- Buying pressure on Bitcoin increased in the last week.

- Technical indicators hinted at a trend reversal soon.

As a seasoned crypto investor who has weathered numerous market fluctuations over the past few years, I find myself intrigued by the recent developments with Bitcoin (BTC). After analyzing various data points and metrics, I believe we might be on the cusp of a trend reversal.

Over the past week, Bitcoin’s performance has been lackluster, with its value dipping close to $55,000. Yet, fortunately for investors, the previous day showed signs of improvement.

Does this pose an opportunity for investors to buy the dip? Let’s find out what is going on.

Bitcoin is in a dilemma

According to CoinMarketCap’s latest data, the price of Bitcoin, known as the crypto king, has fallen by over 17% in just the past week. Currently, it is being traded at approximately $55,128.85, and its market capitalization exceeds one trillion dollars.

Given that Bitcoin (BTC) is currently priced below $56k, it could be an ideal moment to invest in BTC. As a result, AMBCrypto intends to examine various indicators to determine if the demand for BTC is strong.

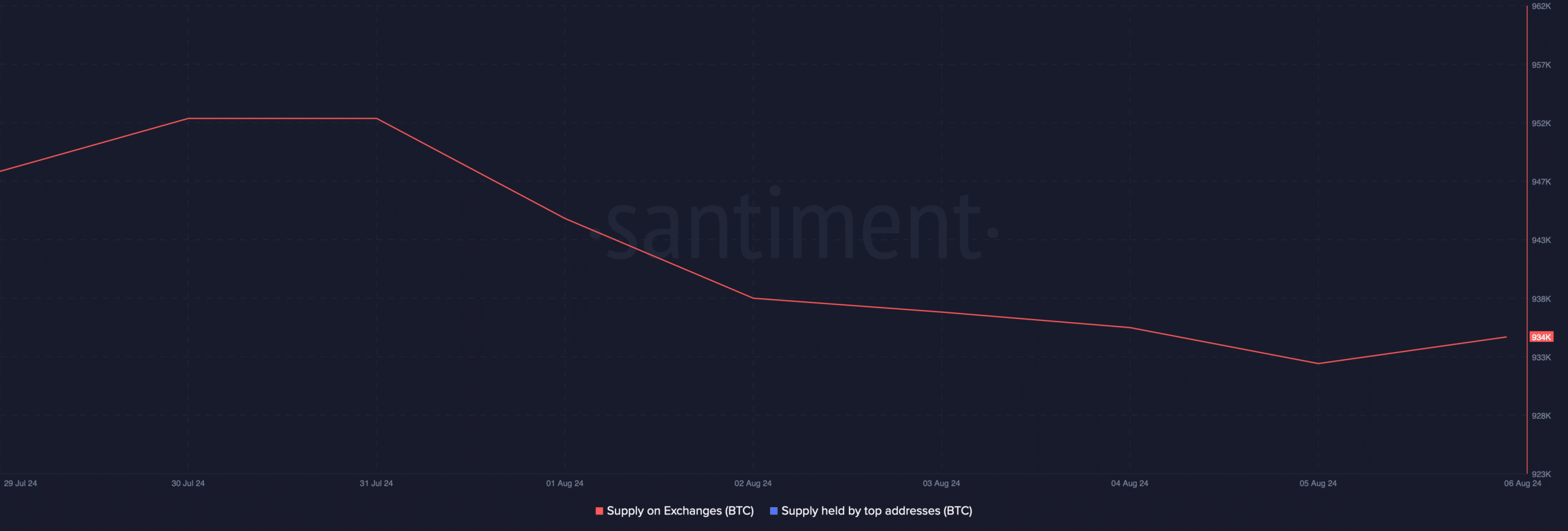

According to our examination of Santiment’s data, the amount of Bitcoin held on exchanges significantly decreased over the past week. This suggests that investors were purchasing Bitcoin at the current moment.

In a similar vein, CryptoQuant’s data indicated a decrease in Bitcoin’s exchange reserves, which supports the notion that investors are actively purchasing Bitcoin.

Additionally, it’s worth noting that the number of Bitcoin transfers and active addresses has risen. This trend might suggest a bullish outlook.

BTC’s upcoming days

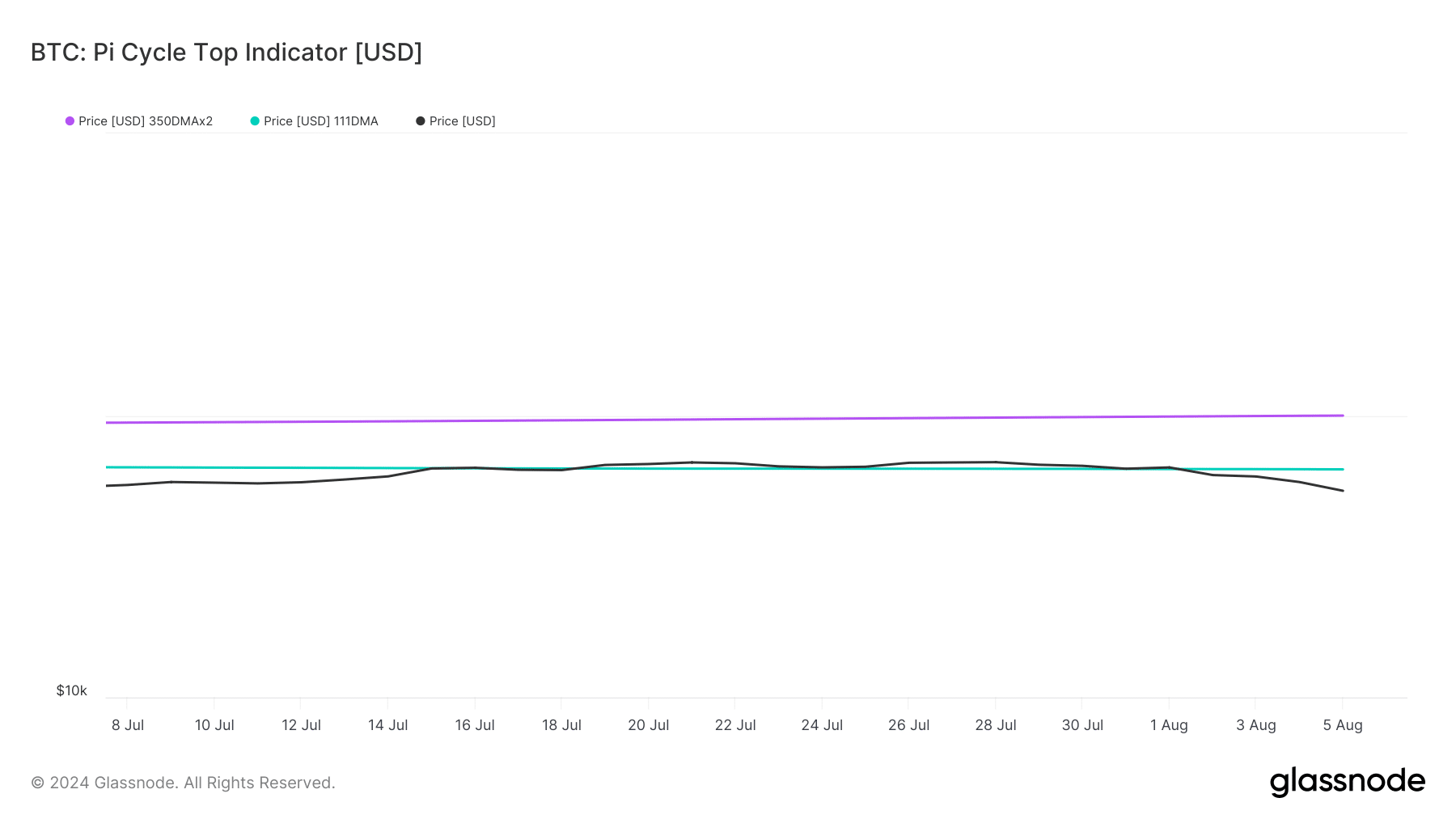

After checking various datasets, AMBCrypto analyzed data from Glassnode and found that Bitcoin was currently sitting comfortably below its market floor level.

According to the Pi cycle top indicator, Bitcoin’s lowest point in the market was around $64,000. Currently, Bitcoin is trading below that figure. Furthermore, if this indicator is accurate, then Bitcoin’s highest point in the market could potentially exceed $99,000.

Examining Bitcoin’s Rainbow Chart by AMBCrypto, we found that the cryptocurrency is currently in an accumulation stage. When this signal appears, it indicates potential opportunities for investors to purchase BTC at relatively lower prices as there may still be room for further price drops.

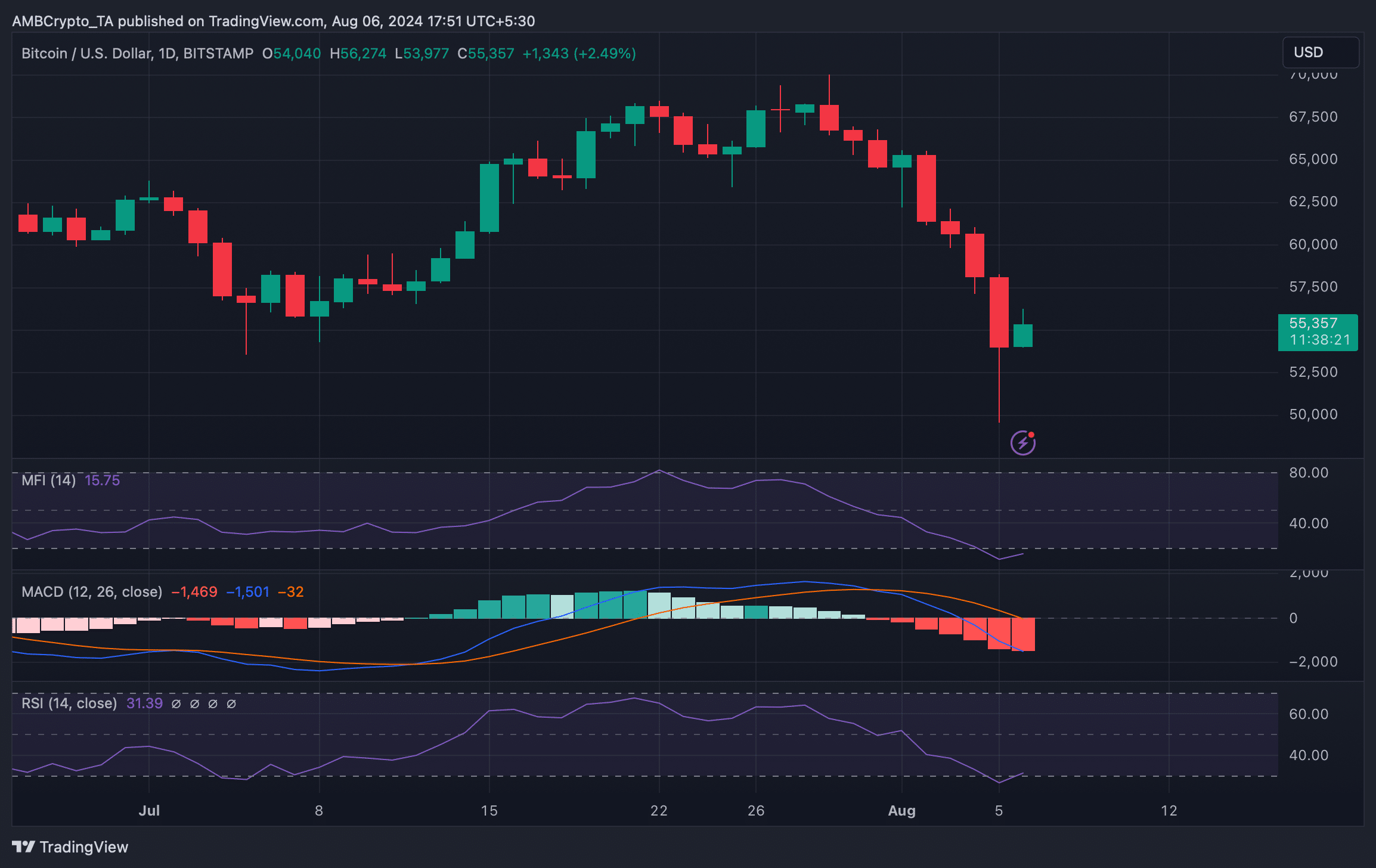

After examining Bitcoin’s daily chart, AMBCrypto aimed to predict its future behavior. As per our assessment, the Relative Strength Index (RSI) showed a rise in value.

The Money Flow Index (MFI) also followed a similar trend.

These market indicators suggested that the chances of BTC gaining upward momentum were high.

But, with the MACD technical indicator showing a bullish edge for the bears, it might hinder Bitcoin’s potential increase in the near future.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-07 05:29