-

Will the anticipated rate cuts by FED on 18th September spark another BTC rally?

Major financial players further institutional investments in Bitcoin.

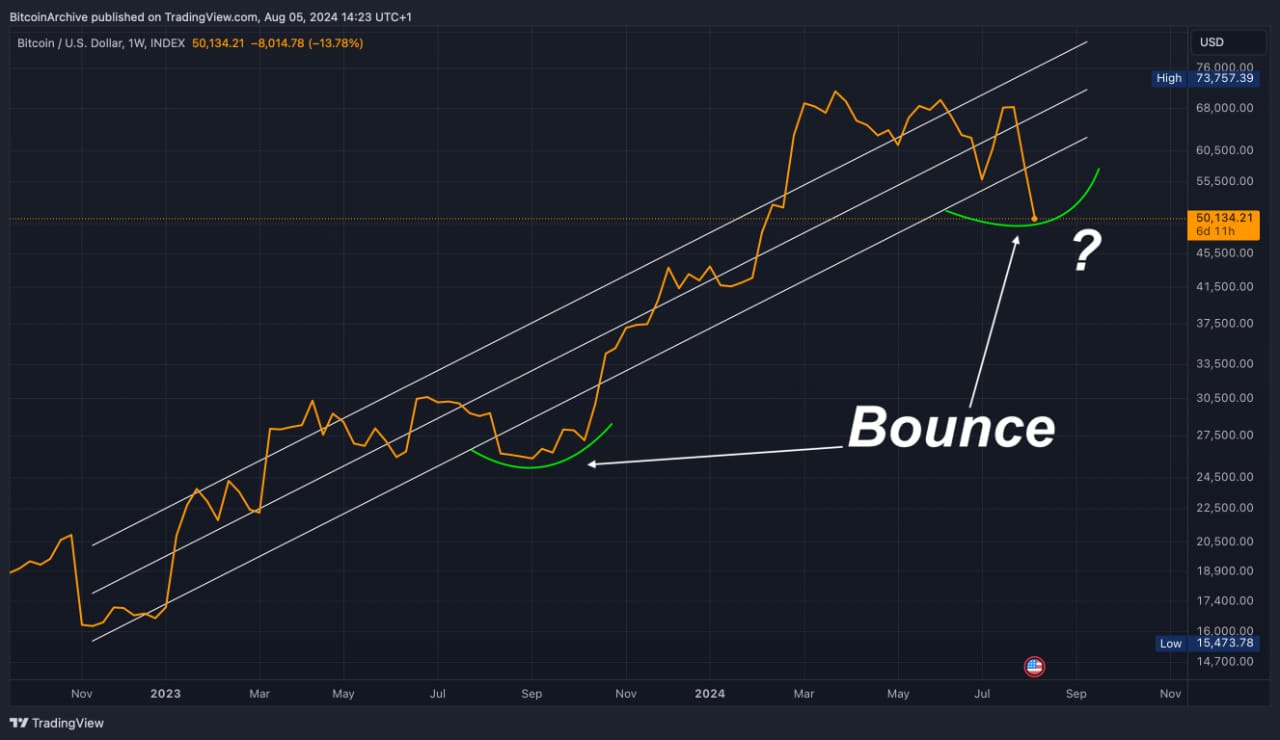

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull and bear cycles. The current state of Bitcoin (BTC) seems reminiscent of the pre-ETF approval period in 2023, which eventually led to a significant rally.

Analyzing the Bitcoin (BTC) graph using technical tools on TradingView indicates that the cryptocurrency has exited the bull market phase once more in 2021, potentially presenting a suitable opportunity for investors to invest.

In 2023, events unfolded similar to those seen previously, which ultimately resulted in an unprecedented peak in 2024. Notably, the price of Bitcoin surged dramatically following the announcement that Bitcoin ETFs would be given the green light in January.

As a researcher examining the current economic landscape, I’m considering the potential implications of proposed interest rate cuts. The question at hand is whether such reductions might propel us back into the upward trend of the bull market.

Investors are keenly observing whether the recent interest rate reduction will have a similar positive impact as the previous ETF announcement.

Capula and Semler Scientific add more BTC

European hedge fund Capula, ranked as the fourth largest, has committed $500 million to Bitcoin by utilizing exchange-traded funds (ETFs) provided by BlackRock and Fidelity.

As a crypto investor, I’m excited to share that Semler Scientific recently poured $6 million into Bitcoin and aims to secure an additional $150 million for further purchases. Since implementing a Bitcoin treasury strategy in late May 2024, Semler has amassed 929 bitcoins, amounting to a total investment of $63 million.

As a researcher examining the market, I observe that significant financial institutions are investing in Bitcoin. This trend indicates growing acceptance of Bitcoin within the financial industry and could potentially spark additional institutional investments. Such influx might fuel a surge in Bitcoin’s price.

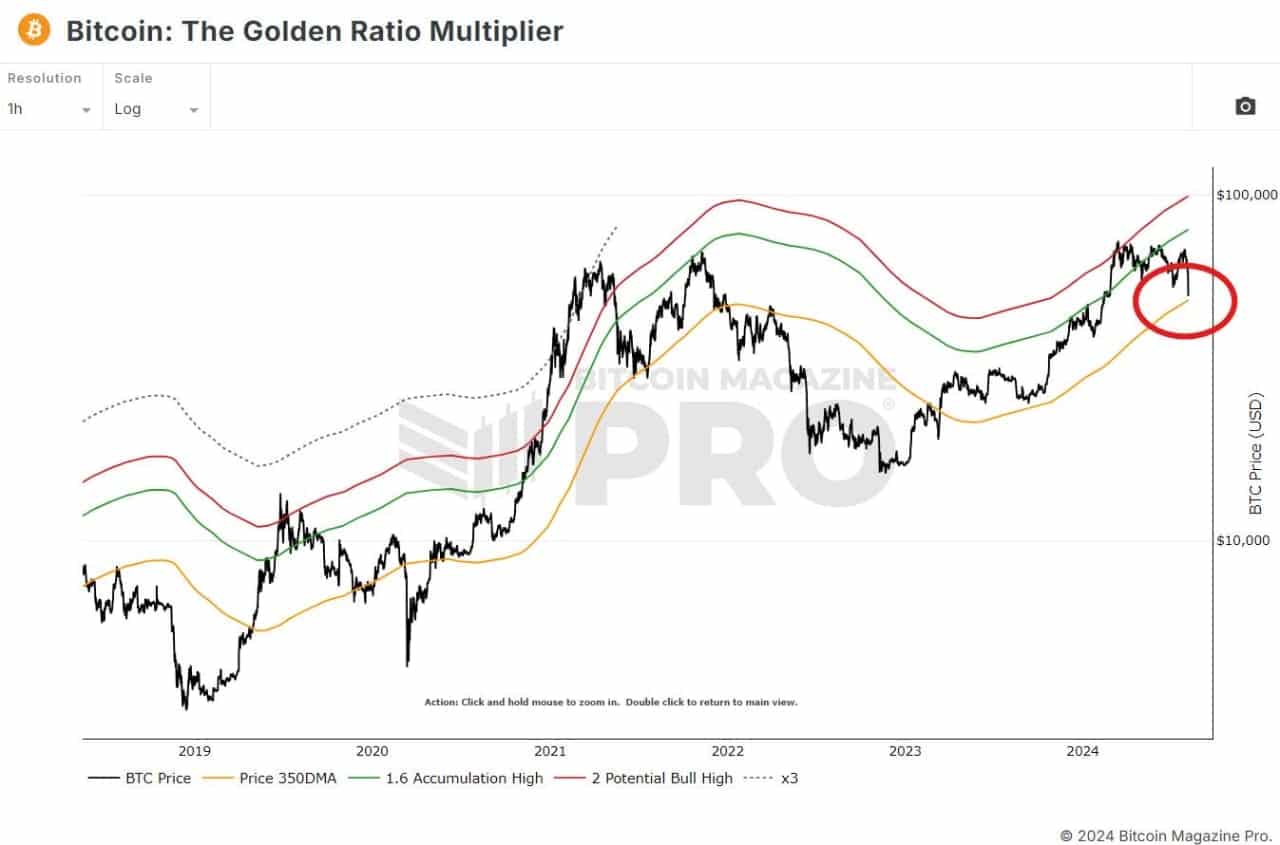

Will BTC secure the 350DMA support?

As an analyst, I’ve noticed that Bitcoin’s price has been consistently aligning with its 350-day moving average, following the Golden Ratio Multiplier. Given this pattern and the anticipated interest rate cuts, it seems plausible that we might witness an upward trend in Bitcoin’s price in the near future.

In an uptrend, the 350-day moving average functions as a base for the asset’s price. Given this, along with other considerations, the current cryptocurrency downturn might present a fantastic chance to purchase before Bitcoin experiences another rally.

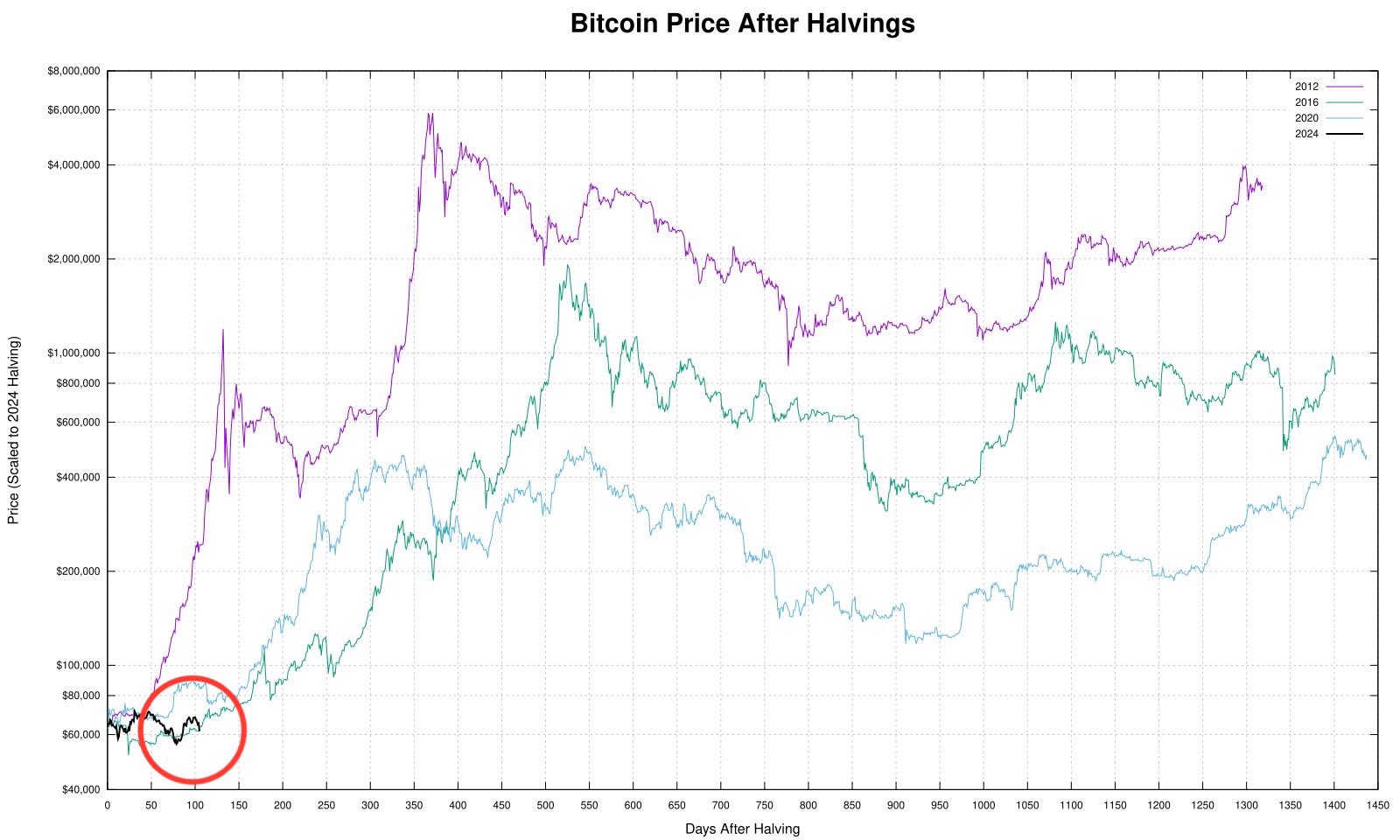

After a halving event, Bitcoin often undergoes a phase of adjustment or stabilization that can last for multiple weeks. Following this period, Bitcoin usually begins to increase in value.

Is your portfolio green? Check the Bitcoin Profit Calculator

At present, it’s at its lowest for this cycle, with predictions that it will surge in Q3 of 2024, much like the trends observed in 2012, 2016, and 2020.

According to user and market analyst Quinten, Bitcoin seems to be adhering to its typical pattern of behavior, even amid ongoing worries.

Read More

- OM/USD

- ETH/USD

- Solo Leveling Season 3: What You NEED to Know!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-08-06 19:03