs associated with mutual funds. If cryptocurrency appeals to you, be sure to look for opportunities in that area as well.

Why ETPs and ETFs are Important for Crypto?

It’s still uncertain if cryptocurrencies should be considered securities or commodities in debates, but there’s no denying that they fall under the category of financial assets for sure.

Over time, there’s been a growing interest in finding easier methods for trading various assets. Fortunately, some Exchange-Traded Products (ETPs), like Exchange-Traded Funds (ETFs), make investing simpler. For example, ETFs let investors explore cryptocurrencies without the hassle of direct ownership or key management, streamlining the investment process and minimizing risks related to storage and security concerns.

For quite some time, the investment world has been waiting with excitement for the green light on a Bitcoin Exchange-Traded Fund (ETF). Such an approval would pave the way for everyday investors to invest in Bitcoin via a legally sanctioned financial instrument. This long-awaited moment arrived in January 2024, as the U.S. Securities and Exchange Commission granted its first approval for a Spot Bitcoin ETF, with BlackRock taking charge of the initiative.

As someone who has been closely following the cryptocurrency market for several years now, I must say that the launch of a Bitcoin ETF is indeed a game-changer. My personal investment journey in crypto has been filled with ups and downs, but the introduction of a regulated ETF offers a level of legitimacy that I believe will attract more institutional investors and provide a safer, more accessible entry point for individual investors like myself.

As the momentum continues, it’s likely that additional Bitcoin ETFs will come into being, catering to a broader spectrum of investors. These new products could offer varying expense ratios, investment strategies, and possibly even leveraged options, offering investors a more customized approach to investing in Bitcoin.

Although Bitcoin was initially the main focus, the approval of the first Bitcoin ETF opened up opportunities for similar exchange-traded funds (ETFs) centered around other significant cryptocurrencies such as Ethereum. Interestingly, on July 22, 2024, the Securities and Exchange Commission (SEC) granted approval to some Ethereum ETFs. This development allows investors to broaden their crypto investment portfolio beyond Bitcoin, potentially gaining from the expansion of other well-established blockchain projects.

As a researcher, I’ve observed that the growing ease of access and credibility surrounding Exchange-Traded Funds (ETFs) might have drawn a substantial number of institutional investors into the fold. Given their immense financial resources, these institutions could have significantly strengthened the crypto market, potentially contributing to increased stability and price growth.

Conclusion

Investing in Exchange-Traded Funds (ETFs) and Exchange-Traded Products (ETPs) might appear complicated at first glance, but mastering their intricacies could greatly enhance your investment approach. Unlike common mutual funds, ETFs and ETPs allow for continuous trading on stock exchanges throughout the day, offering real-time pricing and increased liquidity.

Delving into the crucial components of these financial tools allows for wise choices, possibly leading to increased investment earnings.

Regardless if you’re an experienced investor or new to the game, exploring the various chances provided by ETFs (Exchange-Traded Funds) and ETPs (Exchange-Traded Products) could be a beneficial move for your investment portfolio.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-08-05 14:35