-

Aptos just experienced a substantial surge in network activity.

Is APT approaching its bottom range?

As a seasoned crypto investor with a knack for deciphering market trends and recognizing potential gems, I find myself intrigued by Aptos [APT]. The recent surge in network activity has certainly piqued my interest, particularly since it’s been a while since we saw such vibrant statistics.

Recently, the Aptos blockchain has been generating buzz, even amidst the turbulence in the broader crypto market. Their recent report showcases a significant increase in network activity, leading many to speculate about possible consequences for their native cryptocurrency, APT.

Last week, the Aptos network reported a significant increase of approximately 27% in transactions, reaching a high of 14.6 million. The total number of distinct users surpassed 20 million, and the average number of active users exceeded one million.

Within a few days, the network unveiled its plans for integrating USDY, an action intended to draw in sophisticated financial institutions.

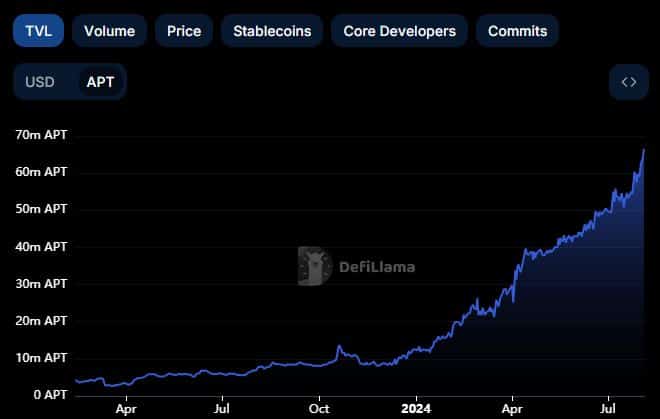

The indicated result indicates a favorable reaction from the Aptos community, as the TVL (Total Value Locked) momentarily surpassed $400 million, but subsequently decreased due to the recent market downturn.

However, Aptos TVL is currently at an all-time high of 66.51 million APT.

Delving further into the statistics of our network, we uncovered some intriguing insights. As reported by DappRadar, Aptos reached a staggering daily transaction peak of approximately 580,690 on Sunday.

In the past 30 days, this day saw the highest number of daily transactions we’ve recorded. Furthermore, there was an increase in the number of individually active wallets (unique active wallets or UAWs) during that very same period.

The number of UAWs surged by over 135,000 compared to the previous day.

APT lends itself to the bears

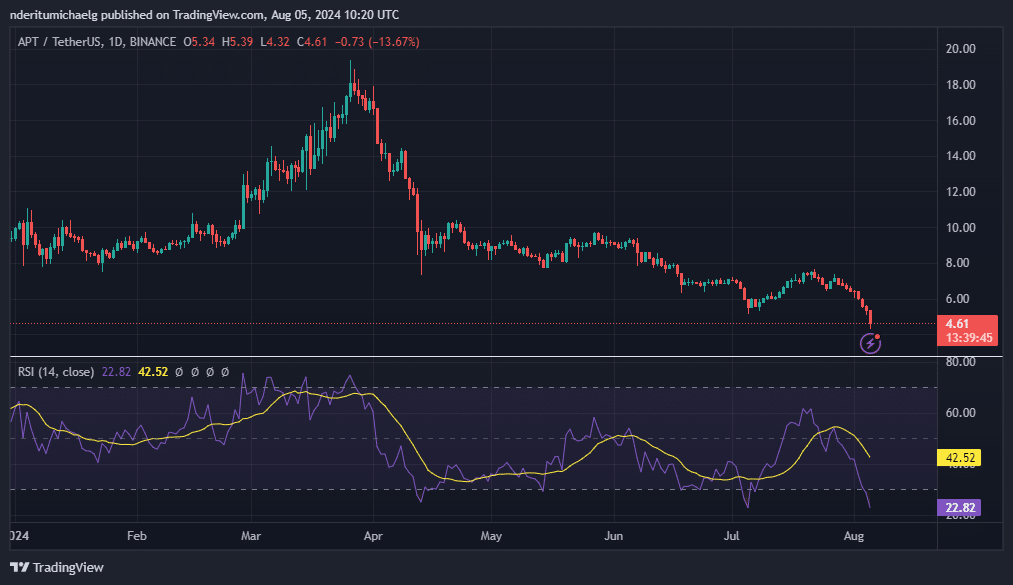

Despite Aptos showing an increase in healthier activities and total value locked (TVL), this growth hasn’t been reflected in the movement of APT prices. Instead, the crypto ended July on a negative trend and continued to decrease over the weekend.

Over the past nine days, APT has experienced a significant decline. It dropped by approximately 43% from its peak in July, reaching a low of $4.32. Currently, at the time of reporting, APT is being traded at $4.61.

At present, APT‘s price stands at a substantial 76% reduction compared to its highest year-to-date value. However, its current status might signal an impending bullish rebound. This optimistic outlook is reinforced by the oversold condition indicated by the Relative Strength Index (RSI).

In simpler terms, since April, it’s been tough for the APT (whatever that stands for) to see a surge. However, recent changes in the network could tilt the balance and possibly make things look more promising over the next few months.

Read Aptos’ [APT] Price Prediction 2024-25

Yet, its current performance is significantly impacted by the prevailing negative market trends, which could potentially lead to an ongoing bearish trend in the crypto market, thereby possibly causing a decrease in APT prices.

Based on my years of market analysis and trading experience, it appears that the Asset Price Tool (APT) was nearing its historical low point during the time of observation. Given this context, I believe that a renewed surge in bullish sentiment could lead to a strong rebound for APT. In my personal journey as an investor, I have seen similar market conditions where a sudden change in momentum has led to significant recoveries. Therefore, it is essential to keep a close eye on the situation and be prepared to make strategic moves when the opportunity arises.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-08-06 03:03