-

Bitcoin, Ethereum ETF volumes saw a surge to almost $6 billion.

BTC and ETH have seen a slight rebound in the last 24 hours.

As a seasoned researcher with years of experience tracking the cryptocurrency market, I find myself both intrigued and puzzled by recent events. On one hand, we see Bitcoin and Ethereum experiencing significant price declines, breaking key support levels. Yet, on the other hand, trading volumes for their respective ETFs have reached record highs, surging to almost $6 billion in a single day.

During the most recent trading period, both Bitcoin (BTC) and Ethereum (ETH) saw significant drops in value, falling below crucial resistance points.

Amid the drop in prices, there was surprisingly high activity observed within each of their Exchange-Traded Funds (ETFs). In fact, trading volume skyrocketed to record levels.

Bitcoin, Ethereum ETF volumes hit record

Recent data from Coinglass highlighted a significant surge in trading volumes for Bitcoin and Ethereum ETFs. These assets collectively neared a substantial $6 billion in the last trading session.

The majority of trading volume was attributed to Bitcoin ETFs, accumulating approximately $5.7 billion, with BlackRock’s Bitcoin ETF being the largest at almost $3 billion.

This figure underscored BlackRock’s dominant position in the market.

On the Ethereum side, ETFs also saw considerable activity, recording over $715 million in volume.

GrayScale’s Ethereum Trust led all others in trading activity, accounting for more than $261 million worth of transactions, underscoring its significance within Ethereum investment options.

In the recent trading session, the increases in Bitcoin and Ethereum ETFs are worth mentioning, given that they happened during a period of market instability and falling prices for these cryptocurrencies.

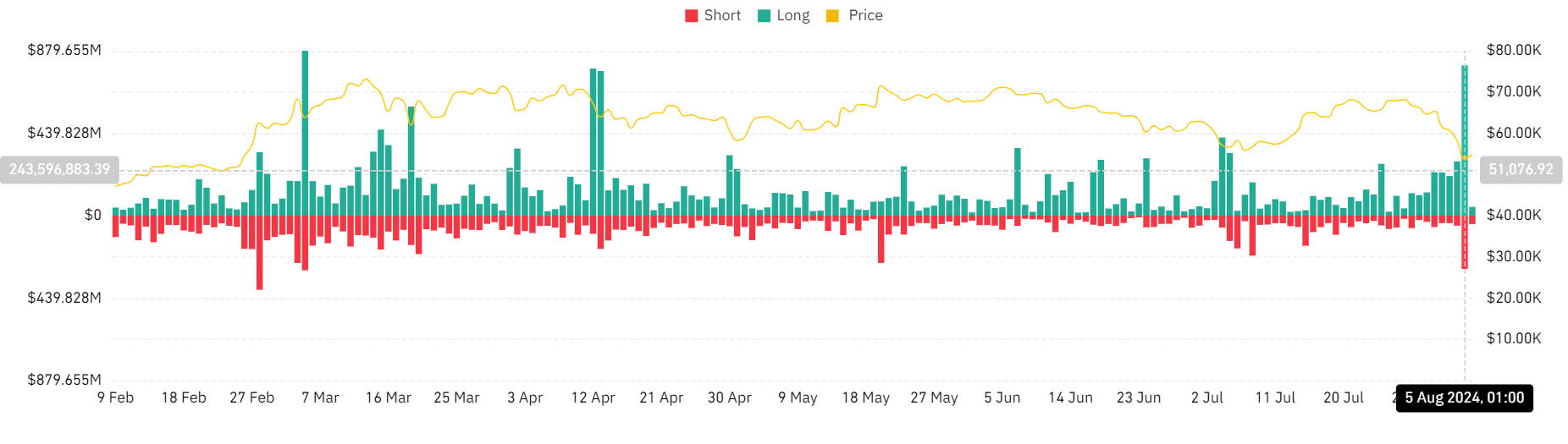

Market liquidation amidst ETF spike

Amid an increase in the trading of Bitcoin and Ethereum Exchange-Traded Funds (ETFs), the volume of liquidations on the broader market experienced a significant jump, reminiscent of the spike observed in March.

On that particular day, the overall amount sold or withdrawn from the market (liquidation volume) exceeded one billion dollars in data analysis. Upon further examination, it was found that most of these liquidations were due to long positions being closed.

The record showed over $801 million in long liquidations compared to $284 million in short liquidations.

In terms of specific cryptocurrencies, Bitcoin was responsible for more than $408 million in total liquidations, and once again, there was a greater volume of long positions being closed.

In addition, Ethereum experienced significant forced sales amounting to approximately $280 million, where long positions held the majority. To put it another way, liquidations for Bitcoin and Ethereum collectively accounted for over half of the total liquidation volume in the market.

BTC and ETH see slight recoveries

Based on AMBCrypto’s assessment, both Bitcoin and Ethereum have shown small daily price increases. At the moment of reporting, Bitcoin was being traded around $55,600, indicating an over 2% rise.

This followed a 6% drop in the previous session, which had reduced its price to around $54,000.

During this time, Ethereum’s value was approximately $2,466. This represents a rise of more than 1% compared to its previous session’s price of $2,421. Notably, this comes after a drop of over 9%.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-08-06 22:15