-

The BNB price plunges 31% amidst a broader market crash.

Widespread liquidations and outflows exacerbate the downturn.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market crashes and recoveries. The recent plunge of Binance Coin (BNB) by 31% amidst a broader market crash is not an unprecedented event, but it certainly serves as a reminder that the crypto market can be as volatile as a rollercoaster ride at times.

Over the last four days, Binance Coin (BNB) has experienced a significant drop of approximately 31%. This downturn is linked to a broader market slump that has resulted in substantial losses for many cryptocurrencies.

Worldwide cryptocurrency markets experienced a wave of sell-offs, and Binance Coin (BNB) was no different. Its value dropped from approximately $634.1 per token to $434.5, shattering significant support thresholds. This downward movement has fueled concerns about potential additional drops in the near future.

At the moment, the Stochastic Relative Strength Index reads 0.06, suggesting that the market is overbought. Yet, despite the fear and greed currently prevalent, this condition might not necessarily result in additional declines.

Fuel to the fire

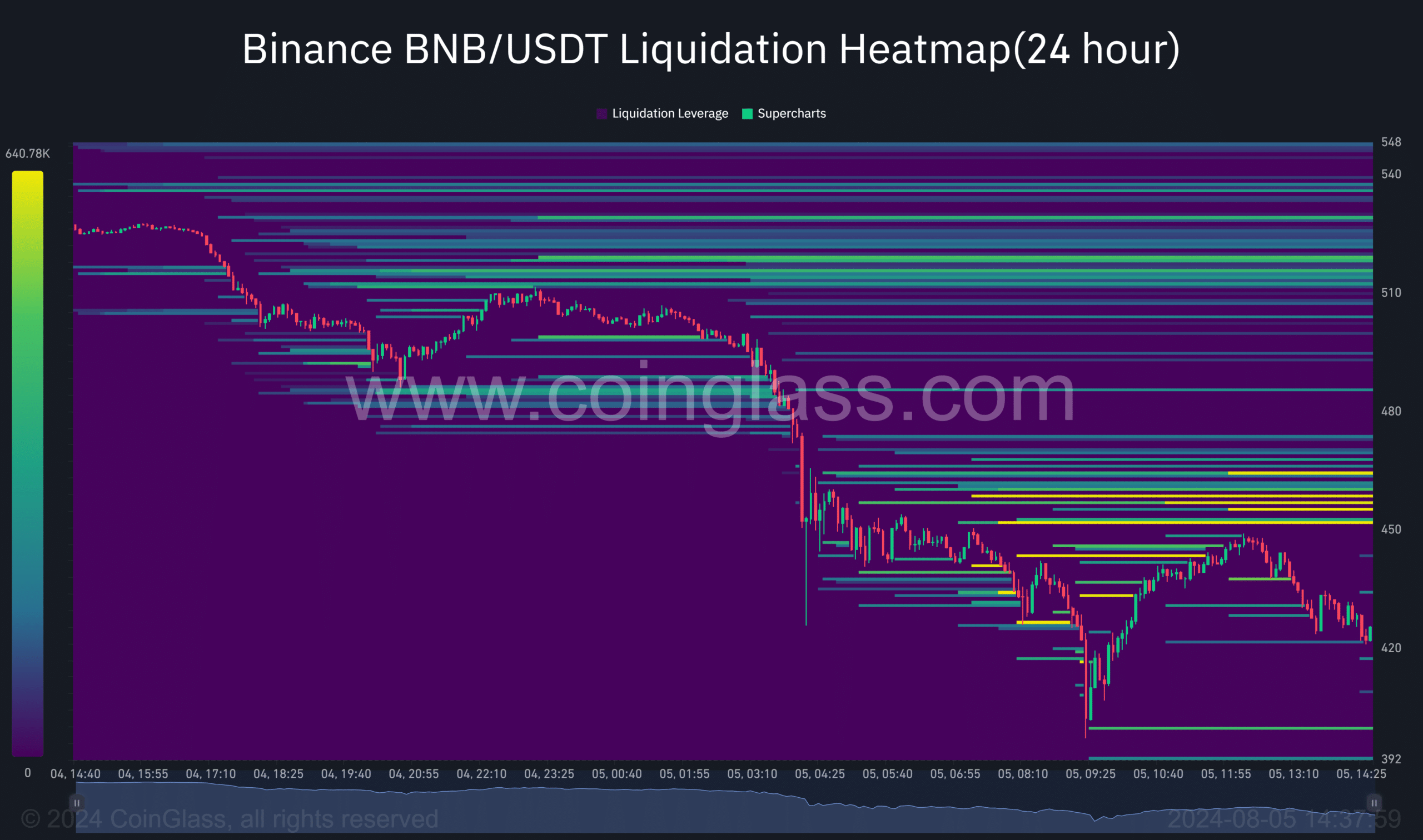

Lately, the market’s downturn has resulted in numerous sell-offs, particularly affecting BNB significantly. As per Coinglass analysis, a surge in sell-offs is observed at approximately $450 price point.

The concentrated nature of these sales is shown as a black hole in the BNB Liquidation Heatmap data. This is indicative of traders’ anxieties as the market collapsed.

Through compelling sellers to dispose of their assets, they amplified the downward trend in BNB‘s price and consequently played a substantial role in its steep decline.

The silent bearish signal

A recent challenge for BNB arises from substantial withdrawals by investors, leading to a steep sell-off. Data from Coinglass shows a notable outflow of BNB Spot, suggesting that investors are quickly transferring their assets out.

Read Binance Coin’s [BNB] Price Prediction 2024-25

As a seasoned investor with years of experience navigating volatile markets, I can confidently say that this recent movement in the market is not just reflecting the current bearish sentiment but also fueling my own anxieties about the future of the currency. I’ve seen similar patterns before and they have often led to unexpected twists and turns. It’s crucial for us all to stay vigilant, keep our eyes on the charts, and make informed decisions based on the latest economic data and expert analysis.

In simpler terms, the significant 31% fall in BNB‘s value can be attributed to a broader financial crisis sweeping across the entire cryptocurrency sector. This decline is associated with the cumulative effects of forced selling (liquidations) and massive withdrawals from the market.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-08-06 13:11