- Bitcoin formed an encouraging chart pattern as it did in March 2020.

- The trade volume and fear factor are not the same, but this drop could still be a good buying opportunity.

As a seasoned analyst with vivid memories of the crypto winter of 2020 and the subsequent bull run, I find myself intrigued by Bitcoin’s recent downturn. The chart pattern we are witnessing bears striking resemblance to the one that preceded the dramatic surge in March 2020, which I remember as a time when the crypto market was on its knees but showing signs of life.

Bitcoin (BTC) experienced another significant dip during the weekend, starting from approximately $65,000 on Friday, 2nd August, and reaching a low of around $49,000 in the early hours of Monday, 5th August. This sharp decline was sparked by reports of Mt Gox’s actions and Germany selling Bitcoin.

The announcement that the Federal Reserve will maintain its current interest rates in September dealt another significant setback, following last week’s news about the Bank of Japan increasing their own rates by 15 basis points to 0.25%.

Some market participants were reminded by recent distressing news reports of the global market collapse that occurred in March 2020 due to the increasing number of coronavirus cases worldwide.

There were similarities and differences between the current crash and the Bitcoin Covid crash.

The chart pattern and recovery implications

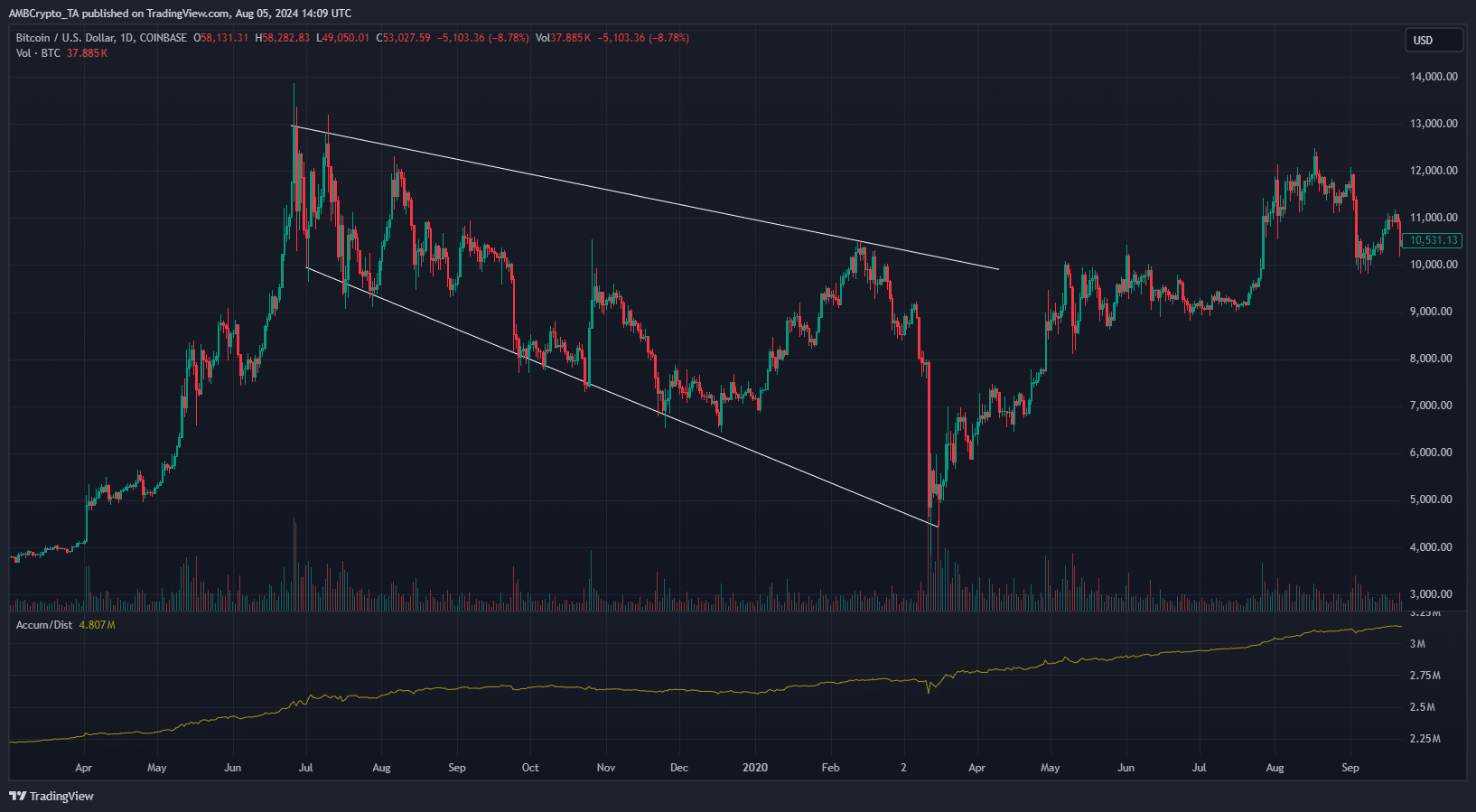

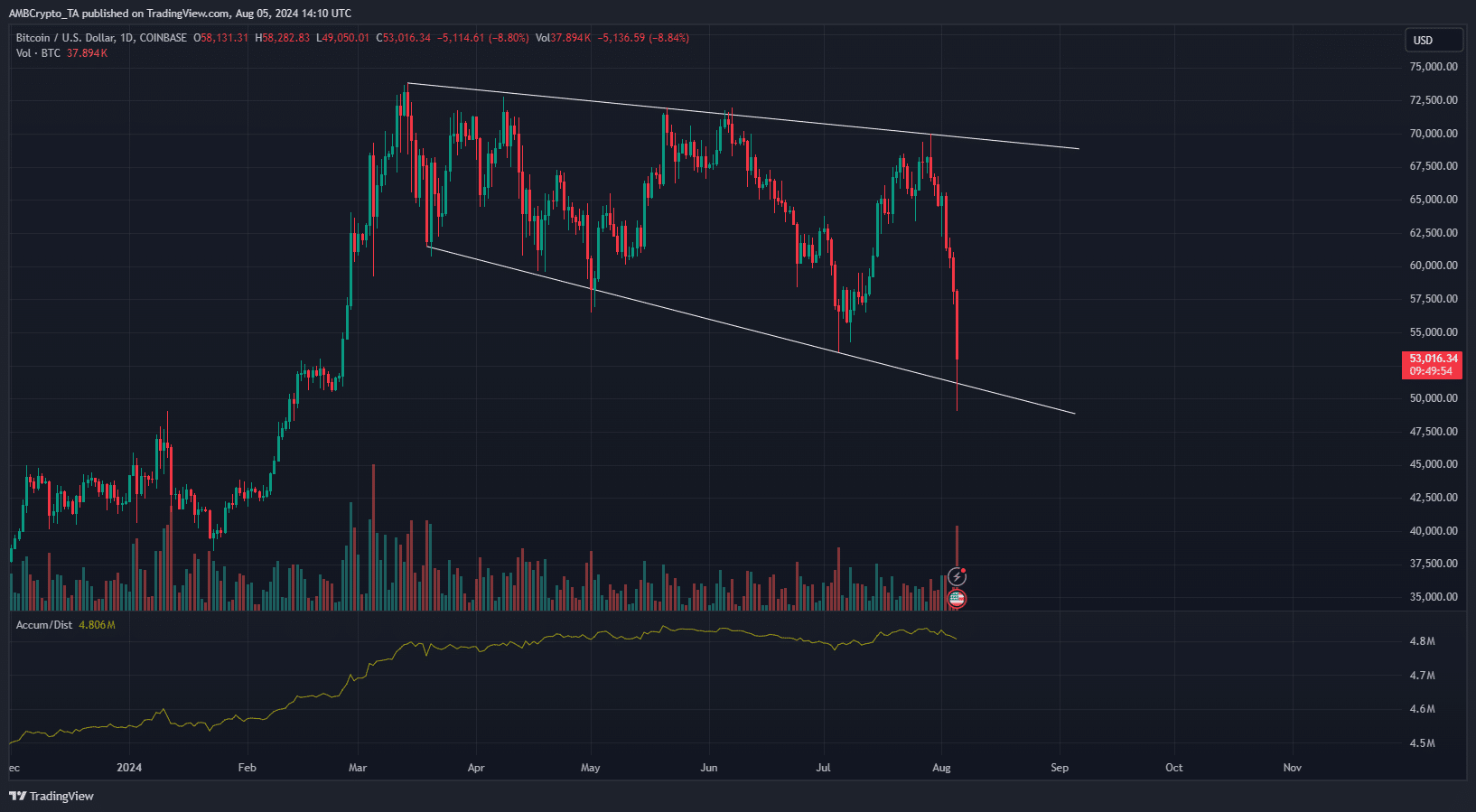

In the daily chart view for both Bitcoin graphs, we see the formation of a widening descending channel known as a “descending broadening wedge.” After testing this pattern one last time, Bitcoin started an uptrend over the subsequent two months and broke decisively above the $9k resistance level, indicating a bullish move.

Since March, the price trend has mirrored a similar chart configuration, indicating undervaluation based on the metrics we’ve observed for Bitcoin.

As an analyst, I’m currently observing that the trendline support for Bitcoin (BTC) stands at approximately $51,200 as we speak. It is crucial for BTC not to close a daily trading session below this level to maintain the validity of the wedge pattern we have been tracking. If it were to breach this support, the significance of the wedge pattern could potentially be undermined.

Despite the market-wide panic, the Bitcoin Covid crash was worse

On Binance, the BTC/USDT trading pair recorded its highest trading volume associated with the market crash on March 13, 2020. This massive volume equated to approximately 402,200 Bitcoins.

On Monday, 5th August, the Bitcoin trading volume was approximately 125.5k BTC, with more trades expected to take place later in the day.

What stood out most is that we lacked significant institutional investment, and retail interest wasn’t as strong as it was in 2024 when Bitcoin and Ethereum [ETH] ETFs were approved.

Is your portfolio green? Check the Bitcoin Profit Calculator

According to experienced cryptocurrency trader DonAlt, Bitcoin and the crypto sector found themselves in a battle for existence.

In this instance, the wider acceptance resulted in Bitcoin’s value falling under $50,000, which was a tough blow, but it nevertheless kept Bitcoin as a digital currency with a market capitalization of over one trillion dollars.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-08-06 10:15